Jun

2022

Staying Active

DIY Investor

18 June 2022

We highlight several alternatives to passive investments for investors looking for core exposure in uncertain markets….

Today, passively managed funds are the dominant owners of US equities, having surpassed actively managed strategies – writes David Johnson

There are clear attractions to passive investing, such as low cost, diversification, easy access and availability. Additionally, the investment approach is clearly defined. Passive investing is inherently a ‘core’ style of investing because, by using an index-tracking fund, investors gain near perfect exposure to the benchmark by which all other styles are measured. Index-tracking funds also bring with them the benefit of diversification, because by effectively owning the entire investable universe, stock-specific risk is minimised far more than would be expected with an active strategy.

However, we think there are attractive opportunities within the investment trust sector which offer some of these advantages along with alpha-generating potential, and think that these trusts could provide the core of an investment portfolio without some of the drawbacks of passives. In fact, we believe the current market may no longer be as suitable for passive ownership as it has been in the past. By investing in market-cap-weighted index funds – by far the most common form of passive investing – investors are inherently exposed to the momentum style in large caps. As their largest underlying exposures will be in the largest constituents of their respective invested indices, passive investors do best when the largest companies outperform. Given the tailwinds behind large-cap growth stocks over recent years, with US mega-cap technology the dominant exposure for US and global passive indices, index investors have often benefitted from having their largest exposure to these stocks. However, post-pandemic there has been greater regulatory scrutiny of large-cap tech, while the interest rate environment no longer favours those companies and instead favours stocks and sectors which have shrunk to a small portion of indices in recent years, such as energy.

Passive investing is also a headache for ESG-minded investors. While we are beginning to see the rise of ESG-aligned passive strategies, broad-based index investing ultimately means that investors will be unable to genuinely scrutinise investments based on their ESG credentials. When an investor invests in an index-tracking fund, they often don’t get to choose whether or not they hold oil or tobacco, nor are they given the option to favour companies which do genuine good. For investors looking for a truly ESG-conscious strategy, active investing may be the only option, as it will require human judgement to determine how morally sound a company is.

An additional point of interest for those investing after the recent sell-off is that the discount opportunity in trusts offers a potentially additional source of return that passives can’t provide. While ETFs trade on exchanges like investment trusts do, they lack the same discount opportunities as they are designed to keep the value of the structure as close to the value of the replicated index as possible. On the other hand, investment trust owners can see some powerful upside potential when NAV growth and discount narrowing coincide – as they may do in the next upswing. Thanks to the current sell-off, today’s market offers some seldom found discount opportunities in many trusts, meaning investors can get core market exposure at historically attractive valuations.

For these reasons we think investors should be considering an investment trust for their core equity exposure, and to that end, below we discuss several actively managed alternatives from the major investment sectors. We think these trusts provide the potential upside that successful active management can bring while also offering some of the advantages that passive funds can enjoy, be that through well-diversified portfolios or stylistically balanced allocations. Importantly, all the trusts have a high active share despite being diversified, meaning they should offer strong alpha-generation potential too.

Global Equities

Proposed trust: Alliance Trust (ATST)

Major index: MSCI All Cap World Index

| ONE-YEAR NAV RETURN (%) | THREE-YEAR NAV RETURN (%) | FIVE-YEAR NAV RETURN (%) | DISCOUNT (%) | |

| ATST | 1.1 | 34.3 | 51.8 | 5.5 |

| MSCI ACWI | 4.0 | 36.3 | 57.0 | N/A |

Source: JPMorgan Cazenove, as at 08/06/2022

Past performance is not a reliable indicator of future results

Alliance Trust (ATST) offers retail investors access to a select group of skilled investment managers, yet it may also be the closest example to a true ETF replacement that we present in this article. Under the management of the Willis Towers Watson (WTW) team, ATST brings together a selection of what WTW believes are the world’s best stock-pickers. Each of ATST’s nine delegated managers typically manages a 20-stock portfolio reflecting a specific style of investing. WTW then weights those portfolios so as to diversify away any factor risks relative to ATST’s benchmark, the MSCI ACWI. This means that ATST offers investors a truly diversified ‘core’ allocation (with 189 stocks currently), while carrying no greater style risk than the wider global equity benchmark.

Where ATST does differ from the MSCI ACWI is that it has a far smaller weighting to the mega-cap stocks that make up so much of its benchmark, a reflection of WTW’s intention to be exposed to the best ideas of the delegated managers rather than merely hugging ATST’s benchmark. For example, ATST has no exposure to Tesla. This means that despite ATST having a 78% active share, it is by some metrics more diversified at a stock level than its benchmark is. While this underweight to mega caps, and to mega-cap technology in particular, has historically hurt ATST, it has been a key factor in ATST becoming one of the best-performing global equity trusts over 2022 so far. In the face of the MSCI ACWI’s -6.2% return and the -12.1% simple average NAV total return of its peers, ATST’s -4.5% year-to-date NAV total return is more than admirable in our opinion.

ATST also has the advantage over passives when it comes to ESG. The board of ATST has made a clear commitment to ensuring that the principles of ESG investing are applied across all of the trust’s delegated managers. More than simply incorporating ESG, WTW ensures that active engagement with all of ATST’s underlying companies is made when appropriate, despite the large number of holdings. When it comes to ESG, active engagement is the truest advantage that actively managed strategies have over passive ones. Although there are ESG-aligned passive investments, typically their ownership is also passive, which means they often do not influence company management in the same way that actively managed strategies do. The board also ensures that there is full disclosure of WTW’s ESG and engagement activities, which can be found here.

US Equities

Proposed trust: JPMorgan American (JAM)

Major index: S&P 500

| ONE-YEAR NAV RETURN (%) | THREE-YEAR NAV RETURN (%) | FIVE-YEAR NAV RETURN (%)* | DISCOUNT (%) | |

| JAM | 11.7 | 63.0 | 97.4 | 1.0 |

| S&P 500 | 11.3 | 52.9 | 90.6 | N/A |

*JAM has only been managed by the current team since June 2019

Source: JPMorgan Cazenove, as at 08/06/2022

Past performance is not a reliable indicator of future results

The US equity market is the home of passives, thanks to the range of options available and the market’s informational efficiency, which should in theory support the passive investing thesis. There is so great a number of professional investment analysts covering the S&P 500 that the argument runs that much of the available information is already fully reflected in each stock. This can therefore make it difficult for professional investment managers to beat the S&P 500 unless they take clear stylistic bets and capitalise on the varying tailwinds within the US markets, such as the meteoric rise in US growth stocks between 2019 and 2021. These dynamics make successful but still genuinely ‘core’ strategies hard to find.

The AIC North America peer group contains one example of a ‘core’ strategy which has been able to generate long-term outperformance against the world’s most efficient index, that being JPMorgan American (JAM). JAM is managed by two different investment managers, who are each allocated 40–60% of the portfolio. Timothy Parton runs the growth allocation while Jonathan Simon runs the value portfolio. Despite the duo’s hard limits on their portfolios’ weightings within JAM, they nonetheless have the ability to overweight their highest-conviction stocks as and when they deem that to be appropriate, allowing JAM to capture the tailwinds behind individual stocks while still also remaining a stylistically balanced ‘core’ allocation. Jonathan currently has the largest active positions within JAM, tilting the trust towards financials, real estate and materials, some of the best-performing US sectors over 2022. Thanks to the effective stewardship of Timothy and Jonathan, JAM has been able to outperform the S&P 500 over the last three years, returning an NAV total return of 63% compared to the 52.9% of the index. Such outperformance is notoriously difficult for a dedicated core manager to achieve, as the majority of them have underperformed the S&P 500. While S&P 500 trackers are famously low cost, JAM offers the clear benefits of active management while still remaining cost-efficient, as the trust currently reports a low OCF of 0.38%, meaning that investors need not fear substantially increasing the cost drag on their portfolio by owning JAM.

European Equities

Proposed trust: JPMorgan European Growth & Income (JEGI)

Major index: MSCI Europe ex UK

| ONE-YEAR NAV | THREE-YEAR NAV RETURN (%) | FIVE-YEAR NAV RETURN (%) | DISCOUNT (%) | |

| JEGI | -1.1 | 27.9 | 28.4 | 10.8 |

| MSCI Europe ex UK | -3.2 | 23.5 | 31.8 | N/A |

Source: JPMorgan Cazenove, as at 08/06/2022

Past performance is not a reliable indicator of future results

Passive investing may arguably be the most daunting approach in Europe, as not only does the region have to deal with the same inflationary and interest rate pressures as the rest of the world, but investors also have to contend with the direct fallout from the war in Ukraine. Such painful scenarios are exactly why investors may wish to use active investment managers, as while diversification is key in times like this, so is analysing which companies are likely to be the most affected by today’s risks in order to determine which are possible opportunities.

We believe that investors looking for core exposure and active stewardship through these troubled times may be well served by choosing JPMorgan European Growth & Income (JEGI). Unlike its cousin JAM, JEGI’s managers intentionally aim to invest in a ‘core’ manner. They utilise a diversified approach to portfolio construction and diversify not only by sector and region but also by style, given their focus on being overweight to value, quality and momentum factors throughout the cycle. This means the team will aim to have cheaper valuations than the market, and that they have been historically underweight to the more speculative high-growth companies; however, it is hard to see that as a disadvantage in the current environment. The team have also created a far more diversified portfolio than their peers, with c. 100 holdings currently, replicating some of the diversification advantages provided by passive strategies.

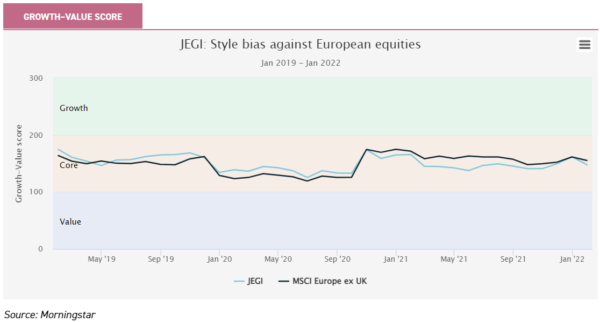

The advantage of this approach is that the style of JEGI’s portfolio holdings tracks that of its benchmark the MSCI Europe ex UK Index very closely, as can be seen in the below graph. Despite its close stylistic alignment, JEGI has still been able to outperform its benchmark over both one and three years thanks to the team’s successful stock-picking. JEGI also enjoys another major advantage that investment trusts have over passive strategies, that being the ability to offer enhanced income. In the case of JEGI, the trust pays out a quarterly dividend based on 1% of NAV, valued at the start of each quarter. This makes JEGI’s c. 4% annual yield superior to the current 3% yield of its benchmark.

UK Large Caps

Proposed trust: City of London (CTY)

Major index: FTSE All-Share

| ONE-YEAR NAV RETURN (%) | THREE-YEAR NAV RETURN (%) | FIVE-YEAR NAV RETURN (%) | PREMIUM (%) | |

| CTY | 12.0 | 17.7 | 23.9 | 1.9 |

| FTSE All-Share | 7.0 | 15.7 | 23.0 | N/A |

Source: JPMorgan Cazenove, as at 08/06/2022

Past performance is not a reliable indicator of future results

When it comes to alternatives to UK passive exposure, we think City of London (CTY) stands out. With a dual mandate of income and capital growth, CTY has been able to outperform its benchmark the FTSE All-Share and its peer group average over five-, three- and one-year periods. CTY also has the lowest five-year tracking error against both the FTSE All-Share Index and the FTSE UK Equity Income Index. This means that CTY has the lowest excess return volatility of its peers, implying its outperformance has been less ‘lumpy’, with investors needing to worry less about timing their exposure and losing out on potential outperformance. This reliability is the direct result of the approach taken by its manager, Job Curtis. Job’s intention is to take a long-term view on investments, and to spread risks across the portfolio so that no one sector or company has an overly large bearing on income or returns for shareholders. The trust has a current portfolio of c. 90 holdings, and while this level of diversification is clearly aligned with the characteristics of passive strategies, Job’s active approach to stock selection is less so. Job’s investment process is based on fundamental analysis, and he tends to have a contrarian style, trimming stocks which the market perceives as ‘hot’, and recycling capital into companies he sees as being undervalued. This contrarian view has been a key advantage for CTY’s investors over the last year in particular, with CTY being the second best-performing trust in the UK equity income peer group by returning 12% in NAV terms over the period, a 5% outperformance of the FTSE All-Share.

UK Small Caps

Proposed trust: Invesco Perpetual UK Smaller Companies (IPU)

Major index: Numis Smaller Companies ex Investment Trusts

| ONE-YEAR NAV RETURN (%) | THREE-YEAR NAV RETURN (%) | FIVE-YEAR NAV RETURN (%) | DISCOUNT (%) | |

| IPU | -9.6 | 21.2 | 40.5 | 15.3 |

| Numis Smaller Companies ex Investment Trusts | -9.6 | 17.8 | 18.3 | N/A |

Source: JPMorgan Cazenove, as at 08/06/2022

Past performance is not a reliable indicator of future results

Gaining small-cap exposure via passives is difficult. Not only does passive exposure to small caps lose the advantage of low costs, with the iShares MSCI UK Small Cap UCITS ETF reporting an OCF of 0.58% and a handful of UK small-cap investment trusts actually reporting a lower OCF, but by taking a passive approach investors also forgo the opportunity to capitalise on what is an inefficient investment universe.

Yet because of the potential for managers to add value in small caps, it can be difficult to find strategies which intentionally take a ‘core’ approach while also demonstrating strong long-term outperformance. We believe that the best approach is to look for a trust which can demonstrate strong historical outperformance combined with the lowest tracking error. In doing so we find that Invesco Perpetual UK Smaller Companies (IPU) comes out on top, as not only does it have the lowest five-year tracking error within its sector, but it is also the best-performing UK smaller-company trust over the last five years, having returned an NAV total return of 40.5% compared to the 18.3% of the Numis Smaller Companies ex Investment Trusts Index.

IPU’s impressive track record and low tracking error are thanks to the distinctive investment process employed by its managers Jonathan Brown and Robin West, whereby they aim to deliver strong performance over the long term but with below-average volatility. When selecting companies, they prefer strong businesses with high-quality management, a strong position within their industry (including pricing power) and uncompromised balance sheets with little or low debt. IPU’s attractive characteristics are not solely due to their stock selection, but also a result of their portfolio construction process, as Jonathan and Robin aim to create a portfolio that allows them to “sleep at night” by being diversified across multiple different return drivers. Given the typical diversification benefits that passive investing yields, we believe that Jonathan and Robin’s mindful approach to portfolio construction makes IPU all the more attractive.

Conclusion

One thing that unifies the five trusts we mention in this article is their ability to demonstrate the advantages of active management, as they have either generated strong long-term outperformance or been able to steward their shareholders through today’s increasingly turbulent markets. Given the macroeconomic and market volatility we are experiencing, the need for professional stewardship is arguably greater than it has been for years. We think the fact that many of the trusts mentioned in this article trade on attractive discounts only adds to the attraction of using active investment trusts instead of passives at the core of a portfolio.

Disclaimer

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Brokers Commentary » Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.