Feb

2022

Technology Enablers: ‘Picks and shovels’ in the technology gold rush

DIY Investor

19 February 2022

Ross Teverson, Colin Croft, and Matthew Pigott, portfolio managers of Jupiter Emerging & Frontier Income PLC, argue that investors may be better off looking beyond the obvious names in their search for those companies that are best positioned to drive, and to benefit from, the major technological changes playing over the coming years.

Ross Teverson, Colin Croft, and Matthew Pigott, portfolio managers of Jupiter Emerging & Frontier Income PLC, argue that investors may be better off looking beyond the obvious names in their search for those companies that are best positioned to drive, and to benefit from, the major technological changes playing over the coming years.

A lot to be excited about (and a cautionary tale)

Digital disruption, ubiquitous high-speed telecommunications, migration to the cloud, electric vehicles, and the promise of autonomous driving – as consumers of rapidly evolving products and services, there is much to be excited about. From a sustainability perspective, the potential that these new technologies present for greater productivity with lower environmental impact is also considerable. And for investors this pace of change creates a multitude of investment opportunities.

However, it also brings with it risks, including the risk of failing to identify the ‘winners’ from these developments. This risk is amplified by the very high prices that investors are currently paying for shares in those companies perceived to be the most obvious beneficiaries of technological change.

At the turn of the millennium, investors were understandably excited about 3G telecommunications. Mobile phones were becoming more affordable and 3G promised to deliver fast, reliable internet access straight into the palms of consumers. Financial analysts were forecasting widespread take-up of new handsets and services and this excitement helped to drive the valuations of ‘obvious’ beneficiaries, such as Vodafone, Nokia, and RIM (makers of the BlackBerry), to extremes.

‘For investors this pace of change creates a multitude of investment opportunities’

Today, 22 years later, investors who bought Vodafone at its peak in March 2000 have experienced a total return of -20% (dividends have helped partially cushion the blow of a -79% fall in the share price). However, this dismal return makes Vodafone the best returning stock of the three by a considerable margin. It is not that analysts overestimated the rate at which consumers would embrace new technologies – if anything, analysts’ forecasts proved too conservative. So, what went wrong? For one, analysts underestimated the level of competition and disruption in a market where so many players were chasing the same opportunities. Investors had bought into a narrative at the expense of ignoring the valuation they were paying to get exposure to that story.

Of course, a handful of stocks did go on to become exceptional long-term performers, but the experience of Vodafone, Nokia and RIM should serve as a cautionary tale, and prompt investors to consider whether there are parallels to be drawn with some of the high valuations being paid for certain stocks in today’s market. It also begs the question as to whether there may be another way to get exposure to technological change with a higher degree of confidence that we, as investors, will actually profit from it. Our preferred method is through investing in ‘technology enablers’: companies providing some of the key components and services that make new technologies possible.

The semiconductor leaders enabling technological change

Over the past two decades, many technology enablers proved to be excellent investments, particularly semiconductor manufacturers, such as Samsung Electronics, the world’s leading memory chip manufacturer, and Taiwan Semiconductor Manufacturing Corporation (TSMC), the world’s largest contract logic chip manufacturer.

Neither Samsung nor TSMC have been immune from cyclicality in equity markets, but from March 2000 to today, shareholders have been rewarded with a remarkable compound total return of 14.8% and 14.6% per annum respectively.

Moreover, current share prices look undemanding in our view; they value Samsung Electronics at a level 11x its forecast earnings for 2022, and TSMC at 22x its own 2022 forecasted earnings. These are valuations we’re happy to pay to access the long-term growth potential each company represents. Both companies have net cash on their balance sheets and the financial capacity to reinvest for growth, while, at the same time, paying dividends (one of the drivers behind the impressive total return figures above).

‘Shareholders have been rewarded with a remarkable compound total return of 14.8% and 14.6% per annum respectively’

Both Samsung and TSMC enjoy very high technological barriers to entry. SMIC, a Chinese company that listed in 2003 promising to become ‘China’s TSMC’ demonstrates that this is not an industry where competitiveness can be achieved simply by investing vast sums of cash. From 2004 to 2020, SMIC invested US$23.6bn in a bid to close the gap, but is forecast to have generated only US$5.4bn in revenue in 2021, making it less than one tenth of TSMC’s size.

TSMC’s scale and intellectual property enables it to continue pulling away from would-be contenders. Similarly, Samsung Electronics (along with SK Hynix and Micron, which together form an effective oligopoly in DRAM semiconductor memory chips) has a manufacturing capability that would be almost impossible to replicate from scratch.

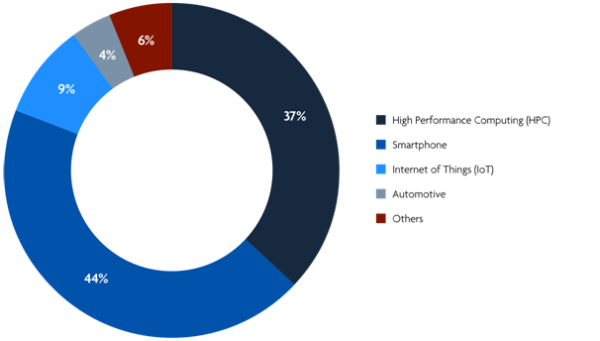

What makes these companies even more compelling as a means of investing in technological change is that they supply to such a broad range of customers that they are positioned to capture the benefits of rising spend on emerging technologies, regardless of which companies ultimately win the battle for the end user. For example, TSMC is the principal manufacturing partner for Apple’s handset chips but also supplies to Mediatek, the world’s largest supplier of chips for Android-based handsets. Even Intel, once the global technology leader in semiconductor production, has committed to increase its outsourcing to TSMC because it is unable to match TSMC’s pace of technology migration.

TSMC’s Revenue Breakdown by Product Segment

Source: Company 3Q2021 results presentation

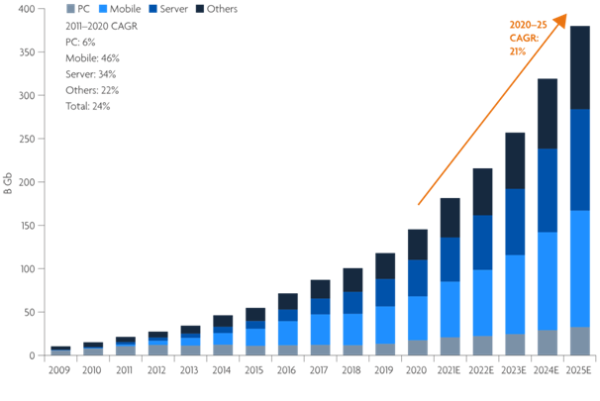

Samsung’s DRAM memory chips are used in everything from PCs to servers, to smartphones and electric vehicles. DRAM is effectively the high-speed, short-term memory of a device and is essential for manipulating and moving data quickly. As society processes and consumes ever more data, whether for streaming videos or enabling driver assistance aids in a vehicle, demand for DRAM will rise. We do not need to predict exactly what end markets will look like, or which products or services will ultimately win consumers’ hearts, minds and wallets, to be confident that demand for DRAM will be higher in the future than it is today.

Aggregate Global DRAM Demand

Source: Gartner, company reports, Bernstein estimates and analysis

Powering the electric revolution

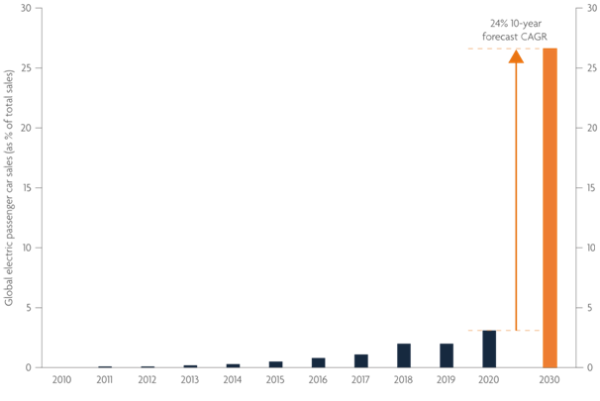

A similar argument applies to the incredible growth in electric vehicles (EVs) and the promise of autonomous driving capabilities. EVs will almost certainly displace internal combustion engine (or ICE) passenger car sales in the next two decades; it will happen first in markets where there is strong political commitment, such as the UK where the sale of new ICE cars will be outlawed in 2030. However, we are close to a point where EVs offer a more compelling cost and performance proposition to consumers, even in markets without any policy support.

In 2020, EVs comprised 4.6% of global automotive sales; the share will have to get close to 100% to achieve net zero targets, so this is a market where penetration could rise twentyfold over the next 30 years. It is no surprise that investors will pay higher valuations to invest in companies having the most obvious exposure to growth of that magnitude – such as Tesla, the shares of which, at the time of writing, value the company at around 99 times its expected earnings for 2022.

However, the most obvious way to play a trend does not necessarily offer the best risk-reward balance for investors; early automotive history is littered with promising companies that did not survive the cut-throat competition of a market whose growth prospects were so obvious as to attract countless new entrants.

Global Electric Passenger Car Sales

Source: International Energy Agency and Roland Berger

In the EV industry, the most threatening ‘new entrants’ are the ‘old auto’ companies such as General Motors (GM), Hyundai, and Volkswagen (VW); late out of the gate, these companies are now investing heavily to counter the EV pioneers, and it is difficult to forecast how battles for market share will play out.

Consequently, we believe the best way to get exposure to the EV transition is through areas where technical barriers to entry are high, competition is correspondingly less fierce, and share price valuations less demanding; the EV battery industry for example. It is incredibly difficult to make large EV batteries reliably and at scale – not a business you can start up without deep pockets and a solid starting point in battery chemistry and mass production. Therefore, EV battery production is a far more concentrated industry than auto manufacturing – dominated by a handful of large players such as CATL, LG Chem, Samsung SDI and Panasonic.

We invested in LG Chem, a Korean company that is the world no.2 EV battery maker with 26% market share, with strong strategic relationships with large automakers such as GM and VW, and also with dedicated EV manufacturers, such as Tesla and Lucid. Despite its leading position in an industry directly exposed to EV’s impressive growth profile, LG Chem’s shares value the company at 16x that of its 2022 forecasted earnings. We hold preference shares, which are roughly half the valuation of ordinary shares, despite having the same economic value (preference shares, unlike ordinary shares, do not carry voting rights). We are thus getting exposure to growth in electric vehicles through a business which not only enjoys strong barriers to entry, but which trades at a share price valuation which is a fraction of that ascribed to dedicated EV manufacturers.

LG Chem’s low valuation may be partly explained by the company’s conglomerate structure, with divisions that include petrochemicals and agrichemicals. However, we believe perceptions will change over time, as battery earnings grow and overshadow the petrochemical segment – and perhaps sentiment will change sooner rather than later, given that the company’s January 2022 initial public offering of its EV battery division, which brings full transparency to the value of this high-growth asset.

Until this change in perception occurs, shareholders of LG Chem are incentivised to wait, with the company aiming to pay out at least 30% of recurring profit as a dividend. For these reasons, we see LG Chem as an attractively valued ‘picks and shovels’ type of business that is far more appealing as an investment than the highly rated ‘gold prospecting’ businesses of listed EV manufacturers.

Chroma ATE: testing new markets

Continuing with our ‘picks and shovels’ analogy, we believe Taiwanese company Chroma ATE closely fits the bill; it manufactures and sells electronic and automated testing solutions that spot faults and inconsistencies and provides feedback for a wide range of components and devices.

Originally focused on IT power solutions (power supplies for laptops and consumer electronics), Chroma has developed test equipment for the latest technical innovations over the past thirty years; it pioneered LCD display testing in 2006, solar cell testing in 2008, and 3D sensing in 2017. Because of this first mover approach, Chroma has consistently grown revenues ahead of the industry and has exposure to a diversified base of high-growth sectors such as EVs and 5G telecommunications.

EV component testing represents 30% of revenues and Chroma is one of the leading testing businesses globally; 5G is at an earlier stage but Chroma should see significant growth, driven by increasing network traffic and speed requirements.

Regardless of who the 5G ‘winners’ are, or which EV maker comes to dominate the market, businesses like Chroma will remain part of the critical infrastructure enabling sweeping technological changes to take place. They are the unglamourous but indispensable side of technical revolution available for us, as investors, at sensible valuations. Chroma trades at a share price valuation well below that of many high-profile end customers which could not get their products to market without it.

Conclusion

Our change-based investment approach targets long-term capital appreciation by investing in companies where positive change is not currently reflected in share prices. There are clearly a number of major structural changes playing out globally driven by technological innovation, and we look for exposure to these changes without overpaying.

Investors who bought into the ‘obvious’ beneficiaries of technological change during the late 1990’s/early 2000 boom without paying sufficient attention to competitive challenges and valuations serve as a cautionary tale.

21 years on we argue that little has changed – while it remains hard to predict which providers of products and services will be the ultimate winners as technology evolves, the strong long-term shareholder returns delivered by ‘technology enablers’ suggests investors may do better to look beyond the headline names to the key players in the supply chain. We believe those companies enabling change – the makers of ‘picks and shovels’ in the technology gold rush – offer investors an attractive risk-reward proposition.

Click here for more information on Jupiter Emerging and Frontier Income Trust >

Please bear in mind that all investments involve risk and the value of, and any potential income from, your investment may fluctuate and are not guaranteed. The company examples mentioned above are for illustration only and not a recommendation to buy or sell or investment advice. We recommend you discuss any investment decisions with a financial adviser, particularly if you are unsure whether an investment is suitable. Jupiter is unable to provide investment advice. The views expressed are those of the authors at the time of writing and are not necessarily those of Jupiter as a whole and may change in the future. This is particularly true during periods of rapidly changing market circumstances. Market and exchange rate movements can cause the value of an investment to fall as well as rise, and you may get back less than originally invested. Past performance is no guide to future performance.

The Jupiter Emerging and Frontier Income Trust can borrow money and use it to invest, also known as ‘gearing’ or ‘leveraging’. The risk with gearing is that when the borrowed money has to be repaid the value of the Company’s investments may not be enough to repay it and any interest and the Company will make a loss. If the value of the Company’s investments falls, any invested borrowings will increase the value of this loss. Investors may get back nothing at all if the fall in value is sufficiently large. The Company invests in developing geographical areas and there is a greater risk of volatility due to political and economic change, fees and expenses tend to be higher than in western markets. These markets are typically less liquid, with trading and settlement systems that are generally less reliable than in developed markets, which may result in large price movements or losses to the Company. The Company invests in smaller companies, which can be less liquid than investments in larger companies and can have fewer resources than larger companies to cope with unexpected adverse events. As such price fluctuations may have a greater impact on the Company. This Company invests mainly in shares and it is likely to experience fluctuations in price which are larger than Companies that invest only in bonds and/or cash.

Important information

The value of active minds – independent thinking: A key feature of Jupiter’s investment approach is that we eschew the adoption of a house view, instead preferring to allow our specialist fund managers to formulate their own opinions on their asset class. As a result, it should be noted that any views expressed – including on matters relating to environmental, social and governance considerations – are those of the author(s), and may differ from views held by other Jupiter investment professionals.

Investment trust companies are traded on the London stock exchange, therefore the ability to buy or sell shares will be dependent on their market price, which may be at a premium or discount to their net asset value.

Before making an investment decision, please read the PRIIPS Key Information Document which is available from Jupiter on request and at www.jupiteram.com.

Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.