Mar

2021

Strength in depth: UK Equity Income Trusts

DIY Investor

20 March 2021

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

UK Equity Income trusts have done a heroic job of maintaining their dividends through the pandemic…

UK Equity Income trusts have done a heroic job of maintaining their dividends through the pandemic…

There are plenty of economic losers from the pandemic, amongst whom those living off an income shouldn’t be forgotten.

Even before the pandemic, the macro-economic winds were moving against them, as ever-declining interest rates and anaemic growth continued to push yields lower and lower. COVID-19 has only worsened the situation, as central banks pump even more money into the economy and some of even the most stalwart dividend payers have been forced to cut pay-outs.

This requires income investors to become more creative. As we discuss below, investment trusts have a number of unique features which have helped them through the short-term income drought and should serve them well if, as we fear, the medium-term outlook for income investors is also likely to be troubled.

UK dividend lockdown

COVID-19 has caused deep problems for the average income investor. The pandemic has heralded the deepest recession in recent history, leading to large cuts in dividends across the globe.

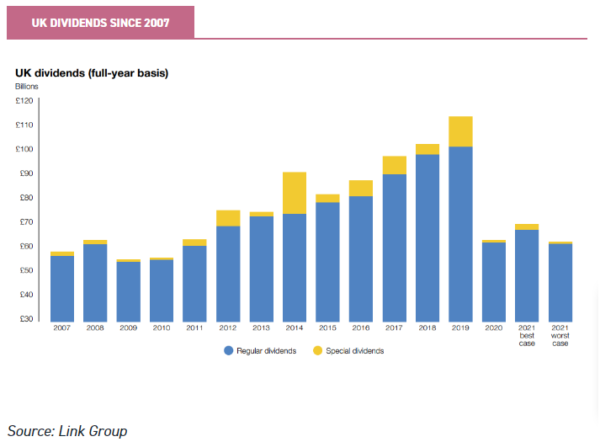

Moreover, some companies which received state support were forbidden from making pay-outs, explicitly or implicitly. In LINK Group’s most recent quarterly dividend monitor, they show that two thirds of UK companies cut their dividends between Q2 and Q4 of 2020, with an aggregate fall of 44% across all dividend payers, as demonstrated by the chart below.

The impact of COVID-19 has been so dramatic that dividend pay-outs have been set back to their 2011 level, essentially wiping out the post financial crisis gains.

The brunt of the pain was felt by the airline, travel and leisure, general retail, media, and housebuilding and consumer goods and services sectors; with the travel and retail sectors having seen a 96% year-on-year cut in the dividends.

However, the financial sector was the largest contributor in nominal terms, given the industry’s large weight in the FTSE, with 40% of the total cuts being contributed to them.

While there appears to be an economic recovery underway, and the easing of lockdown should hopefully see this continue, we think there are reasons to expect dividend yields to remain low by historic standards over the medium term, as we discuss later.

Investment trusts prove their worth

Open-ended funds have been able to dodge some of the pain felt by UK equities on a total return basis, thanks to successful active management, but still remain firmly in the red when it comes to dividends.

Being open-ended vehicles, they are limited in their ability to shield their investors from any fall in their underlying income. Over 2020 the average fund in the IA UK equity income sector saw their dividend fall by c. 29%, based on their full year pay-outs.

Not a single fund in the sector was able to avoid a dividend cut, and only nine funds were able to avoid a dividend cut of more than 10%.

Our hat does go off to the Schroder Income fund however, which managed a mere 0.2% dividend cut (primarily a result of the flattering effects of its payment schedule, not their underlying income[1]), though this was of course the exception to the rule. Conversely the worst offender was Unicorn UK Income, which saw an eye-watering 50% cut to its dividend.

Closed-ended funds on the other hand have fared much better so far. Out of the 22 trusts that compose the AIC UK Equity Income sector, only one cut their dividend for the 2020 financial year, Temple Bar.

Two more have committed to rebasing it in the next financial year to a more sustainable level, Edinburgh Investment Trust and Troy Income & Growth. Of the remaining 19, 16 have managed to grow their pay-out between their 2019 and 2020 financial year; and of these 16 a further six have indicated that their 2021 dividend will be higher than 2020.

Two trusts have already paid higher interim dividends in their 2021 financial year, Chelverton UK Dividend Trust and Merchants Trust. The other 14 trusts which have paid a 2021 financial year dividend have maintained their pay-outs from last year, with Troy Income & Growth the only one to have cut theirs.

While the pandemic is not over, and 2021 is likely to see continued pressure on UK dividends, investment trusts have served income seekers well so far, which has been rewarded with high ratings for the shares.

It looks increasingly likely their revenue reserves will be equal to the task of maintaining pay-outs through this crisis.

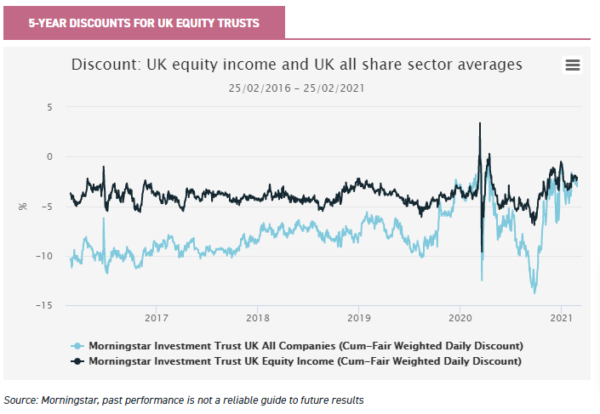

As can be seen from the below chart, the UK equity income sector’s discount has held up much better than its UK all company peers, which we attribute to this excellent dividend performance.

Over 2020, the average discount of the UK Equity Income sector was 3.8%, compared to the 6.0% average of the AIC UK All Companies sector.

However, the gap between the two narrowed substantially in the final quarter of 2020, as bullish sentiment returned to global equity markets and a Brexit deal was struck.

The 4.2% yield on the UK equity investment trusts sector looks attractive versus the FTSE All Share’s 3% and the IA UK equity Income sector’s 3.9%, but what is more important is the outlook for maintaining and growing the dividends in future, and in that respect we think the investment trusts sector has significant advantages.

Close ended advantage

We think the strong income performance by the UK Equity Income sector in 2020 is due to a number of unique mechanisms through which investment trusts can enhance the income received by investors, above and beyond the yield of their underlying holdings.

The single biggest advantage the closed-ended structure offers in our view is their use of revenue reserves to smooth the payments of dividends.

The benefits of such a structure are straightforward: saving for a rainy day allows for reduced volatility in dividends and the maintenance of a progressive dividend policy in an economic environment hostile to yield, such as the one we are in right now.

The AIC counts 19 trusts as ‘dividend heroes’, meaning they have been able to grow their dividend for at least 20 consecutive years. Nine of them are in the UK Equity Income space.

The membership of said club is often the result of more than just the managers’ effective stock picking, but also the judicious use of their revenue reserves, thanks to the board.

We believe one example of both is BMO Capital and Income Investment Trust (BCI), with 27 years of continuous dividend growth under its belt. This is in part due to BCI’s focus on income growth, as opposed to maximising an absolute level of distribution in any one year.

However, even in the absence of dividend growth, BCI’s board was able to draw upon its substantial £11.8m revenue reserve to support the 2020 payment, a war-chest the board sought to grow in prior years to safeguard its progressive dividend policy.

These policies resulted in a 1% dividend growth for BCI over 2020. Julian Cane, the manager, looks to identify UK listed companies where growing free cash flow can ultimately support growing dividends. This, he notes, has helped BCI to outperform over the longer term.

The other weapon in a trust’s arsenal is the use of gearing. While gearing can have a mixed impact on the performance of a trust, amplifying losses on the downside and gains on the up, the underlying revenues of a trust are only improved by its use.

Regardless of a company’s share price movement, a greater level of investment translates to a larger amount of dividends received, and thus a greater amount of revenue to support a trust’s pay-out.

Furthermore, a low-rate environment means it is relatively easy to borrow at a low rate and invest in equities paying a higher dividend yield. While the volatility of the NAV on the journey to maturity date may increase, as long as the portfolio value is at least as high as it was when the debt is repaid, the overall capital effect will be neutral and the yield earned on NAV will be boosted.

Aberdeen Standard Equity Income (ASEI) is one trust that has judiciously used gearing to boost its pay-out. Over the last three years ASEI has typically operated with gearing between 10% and 15%, and currently offers investors a historic dividend yield of 6.3%, the highest in the UK equity income sector.

Whereas by our best estimates (using Morningstar data) ASEI’s underlying portfolio currently has an average yield of 4.3%, implying ASEI’s dividend has been enhanced in part by its gearing. When it comes to its income potential, Thomas Moore, the manager, divides ASEI’s portfolio into three categories: resilient income, interrupted income and resumed income.

With over 65% of the portfolio in the resilient category, ASEI’s income has been able to weather much of COVID-19 (in conjunction with the strong revenue reserves), with ASEI now having 20 years of consistent dividend growth.

As an additional tailwind, Thomas believes these resilient income payers also have the potential for a positive re-rating as the market is underestimating the resilience and robustness of their income streams.

Another advantage investment trusts have is that much like bonds, they allow their investors to ‘lock in’ a higher yield by purchasing trusts at a discount to their NAV.

In this way they can enhance the dividend yield. One such opportunity, in our view, is BMO UK High Income (BHI) which currently trades on an 8% discount (as of 26/02/21), compared to the sector’s 2.4% average. While this discount offers an attractive entry point, and enhances BCI’s yield, we think it may also be unwarranted given BHI’s recent changes to its return profile.

BHI has recently shifted its strategy to become more concentrated, which has historically enhanced investor return, in an effort to better target total returns. Manager Phillip Webster often prefers secular-growth opportunities in high-quality, industry leading companies where he sees significant growth opportunities available at a reasonable valuation.

This has tilted BHI away from many of the highest yielding companies, who often return capital to shareholders because they have limited opportunities to productively reinvest it into their business.

BHI still maintains its ability to deliver income, with the board having utilised its ample revenue reserve to maintain its dividends during the pandemic.

Investment trusts can offer income investors their more ‘creative’ use of yield enhancing strategies. One of the most common income enhancing strategies is paying income directly from the capital account rather than from current year’s earnings plus the retained revenue reserve.

Investors can of course replicate this strategy themselves, by selling a portion of their own portfolio, but delegating it to managers offers its advantages; the biggest one being that the cost of trading is typically much lower for investment managers than it is for individual investors.

One example of a trust which pays out of its NAV is JPMorgan Japan Small Cap Growth & Income (JSGI), which pays out 1% of its NAV each quarter as a dividend. With a current 4% historic yield JSGI stands out in the Japanese small cap equity space, given the sector’s association with low dividend pay-outs.

More so considering JSGI’s investment process, which aims to identify the best growth opportunities in high-quality companies within the Japanese market. Alongside its yield JSGI has delivered impressive performance, with a NAV return of 119% over the last five years.

All these features mean that it is in general possible for investment trusts to generate a high yield while investing in the more illiquid, smaller end of the market.

We believe Dunedin Income Growth (DIG) is a good example of this. DIG returned -0.4% over the last 12 months, ranking it as one of the best performers in the UK equity income sector, and has also performed strongly over five years.

DIG has recently undergone a shift in investment strategy to now focus on a combination of income and capital growth, rather than simply the former, with a greater exposure to small and mid-cap companies as a result.

The companies that comprise DIG’s portfolio now exhibit significantly greater earnings growth than was previously the case, something sorely needed in the UK equity space.

While DIG’s dividend is unlikely to be covered in the current financial year, the board has planned for such an eventuality and will use revenue reserves to ensure a progressive dividend.

Price inflation and income stagnation: why the task for income investors is not going to get much easier

We think the macroeconomic factors that have kept yields low in recent years are likely to reassert themselves when the pandemic is over, meaning that the extra flexibility of the closed-ended structure is likely to remain pertinent.

The first issue is that the inflationary pressures we are now seeing are unlikely to find their way to income investors’ pockets. Thanks to the advent of mass vaccinations, a resolution to the ongoing pandemic seems inevitable.

This should lead to a sudden release of the pent-up demand which has inhibited so many economies. Readers need only cast their mind back to the brief removal of the lockdown earlier this year for examples, like the long queues outside of DIY stores or photos of crowded pubs.

This surge in demand will not only lead to increased inflation, as money flows back into the economy, but also normalise corporate earnings and bringing with it the potential for a resumption of dividend pay-outs.

Yet this potential inflation may be a false dawn for income investors, as it could end up reducing the real yields they receive. This is because a rise in inflation may in fact be unlikely to translate to an immediate return of prior levels of dividend payments.

Companies will first have to repair the balance sheets and take stock of the long-term strength of the recovery before they can consider their own outlook stable enough to resume paying dividends.

Hence LINK forecasts UK dividends will not return to their pre-crisis level until 2025. If this is borne out, this would be a challenge even to investment trusts’ ability to maintain their pay-outs, although they are in a better position than open-ended funds.

We also think growth in inflation could outstrip dividend growth in the near term, eroding real income returns and adding yet another woe for the poor income investor.

Though the short-term economic outlook is certainly more positive than that of the past year, the long-term damage of COVID-19 to certain industries will persist long past the euphoria of a lifted lockdown.

There is also the issue of spiralling global debt levels, as governments and companies relied on cheap credit to survive the crisis.

Yet the idea of impaired growth and high debt levels sustained by low yields is sadly nothing new, it is merely a continuation of the environment we saw before the crisis – one that has been coined ‘secular stagnation’, and yet another headwind for income investors of all forms.

The paper by Larry Summers, The age of secular stagnation, coupled with his speech to the IMF, returned the idea to modern thought. By his definition:

“Secular stagnation occurs when neutral real interest rates[2] are sufficiently low that they cannot be achieved through conventional central bank policies. At the points, desired levels of savings exceed desired levels of investment, leading to shortfalls in demand and stunted growth.”

Secular stagnation is thus a debilitating imbalance between investment demand and abundant capital supply, as defined by a glut of savings and monetary stimulus, leading to stalling GDP growth and low market rates.

Secular stagnation causes problems for economic policy, as saving rates stay stubbornly high and the money supply is so large that its increase would cause negligible incremental gains.

Consequentially, central banks’ hands are tied and they have to resort to lower and even negative interest rates to force the mobilisation of savings, with investors now needing to grapple with the realities of negative yielding bonds.

This has translated to rock bottom yields, both nominal and real, and an ever-upwards pressure on asset prices and a corresponding downward pressure on yields as the flood of cheap money looks to find a home.

As a result of this phenomenon income, investors are now faced with a painful combination of both low bond yields and stagnant dividend growth.

Despite the recent surge in yields and inflation, we think over the long term the picture is still one of low long-term growth and depressed yields (even more so now thanks to COVID-19), certainly when compared to the levels pre-2008.

Central banks also have to grapple with the increased sensitivity of economic activity to interest rates, as it will take years to slowly ween companies and economies off their cheap debt, which has artificially supported much of the market activity over the last decade.

As such we expect there to remain sufficient pressure on central banks to prevent them returning monetary policy to its prior standards, sustaining secular stagnation into the future at the cost of income.

Conclusion

Income investors have undoubtedly had the short end of the stick in recent years, with low bond yields, and constant share price expansion eating away at dividend return contribution. Their situation has only been made worse thanks to COVID-19, with UK dividends having been pushed back to the financial-crisis levels.

Thankfully, the humble investment trust offers a solution to many of their problems. UK equity income strategies been largely able to maintain their dividends through the crisis, and we think they will continue to offer a host of features which can reinforce their position as one of the premier ways to access equity income.

[1] The timing of the Schroder Income Fund’s dividend distributions flatter it’s calendar year dividend payment vs. its peers, with a large portion of its dividend paid in February. What has been seen during calendar year 2020 is not representative of the underlying income from the holdings of Schroder Income Fund.

[2] Neutral real interest rates can be defined as a natural or market driven interest rate, the price of money, which balances the supply of saving to the demand for investments. Low or declining natural real interest rates indicate a surplus of savings.

Click to visit:

Past performance is not a reliable indicator of future results. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. In particular, this website is exclusively for non-US Persons. Persons who access this information are required to inform themselves and to comply with any such restrictions.

The information contained in this website is not intended to constitute, and should not be construed as, investment advice. No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not a recommendation, offer or solicitation to buy or sell or take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm’s internal rules. A copy of the firm’s Conflict of Interest policy is available on request.

Commentary » Investment trusts Commentary » Investment trusts Latest » Isas commentary » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.