Apr

2019

Revealed: The UK’s Businesses that Pay Late

DIY Investor

8 April 2019

Since April 2017, all large companies with a £36 million annual turnover have an obligation to report to the government about their payment practices, which can be accessed by anyone online.

Yet, worryingly, a high proportion of these businesses routinely pay suppliers late even with so much cash in the bank.

Measly 5% Of Businesses Pay Invoices On Time

Only 316 out of the 6,613 businesses in the latest Government report, published in September 2018, pay all their invoices within 30 days. A huge 1,385 of the businesses in this list pay more than half of invoices days late.

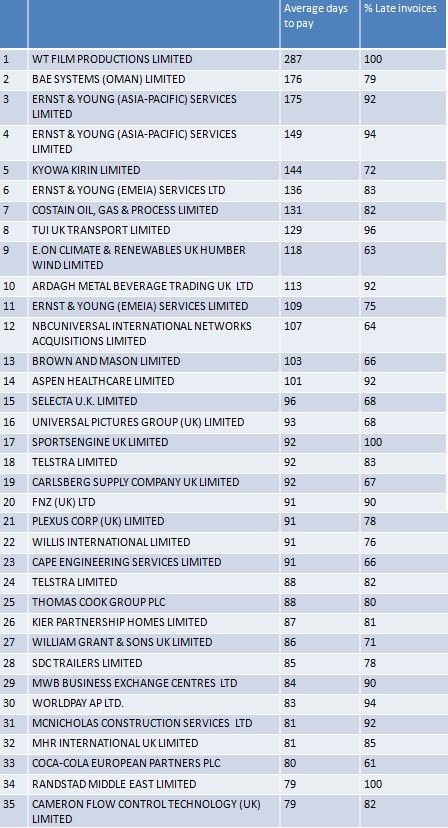

There’s more where that came from, we’ve listed the UK’s top businesses that are paying late in 2018. So, without further ado, let’s take a look at the guilty parties.

Source: The data in this table is correct as of 12th September 2018.

It’s worth noting that it’s not required for businesses to report on contracts for financial services. So, in practice, financial services businesses will only report on other services and goods such as office supplies.

So, who are the companies on this list? There’s certainly some household brands on here, and many that earn more than one can fathom, but regularly pay late. We’ve broken down the most shocking discoveries below.

WT Film Productions

The film company that have brought you Bridget Jones’s Diary, The Theory of Everything and now late payments. Working Title Films maximum contractual payment period is 7 days and vendors classed as freelancers 14 days. Yet, their average time to pay invoices is a massive 287 days.

TUI UK Transport Limited

The TUI group is a favoured travel company among many in the U.K and Germany. It is the largest travel and tourism company in the world and a part of the FTSE 100 Index. Shockingly though, the business is one of the worst offenders for late payments. A typical time for TUI to pay invoices is 129 days, that’s 99 days later than agreed. TUI only manage to pay 6% of their invoices within 30 days.

E.ON Climate & Renewables UKHumber Wind Limited

E.ON a household name in the U.K and one used by many for their energy supply, comes in at number nine on the league table. It’s hard to swallow that an energy company would harass people if they didn’t pay their bills on time, yet this renewable division pays 63% of invoices late.

Universal Pictures Group (UK) Limited

Now showing at a cinema near you: ‘The Late World: Universal Pictures’ and ‘Late & Livid 6’. The iconic Universal Pictures has many high-grossing films under their belt. But no matter how much money the studio makes, they have a terrible repertoire for reimbursing bills. 68% of their invoices are paid late. On average they take a monstrous 93 days to make payments.

Carlsberg Supply Company UK Limited

If Carlsberg did invoices they would…definitely not be the best in the world. The Copenhagen beer company, on average, takes a huge 92 days to pay invoices. More than half of them are not paid within agreed terms.

Thomas Cook Group PLC

The British travel company is not one to shy away from controversy, in 2006 two British children died from carbon monoxide poisoning while on a Thomas Cook Holiday. In August this year, a British couple passed away, again while on a Thomas Cook holiday. And now, while not on the same scale, but shows how not to run a company, is the revelation of their payment practices. 80% of Thomas Cook’s bills are not paid on time, spending a massive 88 days to pay on average.

However, a Thomas Cook spokesperson said “Thomas Cook Group plc represents the Thomas Cook Group parent company only, i.e. solely the corporate Head Office, and not the consolidated Group. This data therefore relates to less than 1% of all Thomas Cook payments made in the UK.”

Coca-Cola European Partners PLC

‘Taste the Feeling’ of a sour taste in one’s mouth after realising Coca-Cola are number 35? So, the slogan doesn’t exactly go like that. The favoured drinks company spends usually 80 days to pay an invoice. More than half of their invoices are not paid on time.

The Devastating Effects On The UK

It’s easy to look at this report and think these large businesses don’t affect me. But this late culture is a problem for the whole of the UK, it is estimated if SME’s were paid on time, the economy could be boosted by £2.5 billion. Freelancers and small business owners are being affected daily by this late economy.

Three Ways The Late Economy Is Punishing Small Businesses

There were 5.7 million small and medium-sized businesses in the UK in 2017, making up 99% of all businesses. Yet, these businesses are facing an ongoing problem: late invoice payments. On average, 62% of small business invoices are now paid once already overdue.

This delayed payment has a huge impact on the finances of small businesses, putting jobs and businesses at risk.

- SME’s are owed £44.6 billion in invoice late payments

- 50,000 SME’s close each year because of late invoice payments

With 16.1 million people currently employed by SME’s, making up 60% of private sector employment in the UK this is a very real concern.

- 70% of Medium-sized SME’s rely on finance

Of those who are using debt, 68% use the money to acquire working capital or improve cash flow, rather than investing in the business.

To see the true implications of late payments, we decided to talk to SME owners and freelancers, and their feedback was startling…

‘Owed over £1k…only got £450 in the bank’

Rae Radford, Social Media Consultant, who has featured on Good Morning Britain and This Morning is owed over “£1K and with the mortgage payment due on the 1st I’ve only got £450 in the bank towards the direct debit.”

“I’ve asked and asked and asked but they always say the same thing! You just end up going around and around in circles.” Radford added.

‘It is the medium-sized customers who are the worst at paying’

Nicola Simmons who owns Single Variety Co, a small batch jam business, recently posted on Instagram about the problems of late payments. She was surprised to find many SME’s are facing the same problems and have had to come up with resourceful ways to tackle slow payments. Simmons said on the matter: “it’s a constant struggle to ensure there is enough money in the bank in order to pay our fixed costs, e.g rent and staff…I go without paying myself to make sure this is the case.”

The ‘Single Variety Co’ founder went on to say that most of the clients want the business to succeed, but “surprisingly it is the medium-sized customers who are the worst at paying- small independents almost always pay on time, as do the big boys!”

‘Despite clients agreeing to terms they still pay late’

Founder of a small marketing business (Strath Communications), Jennifer Macdonald-Nethercott, is likewise feeling the burden of late invoices.

“The main impact to me as a solo entrepreneur is cash flow and ability to pay the household bills. We’ve had to watch our costs as a family while I chase clients for payment. It’s not the reason I set up the business to spend my time chasing payment.”

‘As a small business there is very little you can do’

Andrew Lawson, the founder and CEO of BoroughBox, a small business owner himself chimed in “Someone not paying us for services, means we struggle to pay suppliers, and so the knock-on effect in the chain continues.”

Lawson continued: “As a business, we don’t want to be holding up the supply chain but as a small business there is very little you can do.”

‘I have 4 young children who are going without things they need’

Self-published children’s author, Ellie Jackson, has sold over 7000 books in a year and has over 150 stockists in the U.K. Yet, she has had to take out a loan to pay for more books because “I currently have thousands of pounds of outstanding invoices and this is having a huge impact on my ability to reinvest in my business.”

Frighteningly, Jackson has “4 young children who are going without things they need.”

‘I’ve borrowed money from my husband or asked him to pay bills’

Jenny Pace a freelancer is all too familiar with late payments. She feels delayed invoices have worsened over the years when she first started her business in 2014 she rarely experienced them. But, now in the last six months, “late payments have meant that I’ve borrowed money from my husband or asked him to pay bills while I wait for clients to settle up.”

Thus, this then continues the cycle she added, as the knock-on effect means she’s a late payer too.

99% of businesses in the UK are SME’s and all of these are at risk from invoice late payment. As a freelancer or SME owner, it’s never been more important to ensure proper invoicing to keep you in the black. With this in mind, we’ve outlined tips on getting paid on time.

Charging Interest And Debt Recovery

New government legislation means you can charge an 8% interest plus the Bank of England base rate on late invoices. You can also claim debt recovery from the business for the cost of a late payment.

The total you’re allowed to charge depends on the sum of debt.

Suppliers can also claim for costs each time you try to recover the debt.

Invoice Financing

If your cash flow has been affected by businesses settling invoices late, you may want to consider invoice financing. This allows you to borrow cash from lenders using your unpaid invoices. Depending on the agreement you will chase the payment as usual, or the invoice finance provider will do it for you.

You can compare invoice finance providers, using Business Expert’s tool here.

Click logo to visit:

Leave a Reply

You must be logged in to post a comment.