Mar

2022

Signs of a rebound for funds in these sectors

DIY Investor

24 March 2022

Saltydog Investor is continuing to keep his powder dry, but is keeping a close eye on funds that are trending up.

At Saltydog Investor we believe that people should actively manage their investments. Why stay in a fund when it continues to go down? And why not invest in an up-and-coming sector if market conditions are changing?

We provide fund performance data on a weekly basis, and let our members know if we are making any changes to our demonstration portfolios. Although we look at them every week, we do not necessarily make changes. Over the last month we have made fewer changes than normal. We are mainly in cash (nearly 90% in the Tugboat and 70% in the Ocean Liner). Last week we did not make any changes, but we did pick up some early signs of a recovery.

As part of our weekly analysis, we look at the overall performance of the Investment Association sectors. We put them into our own Saltydog Groups based on their historic volatility.

The two sectors with the lowest volatility, Standard Money Markets and Short-Term Money Markets, are in our ‘Safe Haven Group’. Then comes our ‘Steady as She Goes’ Group, which contains sectors that have been slightly more volatile in the past. The sectors in this group are Sterling Corporate Bonds, Sterling Strategic Bonds, Sterling High Yield, Mixed Investment 0-35% Shares, Mixed Investment 20-60% Shares, Mixed Investment 40-85% Shares and Targeted Absolute Returns. When we looked at our reports last week, all of these sectors were showing cumulative losses over four, 12 and 26-weeks. Only one had gone up in the previous week, Targeted Absolute Returns which made 0.1%.

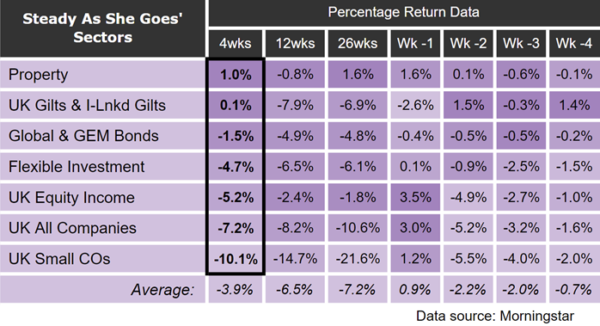

Next up the volatility ladder comes the ‘Steady as She Goes’ Group. Here is an extract from last week’s reports showing the sector performance up until 12 March.

At the top is the Property sector. The average fund in this sector is now showing a four-week gain of 1.0%, having gone up by 1.6% in the previous week. Next is the combined UK Gilts and UK Index-Linked Gilts sector, which is up by 0.1% over four weeks, but had gone down by 2.6% in the previous week.

However, that is not what really caught our attention. At the bottom of the table are the three UK equity sectors, UK Equity Income, UK All Companies, and UK Smaller Companies. They are still showing significant losses over four weeks, and are down over 12 and 26 weeks, but are showing signs of a rebound. UK Smaller Companies is showing a one-week return of 1.2%, UK All Companies is up 3.0% and UK Equity Income made 3.5%.

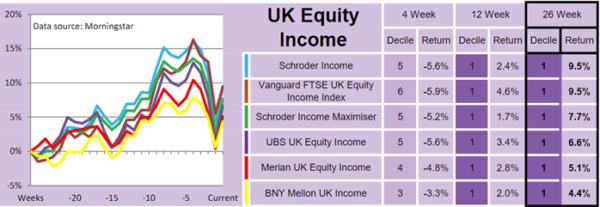

As well as providing information about the sectors, we also give details of the best performing funds over various timescales. This is the table showing the leading funds in the UK Equity Income sector over the last 26 weeks.

You can see that up until a month ago, around the time Russia invaded Ukraine, these funds were trending up. They then fell sharply but started to recover a couple of weeks ago. We have not crunched the numbers for last week yet, but I am expecting to see further gains. Our Ocean Liner demonstration portfolio has small amounts invested in the Schroder Income and Vanguard FTSE UK Equity Income Index funds, and they both went up last week.

A couple of good weeks does not mean that the storm has passed, but at least it is a step in the right direction.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com

Leave a Reply

You must be logged in to post a comment.