Jul

2022

Silver linings amidst the volatility: China mid-year market outlook

DIY Investor

21 July 2022

Inflation at the forefront of investor worries

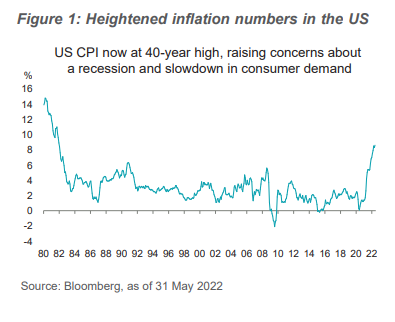

Volatility was carried into 2022, with Asian markets broadly under pressure in the year’s first half. Various risks loomed on the horizon, including unexpected rising geopolitical events, particularly the Russia-Ukraine tensions and the surging commodity prices that drastically changed the world’s inflation

expectations. At the beginning of the year, we expected macro concerns over inflation to be one of the key risk factors in 2022, and we have become more concerned about the heightened inflation

expectations to drive further global weakness.

To combat inflation, the US Fed and other central banks have started hiking interest rates at a faster-than-expected pace.

Central banks have found themselves way behind the curve, especially after CPI numbers continued to rise higher among developed markets. Investors have gradually shifted their attention from the

beginning of an aggressive rate hike cycle and quantitative tightening to recession and stagflation risks.

The market now expects a total of 350 bps hike from the Fed and 175 bps from the European Central Bank (ECB) by December.

With elevated inflation, a more aggressive rate hike is warranted. We view that it is better for central banks to be more hawkish now and should act before inflation is out of control. The heightened

inflation numbers in the US (Figure 1) have already eroded the purchasing power of Americans, inviting greater worries about consumer demand for various goods, including electronic products and

staples.

Key concerns in Asia

Elsewhere, the sudden resurgence of Covid cases in China, notably in Shanghai and Beijing, took investors by surprise, as the subsequent lockdowns further weighed on the economic activities and led to supply chain disruptions, with the latter raising further concerns over inflationary pressures (Figure 2).

Overall, the MSCI Asia ex-Japan index was down by 17% in the first six months of 2022, with mixed performances across the region. Like China, North Asia markets, such as Taiwan and Korea, dragged amid

concerns over end-demand weakness in the technology sector. On the other hand, commodity-driven countries, especially Indonesia, performed well as they benefitted from the elevated commodity

prices.

Figure 2: China’s economic activities weakened

Silver linings in the cloud

Despite a weak macro backdrop, we believe there are some silver linings.

In China, we continue to view that its counter-cyclical pro-growth policies, which contrast with other parts of the world, and fine-tuned regulations shall support its growth stability agenda in 2022:

• The government will provide additional stimulus to the economy. In a national assembly meeting held in May, Premier Li Keqiang has urged provincial governments to step up the policy execution, announcing a package of measures to stabilize the economy.

• Fine-tuned regulations are expected, especially in the internet and property sectors, which were heavily beaten last year. In May, top policymakers in China met with dozens of executives and industry experts, pledging to support the healthy developments of the technology sector.

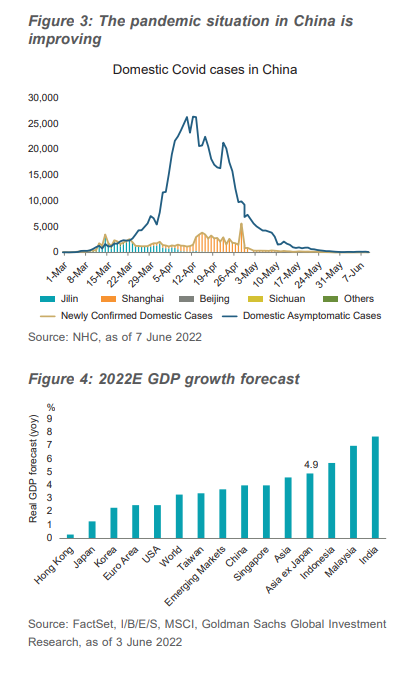

• Although we remain cautious and closely monitor China’s zero-Covid strategy, newly reported Covid cases have been falling in China (Figure 3). At the same time, more measures are being taken to ensure the logistic flows and production resumptions. For one thing, Shanghai has lifted the white-list system for resumed production from the beginning of June.

A solid performance of China will not only support its domestic markets but also potentially benefit other Asian markets, given China’s large scale and relevance in this region. For one thing, China is a key trading partner and a key source of Foreign Direct Investment (FDI) to many ASEAN countries.

In Asia, inflation shall continue to drive diverging developments within the region. Nevertheless, the easing disruptions in the supply chain and the reduced geographical tensions may help lower inflation

pressures and lift investor sentiment.

In a nutshell, we are cautiously optimistic about the China and Asia markets, although we believe market volatility to remain as more rate hikes are in the cards of the US Fed and quantitative tightening starts to gather its pace.

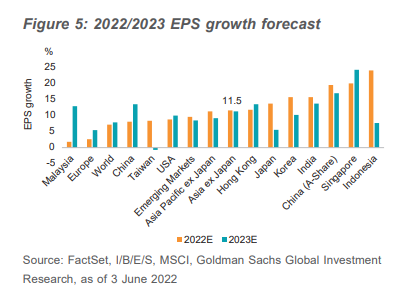

While we expect downward adjustments in GDP and earnings to continue (Figures 4 and 5), we believe having a selective and bottom-up focus on quality fundamentals could be rewarding for long-term investors as some valuations offer compelling investment opportunities, which we will further illustrate in this report.

See the full report here >

Leave a Reply

You must be logged in to post a comment.