Mar

2025

Saver > Investor: How stock market investing can help you get rich slow

DIY Investor

15 March 2025

Like many others, the financial services sector has a series of guiding rules and truisms, and its own vernacular, that have those ‘in the know’, smirking in self-satisfaction – by Christian Leeming

They know that they shouldn’t put all their ‘eggs in one basket’, and that ‘time in the market’ beats ‘timing the market’; they also instinctively know that over the long-term investing in the stock market delivers better returns than savings in cash.

The Bank of England’s recent decision to increase interest rates for the twelfth consecutive time rekindled the savings vs investing debate, as after ten years of rock bottom returns, savings rates have started to rise.

It also ignited consternation among those that saw their mortgages spike overnight, whilst interest on their savings began to begrudgingly creep up some months later; that is probably for another day.

Both cash and stock market investments have a role to play in creating long term wealth and achieving financial resilience; everyone should have a rainy-day fund either in cash, or readily accessible investments, to deal with the inevitable potholes on the road to financial independence; investing should be seen as a long game in pursuit of your financial objectives and life goals.

Now research by DIY investment platform, interactive investor, illustrates the long-term potential of stock market investing versus cash.

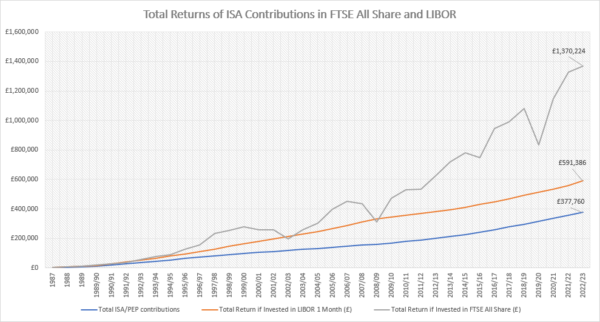

ii analysed data over a 35-year period, during which UK interest rates ranged from 0.10% to 13.88%, and considered a scenario where the full annual Personal Equity Plan (PEP) allowance was invested annually since their launch in 1987.

This was then followed by the full annual Individual Savings Account (ISA) allowance since they replaced PEPs in 1999. The study assumed that investment returns mirrored the FTSE All Share index over the past 35 years, with ‘early-bird’ investments made on 6 April each year.

Investments tracking the FTSE All Share would have delivered a fourfold return, turning total contributions of £377,760 into £1,370,224.

The same amount invested in cash using one-month LIBOR rate as a proxy, similarly, sheltered from tax in PEP and ISA wrappers, would have delivered £591,386.

Over the past 35 years, the government has regularly increased the annual ISA allowance from £2,400 in 1987 – the PEP allowance – to its current level (£20,000). In April 1999, Chancellor Gordon Brown introduced ISAs to replace PEPs with a limit of £7,000.

Get rich slow

interactive investor found that the ‘get rich slow’ approach is one that it’s growing band of ISA millionaires adopted; with an average age of 73, most would have started their investing journey in PEPs before graduating to ISAs.

The data makes a powerful case for the long-term potential of the stock market, and the benefits of investing over saving, which in this instance more than doubled the returns achieved by cash; whilst few may be able to fully subscribe to their ISAs each year, it should still inspire those with much smaller pots.

Source: interactive investor/Morningstar. Total Returns (GBP).. ICE Libor 1 Month TR GBP and FTSE All Share TR GBP indexes. ISA and PEP allowances are sourced from ISACO. Past performance is not a guide to future performance).

In announcing the results, Dzmitry Lipski, Head of Funds Research, interactive investor, says: ‘It is interesting to note that the gap between cash and investing returns grew more rapidly than ever following the Credit Crunch, record low interest rates and a phenomenal recovery in equity markets following the onset of the Covid-19 pandemic.

‘Interest rates has risen significantly following 12 consecutive hikes to the Bank of England’s base rate, which has resulted in a notable reprieve in savings rates. Meanwhile equities have become more volatile recently, and, at the very best, their upward momentum has slowed. There are never any guarantees but investing in shares will more than likely continue to outperform cash over the long term.

‘Apart from maintaining an emergency/rainy day pot, it makes sense for investors to allocate to cash savings as long as they earn positive real return (less inflation).“Given current inflation rate is much higher than rates on offer from retail banks, it makes sense for long term investors to favour investing over saving, even if it’s in simple index trackers so call passive investing strategy. “As we move into a more uncertain market environment, it makes sense for cautious investors – or someone approaching retirement – to focus on capital preservation and limit volatility by maintaining a reasonable cash buffer within a well-diversified portfolio. For those who can afford to keep their money tied up in investments for at least five years and are happy to tolerate inevitable stock market volatility, it is smart to keep money invested.’

Myron Jobson, Senior Personal Finance Analyst, interactive investor, says: ‘Cash is certainly back. There is no denying the allure of cash following a significant uptick in savings rates, but our research illustrates that over the long term, it is costly to ignore the stock market.

‘There isn’t a binary answer in the savings versus investing debate. The answer is you should be doing both if you have the means to do so – whatever your goals and attitude to risk.

‘Savings rates are attractive, with the top deals offering a rate of interest north of 4%. But it is unhelpful to view savings rates and investment returns in the same way because it creates an expectation of having a steady annual return when the reality is you could see a double-digit return in one year and a loss the next. The key is to give your money ample time in the market to smooth out the effects of weekly market ups and downs. And don’t forget that cash rates fluctuate too – there’s no telling if a good rate now will still be there in the future.

‘While past performance is not indicator of future results, a look back at history shows that investing is king over the long term. The graph demonstrates the wonderful benefits of compounding; how an investor would have grown their assets over time if they had invested the full ISA and PEPs allowances since 1987.“It is also important to bear in mind that savings rates remain in the doldrums in reals terms because of rampant inflation which remains in double-digits, meaning you’ll be able to buy less with your money. In fact, the real value of cash savings has been eroded at an alarming rate in recent history.

‘Cash savings is the way to go for short term savings goals – generally those less than five years away. It is also important to maintain a healthy rainy-day fund – three to six months’ salary worth is a good rule of thumb.’

Brokers Commentary » Commentary » Isas commentary » Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.