Jan

2023

Reasons to be cheerful

DIY Investor

6 January 2023

We find reasons to be cheerful this Christmas in the long-term trends that are going to transform society and generate returns…Ryan Lightfoot-Aminoff

2022 has been another challenging year for investors. There has been a surge in volatility across markets stemming from a number of challenging narratives, ranging from inflation to war to zero Covid. One outcome of this is that there have been big falls in valuations in a number of asset classes.

In such difficult times, it is easy for investors to focus on short-term issues and look for immediate fixes, but this can often lead to them losing sight of the long-term trends which are likely to have ongoing structural drivers. We think there are plenty of reasons to be optimistic this Christmas, with positive stories developing in the likes of technology, renewable energy and emerging markets which should drive structural growth and good long-term returns in the years to come. After market falls this year, it could be argued that there are plenty of attractive entry points for long-term investors.

Renewable energy

The cost of energy has been one of the biggest stories of the year. Gas prices were already rising significantly coming into 2022, but the Russian invasion of Ukraine caused them to spike dramatically. One of the solutions to this has been to expand countries’ renewable energy capabilities. This would have three key benefits: better energy security, lower long-term prices and lower carbon emissions.

There has been significant change in this space this year. In the US, we have seen the passing of the landmark Inflation Reduction Act which includes approximately $369bn for climate-related spending. It is one of the most significant climate-related packages of laws in American history. This will lead to a large increase in spending related to energy infrastructure, such as battery storage, electrification of the power grid, electric cars and renewable power manufacturing, which therefore offers many investment opportunities.

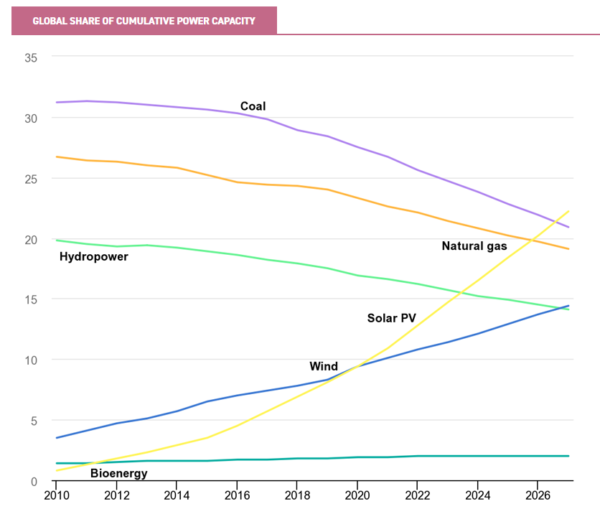

Elsewhere the year has also seen huge announcements for wind energy. As we discussed in a recent article, the UK recently awarded new contracts that will see it have the world’s largest offshore wind capacity, and China in 2021 brought more offshore wind online than the rest of the world combined, jumping up the leader board of top producers. For a country that is currently heavily reliant on coal, this is especially positive. The result of this acceleration in uptake is that renewable energy is set to overtake coal as the world’s largest source of electricity generation by 2025, according to a report by the International Energy Agency, with the primary reason behind this being the impact of the war in Ukraine.

Whilst the Ukraine situation is appalling for many reasons, one of the few silver linings is that it has accelerated the long-term buildout of energy systems that offer domestic security, and at a lower overall price. This means that if there is a major geopolitical event again, the squeeze shouldn’t be as badly felt, and in normal times, there is the possibility for sustained lower prices.

One trust that is at the forefront of wind power in the UK is Greencoat UK Wind (UKW). It was the first trust in the AIC’s Renewable Energy Infrastructure sector and consists of a portfolio of 38 active wind farms, plus another half dozen in development, across the UK. Around a third of these assets are based in offshore wind, including sites in the North Sea and the Irish Sea.

The trust’s managers have been recently acquiring stakes in some of the largest active offshore wind farms in the world. They have also taken the approach of being unhedged to power prices, meaning UKW has been benefitting from the recent price rises, which they have put to use by paying an attractive dividend whilst also reinvesting cash flows back into the business to sustain themselves going forward.

The recent changes in policy have reiterated the drivers behind UKW, as the trust now has the support of consumers and government as it continues to provide low-carbon energy generation. As the UK rolls out its plan to up production capability, we think UKW will be able to sustain its growth trajectory and deliver for investors.

The energy price fallout has not only had an impact on energy generation, but also on energy efficiency. Whilst the improved generation will bring benefits in the medium term, there is a more immediate need for protection from high costs right now, and that is where energy efficiency comes in because one way of reducing the impact of high energy costs is to find ways of using less. Increasing energy efficiency is one way of doing this.

This is a theme that Jupiter Green (JGC) has been playing through its ‘green buildings and industry’ theme, one of six themes the trust follows to help identify companies providing solutions to environmental challenges such as climate change. Manager Jon Wallace has been increasing the portfolio weight to companies offering energy-efficient solutions to homes and businesses. One example is Daikin Industries, a manufacturer of air-conditioning equipment and heat pumps, which provides customers with renewable energy heating systems and energy-efficient cooling products. However, these types of stocks have had a difficult year as they have been caught in the ‘growth vs value’ trade, and the market has become focussed on valuations, rather than the long-term implications for the business case. We believe this disconnect could lead to opportunities for investors in the years to come.

Finally, 2022 has seen major breakthroughs in new energy technologies too, most typified by the successful nuclear fission reaction in December 2022 in the US. One of the biggest obstacles to either reducing energy consumption or making changes to its source has been the impact it would have on people’s living standards, but major scientific breakthroughs such as this offer the ability to maintain people’s standard of living whilst reducing the negative externalities that come from it. This is an early-stage technology, and a long way from commercialisation, but it could be truly transformational. In the meantime, companies like Rolls-Royce continue to work on small-scale nuclear reactors, while hydrogen technology proceeds apace.

2022 has been a year dominated by the negative impacts of increased energy costs, but with improvements in energy efficiency, renewable generation and technological breakthroughs there are reasons to be optimistic for the short, medium and long term.

Technology

The technology sector is another that has been wrapped up in the negative sentiment of the year. The sector was a massive beneficiary of Covid, which caused the stock prices of many companies to rise significantly. These valuations were called into question as interest rates started going up and it was asked whether their growth could be sustained, or whether it had just brought forward some demand from future years.

Some high-profile companies have suffered due to the end of the pandemic, including the likes of Netflix, Zoom and Peloton, which have seen share price falls of 47%, 60% and 66% respectively since the start of 2022. However, it could be argued there is an element of throwing out the baby with the bathwater.

SHARE PRICE FALLS YEAR TO DATE

| COMPANY | SHARE PRICE ON 03/01/2022 | SHARE PRICE ON 14/12/2022 | % FALL |

| Peloton | 35.2 | 12.16 | 65.5 |

| Zoom | 184.26 | 73.22 | 60.3 |

| Netflix | 597.37 | 317.83 | 46.8 |

Source: Morningstar

The likes of Apple, Alphabet (the parent company of Google) and Microsoft have also seen falls in their share prices, yet they have arguably enjoyed sustained benefits from the pandemic. These include the shift to flexible working, where cloud services have become increasingly useful, as well as the wider use of mobile data and more digital infrastructure. It’s very difficult to argue that people will be using less technology in five years’ time than they do currently, yet we have seen considerable share price falls across the sector. There is an argument to make that valuations had climbed too high in the easy-money exuberance of the Covid period and that this is simply the froth coming out, but after a significant adjustment of share prices, what matters is future growth prospects.

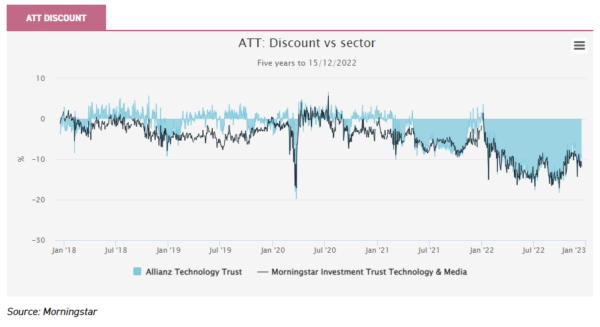

Allianz Technology Trust (ATT) could be an example of an oversold tech stock. . Since the beginning of the year it has delivered NAV returns of -30.97% and has fallen to a discount of c. 9%. The trust is admittedly growth-focussed, with a bias to mid-cap companies which are often at the forefront of disruption and therefore offer the most compelling growth opportunities. The five-strong management team invest across a range of tech subsectors, with software and semiconductors the two largest weights, the former of which includes cyber-security companies which continue to experience sectoral tailwinds. The managers have positioned the portfolio defensively in light of the market moves this year. However, they don’t believe that higher interest rates or price inflation will jeopardise the business models of their holdings. Therefore when the market does recover, they believe their companies will be well placed to capture this.

There are also newer areas of growth from technology that are starting to emerge. One of these is artificial intelligence (AI), which could well be a trigger for the next step of the digital revolution. In recent weeks a new AI chatbot named ChatGPT has been released to much acclaim. It has been able to write essays, poems and computer programs and seems a genuine step forward in technology, demonstrating that innovation is still happening. On a more practical level, a new partnership involving Google Health has helped increase the accuracy of breast cancer diagnosis from scans through the use of AI. The roll-out of this technology is still some way off sci-fi expectations, but progress is happening quickly. Investment opportunities within AI remain in their early stages, though. There are a limited number of dedicated companies, with the biggest players in the sector often being divisions of large technology companies. However, AI is often considered as a part of the automation theme which a number of trusts aim to profit from, including Mid Wynd International (MWY). Automation is MWY’s largest theme which they access via a number of Chinese and Japanese companies. These typically specialise in robotics that can be used to speed up production lines, with AI used as a part of this. The managers believe this theme will continue to benefit from the need to increase productivity as demand continues to rise but global demographics shift.

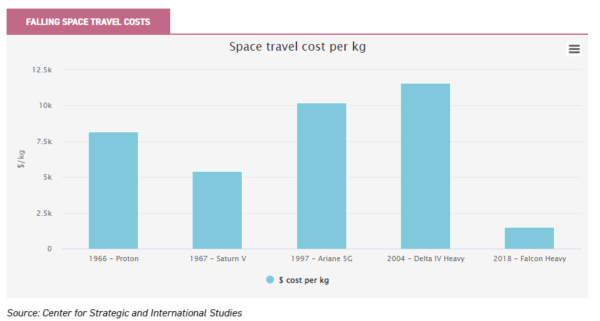

Space is another sector that is arguably on the verge of a new frontier. Between the Soyuz and Saturn V rocket programmes in the 1960s and the Delta Heavy Rockets of the mid 2000s, there had been almost no change in the cost of travelling to space (on a $ per kg basis). In the past decade, technological advancements, mostly driven by Space Exploration Technologies (SpaceX), have reduced costs by nearly 90%. This means that commercial space travel has become considerably more affordable, allowing for a big increase in space travel for practical reasons such as satellites, plus this will have encouraged industries such as space tourism.

Whilst the sector is still in its nascent growth stage, investors can gain exposure through Edinburgh Worldwide (EWI), which has had a long-standing holding in SpaceX. As at the trust’s latest factsheet of 30/11/2022, SpaceX was EWI’s second-largest position at 6.9%. Seraphim Space Investment Trust (SSIT) also offers exposure to the space theme.

The technology sector has been considerably sold down because of the impact of rising interest rates on valuations. Whilst this is in many cases a legitimate reappraisal, we think there are still good long-term growth trends available in the sector.

Demographics

One thing that a difficult 2022 definitely hasn’t affected is the long-term demographic trends in a number of emerging and frontier countries. There are many countries which have populations at the right age and education to allow for significant long-term development that can drive their economies for decades. Not only does this have huge benefits for the global economy, but it also rapidly improves the standard of living for millions of people. One of the best examples of this is to look at contrasting images of Shanghai from 1990 and 2010. These images show a remarkable transformation from a standard city backdrop to a skyscraper-filled metropolis, demonstrating the huge change in wealth and fortunes of the country and population.

There are a number of countries that have the right ingredients to transform in the same way over the next few years and beyond, the most obvious being India. The country has a population of 1.4 billion people, with almost a third of these under the age of 20, an age group with a high level of education. As this cohort enters the workforce it will have a huge impact on the structural growth potential of the country as global companies look to tap into this human capital and the benefits of an expected surge in domestic demand. This will have an impact on the country’s consumer goods, housing, financial and leisure sectors, to name just a few. This is also being aided by supportive government policy, with Prime Minister Narendra Modi having delivered a series of reforms since his first election win in 2014.

Ashoka India Equity (AIE) is one trust aiming to capture this. The trust is run by Mumbai-based White Oak Capital Partners and is supported by a team of over 25 local analysts, the largest team in the sector. This resource is used to perform fundamental analysis of nearly 750 companies, looking to identify recurring cash flows in a business. The trust is multi-cap, but often will have a bias to smaller companies which should provide strong long-term growth opportunities.

Good demographics are not just the preserve of India, though. There are a number of countries which have the hallmarks of strong long-term potential due to demographic tailwinds. Vietnam, Indonesia and Nigeria are all countries with growing populations and the capability to become strong emerging economies in the decades to come. Vietnam and Indonesia in particular are set to benefit from the increasing trend of ‘nearshoring’, where multinational companies are moving their manufacturing out of China and into countries with fewer geopolitical tensions.

Vietnam Enterprise Investments (VEIL) offers investors access to this exciting opportunity. It is the largest and longest-established investment company focussing on Vietnam, having been launched in 1995. The strategy looks to identify companies that are benefitting from key secular drivers in the country, such as increasing urbanisation, consumption growth and the shift of exports up the value chain . The managers’ knowledge and experience in the market arguably put them in a great position to identify the best companies, and this is enhanced by VEIL’s ability to buy pre-IPO companies and thus capture opportunities even earlier in their growth journey.

Emily Fletcher, co-manager of BlackRock Frontiers (BRFI), highlighted Vietnam as well as Indonesia at a recent Kepler event. BRFI has over a fifth of its portfolio in Indonesia and Vietnam combined. Emily points to Vietnam having suffered half the inflation of Germany in the current crisis, as well as having considerably lower government debt, to demonstrate how different frontier economies are to the West, and how potentially less affected by the current levels of inflation. BRFI has generated strong returns this year, in contrast to mainstream emerging market funds.

These demographic trends are not going to change direction because of short-term news events; however, volatility has led to an impact on short-term valuations as markets’ concerns over China have spilled out to the wider region. But the drivers behind these factors are resilient, secular and potentially highly financially beneficial, which could be an opportunity for brave investors.

Conclusion

2022 has been a year of fear and panic in stock markets. However, in times of difficulty, it is important to keep sight of the long term. This too shall pass, and the trends we have identified in renewable energy, technology and demographics look likely to deliver excellent long-term investment opportunities – which can now be accessed at cheaper prices. We hope this gives our readers some comfort this Christmas, and that 2023 will be a successful year for all.

Disclaimer

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Leave a Reply

You must be logged in to post a comment.