Nov

2023

The dark side of the boom – the rise of ecommerce consumer fraud

DIY Investor

15 November 2023

- Consumer fraud is growing rapidly, with 40% of online shoppers drawn in, according to extensive new research from Ravelin.

- Financially stretched middle-aged people are the most actively involved (41%).

- Cost of living crisis blamed for online shoppers across Europe resorting to dishonest behaviour.

- Black Friday and Christmas will see a further spike in fraud, meaning merchants must be extra vigilant.

- Ravelin’s report, “The dark side of online shopping – the rise of friendly fraud”, summarising the research, can be viewed and downloaded here.

Over a third of all internet shoppers (40%) committed fraud within the last 12 months.

This is one of the shocking central findings of new research commissioned by fraud prevention provider Ravelin, exploring the attitudes, motivations, values, and backgrounds of a growing number of consumers who are turning to ecommerce crime.

Ravelin polled over 6,000 adults across the UK, France, and Germany and found that vast numbers of consumers of all ages regularly commit fraud.

Surprisingly, the over-45s are the worst offenders. 41% of respondents who committed fraud in the last year were from this age group, compared to 17% of 18–24-year-olds, 23% of 25–34-year-olds and 20% of 35–44-year-olds.

The cost of living crisis and general sandwich-generation pressures may be driving this behaviour.

Financial gains

This fraud seems to be paying off for many. Acting dishonestly has helped 13% of those who have committed fraud gain over £500/€500 in the last year, and 29% say they have gained £100/€100 or more.

Over a third (37%) of people who have committed fraud in the last year believe their monetary benefit outweighs the company’s monetary loss.

In addition to those actively involved in consumer fraud, many more are tempted, or tempted again: 36% of respondents have considered committing fraudulent activities in the future.

French shoppers are the most likely to commit consumer fraud, with almost half (47%) admitting to first-party fraud compared to 39% in the UK and 36% in Germany.

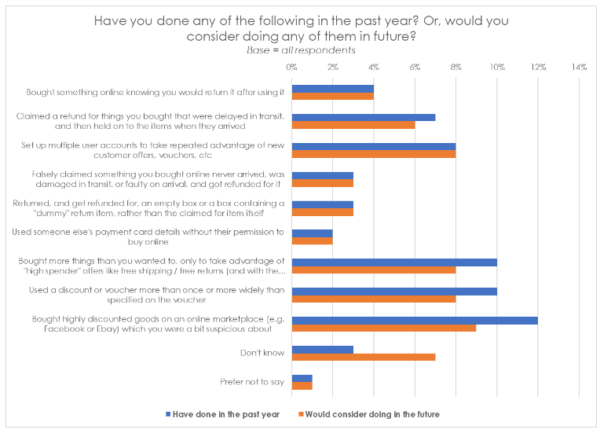

Consumers are finding different ways to commit fraud and play the system. Mostly, they game policies by attempting to take advantage of promotions, returns or refunds so they get more than they should without paying. A small number are pushing into second-party payment fraud, making online purchases using someone else’s card details without permission (see chart below).

The rise in consumer fraud is having a major financial impact on ecommerce across Europe. By 2025, fraud will cost merchants in excess of $48/£39 million, and this figure is set to keep rising.

This type of fraudulent activity often peaks when consumers are spending most, meaning merchants must be extra vigilant around Black Friday and Christmas.

Ravelin CEO Martin Sweeney said: “Merchants are aware they have a problem with their own customers committing fraud, but the scale to which this is happening has not been clear until now.

“We live in difficult times, so it is perhaps not surprising that some consumers find themselves tempted into fraudulent behaviour, but the fact so many otherwise respectable middle-aged people are involved seems quite significant.

“Merchants must be more vigilant and alert to all sources of fraud. And the best way to achieve this is to have a deeper data-led understanding of your business powered by automation. Retailers and ecommerce merchants need to balance the need to clamp down on fraud with offering customers an easy and safe shopping experience. The right automation can help merchants strike the right balance for their business.”

Triggers

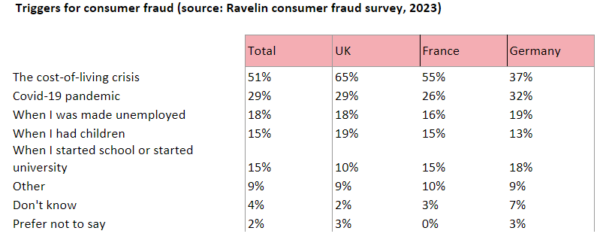

People have different motivations for committing fraud, from socio-economic to life events, according to the research. 51% of respondents agree that the cost of living crisis triggered their fraudulent activity. This number rises to 65% in the UK, where consumers have been hit hardest, and 55% in France. By contrast, 37% of respondents in Germany agree that the cost of living played a part.

Other triggers cited include the Covid-19 pandemic (29%), unemployment (18%), having children (15%), and starting school or university (15%). Men and women are equally likely to commit fraud, but marginally more men (38%) than women (33%) say they would consider committing fraud in the future.

Survey respondents say that once they get involved in customer fraud, they find it hard to stop. More than a third (39%) admit they commit fraud as often, if not more, than in previous years.

Heavy shoppers are heavy fraudsters. 62% of those who admit to committing fraud more than four times, have shopped online more than 11 times in the last year.

A majority of those surveyed find it easy to get away with committing fraud, which suggests merchants are not doing enough to protect themselves or deter consumers from being drawn into fraud.

Ravelin’s report, “The dark side of online shopping – the rise of friendly fraud”, summarising the research, can be viewed and downloaded here.

What are consumer fraudsters doing?

Item not received fraud: Falsely claiming ordered goods never arrived. The customer might then request a refund or a new item to be shipped and then could resell the extra goods or keep them.

Faulty or damaged item: A customer can put through a chargeback request with their bank or a refund request with the merchant, misrepresenting the condition or state of the items upon arrival. They then request a new item and keep or sell the old one, which in fact was in good working order.

Wardrobing/free-renting: Buying an item with the intention of returning it after using it once or twice – for example, returning a new dress after wearing it to a wedding.

Fake returns: Attempting to return different – usually inferior – items to the ones purchased. The merchant will often approve the refund before verifying the parcel’s contents.

Context: ecommerce growth

Ecommerce is growing fast. 21.2% of sales will be from online purchases in 2025. In Europe, retailers can expect to enjoy growth from $599.4/£493.11 billion in 2023 to $880.7/£724.53 billion by 2028 as consumers shop more online.

Survey methodology

Ravelin commissioned a survey of 6278 adult consumers drawn from the UK (2098 respondents), Germany (2092 respondents) and France (2088 respondents) who have shopped online in the last six months. The survey was designed to gauge people’s propensity for and attitudes about ecommerce consumer fraud.

Leave a Reply

You must be logged in to post a comment.