Mar

2024

The Big Picture: economic and political summary March

DIY Investor

16 March 2024

Economic and Political Roundup

Despite further geopolitical uncertainty, US growth appeared undeterred, and the inflation rate continued on its downward trend, strengthening the likelihood of a soft landing. However, the inflation rate was higher than had been expected and the US central bank (the Federal Reserve or Fed) may delay interest rate cuts as a result; that unnerved markets. American unemployment remained at 3.7%, reinforced by continued wage growth. Yet, despite labour market resilience, the US consumer confidence index fell to 106.7, from January’s 110.9. Dana Peterson, chief economist at the Conference Board, partly attributed this to the uncertainty of the ‘political environment’.

Despite further geopolitical uncertainty, US growth appeared undeterred, and the inflation rate continued on its downward trend, strengthening the likelihood of a soft landing. However, the inflation rate was higher than had been expected and the US central bank (the Federal Reserve or Fed) may delay interest rate cuts as a result; that unnerved markets. American unemployment remained at 3.7%, reinforced by continued wage growth. Yet, despite labour market resilience, the US consumer confidence index fell to 106.7, from January’s 110.9. Dana Peterson, chief economist at the Conference Board, partly attributed this to the uncertainty of the ‘political environment’.

‘I expect inflation to continue its return journey to 2 percent, although there will likely be bumps along the way – John Williams, The Federal Reserve

Whilst the Eurozone continued to lag behind the US, indicators of economic strength such as the HCOB PMI have improved, boosting hopes of a recovery. Moreover, the European benchmark STOXX600 index reached a record high on February 26th, building on a 3.4% gain since the beginning of the year. February’s selling price expectations for services also fell slightly, offering momentary solace from inflationary fears. However, even though inflation has been slowly declining, the European Central Bank (ECB)’s Martin Kazaks cautioned that cutting interest rates any time soon would be ‘risky’.

After falling into a recession in the final quarter of last year, the UK’s retail sales figures added to its woes with a decline of 2.5% in February.

Another concern for the UK is that it is still undergoing its longest run of falling living standards since 1955. The Spring Budget’s give with one hand and take with the other approach seems unlikely to do much to change that.

Global

(compare global investment funds here, here, here and here)

Katie Potts, managing director, Herald, 21 February 2024

Maintaining wealth, let alone creating wealth, will be a challenge in a world with so much government debt and in which fiscal deficits will have to be both funded and reduced. Money will be sucked into bond markets and consumers and businesses will be squeezed by higher tax. It seems obvious that good returns may only be achieved through growing markets, and that technology continues to evolve, and that innovation creates new markets offering more potential than other sectors. Entrepreneurial management can exploit these opportunities but need access to capital to do this. Equally growth will occur where people work for $2/hour and there is evident migration of labour-intensive manufacturing to countries like Indonesia and Vietnam. The outlook for Europe including the UK seems challenging because labour is too expensive for low-cost manufacturing and there is limited availability of capital.

The UK does have an innovative, creative entrepreneurial spirit and had already lost energy intensive industries prior to the Russia/Ukraine disruption of the energy markets, so does not have the headwind faced in other economies. The headwind of rising corporation tax and ESG costs in the UK will now be reflected in profit expectations, and other countries will probably follow with higher taxes. The trouble is that the UK stock market also seems broken, and unlikely to provide capital to emerging businesses, and therefore unlikely to provide the investment opportunities that it has in the past. Nevertheless, having capital in a capital constrained world will present opportunities. There is still world leadership in the media sector and the creative industries, but the semiconductor sector, which was so important in the development of the smartphone, has diminished. Key UK-developed technologies included the processor (Arm), the graphics processor (Imagination), audio (Wolfson) and Bluetooth (CSR). Arm has now gone public again on NASDAQ and Imagination seems to be considering a US IPO in 2024, but the US/China semiconductor politics complicates both the valuations and the prospects. New companies will emerge using artificial intelligence. Necessity may lead to Government policy that is more sympathetic to the wealth generating element of the economy. It seems to have been hostile or at least careless for this century to date.

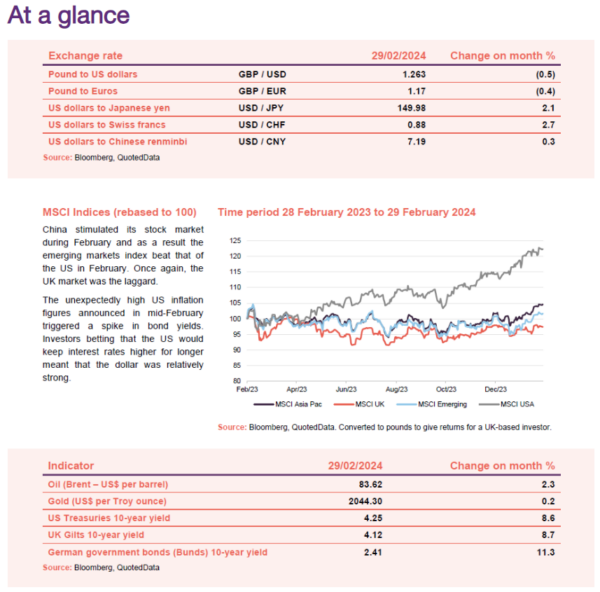

China has driven growth through infrastructure investment and property. There are now too many empty dwellings and too much debt for this to provide growth in future. Wages are now too high for low-cost manufacturing, which is another headwind. The bright spot is that China is emerging as the leading electric vehicle manufacturer. This will be particularly challenging for the German automotive industry, which is not just losing an important export market, but facing a new competitor. The important German chemical industry is endangered by higher energy costs, and East German labour costs are no longer cheap. It seems possible that Germany will face the deindustrialisation that the UK experienced in the 1970s and 1980s.

North America has been the engine of growth in 2023, but this has been driven by extraordinary fiscal and trade deficits, and anomalously low fixed rate domestic mortgages. The technology sector has brilliantly scaled businesses and has had cheap capital to do this. The trouble is that salaries are too high for smaller emerging companies, and in the quoted world the reporting of adjusted earnings per share which excludes share based payments is quite deceitful, and unsustainable in valuation terms. San Francisco is troubled economically and socially, and the elevated pay there seems anomalous in a world of remote working. However, the US is leading the way in artificial intelligence, albeit with an Asian supply chain.

Developed Asia including Taiwan, South Korea and Japan has the most vibrant stock markets, and an enviable work ethic. It has to be the area of greater focus for this Company. The overhanging cloud is President Xi’s ambitions towards Taiwan.

At the time of writing, the markets have taken the negative effect of conflicts in the Ukraine and Israel lightly. There could be an upside surprise from peace in these regions, but continued and even increased tensions seem more likely. This will drive increased defence spending, and investment in technology led defence solutions, not least in cybersecurity.

UK investors are acutely aware of the challenges faced by the UK economy following the explosion of Government spending and the high debt levels. It seems they are less aware that these challenges are faced in almost all developed counties. I fear they may move money to North America where valuations are high and the widespread use of adjusted earnings per share excluding share-based payments which is effectively understating both the costs of running a company and the price/earnings ratio. In the technology sector in particular share-based payments can be material. We are privileged to meet management teams around the world on a daily basis, and aware of the widespread challenges. The greatest concern is that the bond markets will force fiscal discipline, particularly in the United States, which will make global growth challenging. The key is to find strong management teams addressing growth markets to offset these headwinds.

. . . . . . . . . . .

Peter Burrows, chair, UIL Limited, 21 February 2024

Market volatility has been driven by significant uncertainties in both the economy and social and geopolitical considerations.

The key economic driver of markets has been the outlook for inflation in the developed world and the central banks’ focus on reducing it through higher central bank interest rates. While inflation is now on a lower trend, the remarkable outcome in many economies is that unemployment has remained well below trends and many economies have beaten expectations on GDP. However, in the last quarter the market firmly shifted its views on central bank interest rate reductions from if it will happen to when, especially in the USA. Many central banks take their lead from the US Federal Reserve. The upshot has been strong gains for most markets. Going forward we think most central banks have the opportunity to reduce rates.

The war in Ukraine has gone on longer than expected and today there continues to be no clear way forward. The outlook is grim as both sides are unable to gain ground.

The brutal conflict that has erupted in the Middle East is more concerning. These are deep seated politically ideological differences between many parties in the Middle East established over many years. The concern must be that this escalates into a much wider conflict.

The ongoing friction between the USA and China continues to deepen, and given these are the two largest economies globally this must pose significant risks at some point in the future, especially for technology businesses on each side of the Pacific Ocean.

Overlayed on all this is the USA election. The direction the USA takes matters and its position and influence in the above mentioned conflicts is itself very uncertain.

An ever increasing factor for investors is climate change. It has clearly had devastating impacts on a number of communities from wildfires in Hawaii to floods in Germany. We are seeing whole ecosystems being impacted from prolonged droughts to record temperatures. As investors we need to prepare for these outcomes to continue across the holdings in our portfolio.

There is a very perceptible shift to embrace Artificial Intelligence (“AI”) by most businesses and as with most technological developments, those without legacy businesses benefit the most, but eventually all businesses will need to adapt or risk failure. This has been our experience in the Fintech sector. UIL has a number of investments with significant exposure to AI, Blockchain and Quantum Computing.

. . . . . . . . . . .

Managers, Scottish American, 14 February 2024

During the past few years it seems that some parts of the media have become, for want of a better word, hysterical. Even the financial press, which used to be renowned for walking a line between dry and tedious, has often joined the fray of shouty headlines and breathless articles. This is understandable. Technology has disrupted the business models of traditional media channels. In a digital world, whoever conjures the most shocking headlines will gather the most clicks. And whoever accumulates the most clicks might be able to keep their jobs.

The headlines blaring at investors at the start of 2023 were alarming. Inflation was proving “untameable”, central banks were hiking “too aggressively”, and an economic “hard landing” was certain. Investor confidence declined, and stock markets fell. By March, the mood had changed. Inflation seemed to be peaking. Many of the grim predictions at the start of the year, like crashing house prices and tumbling profits, were swiftly forgotten. In their place appeared two words promising great riches: “Artificial Intelligence”. The stock market began a triumphant rise, which would continue until the summer.

Gloom then returned. Economic data looked “hot”, and inflation seemed persistent. Stocks fell. By November, behold! The data looked more friendly. Fears of war between the US and China, which had generated dire forecasts only months earlier, now receded. The stock market began another charge upwards, buoyed by a new hope: interest rate reductions. Stock indices reached new heights at the dawn of 2024. “Time to buy!” was the headline.

For the long-term investor, who is earnestly attempting to grow their capital and income over a period of many years, this hysteria is unhelpful. It is rather like trying to hold a conversation at a dinner-party while being repeatedly interrupted by a drunken guest, who veers endlessly between loud euphoria and wallowing self-pity. An unfortunate distraction.

Over the multi-year periods that matter to serious savers and investors, stock prices and dividends tend largely to follow company earnings. The key task for portfolio managers, therefore, is to identify companies with strong prospects of growing their earnings over many years. These prospects are unlikely to be affected by the monthly mood swings of the media. It is a job best done when sober.

. . . . . . . . . . .

Carolan Dobson, chair, Brunner, 13 February 2024

2024 will likely be another significant year in terms of ‘headline’ events with 64 countries plus the European Union holding elections. Associated ‘news’ is likely to be rampant. Along with two major conflicts, the geopolitical landscape remains dangerous.

Markets have been acutely concerned with inflation and second-guessing central bank’s rate rhetoric. Inflation appears to be more under control but events in the Middle East have the potential to disrupt that.

Not all economies are built equally, and we have already seen divergence in economic performance. As you will read in the Investment Manager’s Review on pages 24 to 39 of the annual report, the portfolio managers are largely agnostic to where a stock happens to be listed. A large proportion of world class businesses derive their revenues from a diverse range of locations around the globe, often unconnected with where their stock is listed. The managers also argue in their report that the ‘macro’ factors, which undoubtedly move markets (possibly dramatically) in the short term, ultimately have limited impact on the long-term outcomes for individual businesses and thus for stock market returns over the long term.

As ever this scenario provides a good hunting ground for stock pickers who can look past the immediate noise and focus on the long-term opportunities available from individual businesses, crafting a balanced portfolio of such opportunities.

. . . . . . . . . . .

UK

(compare UK funds here, here, here and here)

Dan Nickols and Matt Cable, fund managers, Rights and Issues, 20 February 2024

The Russian invasion of Ukraine in early 2022 sparked a surge in inflation around the world that has dominated markets ever since. As the direct effects of energy prices fed through into goods, services and wages, central banks reacted by sharply tightening monetary policy. This resulted in interest rates that have not been seen since before the financial crisis a decade and a half ago.

At the macro level this led to the market questioning whether monetary policy could tame inflation without causing a painful recession. For individual companies it was a test of both pricing power (the ability to pass on inflation to customers) and balance sheet strength (through the cost of debt finance). Meanwhile the implied market ‘discount rate’, or cost of equity, caused valuations to decline, especially in the case of higher-growth companies whose cash- flows are assumed to be higher further into the future. The combination of these factors has resulted in both weak returns and heightened volatility in markets around the world.

The UK has been no exception, with the FTSE All-Share index experiencing a series of dramatic swings throughout the year as market sentiment shifted from relative optimism to doom and gloom and back again. While it is clearly too early to definitively say that this phase is over, it is reassuring to note that global inflationary indicators were starting to look more benign towards the end of the year. As a result, the outlook for interest rates has started to come down while economic activity seems to be holding up. This combination suggests an increasing chance that inflation can be bought under control without the need for a damaging recession.

Under these circumstances it is no surprise that equity markets performed well into the end of the year, with the FTSE All-share index ultimately posting a positive return for 2023 as a whole.

. . . . . . . . . . .

Sir Laurie Magnus CBE, chair, City of London, 16 February 2024

The tightening of monetary policy in 2022 and 2023 by the world’s leading central banks is expected to lead to a further reduction in the rate of inflation. A significant slowdown in economic activity, however, appears unlikely as consumers continue to draw down excess savings from the Covid lockdowns and employment statistics remain relatively buoyant. Although it is generally accepted that interest rates have now peaked, market expectations for cuts may be exaggerated given continuing wage increases and “quantitative tightening” by central banks. There are also considerable risks resulting from the current war in the Middle East, with a widening conflict, such as the recent hostilities in the Red Sea area, raising the prospect of further political and economic turbulence including the disruption of supply chains and destabilisation of energy markets, as observed already in the Ukraine conflict.

UK equities remain attractively valued relative to overseas equivalents. This has encouraged further takeovers of UK companies by private equity firms and foreign businesses, including the acquisition of Round Hill Music Royalties Fund from the Company’s portfolio. There has subsequently been a bid in January 2024 for Wincanton, another of City of London’s investee companies, from a large French private company. More takeovers can be expected while the discounted value of UK equities relative to global peers persists. Although the prospect of political change in the UK may weigh on equity valuations until after the general election, the compelling dividend yields from many companies effectively “pay investors to hold on” and should help to mitigate the downside risks of current uncertainties.

. . . . . . . . . . .

Andrew Bell, chair, Diverse Income, 13 February 2024

There is a well-known pictorial illusion which, depending upon the viewer’s perspective, can look like a duck or a rabbit (Google “duck or rabbit” to see). For much of the second half of 2023 this was what faced investors. Inflation rates were falling sharply, and interest rates had reached a plateau, but was the reason that higher rates were leading economies towards a recession (the hard landing fear) or that inflation had been more transitory than was diagnosed in 2022 so that its elimination did not require a recession and economies could rebound as it fell?

Either way, expectations have grown that interest rates have peaked in most major economies and will begin to decline in 2024. At the time of writing, it remains unclear whether this will occur to revive depressed economies or to reward declines in inflation in economies experiencing modest or weak growth. One scenario would argue for defensively hunkering down, the other in favour of looking forward to better times. Our strategy is adaptable to either. Diverse Income’s manager aims to invest in well-managed, soundly financed companies which prosper in normal times but are able to use their cash flows and access to capital markets to gain strength in tougher conditions.

Partly as a consequence of the long-term structural factors that have contributed to the derating of the UK market, one particular feature of the past year has been the opposite directions taken by the large-capitalisation companies and the rest of the market, continuing the trend seen in 2022. In late October 2023 the large caps were little changed, while the mid and smaller capitalization stocks were down 5-10% and AIM stocks down almost 20%. When a market sustains a prolonged period of disengagement by investors, almost inevitably the less liquid parts suffer the most, a particular headwind for our manager’s investment approach, which by design invests across the size spectrum. The consequence of recent shifts within the market is that the valuation gap in favour of smaller companies is as significant as it has been for many years.

More encouragingly, since late October, when there were tangible signs of the UK’s inflation performance improving (alleviating fears of a further series of interest rate rises), the ensuing market recovery has been led by smaller and mid-sized companies. If this trend continues, the Company’s exposure to smaller companies can be expected to become a tailwind and see better rewards in the coming year, on the back of improved earnings performance (as the cost and demand hurdles abate) and a greater willingness of investors to give credit for the fundamental performance of smaller companies.

Read Research NotePlease click here to subscribe to QuotedData’s research which can be accessed for free.

Click here for the full macro commentary for March >

The legal bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.

Leave a Reply

You must be logged in to post a comment.