Dec

2019

Technology – instinct is the nose of the mind: Thoughts of Saltydog Investor

DIY Investor

29 December 2019

I do not trust my instinct as much now as when I was younger. It is well known that our brains lose many thousands of neurons each day; but where they go I have no idea, but disappear they do.

Just ask my wife, Whatshername? Nevertheless, this greatly depleted brain of mine still has the instinct to back technology as a safe place to invest my shekels for future gain.

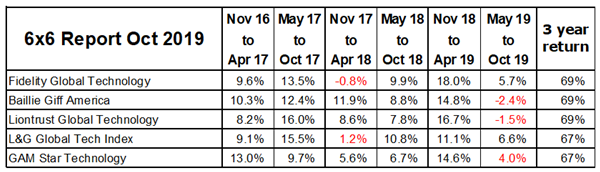

Earlier in the year we produced our first 6×6 report, this is where our algorithm looks for funds that over the last three years have achieved a 5% gain every six months.

‘our algorithm looks for funds that over the last three years have achieved a 5% gain every six months’

We have now run and published the results three times. We run it on a three-monthly basis looking for developing or receding trends in sector momentum.

Richard’s report in the last newsletter showed that no single fund had achieved ‘nirvana’ this time, but sixteen had still managed it five times over the last three years. Quite an achievement!

It is worth noting that despite the lies and misinformation being sprayed around by politicians in the fervour of their election campaign:

- In the UK, investment in Technology companies and research, hit record highs in 2019, almost double the amount invested in 2016, the year of the infamous referendum.

- Remarkably this UK investment accounted for almost half of the total investment in Technology for the whole of the EU.

Fortunately, this investment is mainly in the technologies of the future from where breakthroughs in productivity will originate, it does not come from reinventing the old.

Flight was a revolution, but it is not dramatically different whether you use propellers or a jet engine.

Steam engines, fuelled by wood or coal, created new ways to harness energy; oil and the combustion engine just improved the efficiency.

The changes that are taking place today in computing speeds using quantum mechanics and artificial intelligence are entirely different, and are in themselves the revolution.

The high performing funds at the top of the 6×6 report include many familiar funds from the technology sector. Here are the top five:

For a more extensive list, here’s a link to the October 6×6 Report.

The funds shown above are mainly invested in technology companies of today, but they are by default also investing in the future.

They own shares in the FANG businesses, which in turn have been buying up the high-tech start-up operations of tomorrow.

These are the companies developing quantum computers, robotics, 3D printers, desalination plants, solar energy conversion, biomarker analysis, and the ubiquitous smart phone, to name but a few (I have run out of steam).

There are some that say if you are developing a new idea or product, if it does not involve your mobile phone, then forget it!

There is one particular fund that appears in the Saltydog specialist sector which seems to focus more in generalised new technology start-ups. It is called Smith & Williamson Artificial Intelligence, and I have been invested in this fund with varying amounts since March 2018.

‘Having read all of the manifestos, I probably have less faith in the politicians than ever before’

It is a volatile fund and reacts to the sterling/dollar relationship – nevertheless it is still up 34%.

I mention this fund only because of its policy of chasing and investing in the new future technologies and, even though it does not feature as a leading fund in the 6×6, it could still be a good place to be, owing to the astronomical speed of these new developments.

However, I do admit that today a better return might be had from the above more established technology funds. For me it is a curiosity investment, a wait and see approach.

Having read all of the manifestos, I probably have less faith in the politicians than ever before (and that’s saying something).

Hopefully in a few weeks we’ll at least end up with a government that is able to govern, ending the stalemate of recent years.

I leave you with this thought:

The year is 2119, and the UK is celebrating a century of visits to Brussels by the British Prime Minister asking for an extension to the Brexit deadline. The origin of this annual ritual is long forgotten and buried in the clouds of antiquity.

Best wishes and good investing,

Douglas.

Founder & Chairman

Leave a Reply

You must be logged in to post a comment.