Jan

2024

Schroder Japan Trust plc: where next for Japanese equities?

DIY Investor

11 January 2024

Japanese shares had a stellar first half of 2023 but momentum has since halted. We look at the factors that might drive further gains from here and the implications for investors in Schroder Japan Trust plc – fund manager Masaki Taketsume

Japanese shares had a stellar first half of 2023 but momentum has since halted. We look at the factors that might drive further gains from here and the implications for investors in Schroder Japan Trust plc – fund manager Masaki Taketsume

Japanese shares had a strong first half of this year, hitting 33-year highs. That upward momentum then stalled over the summer as investors debated the next moves for US interest rates and the chances of a global recession. But we believe the resurgence of Japanese equities has much further to go.

‘we believe the resurgence of Japanese equities has much further to go’

Earlier this year, we discussed the multiple reasons behind the Japanese market’s strong performance in the first half of the year. Some of these reasons were short-term ones, like Japan’s delayed re-opening after the pandemic. But others look set to be sustained for over a much longer time frame.

Foremost among these is the Tokyo Stock Exchange’s (TSE) call for companies to focus on enhancing their corporate value, as well as the return of inflation and wage growth. On these fronts, we see progress that looks likely to play out over many years, not months, with positive implications for investors in Japan-focused equity funds such as Schroder Japan Trust.

Corporate governance improvements

Investors in Japan have been waiting a long time for improvements in corporate governance. But change is now coming and was given further impetus earlier this year by the TSE’s call for listed companies to focus on achieving sustainable growth and enhancing corporate value.

This call was particularly directed at companies with a price-to-book (P/B) ratio of below one (meaning that the market is valuing the company at less than its assets are worth). These companies were asked to develop and disclose a plan for improvement, then to implement it and track its progress.

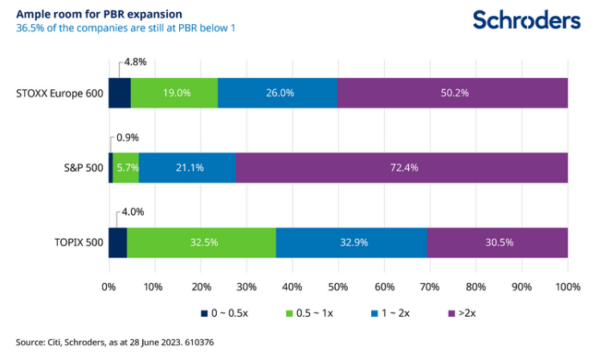

As the chart below clearly illustrates, there is a greater proportion of businesses with a P/B of less than one in Japan than in Europe and the US. This reflects the extent of the undervaluation that persists in the Japanese stocks and the opportunity that therefore exists for funds such as Schroder Japan Trust, should the drive to improve P/B ratios be successful.

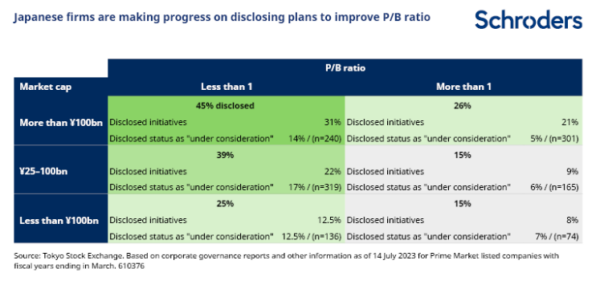

There are encouraging signs that the TSE’s call is being heeded. As of mid-July, 31% of companies on the Prime Market had made a disclosure of initiatives they plan to take. Larger companies have so far been the most proactive. Smaller companies – who are perhaps less well-resourced – have made slower progress with disclosure.

We are encouraged by this progress but it is, of course, early days. We think there is more to come as the TSE nudges Japanese companies’ management. We can call it peer pressure, but this is going to be highly effective.

Different paced measures to improve corporate value

The TSE wants companies to achieve sustainable growth and enhanced corporate value over the mid-to-long-term. There are many ways to do this, but some of them may take time. The TSE itself gives the example of “investment in R&D and human capital that leads to the creation of intellectual property and intangible assets that contribute to sustainable growth, investment in equipment and facilities, and business portfolio restructuring”.

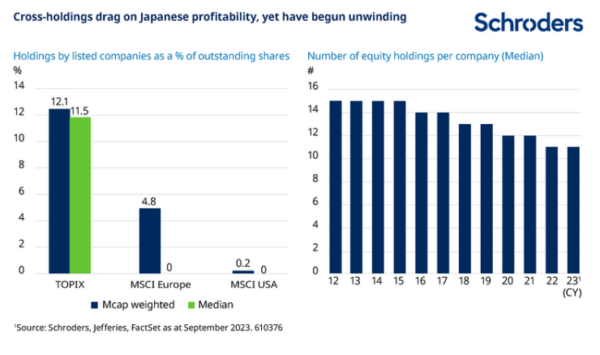

While these longer-term initiatives are needed for sustainable growth, there are measures that can help to boost corporate value in the near term too. For example, unwinding some of the cross-shareholdings that many listed Japanese firms hold in each other should deliver a faster benefit.

‘These are a quick way for companies to deliver a tangible benefit’

Cross-shareholdings have been criticised for contributing to management complacency, discouraging risk-taking and making companies less responsive to the needs of smaller shareholders. Many Japanese banks have already sold their cross-shareholdings and other companies are now following suit amid the pressures coming from the corporate governance code and investors themselves.

The unwinding of these cross-shareholdings can also provide capital for other shareholder-friendly measures such as increased dividends or share buybacks. These are a quick way for companies to deliver a tangible benefit of the type being sought by the TSE, while they also focus on actions with a longer time horizon.

Promising signs on inflation

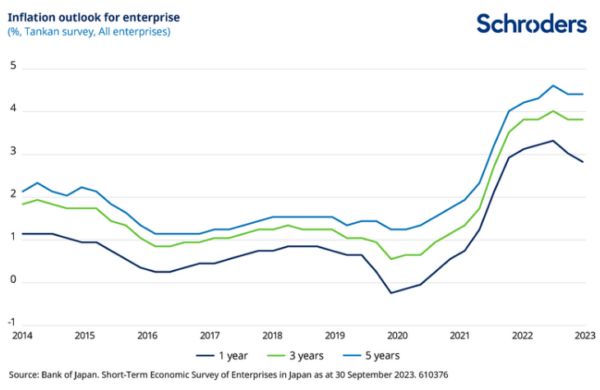

Next, let’s take a look at the macroeconomic backdrop. After a prolonged period of low or even negative inflation since the 1990s, the post-pandemic pick-up in inflation has been more welcome in Japan than elsewhere. The latest (August) inflation reading showed an annual rate of 3.2% – above the Bank of Japan’s 2% target but not as dramatically high as has been seen in other countries.

Inflation is important. If companies can put through price increases, they can have confidence to increase wages. This translates into stronger purchasing power for households, leading to further increases in demand, which then leads to improving sales and profits for companies, and so on. It’s a virtuous circle, but one that has been missing in Japan for many years, forcing companies to focus on cutting costs instead of raising wages or otherwise investing in their businesses.

The cost of living in Japan looks relatively low according to popular measures such as the “Big Mac index” or the more recently introduced “Starbucks index”. Meanwhile, looking at minimum wage levels around the world, Japan sits among the lowest of the developed economies. This suggests there is meaningful room for price and wage hikes should this virtuous cycle become established.

Demographics may help wage growth

As things stand, wages in Japan are already ticking higher, with positive wage growth for 19 consecutive months. Recent data showed a rise of 2.9% year-on-year in May but smaller increases of 2.3% y/y for June and 1.3% y/y for July. That still leaves wage growth lagging behind inflation.

‘we continue to see a positive outlook for the Japanese stock market’

We do see reasons for wages to keep growing though. Corporate profits reached a new peak in the April-June quarter because companies were able to pass cost increases through into their selling prices. That bodes well for future wage growth.

Japan’s demographic challenges may also see employees gain more power in wage negotiations. Japan’s working age population is shrinking more rapidly than that of many other developed countries. The Bank of Japan has said that “it seems highly likely that, if the economy continues to improve, competition over human resources will become more intense and wage growth will rise”.

Potential super cycle for Japan triggered by inflation

In a deflationary environment, cash is king, so Japanese households and corporations have tended to hold a lot of cash. Although this has was rational during the era of deflation, the return of inflation means there is a “cost” to holding cash, and we foresee behavioural changes going forward.

‘we can be very confident in the long-term outlook for Schroder Japan Trust’

Indeed, the Japanese government has made some interesting and bold changes to the tax-exempt “NISA” savings scheme which are designed to promote a broad shift from savings to investments.

Furthermore, we think corporations will also strive to use the idle cash on their balance sheets, mainly to improve productivity. Capital expenditure remains strong, and we expect this trend will continue in the inflationary environment.

Implications for Schroder Japan Trust

All in all, we continue to see a positive outlook for the Japanese stock market in general terms. More importantly, as active investors, we can find many opportunities in individual companies which can meaningfully benefit from these pivotal changes in Japan. By building a portfolio of stocks in which we hold high conviction, where the opportunity for improved returns and valuations is greatest, we can be very confident in the long-term outlook for Schroder Japan Trust.

Click here to find out more about the Schroder Japan Trust >

Annual Results 2023 – On Thursday 12 October 2023, Fund Manager Masaki Taketsume presented the Trust’s annual results for the year ended 31 July 2023.

Download presentation >

Disclaimer:

Third party data including MSCI data is owned by the applicable third party identified in the material and is provided for your internal use only. Such data may not be reproduced or re-disseminated and may not be used to create any financial instruments or products or any indices. Such data is provided without any warranties of any kind. Neither the third party data owner nor any other party involved in the publication of this document can be held liable for any error. The terms of the third party’s specific disclaimers, if any, are set forth in the Important Information section at www.schroders.com

Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.