Apr

2024

Saving for the future: why cash won’t cut it

DIY Investor

15 April 2024

Cash deposits might seem a safe way to save. But if you hold onto cash for long periods, it can pose a serious risk to your wealth

Cash savings accounts are extremely useful ways of setting aside money to use for short-term spending or emergencies. They are also familiar and reassuring: after all, the cash is somewhere secure.

But in fact for longer-term goals – such as buying property, paying for education or saving for retirement – cash is not so smart. Over time. cash savings are riskier than other forms of investment. This is because cash is less likely to keep pace with inflation, meaning your overall wealth could fall.

For the past 30 years inflation around the world has averaged at well over 5% per year1. With inflation at 5%, a bunch of flowers which cost $20 one year would cost $21 the next.

Unless your savings deliver returns of 5% or more, you are losing money.

Inflation is only one enemy of cash: time is the other

Many countries aim to keep inflation low, for example at a target of 2%. A low figure like 2% or 3% may not seem harmful over the short term. But over longer periods the harm to your wealth can be great, even where the inflation rate is modest.

|

Your original 10,000 in savings |

…with inflation at 2% |

…with inflation at 4% |

…with inflation at 6% |

|

After two years |

9,612 |

9,246 |

8,900 |

|

After five years |

9,057 |

8,219 |

7,473 |

|

After 10 years |

8,203 |

6,756 |

5,584 |

|

After 15 years |

7,430 |

5,553 |

4,173 |

|

After 25 years |

6,095 |

3,751 |

2,330 |

Source: Schroders. Assumes no cash interest is earned on the original deposit

In real life, the rate of inflation is different for all the different goods and services that you buy. In many parts of the world the costs of healthcare and housing, for example, have gone up faster than the prices of other items.

Cash savings? You could be vulnerable if everyday essentials rise sharply in price

If inflation is especially high for essentials, then savers who depend on cash for their future spending could face difficulties.

In 2022, a difficult year when world trade was being disrupted by the aftermath of the pandemic and the outbreak of conflict in Ukraine, global inflation averaged 8% across all goods measured.

But the 8% figure concealed some more unpleasant truths. Food inflation averaged 12%, and energy inflation averaged 14%1. In some countries it was far higher.

With food inflation at 12%, the amount of food you can buy for every $1 will be almost halved in five years. After 10 years your $1 will buy just one third of the original amount.

But surely if I earn a good rate of interest on my cash I can beat inflation?

Cash earns interest on deposit and that can help in the fight against inflation. However not all accounts pay attractive rates of interest all the time. And during periods when savings rates are high, inflation tends to be higher too.

So just how easy is it to beat inflation with cash? We looked back over almost 100 years of historical returns to discover exactly what the likelihood is that your cash will beat inflation if you saved for ANY period of one year, three years, five years or ten years. And this is what we found.

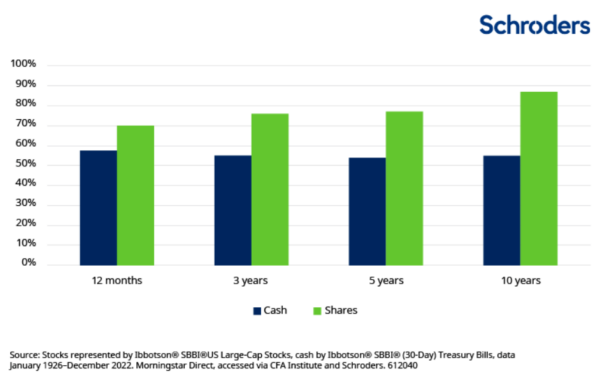

% chance of beating inflation if you save in either cash or shares – over different timeframes

The chart shows that cash has an approximately 60:40 chance of beating inflation, however long you save for. By comparison the likelihood of stock market investments beating inflation increases quickly the longer you invest.

In fact, the likelihood of stock market investments beating inflation reaches 100% for any time period of 20 years.

If cash savings pose a threat to my long-term wealth, what can I do to protect myself?

As the chart shows, not all investments are equally likely to lose out to inflation. So one way to safeguard your wealth could be to expose your savings to a range of investments such as shares, bonds, real estate and other alternative assets.

These all generate returns in different ways, and all offer a good opportunity – but not a guarantee – to beat inflation.

1Source: The World Bank. A Global Database of Inflation (worldbank.org)

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.

Leave a Reply

You must be logged in to post a comment.