Apr

2024

The bond fund giving investors a smooth ride

DIY Investor

24 April 2024

After analysing volatility, this bond fund stood out for Saltydog Investor. Douglas Chadwick explains how it invests and how it has been delivering the goods so far

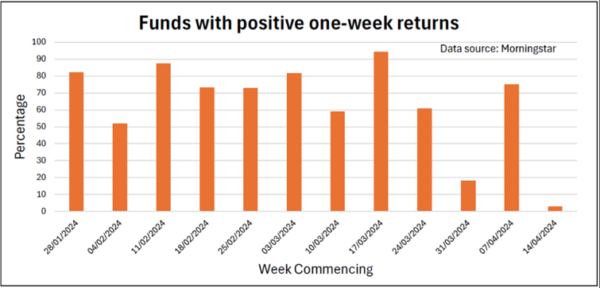

Each week, before we start our in-depth analysis, I like to have a quick look at the overall performance of all the funds we monitor. I like to see how many of the sectors have gone up, how many funds have made one-week gains, and what the average return has been for all the funds. It is a very crude measure, but it does offer a feel for the overall market performance.

Last week, fewer than 3% of the funds went up and, on average, they fell by -2.4%.

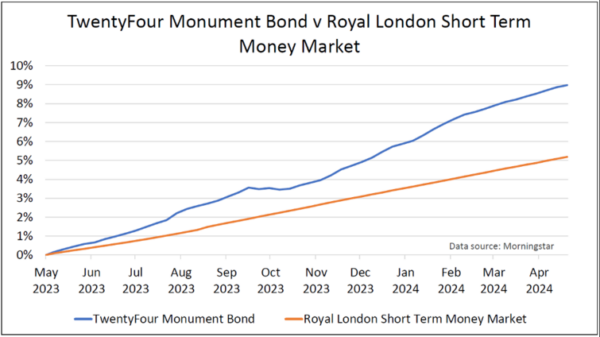

One of the few that did go up was the MI TwentyFour AM Monument Bond fund that we have been holding in our demonstration portfolios since June.

It is generally accepted that when investing there is a trade-off between risk and reward. We have seen this with the funds that we track. The ones with the potential to give the greatest returns tend to be the most volatile, and so on occasion also suffer the largest losses.

To help our members control the overall level of volatility in their portfolios, we put the funds into our Saltydog groups. We do this based on the historic volatility of the sectors they are in. Funds from the least volatile sectors are in our “Safe Haven” group. Then, as the volatility increases, we go through the “Slow Ahead” and “Steady as She Goes” groups. Finally, we finish with the most volatile sectors in the ‘Full Steam Ahead’ groups.

We also calculate the standard deviation of all funds based on their performance over the past 12 weeks and give them a Vindex (Volatility Index) rating of one to 10. Funds with a Vindex rating of one have been the least volatile ,while funds with a Vindex of 10 have been the most volatile.

The reason why we invested in the TwentyFour Monument Bond fund was because, at the time, it had a Vindex rating of one. Nearly all sectors had made losses in 2022 and although there was an improvement in the first quarter of 2023, the second quarter was less encouraging. As a result, in June, both of our demonstration portfolios had a significant proportion of their value in funds from the money market funds sector. They were low-risk, and giving positive returns, but we were also looking for other funds where we might be able to get a better return, with only slightly more volatility. That is when we invested in the TwentyFour Monument Bond fund. So far, it has done exactly what we were hoping for.

It is an unusual fund, from the Investment Association’s ‘Specialist Bond’ sector. It invests in asset-backed securities (ABS), which are usually loans, things such as mortgages, car loans, credit cards, student finance, etc.

One of the risks associated with ABS is that the underlying loans are never repaid. This was a contributing factor in the 2007-08 global financial crisis. Mortgage-backed securities (MBS) were issued based on subprime mortgages; high-risk loans made to borrowers with poor credit histories. When house prices started to fall, homeowners defaulted on their mortgages at increasing rates, leading to widespread losses in the mortgage market. This triggered a cascading effect, causing the value of MBS and related derivatives to plummet, and exposing the vulnerabilities of financial institutions heavily invested in these securities.

Since the global financial crisis, there have been efforts to address some of the weaknesses and vulnerabilities associated with ABS. This includes regulatory reforms, enhanced risk-management practices, and increased transparency and disclosure.

The Monument Bond fund mainly invests in European ABS, although it does hold some Australian ABS. It only invests in investment grade floating rate securities (with a credit rate of AAA to BBB).

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

Brokers Commentary » Commentary » Fixed income Commentary » Fixed income Latest » Latest » Mutual funds Commentary » Mutual funds Latest

Leave a Reply

You must be logged in to post a comment.