Sep

2023

Why it’s time to reconsider this rising sector

DIY Investor

19 September 2023

With oil now at $90 a barrel and set to continue rising, Saltydog Investor assess the pros and cons of the energy sector.

In the last couple of months, we have seen the price of crude oil move up significantly.

You have probably already seen the effect of this at the petrol pumps. According to the RAC, the average price of a litre of unleaded petrol has risen by more than 10p since 30 June, up from 143.90p to 154.55p. Diesel has gone up by slightly more. It was 145.46p and is now 157.62p.

Have you noticed how the forecourt prices tend to go up in line with the crude oil prices, but they are a bit slower going down when the price falls?

West Texas Intermediate (WTI), one of the most commonly traded and referenced benchmarks for crude oil prices, has gone from below $70 per barrel at the end of June to over $90. That’s an increase of more than 25% and is now at a ten-month high.

There are a couple of key drivers pushing up the price. On the supply side, Saudi Arabia and Russia have recently announced that they are going to extend voluntary oil production cuts, totalling 1.3 million barrels per day, until the end of the year. These are on top of the cuts agreed by OPEC+ produces last April that are set to continue through until the end of next year.

On the demand side everyone is looking at China which is the world’s largest oil importer. Their economy was slow to rebound after the coronavirus pandemic, when the government’s zero-Covid policy kept much of the country in lockdown long after other countries had started to open up. However, the latest figures show that factory output and retail sales are growing. The Chinese central bank has recently cut the cash reserve requirements for its banks to help boost liquidity and strengthen the economic recovery.

OPEC, the US Energy Information Administration, and the International Energy Agency, all expect demand to exceed production in the final quarter of the year. At the same time US oil reserves are at a forty-year low. As we head into winter it seems likely that prices will remain inflated for some time.

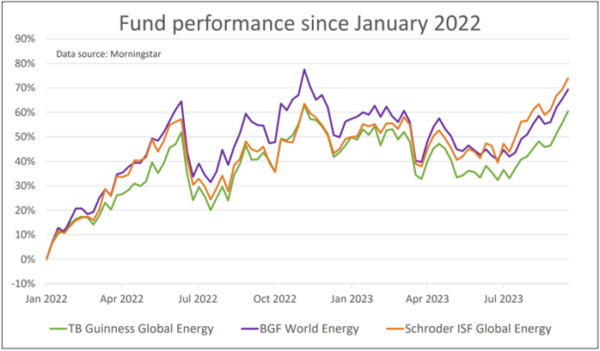

We have also seen this coming through in our latest fund analysis. Funds like Guinness Global Energy, BGF World Energy, and Schroder ISF Global Energy are currently among our top performers.

These have been some of the best-performing funds over the last few years with cumulative three-year returns above 150%.

They all suffered a dramatic drop in 2020 when the world went into the first covid-19 lockdown. There were travel restrictions and manufacturing almost ground to a halt. Demand for energy plummeted. At one point the price of crude oil dropped below $20 per barrel.

However, towards the end of 2020 these funds started to pick up and rose fairly steadily until June 2022. Since then, they have been on more of a rollercoaster ride. By mid-July 2022, they had fallen by more than 20% from their recent peaks, but then recovered and went on to set new highs last November. They then dropped again and only really started to go up again this July.

If the Chinese recovery continues, and with oil supply being constrained, now might be a good time to reconsider investing in these funds.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

Commentary » Latest » Mutual funds Commentary » Mutual funds Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.