May

2019

Scam-a-lot: how to protect yourself against fraud

DIY Investor

7 May 2019

A report from Money Guru says that £500m was lost to scams from UK bank customers in the first half of 2018; see the article here

When you think of someone committing fraud or stealing your details, you imagine perhaps a single person. A loner, at a computer, in a darkened room, preying on the vulnerable.

Or maybe an email from a fictional prince asking you if you wouldn’t mind holding onto $10bn for him, if you’d just let him have your bank account details.

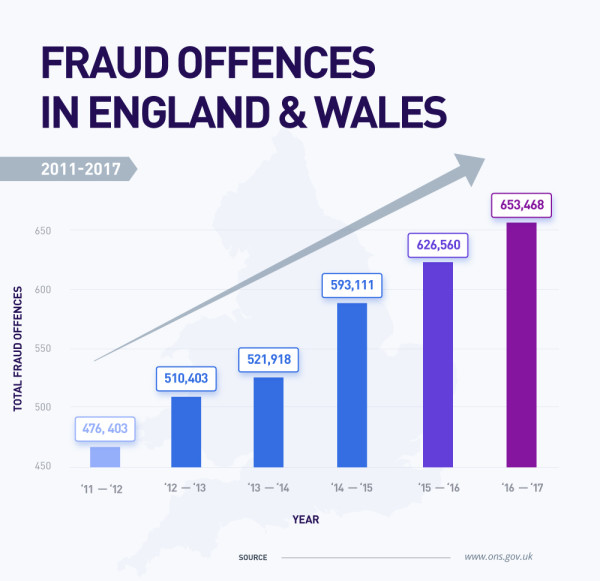

Unfortunately, scamming is a much bigger business than that, with attacks often well organised and hitting thousands every day. £500m was lost from UK bank accounts in the first 6 months of 2018 alone.

‘It’s estimated that the total cost of all fraud to the UK is £190bn a year’

That’s the equivalent of unlocking 650,000 new homes. It’s estimated that the total cost of all fraud to the UK is £190bn a year.

That’s a little less than both the health and defence budgets for the UK. When you also consider that only one in five people report the incident to Action Fraud, the UK’s national fraud reporting service, or the police, the true figure could actually be much higher.

30% of customers duped into authorising access to their account – with no legal protection

Although we live in an increasingly digital world, a lot of fraud happens face-to-face, over the phone or through postal services, with smart scammers tricking people into handing over crucial details and access to accounts.

Out of the £500m lost in the first half of 2018, 30% (£145m) of that was lost through this type of scam. It’s called Authorised Push Payments (APP) and unfortunately, people subject to this kind of scam do not currently have legal protection to cover their losses.

‘people subject to this kind of scam do not currently have legal protection to cover their losses’

In 2018 the Financial Conduct Authority (FCA) proposed plans to increase the powers of the Financial Ombudsman Services, which would allow victims to escalate complaints and ultimately, enable more people to claim reimbursement of funds lost through this particular type of scam.

Under current regulations, if your bank has not taken enough action, they don’t reimburse you or they don’t respond, then you have no right to complain or escalate your complaints to any authority.

Just under half (44%) of fraud victims do not receive a full reimbursement

Research from the Office for National Statistics, says that a little less than half of all those who were a victim of fraud received no or only partial reimbursement. The figures, from the year ending June 2018, show just how serious a matter this is.

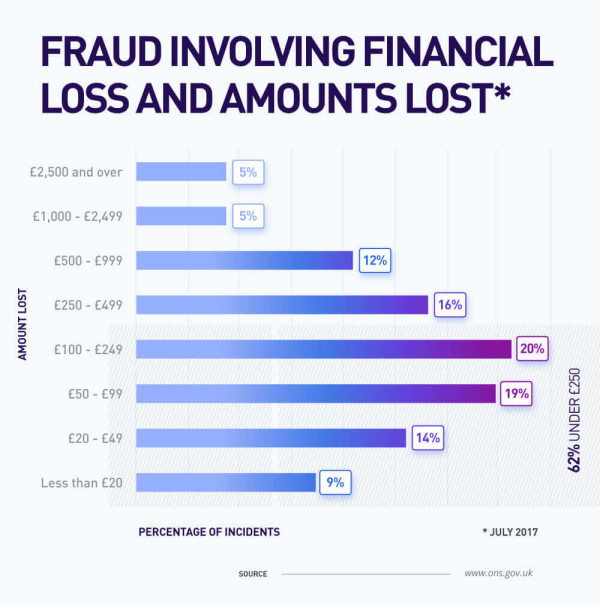

The majority of reported losses are under £250 (62%) although it appears that the data collected by the Crime Survey of England and Wales for the Office of National Statistics does not capture many high-end losses, i.e. those in the tens of thousands of pounds.

Three quarters of us fell victim to a scam between 2015 – 2017

According to a report from Citizens Advice, 72% of us have been targeted by scammers in a 2 year period between 2015 – 2017, with 1 in 10 of us knowing someone who has lost money through a scam.

Unfortunately, the elderly are particularly vulnerable. 5 million people over the age of 65 believe they have been targeted by scammers. This can be devastating, especially to those who are defrauded within their own homes, losing life savings.

‘5 million people over the age of 65 believe they have been targeted by scammers’

What makes it even more alarming, is that many scams are authorised push payments (APP).

While current legislation makes banks liable for fraud that has not been authorised by the customer, they are not liable for fraud where the fraudster has manipulated someone into authorising a payment.

In 2016, Which? made a super-complaint to the financial regulators, calling on banks to better protect customers who are duped in this way. Although the Financial Conduct Authority agreed there was a serious issue, they stated that there was not enough evidence to create new laws to force banks into better protecting their customers.

What is being done to combat scams

As mentioned above, falling foul to Authorised Push Payment scams does not offer legal protection. However, there are plans in place to stamp out the scams. Four of the UK’s largest mobile network operators have joined forces to reduce the number of people suffering from APP scams.

EE, O2, Three and Vodafone are delivering the SMS Phishguard initiative service for banks. This will mean fraudsters are unable to impersonate the bank and send out mass bogus texts. The initiative will also extend to other merchants and public sector bodies that use SMS messages when communicating with consumers.

APP fraud is a growing problem in the UK and, as such, the FCA (Financial Conduct Authority) is consulting with a number of firms to discuss handling the complaints procedure.

The FCA is proposing to allow those that do lose thousands from the scam to refer their complaints to the Financial Ombudsman Service if they are unhappy with the outcome reached with the Payment Services Provider (PSP).

Similarly, the Payment Services Regulator (PSR) has drawn up a new voluntary code, seeking the reimbursement of APP victims. The code – which is undergoing consultation and is ready for implementation in early 2019 – has been developed by representatives of the banking industry, providing new levels of protection against APP scams than ever before.

Types of scam to watch out for

Not everyone who comes to our front door or cold calls us is out to con us, but unfortunately there are many who will. Even people who you know and have let into your home to do work of some kind can turn to a scam in time. People like this often prey on the elderly or vulnerable, building trust and then duping the individual. Below, we’ve included some of the most common types of scam and the ways in which the perpetrator will try to trick you.

1. Rogue Traders and bogus callers

- Getting you to set up an account for a catalogue in your name and with your account details and delivery address, saying that they will pay you cash for whatever they order.

- Carrying out unnecessary repairs or building works on your home or garden.

- Trying to sell unnecessary products or services, which are of poor standard, or they are not properly qualified to provide.

2. Scams by telephone, letter or email

- Asking you to donate to a charity or cause, requiring that you share financial details.

- Pretending to be a service provider to gain information about your account.

- Pretending to be your bank to gain access to your account.

3. Pensions

- Offering unsolicited advice or pension reviews.

- Trying to sell you false or dodgy investments, such as wine, shares or land investments.

4. Money mules

- Someone attempting to use your account to launder funds, promising a fee in return.

- This type of scam involves you in illegal activity and the consequences can be very serious.

5. Copycat websites

- Charging a fee to renew or process official documents, such as a passport.

- Selling items that aren’t really for sale.

6. Tech support

- Being told your computer has a virus and it can be fixed – for a fee.

- Being tricked into downloading malware or clicking on ads or suspicious emails, which then infects your computer with a virus.

- Bogus virus protection or warranties.

7. Employment scams

- Paying for training courses that don’t exist.

- CV services or security checks with companies that are not legitimate.

8. Auction sites

- Buying goods that don’t exist through auction sites.

- Asking you to pay via a bank transfer.

9. Ticket scams

- Selling a fake ticket that can’t be used and won’t be refunded.

- Fraudsters often create their own websites that look very real.

10. Phishing

- You’ll receive a text or email from a malicious account asking you to log into your account – it could your eBay, your PayPal or your bank account which reveals your username and password to cybercriminals.

- Emails look very real – as if they are from eBay, PayPal or your bank.

- Can be any account for goods and services that you use.

Top tips to spot a scam

Never freely give away any personal information, such as bank account details, computer passwords, your mother’s maiden name or PIN numbers. Legitimate companies will never ask for this via email or over the phone.

Never let anyone into your home if you do not know them.

Never give over your account details to sign up for anything over the phone, by email or to someone at the door.

Never download any attachments or files in emails or click on links from email accounts you don’t recognise.

Never ring any phone numbers in emails or letters you receive unless you are 100% sure they are official contact details for a reputable company.

Never directly transfer money to anyone but trusted close friends and family and make sure to keep tabs on these transactions.

If you have been scammed, defrauded or experienced cybercrime you should immediately report it to Action Fraud. You can report any time of the day or night using their online tool and they also have advisors available on web chat 24 hours a day for help and advice.

You can also call 0300 123 2040, Monday – Friday 8am – 8pm.

Click to visit

Leave a Reply

You must be logged in to post a comment.