Nov

2023

The Asian century

DIY Investor

18 November 2023

Failing to invest in Asia means omitting half the global economy from your portfolio…by David Kimberley

“History has turned a corner,” writes Kishore Mahbubani in his 2021 book The Asian 21st Century. “The era of Western domination is ending. The resurgence of Asia in world affairs and the global economy, which was happening before the emergence of Covid-19, will be cemented in a new world order after the crisis. The deference to Western societies, which was the norm in the nineteenth and twentieth centuries, will be replaced by growing respect and admiration for East Asian ones. The pandemic could thus mark the start of the Asian century.”

Mahbubani was a Singaporean diplomat for over three decades. He also seems to have something of a bugbear about the West’s role in the world. Considering both of those points, it’s probably worth taking his forecasting with a pinch of salt. Nonetheless, the increasingly dominant role of Asia in the global economy means you would be hard-pressed to argue against having some exposure to the continent’s companies in your portfolio.

Consulting group McKinsey estimates that Asia’s share of nominal global GDP will rise to almost 50% by 2040, up from 37% today and less than 20% in 1970. As you can probably infer, that also means Asia looks set to be the primary engine of global economic growth, in part because of a commensurate increase in its level of consumption. As recently as 2000 the continent contained only 20% of the global consumer class. That figure had risen to 50% in 2020 according to the Brookings Institute, a US think tank, which estimates the proportion will increase again to approximately 80% by the end of this decade.

However, demography is not destiny and simple passive exposure that may prove successful in developed markets can often deliver poor returns in Asia. China is a good example of this. The country’s economy has more than doubled in size over the past decade. But in the ten-year period up to 07/11/2023, the MSCI China Index delivered annualised returns of just 1.76%. There were multiple reasons for this discrepancy but a key one is common to many stock markets across Asia, namely a high proportion of state-owned enterprises that often allocate capital poorly and place shareholder returns second to wider government policy goals. A knock-on effect of this is that passive exposure can mean you aren’t actually investing in many of the themes that can deliver superior returns, like a rising consumer class, due to the outsized weightings in indices to these SOEs.

This is one of the key factors driving the differentiated approach the managers of Schroder Asian Total Return (ATR) take to the market. Managers Robin Parbrook and King Fuei Lee look to invest in quality companies from across the region. They believe that indices do not provide a good indication as to why you should be invested in Asia and so they don’t make investments based on them. Nor are they concerned as to where a stock is listed, so long as its primary revenue drivers are in the continent. As you can infer, that also means investments are not made based on a stock’s weighting in an index—the managers only think about the absolute returns an investment can deliver. ATR is also unusual in that it makes use of derivatives, typically to reduce market exposure at times when the fund managers see risks of market drawdowns.

This is one of the key factors driving the differentiated approach the managers of Schroder Asian Total Return (ATR) take to the market. Managers Robin Parbrook and King Fuei Lee look to invest in quality companies from across the region. They believe that indices do not provide a good indication as to why you should be invested in Asia and so they don’t make investments based on them. Nor are they concerned as to where a stock is listed, so long as its primary revenue drivers are in the continent. As you can infer, that also means investments are not made based on a stock’s weighting in an index—the managers only think about the absolute returns an investment can deliver. ATR is also unusual in that it makes use of derivatives, typically to reduce market exposure at times when the fund managers see risks of market drawdowns.

The result is that ATR offers a highly differentiated portfolio for investors in Asia. For instance, the trust is currently substantially underweight China and overweight Taiwan compared to the MSCI AC Asia Pacific Ex-Japan Index and has exposure to companies listed in Vietnam and the US, which aren’t included in the index at all. The managers also held short positions, equal to close to 11% of the portfolio, at the end of September.

ATR’s focus on quality companies means it has exposure to some of the key growth themes that Asian companies offer. Although the distinction is not always clear cut, there is a rough divide in this area between more developed economies in the region, such as Korea or Taiwan, and those that are going through a process not dissimilar to the one China has gone through over the past three decades, with increasing urbanisation, infrastructure investment, and demand for consumer goods and services. Vietnam, Indonesia, India, and the Philippines are arguably good examples of this.

Regarding the former, many opportunities are akin to those available in the US, with firms selling advanced products and services to a global client base. For example, Taiwanese semiconductor manufacturers, like TSMC or MediaTek, have products that are used in technology hardware globally.

The same is true of electronics and appliance manufacturer Samsung Electronics, which is second only to Apple in terms of smartphone sales globally. Other companies, like Tencent and NetEase, operate across a swathe of sectors, whether it be video games, cloud services, e-commerce, or financial services. It is worth noting that many of these companies are global leaders in their fields and often have no meaningful analogue elsewhere in the world. TSMC is probably the best example of this as it has the most advanced semiconductor manufacturing capabilities of any company globally.

The other area for growth is more domestically oriented and typically revolves around new consumers either entering a specific market for the first time or spending more on goods that they already use. For example, Indian financial services group ICICI Bank has delivered strong returns in recent years, in part because of the hundreds of millions of Indians that have opened bank accounts for the first time over the past decade. Similarly, insurance group AIA is benefitting from the growing number of Chinese consumers who are increasing their spending on financial services by buying life and medical insurance.

These are some of the key trends that you see in the Schroder AsiaPacific (SDP) portfolio, albeit with the important caveat that this is not the result of a top-down investment process. Instead, SDP manager Richard Sennitt and his co-manager Abbas Barkhordar use a bottom-up approach to look for companies that can produce superior returns on capital and which have the ability to sustain a market-leading position for the long term.

These are some of the key trends that you see in the Schroder AsiaPacific (SDP) portfolio, albeit with the important caveat that this is not the result of a top-down investment process. Instead, SDP manager Richard Sennitt and his co-manager Abbas Barkhordar use a bottom-up approach to look for companies that can produce superior returns on capital and which have the ability to sustain a market-leading position for the long term.

You can see how that process has influenced the structure of the portfolio today. The managers had invested in some of the more domestically-oriented growth that firms like ICICI Bank offer. However, valuations for these companies rose to the point where they started to look expensive, meaning they cut back the trust’s exposure to some of the more expensive Indian stocks. SDP’s portfolio is now more weighted towards financials and technology, both of which have faced headwinds from recent economic conditions, but which the managers believe still offer compelling long-term potential.

SDP is not focussed on generating income, so even though the trust has generally paid out the revenue it generates to shareholders, those looking for dividends may find the trust’s stablemate Schroder Oriental Income (SOI) a more attractive proposition. We appreciate that amongst some investors, there is a sense that an Asian company paying dividends is an oxymoron. Given the low payout ratios in some countries, most notably Korea, this is somewhat understandable. However, taken as a whole, the idea that income investors should not be invested in Asia is not supported by the facts.

Indeed, there is even an argument to be made that income investing in Asia is a more attractive option than other markets like the UK or Europe. Partly that’s because the region offers diversification benefits. But the key reason is that, unlike some of the more growth-oriented tech firms in the US, EU, and UK, many of Asia’s leading technology companies pay sizeable, growing dividends. For example, SOI’s largest holdings at the end of September were TSMC and Samsung Electronics, with the trust also maintaining a sizeable overweight position in the technology sector. The former company has been a holding for over a decade, reflecting the fact that TSMC has been consistent in delivering both earnings and dividend growth for shareholders in that time. The trust also maintains overweight positions to financials and real estate, both sectors that investors are likely to associate more with dividend investing.

Income investing is also one of the key reasons that Japan is starting to appear more attractive again to investors. Companies in the country have a history of hoarding cash, as well as poor corporate governance practices.

Income investing is also one of the key reasons that Japan is starting to appear more attractive again to investors. Companies in the country have a history of hoarding cash, as well as poor corporate governance practices.

But things have changed dramatically over the past decade because of reforms enacted by the former prime minister Shinzo Abe. Those have put companies in a position where they have been compelled to increase dividend payouts to shareholders, as well as make significant changes to their corporate governance practices. The current prime minister, Fumio Kishida, is continuing many of these changes. For example, he has pledged to set up a special economic zone to make it easier for foreign asset management groups to set up in Japan. He is also pushing for reforms to pensions and labour laws.

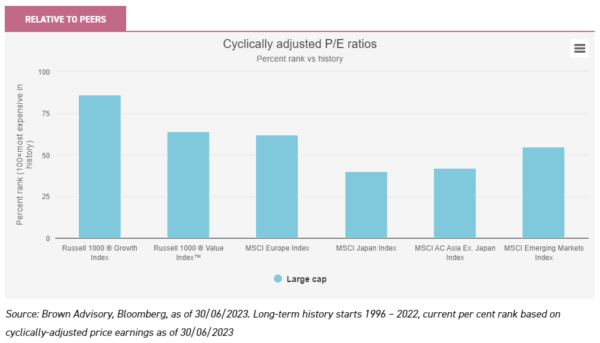

There are other reasons to be optimistic about Japan. One is that valuations are still low relative to both peers and the historical average. For example, looking at data from 1996 – 2022 and taking the cyclically-adjusted P/E ratio at the end of June 2023, the MSCI Japan Index was trading at a lower level than the US, European, emerging market, and Asia ex-Japan indices. It was also trading at 40% of the levels it was at when it reached its all-time high in that 1996 – 2022 period. Inflation has also been lower than in other parts of the world in Japan and has even been welcomed to some extent given policymakers have spent years attempting to generate the phenomenon in order to stimulate the economy. The yen is comparatively cheap today too, making Japanese exports more attractive. Finally, Japan is well-positioned to benefit from the growing middle class in Asia.

Schroder Japan (SJG) offers investors one way to take advantage of these opportunities. Manager Masaki Taketsume takes a more value-driven approach to markets, using in-house fundamental research to identify companies where they believe there is a mismatch between their market price and what the company is really worth. Corporate governance also plays a role in this process and Masaki believes that companies which have been proactive in responding positively to corporate reforms by, for example, improving their return on equity, have been rewarded for doing so by the market. This year SJG has been tilted more towards the domestic economy via exposure to small- and mid-cap stocks. However, global firms, like Toyota or Hitachi, also have sizeable weightings in the portfolio as well given their attractive valuations and potential changes through management efforts.

Japan’s potential is also another reminder of that banal quip that economic growth is not tied to stock market performance. The country’s ageing, declining population is hardly a positive factor, but they are not stopping public companies from performing well, just as China’s meteoric GDP growth was not really a boon for passive investors. Nor is Japan unique, while Japan’s turning around to an inflationary era after decades of deflation may provide interesting opportunities. Although the country is perpetually singled out for it, Taiwan, South Korea, Singapore, and now China are all suffering from a similar malaise, of ageing populations and lower GDP growth. This is why the Brookings Institute notes that the next decade is likely to see South Asian countries, most notably India, as the primary drivers of economic growth in the continent and the main contributors to that increase in the number of people in the consumer class.

Japan’s potential is also another reminder of that banal quip that economic growth is not tied to stock market performance. The country’s ageing, declining population is hardly a positive factor, but they are not stopping public companies from performing well, just as China’s meteoric GDP growth was not really a boon for passive investors. Nor is Japan unique, while Japan’s turning around to an inflationary era after decades of deflation may provide interesting opportunities. Although the country is perpetually singled out for it, Taiwan, South Korea, Singapore, and now China are all suffering from a similar malaise, of ageing populations and lower GDP growth. This is why the Brookings Institute notes that the next decade is likely to see South Asian countries, most notably India, as the primary drivers of economic growth in the continent and the main contributors to that increase in the number of people in the consumer class.

Does that mean Mahbubani was correct and we are on the cusp of entering the ‘Asian century’? Time will tell whether the sort of power shift that he seems to want will actually take place. Maybe it will, maybe it won’t. What is harder to deny is that to not invest in Asia today is to omit a huge amount of the world’s economy from your portfolio, whether that’s the more global, tech-driven growth story of companies like MediaTek or the income that a trust like SOI offers. Indeed, for the equity investor, Mahbubani’s claim that the world will increasingly come to respect East Asian countries seems odd. We already do.

Disclaimer

This is a non-independent marketing communication commissioned by Schroder Investment Management. The report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on the dealing ahead of the dissemination of investment research.

Leave a Reply

You must be logged in to post a comment.