Jul

2023

Are there downsides to money market funds?

DIY Investor

4 July 2023

Such funds are low risk and have attractive yields, but there is something important to remember, points out Saltydog.

All the major stock market indices that we track did better in June than they had in May, and most made gains. The only exceptions were the FTSE 250, which fell by 1.6%, and the Shanghai Composite, which fell by 0.1%.

The star performers were the Brazilian Ibovespa, up 9.0%, followed by the Japanese Nikkei 225, which made 7.5%. The US indices also did relatively well. The Dow Jones Industrial Average made 4.6%, the S&P 500 rose by 6.5%, and the Nasdaq did slightly better, up 6.6%.

Stock Market Indices 2023

| Index | Jan 2023 | Feb 2023 | Mar 2023 | Apr 2023 | May 2023 | June 2023 |

| FTSE 100 | 4.3% | 1.3% | -3.1% | 3.1% | -5.4% | 1.1% |

| FTSE 250 | 5.3% | 0.3% | -4.9% | 2.6% | -3.6% | -1.6% |

| Dow Jones Ind Ave | 2.8% | -4.2% | 1.9% | 2.5% | -3.5% | 4.6% |

| S&P 500 | 6.2% | -2.6% | 3.5% | 1.5% | 0.2% | 6.5% |

| NASDAQ | 10.7% | -1.1% | 6.7% | 0.0% | 5.8% | 6.6% |

| DAX | 8.7% | 1.6% | 1.7% | 1.9% | -1.6% | 3.1% |

| CAC40 | 9.4% | 2.6% | 0.7% | 2.3% | -5.2% | 4.2% |

| Nikkei 225 | 4.7% | 0.4% | 2.2% | 2.9% | 7.0% | 7.5% |

| Hang Seng | 10.4% | -9.4% | 3.1% | -2.5% | -8.3% | 3.7% |

| Shanghai Composite | 5.4% | 0.7% | -0.2% | 1.5% | -3.6% | -0.1% |

| Sensex | -2.1% | -1.0% | 0.0% | 3.6% | 2.5% | 3.3% |

| Ibovespa | 3.4% | -7.5% | -2.9% | 2.5% | 3.7% | 9.0% |

Data source: Morningstar. Past performance is not a guide to future performance.

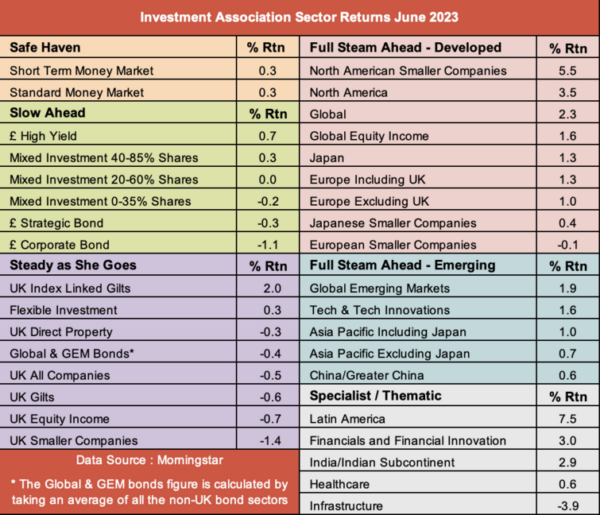

We also saw an increase in the number of Investment Association (IA) sectors making gains.

In May, only 10 of the 35 sectors in our monthly summary report had gone up. In our latest analysis that number has risen to 24. The best-performing sector was Latin America, which went up by 7.5%, followed by the North America and North American Smaller Companies sectors

Our problem as investors has been finding sectors that have been doing consistently well from month to month.

Over the last two months, the American sectors have performed relatively well along with the Technology & Technology Innovations sector. This also tends to give a boost to the Global sector, where a lot of the funds hold shares in the large US technology companies.

Since the end of May, our demonstration portfolios have sold the funds from the UK and European sectors and now have some exposure to the US and technology funds.

If you look over April, May and June, then only three sectors have consistently made gains. The two Money Market sectors and India/Indian Subcontinent. Only the money market funds have gone up in each of the last four months.

This is why we are still holding three money market funds, Royal London Short Term Money Mkt, L&G Cash Trust and abrdn Sterling Money Market. They are also our largest investments.

Although they are generally considered low risk, it is important to realise that they are not completely risk-free.

The Financial Conduct Authority (FCA) along with the Bank of England launched a joint discussion paper last year on reforming money market funds. More details can be found here.

They were particularly concerned about the role that money market funds play in the wider economy and what can happen if things go wrong.

It was not the main focus of the paper, but it did make me think about the potential problems for private investors.

The risks associated with funds will vary from sector to sector, however there are some basic fundamentals that we should all consider. The two main areas of risk are overall loss and the lack of liquidity.

Overall, the money market funds look like a fairly safe bet when it comes to the preservation of capital. However, liquidity could be more of an issue. The funds have very strict rules regarding the timescales over which they invest.

For example, there are rules that determine how much of the fund is invested in assets that mature within certain time frames. Many funds need to ensure that at least 30% of their assets will mature within one week. If a large investor suddenly reduces its position, then it could throw the whole fund out of kilter, and it may need to impose redemption fees or even stop withdrawals until it rebalances the portfolio.

I do not consider this a particularly large risk for our demonstration portfolios. At the end of the day, it would not be a major problem if we were unable to sell our funds for a few weeks or even months, but I can see why it could be an issue for some investors.

For more information about Saltydog, or to take the two-month free trial, go to:

Commentary » Latest » Mutual funds Commentary » Mutual funds Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.