Dec

2020

Sustainability: My haven’t you grown!

DIY Investor

29 December 2020

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

How sustainability has gone from zero to hero in 2020…

How sustainability has gone from zero to hero in 2020…

Like childbirth, we think 2020 will be remembered for what it produced rather than the agony of the experience.

Events have conspired that, rather than the sickly and unpopular child it once was, sustainability as an investment theme has become a thriving, healthy teenager which seems destined for great things (note the torturous lack of gender specifics in this sentence, another thing we can thank 2020 for).

As with many trends that were already in progress at the start of 2020, the speed at which this particular infant has grown has accelerated this year. I for one didn’t begin the year thinking I’d be using a bamboo toothbrush by the end of 2020.

The recent news that Keystone Investment Trust is (subject to shareholder approval) switching strategy to Baillie Gifford’s sustainable Positive Change strategy provides further evidence that this is a trend that is gaining momentum.

COVID-19 has brought existing trends forward by a factor of years

Putting that somewhat lumpy analogy to bed for now (young people need their rest), COVID-19 has shown how health issues have material implications for the global economy, and can present significant issues for the ways that businesses operate.

The pandemic illustrates that companies which build sustainable and resilient business models based on stakeholder (rather than just shareholder) considerations can be those that are most financially successful.

2020 has also drawn attention to other global issues including climate change, pollution, health inequalities and social justice. Social media has enabled groups around the world who are being affected by similar threats make their voices heard, united as never before.

Governments everywhere are listening to these global jungle drums, and are reacting; so are corporates. What could have blown sustainability off course from a regulatory and political perspective, has in fact deepened and entrenched it.

These events have also prompted investors to rethink long term assumptions about how corporates behave. One has to question whether the financial risks presented by the 2001 Enron Corporation accounting fraud, the 2010 Deepwater Horizon oil spill, the 2015 Volkswagen emissions test cheat¬ing, and the 2018 Facebook data privacy scandal could have been mitigated by ESG integrated research processes.

We will never know, but managers everywhere who profess their deep ESG research skills are on notice that they will find it hard to avoid the reputational damage from owning the next ESG disaster the next time around.

Sustainability is ESG

Before we go any further, let’s just confirm what we mean by sustainability. In our view ESG accounts for the three major pillars of sustainable investing: environmental, governance, and social factors, and they are therefore synonymous with each other.

From an investment perspective, sustainability means including as many internal and external factors into a decision-making process to ensure that opportunities and threats are fully accounted for, both for the foreseeable and indeterminate future.

For a corporate as well as an investor, decisions need to be made acknowledging all of the issues in the table below. Only those companies (or fund managers) that show they have paid due regard to these can be considered truly sustainable over the long term.

Climate change: THE biggest sustainability threat (and opportunity)

Early this year, Larry Fink of BlackRock published his Dear CEO annual letter, which this year proved exceptionally well-timed, and highlighted climate change as a key area of focus for the world’s largest asset manager, stating that “Climate risk has become financial risk”.

He highlighted the risks and explained that “because capital markets pull future risk forward, we will see changes in capital allocation more quickly than we see changes to the climate itself.

In the near future – and sooner than most anticipate – there will be a significant reallocation of capital”. He cannot have known how quickly capital would reallocate. As we illustrate further below, we have seen a big shift in investor capital already.

This has implications for investors because firstly, those managers who do not anticipate these changes may end up making costly investment decisions.

Secondly, such is the weight and effect of capital flows, that those who invest ahead of the curve will benefit significantly more than those who are late to the party.

This effect is likely to be enhanced with the democratisation of investing, with end clients/retail investors increasingly conscious of their investments – caused by defined contribution schemes, and the falling cost of brokerage platforms.

As such, as well as benefitting from the upside, a sustainability mindset can help investors avoid the downside. With many managers we speak to, they see ESG as part of the toolkit that helps highlight risks.

Companies that have high exposure to environmental risks, dubious social practices or governance issues can be seen as generating unsustainable profits over the medium to long term. Managers who are aware of the issues are better equipped to avoid them.

The transition mechanism that will reward those corporates (or investors) who consider sustainability or ESG issues is summarised neatly by Larry Fink in his 2020 letter.

He states that over time “companies and countries that do not respond to stakeholders and address sustainability risks will encounter growing skepticism from the markets and, in turn, a higher cost of capital.

Companies and countries that champion transparency and demonstrate their responsiveness to stakeholders, by contrast, will attract investment more effectively, including higher-quality, more patient capital”.

Sustainability is therefore a competitive advantage which countries and companies alike can use to attract capital, which will improve and entrench their competitive position relative to others.

In Europe, it is worth being aware that we are well ahead of the sustainable investing curve. In aggregate, the US is a notable laggard, with awareness of ESG and sustainability issues relatively narrowly spread.

President Trump has hardly helped, with the US Department of Labor proposing a rule in June 2020 that would require private pension administrators to prove that they are not sacrificing financial returns if they put money in ESG-oriented investments.

In the investment trust world sphere, there is a small but growing cadre of equity trusts which we believe fit the criteria for sustainability, but also – unique to investment trusts – an ever growing alternative asset universe which also fit. We examine the background for equity funds below, and will revisit alternative asset classes early in 2021.

Sustainability is selling: massively

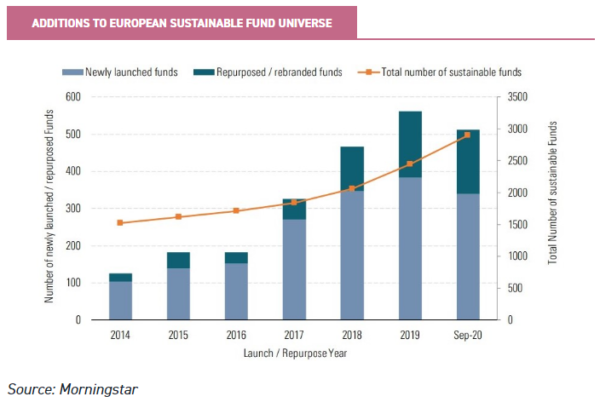

According to Morningstar data, 2020 is set to break records, with 333 new sustainable funds launching within Europe in the first nine months of the year.

This compares with 265 over the same period last year. Conventional funds are also converting into sustainable funds, many of which are also changing names (Morningstar data indicates that in the nine months to 30 September, this may have added around 175 funds to the sustainability universe).

As the graph below shows, this marks a significant rise in the number of funds available to investors.

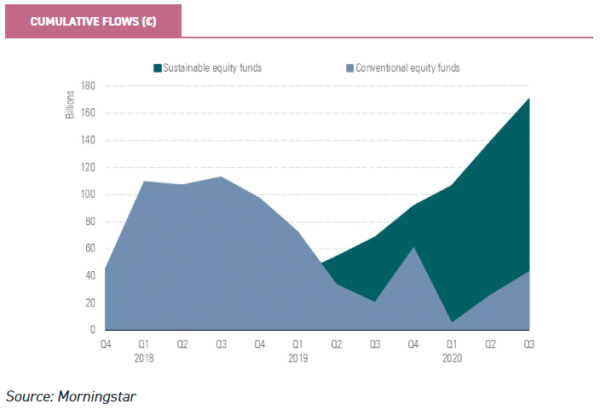

Launches of funds doesn’t necessarily translate into assets. However, in this case, the effect of all these new funds launching, and of investor interest means AuM is rising rapidly and equity funds which Morningstar designates as “sustainable” are raising significantly more capital than conventional equity funds.

According to Morningstar, data assets in European sustainable funds rose in the third quarter to €882bn, up from €800bn at the close of the second quarter, a 10% increase.

This compares with just a 1.6% increase in assets for the overall European fund universe. Sustainably managed assets account for 9.3% of total European assets.

Morningstar states that this high level of new products hitting the market at once is “unprecedented”. It’s hard not to see why sustainable funds have seen such huge and rapid growth.

We believe there are three fundamental drivers why sustainable funds have proved so attractive, and why it will remain on the agenda for managers and investors for many years to come.

1. Wealth transfer – younger investors are significantly more aware of climate change risks, and numerous UK studies have shown that millennial investors want to use their money in a way that has a positive impact. A US report showed that millennials are twice as likely as the overall investor population to invest in companies targeting social or environmental goals.

According to the King’s Court Trust, £5.5trn will be inherited and move hands from baby boomers to younger generations in the UK between now and 2055, with a peak seen in 2035. This sets up a strong multi-year tailwind of new potential clients for investment managers to attract business from.

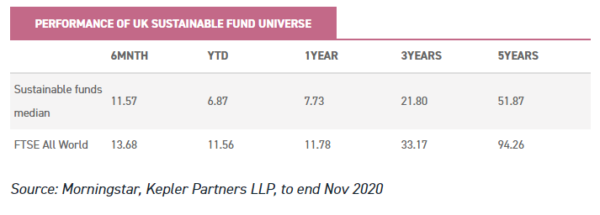

2. Performance – sustainable funds used to be seen as those that were likely to perform worse than conventional funds. The experience of more recent years has prompted people to re-think this.

An analysis of more than 1,800 US mutual funds and exchange-traded funds (ETFs) shows that sustainable equity funds outperformed their traditional peers by a median of 3.9% in the first six months of the year, according to a Morgan Stanley Institute for Sustainable Investing Report.

This builds on outperformance delivered in 2019, where sustainable equity funds outpaced traditional portfolios by a median of 2.8%. In fact, in any given year from 2004 through 2018, median performance for sustainable funds was in line with that of traditional counterparts and provided more downside risk protection, especially during periods of increased market volatility.

We have attempted our own analysis of the 155 funds marketed primarily to UK investors which meet Morningstar’s sustainability requirement, and compared their historic performance with the FTSE All World.

The results seem to indicate that performance has lagged wider equity markets over all time periods. What we cannot know is whether the funds available to UK investors – or those that fit Morningstar’s criteria – are representative of the actual universe of sustainable funds, or that of UK investor experience.

In our view, in the coming years and with a background of increased regulation and/or carbon taxes, it makes sense that companies that can operate with lower carbon emissions (or other negative externalities) will have a lower cost proposition than competitors and are therefore positioned to deliver higher returns to shareholders (all things being equal). That said, as we discuss later, not all green investments make good investments.

A thorny issue for some has been the contribution from the technology sector (which scores highly in some ESG analysis tools) to performance of sustainable funds around the world.

Nay-sayers have questioned whether it is technology or ESG driving the performance of sustainable funds in recent years. In our view, it is irrelevant: many technology companies are enabling the transition to a lower carbon economy.

In the same way, the fundamental drivers of the sustainability and technology investment propositions are the same: that of companies profiting from a rapid shift in behaviour and offering huge opportunities to those companies providing innovative solutions to aid the shift.

3. Mandates – Many investors are proactively asking for sustainably aligned investment management. The world’s largest sovereign wealth fund (Norway) has pursued a sustainable agenda for some time now. In 2015 the government voted that it should divest companies with more than 30% of revenues deriving from coal.

According to an interview with the outgoing chief investment officer recently, “the fund believes environmental unsustainability is also financially risky in the long run.

It has divested from 300 companies it deems to have negative environmental ‘externalities’ (such as palm oil producers) and directed some money actively to ones judged positive”.

The fund believes that these choices have been profitable, validating their “sustainable” investment philosophy. In Europe, the European Commission’s “Sustainable Finance Action Plan” aims to direct capital towards sustainable activities to align with the goal of “net zero” emissions by 2050. With these, and other very large pools of capital pursuing a sustainable agenda, it is no surprise that products are being launched to meet the need.

Outlook getting rosier?

As we have discussed, once the imminent threat of COVID-19 recedes from memory, climate change remains an all pervasive existential threat to companies and economies.

For investors, the opportunities abound. And for sustainable funds, the good news is that recent research suggests that climate risks aren’t yet priced in to markets.

This offers the prospect that, far from being late to the party, investors boosting sustainability aspects within their portfolios today are not late to the party.

The research conducted by Krueger, Sautner, and Starks (2020) surveyed the perceptions of more than 400 large institutional investors on matters related to climate change and their approach to considering climate risks in their investment decisions.

In their view, institutional investors seem to only be taking the very first steps towards incorporating climate risks into investment processes. They highlight that many investors still do not incorporate even a basic approach towards identifying and measuring carbon and/or stranded asset risks. If this is the case, then many sustainable managers will be very far ahead of the game.

Other recent events suggest that the sustainability investment tailwinds will build ever stronger in 2021. The day before President Trump was voted out of office, the US officially left the Paris climate pact, a process that started in 2017.

President-elect Biden has vowed to bring the US back in on his first day of office. This, as well as recent news from the EU and China, means that the largest economies of the world are now committed to address climate change. With electorates calling for stimulus spending to be spent on “build back better”, it would appear we will start to see some meaningful changes soon.

How to participate

Within any secular growth theme, it’s always possible to get caught up in the excitement and make mistakes.

As such, we think it is worthwhile getting exposure through a fund or trust, which spreads risks across a range of different companies, but more importantly should offer an active manager who can make day-to-day investment decisions formed from many years of experience behind them.

The constituents of the AIC’s environmental sector number three. We provide an overview of them below (and further detail in updated profiles which we have published in recent weeks).

There are other equity funds which, in our qualitative view, might suit which we also review further down. As we mention earlier, there is also a burgeoning sustainable alternative asset universe in the closed end world, which we will review early in 2021.

As we have heard from several managers in recent weeks, there are certain areas of the equity market that look frothy in terms of historical valuation metrics (such as hydrogen fuel cells?).

That said, such are the rapid changes happening around the world, which suggest that perhaps this time it really will be different.

The board and manager of Jupiter Green Investment Trust (JGC) believe it will. The trust has shifted the balance of its investment focus from larger, more established companies towards smaller more innovative ones which are providing new solutions to environmental problems to benefit from what they view as a dramatic acceleration of the theme.

Changes to the portfolio have already started to be implemented (the weighted average market capitalisation has fallen from £13.5bn to £8bn). JGC invests across seven sustainable themes, including: clean energy, water and sustainable agriculture, and nutrition and health. With the sustainable investments team at Jupiter at the helm, stock picking will remain the key driver for returns.

Impax Environmental Markets (IEM) has been the leader in the AIC’s Environmental sector over past years. IEM offers a specialist exposure to mid and small-cap companies around the world within four broad overarching sectors: new energy, water, waste/resource recovery, and sustainable food and agriculture.

The trust has seen a marked change in fortunes over the past three years or so with a strong performance and the discount to NAV turning into a persistent premium. IEM certainly offers exposures that are unlikely to be found in other large, generalist global funds.

Enthusiasm for the length of experience and stability of the management team who have been managing IEM for nearly 20 years might be balanced by the significant premium of the shares: any lessening of this could be a potential opportunity.

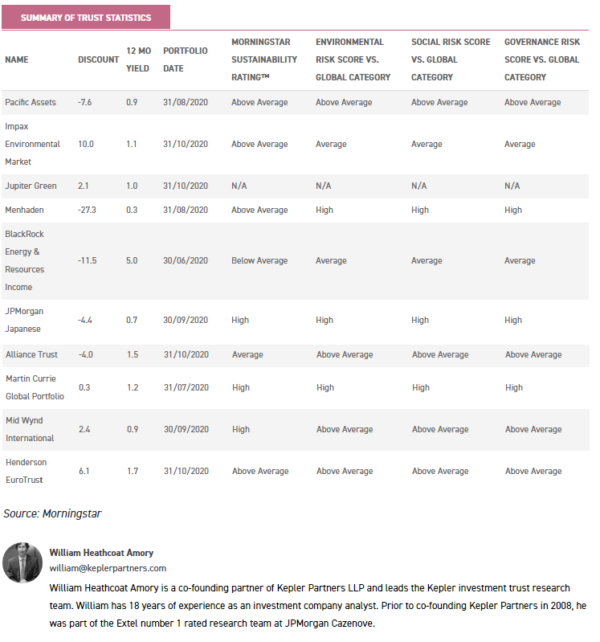

Menhaden (MNH) was the most recent trust to join the AIC’s Environmental sector in 2015, which seems remarkable given the growth seen elsewhere in sustainability funds. It had a poor start to life which prompted a change in the management team, since when the trust has shown good results in terms of performance.

MNH uses the closed ended structure to have a highly concentrated portfolio (which presents risks as well as opportunities), and also makes unlisted investments.

The team look for investments which fit two criteria: a dominant position in their market with a very high competitive moat, and they need to deliver – or benefit from – the efficient use of energy and resources. As such, we believe it fits a ‘sustainability’ definition in two ways.

The discount has remained wide since its poor start to life, and the shares currently trade at a 27% discount relative to JPMorgan Cazenove’s estimated NAV, making it the value play in the sector. As we discuss in the recent note, there are several reasons why the chances must be rising of the discount narrowing on a sustained basis.

Outside of the Environmental sector, there are a number of trusts which have a sustainability angle, but which don’t necessarily get picked up in qualitative or quantitative screens from data providers.

Pacific Assets (PAC) is one such trust. It is managed by Stewart Investors, and for over ten years now has had a sustainable investment strategy in the Asia ex Japan region.

The managers try to ensure that each investment decision is made from a standpoint to purchase part of a real business with all the rights and responsibilities that go with this ‘share’ of the ownership of the company.

The trust invests in companies which are positioned to benefit from, and contribute to, the sustainable development of the economies in which they operate. Investment decisions are based on identifying companies that manage risks and opportunities and contribute towards global human development without exceeding their ecological footprint.

The trust has had a poor year so far, largely thanks to its long running overweight to India (and underweight to China – although the managers made some timely investments in China earlier this year).

The managers claim that historically they have outperformed 75% of the time when markets are falling. This year has not fitted this pattern, and as a result the discount has remained wider than longer term historic norms, currently 7.3%.

We view the trust as a solid, conservative way to invest in the region, with the key differentiator of having long focused on sustainability.

Staying out east, this time in Japan, we would highlight JPMorgan Japanese (JFJ) as a contender for an under the radar sustainable trust. The team, led by Nicholas Weindling, believe that all three areas of E, S and G are material issues which can impact future performance for companies in Japan.

Whilst JFJ does not seek to label itself as an ESG fund, its investment process heavily scrutinizes the governance structures of its companies and the team actively engage with companies over their governance.

They also press for corporate disclosures around ESG issues, such as emissions and data privacy. Their attention to environmental issues is so effective that they estimate it has produced a portfolio with carbon emissions which are less than c. 4% of those of the index (as at 31/03/2020).

In our view, JFJ represents a good example of an investment process where the managers don’t have a typical ESG screen but ultimately don’t need one, as their investment philosophy already embodies the major ESG issues in Japan.

Martin Currie was one of the early adopters in the UK of the firm-wide application of ESG analysis tools into its investment process. Martin Currie Global Portfolio (MNP) has a highly active investment mandate, which Zehrid Osmani took over in 2018. He runs the trust with a portfolio of just 30 holdings, selected for their growth potential. Zehrid sees ESG as a vital input into stock research, which he splits into governance and sustainability.

Companies that exhibit strong governance and are well managed are more likely to be successful long-term investments. Sustainability involves looking at the environmental and social risks, management of risks and opportunities, and factors including climate change and cyber security.

The sustainability of a company’s business model is deemed critical to maintaining its competitive industrial positioning and strong capital returns. MNP has delivered (AIC Global) sector leading returns over one (3rd out of 15) and three years (4th out of 15) to 30 November 2020.

BlackRock Energy and Resources Income (BERI) encapsulates some of the more difficult questions that sustainable investors need to address. As we highlight above, Larry Fink, BlackRock CEO, recognises that climate change is “a key area of focus”.

To address this global issue, we need to decarbonise economies, which will necessitate huge investment – not least in the electricity network. The extraction of natural resources will play a vital part in addressing this, with large volumes of copper required to upgrade electric grids and more traditional, power generation still needed to cover current shortages of renewable energy.

Besides its holdings in conventional resource extractors, a key structural weight within BERI is now specifically to “energy transition” stocks which amounts to c. 31.8%.

If one were to count mining exposure to metals required for the energy transition (such as copper), exposure rises to c. 50%. BERI offers a highly attractive (historic) dividend yield of 5.5%, and on a wide discount to NAV of 11.1%.

We believe that should investors start to recognise the trust as an “ESG improver”, there is considerable potential for the discount to narrow from here.

Alliance Trust (ATST) applies a manager-of-managers strategy, giving each of the underlying managers the mandate to create a ‘best ideas’ portfolio of around 20 stocks with few restrictions.

This approach was brought in with Willis Tower Watson (WTW) on its appointment in April 2017. The team hope to generate the levels of alpha associated with concentrated portfolios without the risk of a single portfolio.

WTW believes responsible investing helps to improve returns for investors and reduce risks, as well as having a positive impact on society. It is core in their selection and management process.

WTW expects each of its fund managers to demonstrate ESG processes. However, the WTW team also look at the combined portfolio relative to the benchmark and peers and assess it on various ESG risks. WTW uses the data to review stock holdings by managers and, if necessary, challenges the managers on some of the stocks with less attractive ESG profiles.

A further layer is provided by third party advisor EOS, which engages with investee companies on behalf of the trust, and provides advice to WTW and the stock pickers on corporate engagement, voting and public policy.

Trusts that we highlighted in our ESG article from October included Henderson EuroTrust (HNE) and Mid Wynd (MWY), both examples of trusts which score strongly in sustainability rankings. In the case of HNE, Jamie Ross’s investment process is so focussed on governance and sustainability that it naturally aligns with ESG.

As a result HNE has consistently ranked as one of the best trusts on Morningstar’s sustainability rankings. MWY is far more straight forward, with specific and clear integration of ESG in the investment process. It ranks amongst the top 10% for sustainability in the Morningstar global equity large cap sector.

What we particularly like is the clarity in how MWY integrates ESG and its reporting. This, plus the team’s pragmatism in identifying ESG factors material to valuations, gives us confidence that the portfolio will remain ESG-compliant in the future and that its integration will enhance returns.

Click to visit:

Past performance is not a reliable indicator of future results. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. In particular, this website is exclusively for non-US Persons. Persons who access this information are required to inform themselves and to comply with any such restrictions.

The information contained in this website is not intended to constitute, and should not be construed as, investment advice. No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not a recommendation, offer or solicitation to buy or sell or take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm’s internal rules. A copy of the firm’s Conflict of Interest policy is available on request.

Alternative investments Commentary » Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.