Nov

2022

Strong income and growth: JPMorgan Global Core Real Assets

DIY Investor

15 November 2022

Flash update: JARA continues to deliver strong capital and income returns in troubled markets…by Thomas McMahon

JPMorgan Global Core Real Assets (JARA) has reported another strong NAV, this one for the quarter ending 31/08/2022. Amidst a volatile economic environment, the portfolio’s major allocations to infrastructure, real estate and transportation have all made good returns, while the strength of the dollar has been beneficial for the portfolio. The NAV total return for the quarter was 7.1%, with the trust paying a 1p dividend which annualises at a 3.7% yield on the current share price.

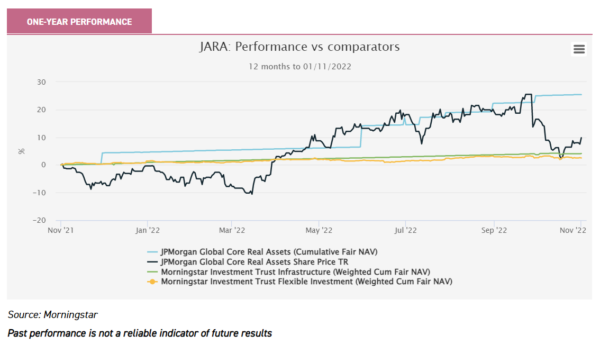

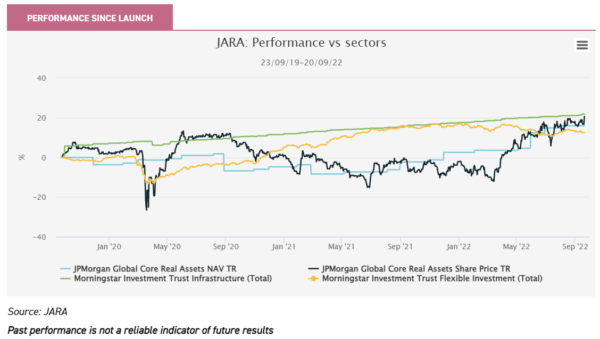

Over the past 12 months the trust has generated NAV total returns of 25.4% through one of the most volatile periods for conventional asset markets in recent years. In comparison, over the past year the MSCI ACWI is down 4.7% and the Bloomberg Global Aggregate Bond Index is down c. 5.3%. JARA’s returns are also strong compared with those of its peers. The Morningstar Flexible Investment sector generated an average NAV total return of 2.5% over the year to 01/11/2022, while the Morningstar Infrastructure sector is up just 4.1%.

JARA offers investors exposure to a widely diversified portfolio of real assets. The portfolio is global in scope, investing in institutional strategies run by the JPMorgan Global Alternatives group for infrastructure, real estate and transportation. There is an allocation to listed real assets which brings liquidity, but the majority of the portfolio is invested in private open-ended strategies predominantly run by JPMorgan for institutional clients. The objective is a 7–9% total return, with a yield of 4–6% on issue price.

By investing through private open-ended strategies, JARA can offer a slice of a much bigger pie to the mass market investor. JPMorgan’s scale means its strategies can participate in deals that would be beyond more than a handful of investors, and so JARA can participate in these deals while offering daily liquidity via its own shares. A good example of this in action is JARA’s exposure to renewable assets. In total, this now equates to around 7GW of generating capacity and over $5bn of equity invested. By itself, JARA would not be able to gain exposure to such an established and well-diversified asset base, but alongside the broader JPMorgan Global Alternatives platform this is possible.

Additionally, JPMorgan’s scale in the real assets market means it can help originate and develop assets. A good example of this is the fleet of liquefied natural gas (LNG) tankers which JPMorgan advised institutional investors to undertake new-build contracts for, and which JARA participated in. The first of these were commissioned in 2019 and have started to come on stream this year, entering a strong market for the assets given the state of the energy market. Such investments bring additional risk, and so in keeping with the core strategy, they are expected to make up a very small portion of the portfolio. As at the end of August, less than 3% of the portfolio was in assets in development.

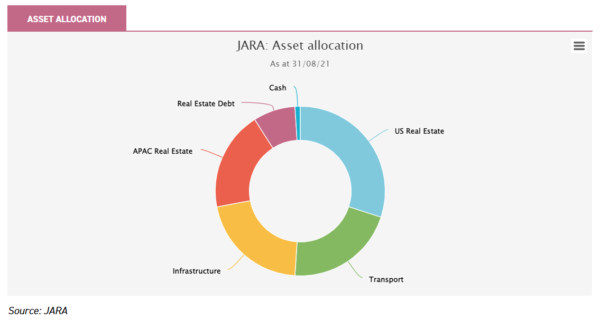

At the top level, as at 31/08/2022 the portfolio had 49% exposure to real estate equity, with 22% in infrastructure and 21% in transportation assets (see chart below). In early 2022 the team made an investment in real estate debt at the mezzanine level, reducing the real estate equity exposure. This therefore gives greater security to the exposure to the asset class as debt is higher up the capital structure. The debt investments provide higher yields from real estate and reduced volatility, and are now worth 8% of the portfolio. Real estate exposure is split between the US and Asia, which we think is likely to complement the property holdings of the typical UK investor. These key categories also hide much greater diversity at the asset level: in total JARA has exposure to 1,168 individual assets, and as much as 82% of the entire portfolio is invested in private assets.

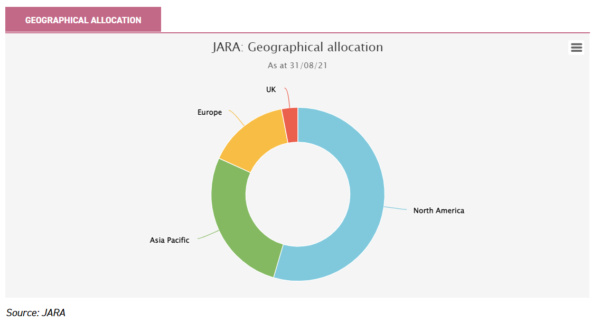

On a geographical basis, JARA has a strong bias towards the US, as the below chart shows. There is minimal UK exposure (reducing the risk JARA would double up investors’ existing real asset exposure) and a significant weight to Asia Pacific, which is itself a diverse region. JARA aims to provide a stable, core real asset exposure, and in Asia focusses on the strongest local and national economies. This includes logistics assets in New Zealand, Japan, Singapore and Korea, while there is minimal exposure to China. On a look-through basis less than 3% of the portfolio is in the logistics real estate sector.

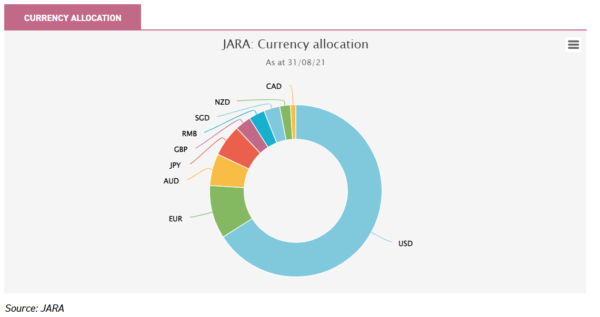

On a currency basis, the trust’s dollar exposure is most pronounced at 66%. After this the exposure is very diversified, as the below chart illustrates. Clearly dollar strength has been beneficial for JARA over the past year, although should it reverse, the opposite would be true. We would argue that the main driver of dollar strength has been rate differentials. While the US Federal Reserve looks committed to further rate hikes, it is arguably able to do so more comfortably given the strength of its underlying economy, which is arguably stronger than peers’ and therefore better able to handle higher rates for longer. Additionally, if the current weakness of sterling reflects medium-term uncompetitiveness or economic weakness, then JARA’s exposure to ex UK currencies could be appealing.

One of the attractions of JARA is the steady capital growth potential in its portfolio of core real assets, which are intended to deliver steady returns over the course of the cycle with limited cyclicality. These qualities should contribute to the stability of the dividend, a second major attraction of the trust. The diversity in JARA’s portfolio should also contribute to resilience in the income backing the dividend. Additionally, around 65% of the income received is indexed to inflation, a critical factor in the current environment. This is not only beneficial to the income account, but also to the NAV: as much of it will be valued on a discounted cash flow basis, indexation will boost the value of the assets as inflation rises.

As inflation rises, JARA should over time see a boost to its income received. However, this has to be offset against the rising cost of debt: JARA does not take on gearing at the trust level, but the underlying strategies do use varying amounts of gearing. As at the end of August, on an LTV basis this had fallen from 39% at the end of February to 35%. The blended cost of debt has remained stable at 3%, and 77% of the debt is fixed rate and therefore not exposed to rising interest rates, while the remaining 23% will cost more as rates rise. All told, rising interest rates should therefore be benefitting the income account on a net basis, given only 23% of the debt is experiencing coupon increases as rates rise while 65% of the income is increasing. We note the target dividend is 4–6p, and the trust is currently paying at the lower end of that range. The board will meet in February at the end of the financial year to decide on the level going forward, and given the inflation experienced this year we think there may be scope for the board to consider a dividend increase at that time.

The majority of the assets in the portfolio are valued on a discounted cash flow basis. In terms of cash flows, valuations have been boosted in many cases by indexation to inflation. On the discount rate side, an increase in the base rate should lead to an increase in this too, ceteris paribus. JARA’s asset were valued using quite conservative discount rates prior to the hiking cycle, and therefore arguably had scope to lower them, offsetting any increase in the base rate. While there is a spread of rates on the underlying assets, we note infrastructure and transport are still valued using quite high rates of 8.8% on average, and property 6.2%. These have seen slight increases from 8.6% and 6.1% respectively at the end of February, but this has netted out to a stable discount rate of 7.3% on the whole portfolio as the mix of assets has changed. An important consideration is that the diversification in the portfolio means the exposure to interest rates is also diversified geographically. To a modest extent rate hikes in the US, eurozone and UK have been offset by stable rates in Japan and falling rates in China.

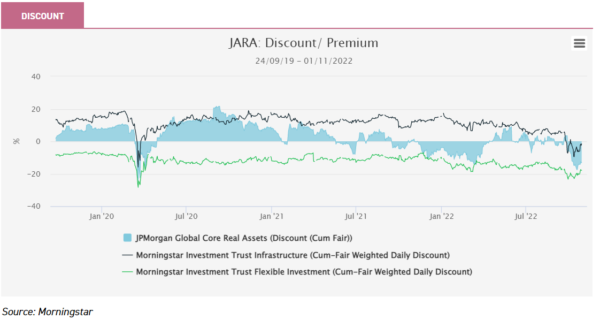

We think JARA’s strong performance over the past year likely contributed to the shares having tended to trade on a premium between April and October. The board issued new shares as a result, with two million being issued in the quarter to the end of August, and in aggregate the share capital having grown by 47.3% since JARA was launched in September 2019. Net assets were £237.1m at the end of August.

Kepler View

We think JARA has come of age in the current crisis. The trust was launched into the teeth of the pandemic, which was unhelpful for the managers’ efforts to fully invest the proceeds and for asset values. As economic activity has restarted and inflation has risen, the portfolio has started to churn out steady returns, looking through the turmoil in debt and equity markets. Dollar strength has certainly increased the magnitude of returns at the portfolio level, but all underlying allocations have been generating good positive returns in recent quarters too. We think the focus on core assets, which should be relatively resilient, should support the NAV and the income during tough economic times. Additionally, in our view the positive sensitivity to inflation is a key attraction on both an NAV and income level, and could keep demand for the shares strong.

The dollar exposure is certainly a risk factor to bear in mind. However, this should be a relatively short-term risk and can be balanced against the decent inflation linkage and low economic sensitivity of the infrastructure allocation in particular. For the long-term investor the scale of the resources and platform that JARA has access to, as well as the trust’s flexibility to use these, makes JARA look a highly attractive way to gain exposure to real assets.

See the full research paper on JP Morgan Global Core Real Assets here >

Disclosure – Non-Independent Marketing Communication. This is a non-independent marketing communication commissioned by JPMorgan Global Core Real Assets . The report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on the dealing ahead of the dissemination of investment research.

Brokers Commentary » Brokers Latest » Commentary » Investment trusts Commentary » Investment trusts Latest » Isas commentary » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.