May

2020

The biggest recession since the Great Depression

DIY Investor

23 May 2020

![]()

Recent economic data across the globe is consistent with a very severe recession in 2020, which on a global basis may represent largest contraction in GDP since the Great Depression of the 1930s.

Nevertheless, investors should not equate the two episodes.

During the Great Depression global GDP declined by 15%. In comparison, current consensus forecasts calls for a decline of 3% in 2020.

‘GDP recovery from COVID-19 will be slower than we originally anticipated’

We believe uncertainty in respect of the duration of social distancing measures and the recovery of demand post-lockdown remains high yet this is not accounted for in current market valuations.

A highly selective approach to equity risk, in the context of a cautious overall allocation remains appropriate in our view.

We believe the “liquidity bounce” in markets from March to April is in the rear view mirror and the GDP recovery from COVID-19 will be slower than we originally anticipated.

A quick drop and slow walk back to trend GDP

Despite increasing market optimism, at this point we are not convinced that global economies will make a swift recovery from COVID-19.

There will be relief that people are returning to work and schools re-opening shortly.

However, the global nature of the lockdown combined with the likelihood of continued social distancing measures until a second wave of infections can be ruled out means that spending, employment and business investment patterns are unlikely to return to normal until a vaccine is within sight during 2021.

Current survey data indicates that a severe recession in global GDP is underway despite the efforts of governments and central banks to cushion the blow.

‘survey data indicates that a severe recession in global GDP is underway’

Hard data is likely to confirm that Q220 GDP will represent the trough in economic activity globally. Yet for the remainder of this year, it is difficult to escape the conclusion that there will be a material impact on demand due to social distancing measures.

These have the potential to shutter or render unprofitable a significant proportion of the service sector economy.

We therefore believe the economic risks remain to the downside, given the tightrope which governments now walk.

While loosening social restrictions early would benefit an economy in the very short-run, it risks a serious second wave of cases later on.

Furthermore, the risk of second waves of infection remains high in our view due to the relatively low proportion of the population which has so far developed antibodies.

‘the risk of second waves of infection remains high in our view’

This is true even in the worst-affected areas of Italy where the estimated prevalence of antibodies in the general population of Milan is only 7.1%, based on samples taken from blood donors.

Yet keeping social restrictions in place for too long may unnecessarily delay any economic recovery and risk non-compliance by the general public.

Given the safety-first approach being taken in many developed markets, there may also be a bias to underemphasise the impact of social distancing measures on business profitability and consumer spending.

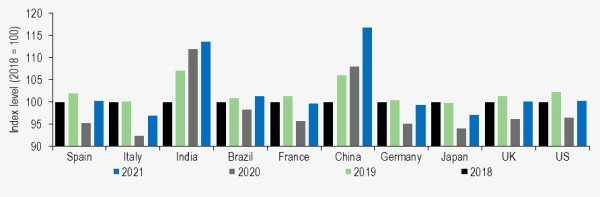

Consensus forecasts for GDP growth for 2020 and 2021 have fallen sharply.

Downgrades to GDP for developed markets have been sufficiently large they indicate that for the period 2018-2021 real GDP will be unchanged in most developed markets.

China and India are forecast to slow their growth due to coronavirus but to continue to expand during the same period.

Notably, China has recently declined to provide a target for GDP growth in 2020 due to COVID-19, breaking a decades-long tradition.

Exhibit 1: Stagnation of GDP in developed markets due to COVID-19

Source: Refinitiv, Edison calculations. 2018 = 100

A period of stagnating GDP growth, social distancing and rising unemployment is likely to be a challenging environment for many sectors due to the combination of changing supply-side and demand dynamics.

The standout risks for us are first the impact on SMEs and second the impact on household finances, with the prospect of a sharp increase in unemployment.

Larger companies operating factories or sparsely staffed industrial processes are likely to suffer relatively little disruption from COVID-19 once lockdowns ease.

‘standout risks for us are first the impact on SMEs and second the impact on household finances’

However the very large number of SMEs which rely on physical social interaction to drive sales, such as those found on the high street, are likely to suffer a disproportionate burden from social distancing.

A broad swathe of the service economy will be affected – and SMEs account for approximately 66% and 50% of the EU and US workforce respectively.

For investors in the stock market, there is some comfort as larger corporations are more easily able to work around social distancing restrictions, which may be in place for some time.

From the demand side, an explosion in unemployment will impinge on consumer spending both in terms of those directly affected and through an expected rise in precautionary saving for populations as a whole.

We believe investors are likely to favour essential goods sectors over those reliant on discretionary or big-ticket purchases in this environment.

‘an explosion in unemployment will impinge on consumer spending’

Property remains an interesting case as the impact of digital and social distancing measures differs by sub-sector.

Retail property has been under pressure for some time but bigger stores are likely to benefit on a relative basis from the difficulties of running small stores profitably with social distancing in place.

The future of offices has been called into question for the long term through increased remote working but in the near future companies will have to plan for a return to office working with a much reduced employee density and therefore increased space requirements.

Logistics and warehouse operators appear well placed, as demand for online delivery services increases.

Central banks have shielded markets – and policymakers – from lockdown

Many investors and especially those facing professional career risk will have been grateful for the interventions of the world’s major central banks during H120.

These interventions have stabilised a market rout which risked turning into a catastrophe for asset managers.

The re-introduction of asset purchase programs and the targeting of corporate debt for purchases has led to a sharp compression in yields and has ensured an active primary market for investment grade issuance in the US, easing earlier fears of a US corporate credit crunch.

However, the central bank liquidity “insurance” offered to markets during this crisis has shielded policymakers from the economic consequences of lockdown policies.

The sharp drop in markets and subsequent recovery did not reflect a change of heart among investors in respect of the severity of the COVID-19 outbreak, in our view.

‘Despite appearances, risk assets have not signalled the all-clear’

In many respects the economic risks surrounding this viral outbreak have only increased since March as it has become clearer that a long period of non-pharmaceutical interventions lies ahead.

The recent rebound in markets is therefore more likely to be a result of a change in the liquidity preference of investors.

This switch was driven by central banks who, through liquidity interventions and guidance, reassured investors that markets would not be permitted to become dysfunctional, or even close entirely for the duration of the crisis, as was mooted at one stage during March.

Therefore, in the light of this interpretation of the decline and subsequent rebound in markets, investors should not drop their guard. Despite appearances, risk assets have not signalled the all-clear.

Questions remain on the long-term impact of (yet) another period of ultra-low rates

Central banks continue to operate from the same playbook first seen during the financial crisis of 2009, followed by the eurozone debt crisis of 2012 and other minor market wobbles during the past 6 years.

The toolkit is a pre-emptive easing of monetary policy and reintroduction of asset purchases to either stabilise markets or stimulate growth.

Asset prices have therefore been supported, but at the cost of ever lower interest rates, dramatically larger central bank balance sheets and increased global indebtedness.

When a structure is fragile or brittle it is still difficult to know precisely what magnitude or type of shock might cause a crack to propagate throughout the system.

‘there remains a fragility in this century’s over-reliance on monetary policy’

While critics have been proved wrong in the past in terms of the debasement of money and likelihood of future inflation, there remains a fragility in this century’s over-reliance on monetary policy in our view.

The fundamental question, which is now less academic following the strength of the gold price this year, is whether money can be debased without end in order to stimulate the economy, if not finance government spending at artificially low rates.

It is becoming increasingly likely the 12-year period of supressed real interest rates is likely to be extended for a further half-decade.

The distributional effects are significant as higher asset prices benefit richer and on average older members of the population, widening both wealth and intergenerational disparities. It is also younger people who have disproportionally suffered in an economic sense from COVID-19 as jobs, education and training have been disrupted.

‘widening both wealth and intergenerational disparities’

We believe that the expansion of central bank balance sheets and renewed questions over fiscal sustainability during a deep global recession will continue to drive demand for precious metals.

There remain lower but not zero probability scenarios of significantly higher future inflation, which would erode the real value of nominal assets.

Gold is likely to continue to find favour within portfolios as a diversifying hedge. For UK investors, we suspect gold has further attractions as the UK economy slumps into the run-up of UK/EU negotiations which could still result in a no-deal Brexit.

Dividends, buybacks, M&A on hold and rights issues in the pipeline

One of the primary supports for stock markets in recent years has been unusually high after-tax profitability of listed firms.

These strong cash flows have been returned to investors via dividends, share buybacks and indirectly via cash mergers and acquisitions activity. The corporate sector has been one of the largest net buyers of stock market equity.

Since the onset of COVID-19, not only has earnings guidance often been withdrawn but in many cases dividends have been cut or cancelled and share buybacks suspended.

The effect is significant as major banks have stopped paying dividends in Europe and the US.

In addition, non-financial firms have suspended dividend payments as balance sheet requirements are reassessed. Further out, we note dividend futures for 2023 have fallen by 30% as a result of COVID-19. We have also seen negligible new M&A activity since the onset of the crisis.

‘dividend futures for 2023 have fallen by 30% as a result of COVID-19’

Cancelled dividends and buyback programs represent the first stages of balance sheet repair for the corporate sector and represent implicit capital raising activity.

The second phase is rights issues and we note this week two large UK rights issues took place, raising £3bn from investors. We suspect more deals will follow as companies build a new margin of safety into corporate financing.

While it may be difficult to precisely quantify the impact of this reversal of corporate stock purchases, this is a new phenomenon which investors should provide for in coming quarters.

An abnormal situation demands an abnormal price

These are very difficult times for the global economy and the outlook for the COVID-19 epidemic and corporate profits remains clouded with uncertainty.

This uncertainty is an amalgam of risks surrounding the disease, the depth of the coming recession, the potential triggering of existing fiscal fragilities and rising geopolitical tension, both in terms of the US/China relationship and Brexit.

For the disease, we believe a second wave of infections in a number of jurisdictions remains a clear possibility, given the low level of antibodies evident in tests following the first wave of cases.

‘We believe investors still have at this point good reason to keep powder dry’

Furthermore, the increased prevalence of COVID-19 clusters in segments of the population which live or work in close proximity implies that at least some form of social distancing may need to remain in place until a vaccine becomes available.

This remains an abnormal economic situation with developed economies now forecast to deliver 0% GDP growth between 2018 and 2021.

Following the rebound since March we maintain a cautious outlook on equity markets.

Valuations of the largest global corporations are lower but merely in-line with long-term averages. Pay-outs to shareholders in the form of dividends and share buybacks remain under pressure while the prospect of further capital increases is likely to weigh on market sentiment.

We believe investors still have at this point good reason to keep powder dry.

Click to visit:

Leave a Reply

You must be logged in to post a comment.