Sep

2022

Same same but different

DIY Investor

17 September 2022

We discuss the case for emerging markets at different stages of development…by Helal Miah

To many investors the thought of investing in emerging markets may sound somewhat exotic, with the prospect of high returns, while to others the first thing coming into their heads will be the risks and volatility of past events, as well as how investors got burned by events such as the numerous defaults by Argentina, the Russia crisis in the late 1990s and the multitude of political uprisings in individual countries which have upset foreign investors.

We think emerging market equities are a crucial asset class, and as individual countries develop fast and close the gap with the developed world there are many investment opportunities being thrown up. Emerging or developing markets are at an earlier stage of development than say the UK, but are making progress in modernising their economies, which is where the opportunities lie.

For these countries, structural factors are the driving force, much as they drove the UK’s path to modernisation. In the UK, population growth – aided by better healthcare, manufacturing and production rates – soared due to the Industrial Revolution, which was essentially a scientific and technological revolution.

Combined with an improving legal framework, the development of a financial system and the profit motive, it in essence brought us to where we are today. Similar structural drivers are today to be found in countries and regions that have yet to reach developed market status.

One of the key structural drivers is demographics. Many emerging nations are experiencing a high rate of population growth, and better healthcare is lowering death rates. A growing population also means a bigger market for companies to serve and a growing labour force.

Educational improvements, aided by emigrees returning from abroad, should also help to improve labour productivity rates. This tends to create a pool of attractive cheap labour for multinationals which can help develop domestic industries and raise the general standard of living – boosting consumption, and leading to the development of more sophisticated homegrown industries.

Different countries are at different points along this path of development. Countries such as South Korea and Taiwan are still considered to be developing by MSCI’s classification. However, the FTSE places both South Korea and Poland amongst the developed nations, highlighting that such classifications are a grey area.

South Korea is home to some of the best-known brands around the world and has a legal and financial system on a par with those of some developed nations, while its GDP per head is as high as that of Spain or Italy. The same could also be said of Taiwan.

Investors may be in search of the next Singapore, South Korea or Taiwan. China has achieved a high level of development, although GDP per capita still remains low by developed world standards. It is the source of many interesting companies but has shifted from a state in which demographics are a driving force. India on the other hand, is earlier on the path of development China has experienced, which is throwing up many interesting opportunities for catch-up growth.

India is benefitting from many of the structural factors mentioned above, but given its highly educated and English-speaking labour force, it offers a different opportunity set to other developing countries.

Amongst investment companies focussed on India, we suggest investors consider Ashoka India Equity (AIE), which has been the standout performer amongst its peers since it was launched in July 2018. Its management group White Oak Capital Partners was founded by former Goldman Sachs CIO of Global Emerging Markets, Prashant Khemka.

AIE has a broad team of India-focussed analysts who have built a portfolio of around 80 stocks using their unique cash-flow-centric valuation framework to pick stocks. It also has a performance-fee only structure intended to align the interests of the management team and investors.

Alternatives to this are Aberdeen New India (ANII) and JPMorgan Indian (JII). ANII focusses on identifying quality stocks at attractive valuations. It is managed by Kristy Fong and James Thom, but they draw on a much broader team of analysts and PMs considering Indian companies. The portfolio is diversified across a variety of old and new economy sectors, in companies the managers believe have many years of above-market growth ahead of them.

While the search for durable long-term growth leads the managers to companies benefitting from structural trends in the Indian economy and society, the portfolio is managed in a purely bottom-up way, the preference being for companies which are resilient to the ups and downs of the economic cycle. We published a full note on the trust in August.

JII is managed by Rajendra Nair and Ayaz Ebrahim. It is the oldest and largest Indian specialist trust, drawing on JPM’s broad tams in the region. Raj and Ayaz aim to identify long-term quality growth opportunities in India. Many of their ideas are benefitting from the country’s rapid economic development, which in some ways is following the path China has travelled.

The financial and consumer stocks the managers buy are serving a huge and rapidly growing market of consumers, and the managers cite estimates by the Brooking Institute showing there are more new consumers to come into India’s economy than China, looking out to 2030. ANII and JII have less exposure to mid and small caps than AIE, but have the advantage of trading on wider discounts, while AIE has tended to trade at close to or above par.

Other Asian nations such as Malaysia, Indonesia, Thailand and the Philippines are making steady progress, also benefitting from supply chains moving away from China as well as an abundance of natural resources and a thriving tourism industry. In this region we think Vietnam looks particularly interesting. and it has inspired the launch of a number of specialist investment trusts.

Vietnam has been undergoing significant development over the past four decades as its government has gradually developed a market economy and opened up to foreign investment. It also has a large and growing population which is increasingly educated and moving to urban centres for jobs and a better lifestyle. Its GDP is amongst the highest in the Asian region and set to grow by roughly 7% in 2022 and remain high for some years ahead.

Vietnam Enterprise Investments (VEIL) is run by Dragon Capital, the largest and first international investor in Vietnam. Launched in 1995, VEIL has an excellent performance record and its managers have a deep knowledge of the local market, gained through the accessibility of the country’s corporate management teams.

Portfolio manager Dien Vu and his extensive team have created a concentrated portfolio using a bottom-up stock selection approach that is biased towards quality companies. They see the best opportunities within the banks, property and retail sectors where the portfolio is most overweight. We wil be publishing a full nots on the trust in the coming weeks.

Some of the oil-rich nations in the Middle East are also attracting investors’ capital in the light of the energy crisis. While their fossil fuel reserves are a key advantage, demographics and rising consumerism are also leading to investment opportunities.

This region is only recently opening up to outside equity investors, and Barings Emerging EMEA Opportunities (BEMO) is one vehicle which offers access. Its EMEA region is one which has little exposure in mainstream emerging market funds and we think it could therefore complement other more broad-based emerging market strategies with a strong bias to North Asia.

BEMO’s benchmark (since November 2021 the MSCI Emerging Markets EMEA Index) is roughly 34% invested in Saudi Arabia and 28% in South Africa, with the majority of the remainder invested in the Gulf and a small allocation to Eastern Europe. Saudi Arabia’s importance as a source of hydrocarbons during the transition has been increased by the cutting out of Russia from the global market, while South Africa offers exposure to companies generating the metals needed to facilitate new energy sources and electric vehicles.

BlackRock Frontiers (BRFI) is another option which provides diversification to the mainstream emerging market indices. It invests in emerging and frontier markets outside the largest eight, an interesting set of countries typically at an earlier stage of development and with more endogenous growth drivers.

The investible universe of BRFI is spanned by the current benchmark of the MSCI EM Index ex Selected Countries + MSCI Frontier Markets Index + MSCI Saudi Arabia Index. Crucially, the ‘ex Selected Countries’ excludes the eight largest EM countries by market capitalisation: China, Taiwan, India, Korea, Brazil, Russia, Mexico and South Africa. These countries make up c. 84% of the EM index as at 31/03/2021, so it is clear that BRFI is a highly differentiated offering by design.

BRFI is predicated on the belief in economic convergence, meaning the ability of less developed countries to grow at supernormal rates as they catch up with more developed nations. Although there is no simple deterministic link between GDP growth and equity market returns, Sam and Emily believe that from within a universe of 3 billion of the world’s poorest people, there is a rising middle class that generates a tailwind for these markets.

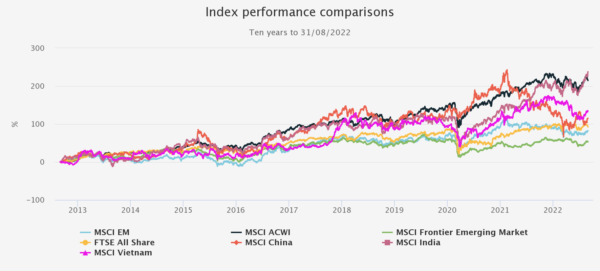

Emerging markets in general have failed to beat developed markets over the past decade as the US has outperformed and the emerging market index has latterly been pulled down by the crash in the Chinese market (see chart below). Supply chain after-effects from the pandemic and the war in Ukraine have now made for a very different scenario going forward as central banks push interest higher to combat inflation.

This will no doubt be a cause for concern for emerging market countries which have seen their currencies take a beating in the past when the dollar has strengthened. However, we believe that emerging market countries today are more resilient than they used to be and can now stand on their own two feet, and we think that Vietnam is an example of this.

Its currency has been remarkably stable, domestic demand accounts for over 70% of GDP, and foreign direct investments are still making their way in rather than out. While the immediate outlook may be uncertain, we think there are many opportunities in emerging markets which are worth adding to a long-term portfolio, in particular in the earlier-stage countries which still have catch-up growth to come.

Disclaimer

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.