Jan

2023

The advantage of high dividend stocks in a stagflationary environment

DIY Investor

14 January 2023

While historically, sectors such as utilities and energy have generally provided the best examples of high and stable dividend paying companies, today we are able to find these stocks in most sectors – by Paola Toschi and Vincent Juvyens

In the fourth quarter of 2022, two things began to seem almost certain:

- Economic growth will continue to decelerate with some countries entering a recession

- Inflation will remain well above central banks targets

The risk of recession has increased in several regions as a result of higher inflation, surging energy costs and rising interest rates. Central banks have radically shifted their tone in response to the unprecedented rise in prices, becoming more hawkish and clearly declaring their intention to fight inflation, even at the cost of a recession. While this environment is challenging for equity markets, we think certain equity factors, such as “high dividend1 ”, should be more resilient than others. We explore why high dividend paying stocks may be attractive in periods of stagflation.

Resilience during recessions

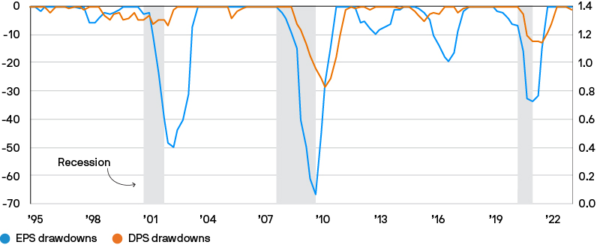

In recessionary periods, it is common for equity performance to turn negative. Earnings-per-share tend to drop as consumers and businesses rein in discretionary spending, and margins are eroded as companies try to stay competitive. However, there is evidence that dividends are more stable than earnings when recessions bite.

Exhibit 1: MSCI World earnings and dividends drawdowns

% drawdown from rolling 2-year high, EPS and DPS

Source: Bloomberg, J.P. Morgan Asset management. Data as at 30 September 2022.

Dividends hold up because high dividend paying companies are reluctant to cut their dividend, even in the face of falling earnings, preferring to use their reserves to maintain payouts if they need to. As a result, payout ratios – dividends as a proportion of earnings – tend to rise in recessionary periods.

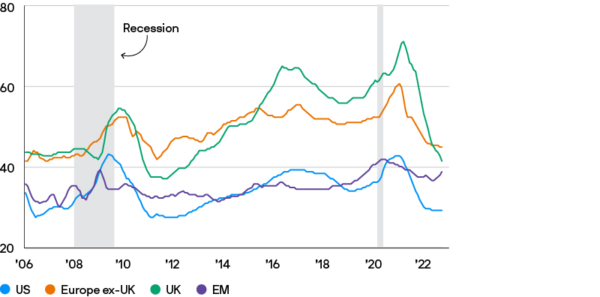

As we are likely approaching the start of a new recession, it is notable that payout ratios are currently at particularly low levels. This is because dividends have just started to recover from the Covid crisis, and implies that companies could accept higher than usual earnings weakness before deciding to cut dividends.

Companies that manage to maintain a stable (or even growing) dividend in all circumstances (also known as dividend aristocrats) tend to outperform in recessionary periods. While historically, sectors such as utilities and energy have generally provided the best examples of high and stable dividend paying companies, today we are able to find these stocks in most sectors.

Exhibit 2: Dividend payout ratios

%, three-month rolling average

Source: FTSE, MSCI, Refinitiv Datastream, Standard & Poor’s, J.P. Morgan Asset Management. US: S&P 500; Europe ex-UK: MSCI Europe ex-UK; UK: FTSE All-Share; EM: MSCI Emerging Markets. Dividend payout ratio shows 12-month trailing dividend per share divided by 12-month trailing earnings per share. Periods of “recession” are defined using US National Bureau of Economic Research (NBER) business cycle dates. Past performance is not a reliable indicator of current and future results. Data as of 30 September 2022.

Offsetting inflation

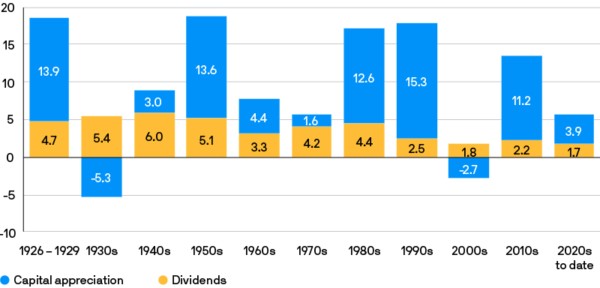

While recessionary periods are generally associated with falling/low inflation, this is not the case this time round. The energy crisis triggered by the war in Ukraine and Covid-related supply chain disruptions have raised the risk of stagflation, an economic situation that we haven’t experienced since the 1970s. During that decade, dividends accounted for two thirds of the S&P 500’s total return, compared to a third of total returns on average over the last century.

Inflation is not always an enemy of companies’ profitability. Earnings can often grow if inflation is a sign of a robust economy, for example. However, if there is an extreme increase in inflation, as we’ve seen recently, earnings and economic momentum can both suffer. As we previously mentioned, in this scenario high dividend paying companies may be attractive as they tend to increase their payout ratio in order to keep their dividend steady.

Exhibit 3: S&P 500 returns: Capital appreciation and dividends

%, three-month rolling average

Source: Ibbotson, Refinitiv Datastream, Standard & Poor’s, J.P. Morgan Asset Management. Past performance is not a reliable indicator of current and future results. Data as of 17 October 2022.

We observe that high dividend paying companies generally enjoy inelastic demand for their goods and services, giving them a relatively higher degree of pricing power, which is crucial at a time of high inflation. This means that when inflation increases, they can more easily pass on higher prices, and when a recession occurs, they can at least maintain their selling prices without hurting demand for their goods and services. The result is more resilient cash flows in periods of stagflation.

At the moment, we believe sectors such as banks, healthcare and even software contain a number of recession proof dividend payers. Indeed software companies’ revenue mainly comes from yearly license renewals, the price of which rises with inflation. Even in a recession, individuals and companies will still need to use their computers and hence are unlikely to cancel their software licenses.

Summary

The onset of stagflation will present a difficult environment for equity investors, but dividend paying stocks may offer an area of resilience. Interestingly, the valuation disconnect between high yielding and low yielding stocks is beyond the 5th percentile2 , implying high dividend companies are trading at a significant discount and therefore offer an attractive entry point. Given the relatively low payout ratios we currently see globally, we also think high dividend paying stocks are well placed to maintain healthy dividends despite the tough economic backdrop.

1 We define high dividend companies as those with long track record of dividend growth, capacity to grow future dividends, sustainable high payouts, strong free cash flow generation, resilient business and financial models and finally dividend yields that are 1-1.5% higher than the index average dividend yield.

2 Source: J.P. Morgan Asset Management as of 26 August 2022. Valuation spreads are calculated by subtracting the median valuation of stocks in the lowest ranked quintile from the median valuation of stocks in the highest ranked quintile and then dividing this by the median valuation of the market. Data starts from 31/12/1994. 1st percentile is cheap, 100th is expensive. The universe is the global investable universe.

The Market Insights program provides comprehensive data and commentary on global markets without reference to products. Designed as a tool to help clients understand the markets and support investment decision-making, the program explores the implications of current economic data and changing market conditions.

For the purposes of MiFID II, the JPM Market Insights and Portfolio Insights programs are marketing communications and are not in scope for any MiFID II / MiFIR requirements specifically related to investment research. Furthermore, the J.P. Morgan Asset Management Market Insights and Portfolio Insights programs, as non-independent research, have not been prepared in accordance with legal requirements designed to promote the independence of investment research, nor are they subject to any prohibition on dealing ahead of the dissemination of investment research.

This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment from J.P. Morgan Asset Management or any of its subsidiaries to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical and for illustration purposes only. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with their own financial professional, if any investment mentioned herein is believed to be appropriate to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not reliable indicators of current and future results.

J.P. Morgan Asset Management is the brand for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide.

To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our privacy policies at https://am.jpmorgan.com/global/privacy.

Brokers Latest » Commentary » Equities » Equities Commentary » Equities Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.