Nov

2015

Retirement Realities: What Lies Beneath the Income Gap?

DIY Investor

5 November 2015

A recent survey conducted by You Gov on behalf of M&G Investments has revealed some of the factors behind the ‘gap’ that is accepted to exist between people’s expectations and reality in retirement.

A sample of 2,217 members of You Gov’s UK panel were surveyed via an online interview and the results provide a fascinating insight into the reasons why some people fail to make adequate financial provision for retirement and reveal some of the behaviours and actions that might make a difference

New pension rules that came into force on 6th April 2015 give unlimited freedom to anyone aged 55 and over to use a pension pot accrued via a Defined Contribution (DC) scheme in any way they choose; the survey was conducted to gauge the level of public awareness around the reforms and to predict whether it is likely that those in retirement are equipped to achieve better financial outcomes and thereby close the ‘income gap’.

With the opportunities that come with pension freedom come attendant risks and whilst some people will be able to close the gap, others face the risk of widening it unless the other gaps uncovered in the survey are plugged – gaps in goals and expectations, gaps in knowledge and understanding, gaps in attitudes and gaps in planning.

The survey concludes that the most likely route to a comfortable retirement seems to be careful planning and a willingness to take advice – both from professionals and from older generations that have already learned some difficult lessons

Detailed analysis of the survey results highlights behavioural differences that exist between those that have actively participated in their retirement planning and those that have chosen not to, as well as quite marked generational differences.

The Planning Gap: Why Reality may not meet Expectations

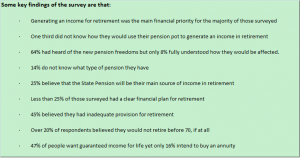

The M&G Investments survey established that generating an income for living expenses in retirement was the main financial priority for the largest proportion of people although other results suggest there is a gap between prioritising this goal and taking action to achieve it.

A concerning 45% of all respondents said that they were unsure they had made adequate financial provision for retirement, and 31% said they had not made a financial plan for retirement including 28% of those aged 45-54, 42% of whom thought they had left it too late to make up ground.

In addition to living expenses, 27% of those approaching 55 had wider financial objectives such as helping family members or leaving an inheritance, although a similar proportion said that they did not know how they would achieve this.

There was a general acceptance of the need to alter spending habits and invest more although those nearing retirement were pessimistic that they had time enough to effect sufficient change and did not know what else to do – resulting in 22% believing that they would be working until 70 or beyond.

The Knowledge Gap: the new World of Pensions

The ability to create better financial futures for themselves and their families should be a positive thing for many people as long as they are educated and equipped to harness the opportunities and avoid the pitfalls created by the new freedoms.

However, the survey suggests there remains a significant degree of risk in this area in terms of a lack of awareness or understanding around pension reform so before taking action, individuals must ensure they have engaged with the issues and understand their options.

Whilst 64% of those surveyed said that they were aware of changes to pension legislation only 8% said that they fully understood the ways in which they would be impacted.

Highlighting one of the gaps between aspiration and reality, 47% said that they wanted a guaranteed income for life yet only 20% said that they would be purchasing an annuity.

Mark (right), 52, retired

Whilst there was a good level of general awareness, one third said that they did not know what they would do with their pension pot in retirement which was the case for 44% in the 45-54 age bracket; what they have decided is to eschew the Lamborghini garage – only 2% said they were going to use some of their pot for a one-off purchase such as a car or a holiday.

The Advice Gap: a Problem Shared

Around a quarter of those surveyed said that they did not know what to do to make a positive impact to achieve their goals in retirement and in many instances professional advice could be shown to have made a significant difference.

Twice the number of people using financial advisors felt they had made adequate provision compared with the non-advised and believed that they could improve performance by a better investment strategy rather than simply saving money.

28% of people that are non-advised believe that the State Pension will be their main source of income as opposed to 15% of those that use an adviser who tend to take a longer term view in terms of their financial planning.

27% of the non advised group had yet to start to plan for retirement compared with 4% of those that are advised with the proportion of those expecting to retire at age 65 being 42% for the former group and 51% for the latter.

Ian, 57, retired

More than double the proportion of the advised group knew exactly what the pension reforms meant to them, although this was still only 16%; those unadvised appear unlikely to take advantage of the government’s Guidance Guarantee as 83% said they had not heard of it.

In an interesting conundrum 35% said they wanted the certainty of guaranteed income in retirement yet 21% said they wanted the flexibility to access their cash if they needed it – suggesting that the optimum solution may be some form of hybrid approach.

The Age: a Message from Those Ahead of us

One of the most notable indications that came out of M&G Investments’ survey was the difference between what people did and what they thought they should have done. Breaking the responses down by age particularly highlights this gap and suggests there are some lessons pre-retired people can learn from those who have been there and done that.

The average age the respondents started saving for retirement was 27.5 yrs, four years later than the average they gave when asked when they should have started, although 55% did not start until they were beyond 30.

The average age that respondents over 55 started saving was 31.5 yrs, fully ten years after what they considered the optimum start point; 25% of 18-24 year olds thought 25.5 yrs was OK showing a generational gap between youth and experience.

83% of those over 55 thought that saving should begin before age 30, yet only 38% had done so and whilst 88% of 45-54s thought that 45 was too late to start saving for retirement, 18% had yet to do so.

15% of those aged over 55 said that they definitely had not made enough provision for their retirement fuelling concerns of a sizeable problem to come.

The message regarding State Pension provision appears to have been received – only 16% of the under 24s expect this to be their primary source of income in retirement compared with 36% of over 55s.

The survey also highlighted the shift toward private pensions as the closure of so many Defined Benefit (DB), or Final Salary schemes filters down; however this highlights another issue as 67% of those in DB schemes expect that to be their primary source of income in retirement as opposed to just 47% in DC schemes.

The results of this survey give a very clear indication of some of the root causes of the ‘income gap’ and their identification is a useful first step toward addressing some of the attitudinal and behavioural issues that are currently seeing a large number of retirees undershoot their expectations.

Working out how to make adequate financial provision for retirement is one of the most important financial decisions most of us will ever face.

Retirement used to be about annuities for most people, but growing concerns that some of these products were offering poor value, and failing to cope with a changed retirement landscape, led to the Government announcing its ‘pension freedoms’ in the 2014 Budget.

With the flexibility to use your pension pot in the way that suits your needs to create better financial outcomes for you and your family, comes the responsibility to ensure that you achieve the income you require without running out of money.

Those reaching age 55 can take 25% of their pension pot tax free and then choose to either take the balance taxed as income, purchase a guaranteed income for life via an annuity or invest the remainder or all of their pot and take flexible income.

These are not small decisions and there is no easy answer or ‘one-fits-all’ solution, so it is important to understand the options as each has its pros and cons.

You do not have to choose just one option and you may find that a ‘mix and match’ approach is the most appropriate for your situation.

Just because certain options exist, does not mean that they are right for your individual circumstances – for example, it is possible for those in a DB scheme to cash in and transfer into a personal pension such as a SIPP; however, the reason the number of DB schemes is in steep decline is because of the relatively generous terms they offer, so it would be rash to jump ship unless a better income is achievable elsewhere.

The fact that many pension providers are unable or unwilling to allow pensioners the new found freedom to use their pension like a bank account has filled many column inches as have the number of scams that have been hatched by those seeking to lead the unwary astray.

The fact that this survey highlights that awareness of the Guidance Guarantee is so low should be of great concern and the fact that those that have taken advice appear to be better prepared for retirement suggests that however diehard the DIY investor, it may be that a sanity check with a professional will ensure that everything has been considered – particularly if its free!

Commentary » In Retirement » Latest » Mutual funds Commentary » Mutual funds Latest » News » Pensions commentary » Take control of your finances commentary » Uncategorized

One response to “Retirement Realities: What Lies Beneath the Income Gap?”

Leave a Reply

You must be logged in to post a comment.

[…] Given that life expectancy in the UK (outside of celebrity circles) has now reached 81.5, as identified by a recent YouGov survey for M&G Investments there are a lot of pension pots out there that are going to struggle to deliver the quality of life that savers aspire to – read more. […]