Jul

2023

The funds we own to navigate topsy-turvy markets

DIY Investor

18 July 2023

Saltydog Investor takes stock of volatile financial markets and explains why its portfolios are still predominantly invested in cash.

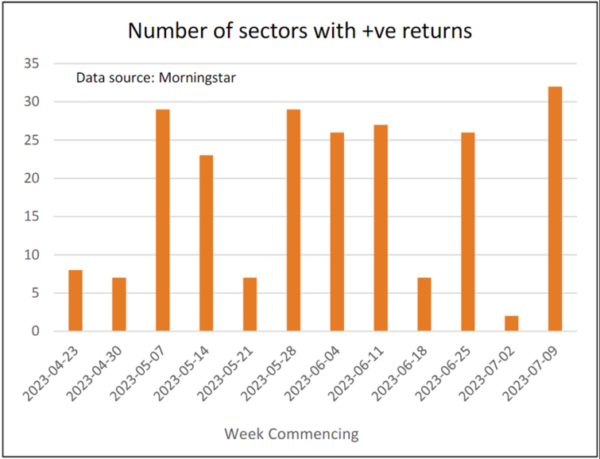

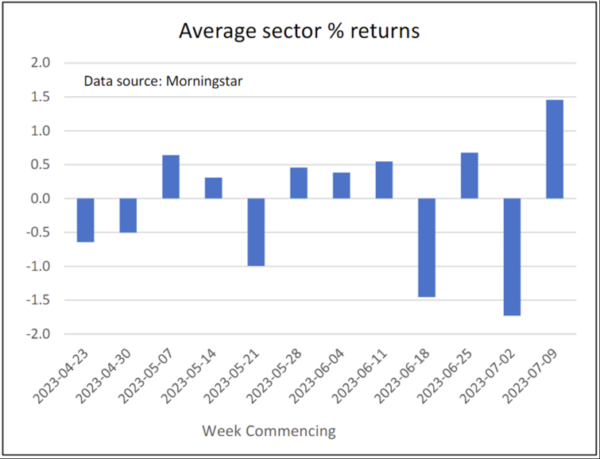

With the recent market volatility, it is not surprising that the number of sectors making gains each week has varied quite significantly. However, the swings in performance across all sectors over the past four weeks has been quite extraordinary.

In the penultimate week of June, only seven of the 35 sectors that we track rose in value. They were mainly sectors investing in fixed interest investments (UK Gilts, UK Index-Linked Gilts, £ Corporate Bonds, and Global & Global Emerging Market Bonds), along with the two money market funds. Latin America was the only sector investing in equities showing a one-week gain.

The following week was much more encouraging, with 26 sectors making progress, but the recovery was relatively short-lived. Two weeks ago only two sectors went up: Short Term Money Markets and Standard Money Markets. That is the worst week that I can remember for a long time.

What we also found concerning was that when most sectors were falling, the average losses tended to be greater than the average gains when they were rising. It is not easy to make money when the gains built up over a number of weeks can easily be wiped out in just one poor week.

Fortunately, last week we saw another rebound with 32 sectors increasing in value. Only the Latin America, India/Indian Subcontinent, and Healthcare sectors fell.

The three largest holdings in our portfolios are the Royal London Short Term Money Market fund, L&G Cash Trust fund, and abrdn Sterling Money Market fund. As you would expect, they have all gone up in each of the last four weeks.

Both portfolios are also holding the MI TwentyFour AM Monument Bond fund from the Specialist Bond sector. We picked this fund because it had a low volatility ranking, and we hoped that it would be resilient if market conditions turned against us. Well, this has been its first proper test and it has behaved just as we would have hoped. It has also gone up in each of the last four weeks.

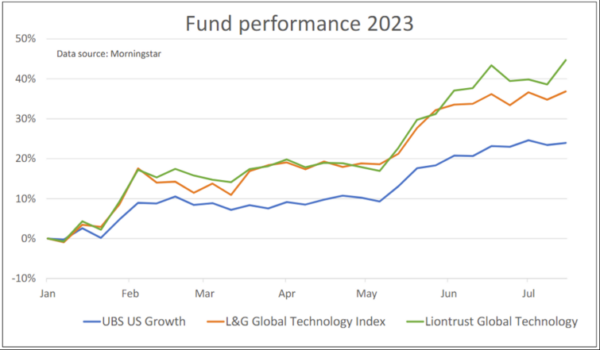

The US and Technology funds that we are holding have been more up and down, but after last week’s recovery appear to be heading back in the right direction again.

At Saltydog Investor, we try to stick to reporting on what has actually happened to stock markets around the world and how it has affected the funds that we monitor. We are often asked why things have happened and what will happen next, but the honest answer is that we probably do not know and would be wary of anyone who says that they do.

This weekend, I was asked to explain why the FTSE 100 rose 2.4% last week having fallen by 3.6% the week before. The easy answer is that there were more buyers than sellers for the stocks that make up the index last week, lifting prices, but the opposite was true the week before.

What drives those movements is much harder to establish. For what it is worth, and I may well be wrong, I believe that the main force affecting markets currently is what is happening to interest rates, especially in the US.

Following the suspension of the US debt ceiling at the beginning of June, US stock markets rallied, lifting stock markets all around the world. There were also signs that inflation had started to come down, especially in the US, and last month the Federal Reserve decided to leave interest rates unchanged after 10 consecutive rises over 15 months.

When the minutes from the latest Federal Open Market Committee meeting were released, they revealed that although the final decision was unanimous there had been some disagreement among the members. Most expect that at least one more rate hike will be needed, and I think that this is what initially spooked the markets a couple of weeks ago.

The situation was then made worse when the ADP US jobs data came in suggesting that US companies had employed nearly 500,000 new workers in June, more than double what most analysts were expecting. High employment means that pay rises are likely to be higher, leading to higher inflation, which strengthens the argument that the Fed should increase interest rates further.

However, the government non-farm payroll data was then released showing 209,000 new hires compared with a 225,000 forecast. Maybe markets had overreacted.

The ‘good’ news last week was that the latest figures from the Bureau of Labor Statistics show that US inflation is now running at an annual rate of 3%, down from 4% in May and over 9% this time last year. It is definitely heading back down towards the government’s 2% target. Perhaps another interest rate increase will not be necessary, or could be postponed.

If I am right, and this is what has been causing the latest movements in the stock markets, then it just goes to show how finely balanced they are and how far they can move on a relatively small change in sentiment. I would therefore expect conditions to remain volatile and so I am comfortable knowing that both demonstration portfolios are predominantly in cash or money market funds.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com

Leave a Reply

You must be logged in to post a comment.