Jan

2023

Quarterly markets review – Q4 2022

DIY Investor

7 January 2023

A look back at markets in Q4 2022, when shares made strong gains

A look back at markets in Q4 2022, when shares made strong gains

The quarter in summary:

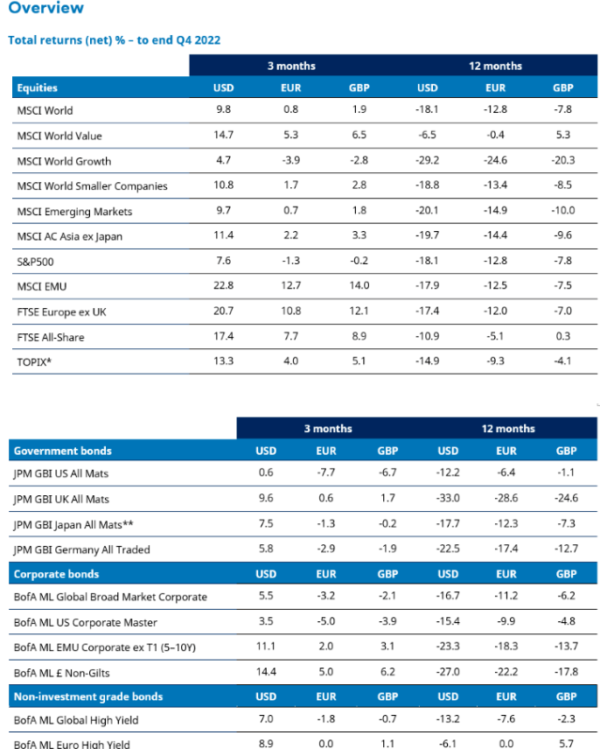

Stock markets rounded off a tumultuous year with gains in Q4. Asian shares were boosted by China’s relaxation of its zero-Covid policy, while European equities also advanced strongly. Government bond yields edged up towards the end of Q4 (meaning prices fell). This reflected some market disappointment at major central banks reiterating plans to tighten monetary policy, even as inflation showed signs of peaking. Commodities gained in the quarter, led by industrial metals.

Please note any past performance mentioned is not a guide to future performance and may not be repeated. The sectors, securities, regions and countries shown are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

US

US equities made robust gains in Q4, with much of the progress made in November. Investors balanced ongoing caution from the Federal Reserve (Fed) with indications that the pace of policy tightening would slow, and signs that elevated inflation could be cooling. There were also especially strong corporate earnings in certain sectors.

Annualised Q3 GDP for the US was confirmed at 3.2% in December, which was stronger than the second estimate of 2.9%. Unemployment remains at 3.7%. 263,000 jobs were added in November; the lowest number since April 2021. The latest consumer price index (CPI) print – for November – showed inflation slowed to 0.1% (month-on-month) versus October. Inflation remains elevated however, at 7.1% year on year. The Fed’s final rate hike of the year was indeed a pared back 50 basis points (bps) rise after four consecutive 75 bps tightening moves. The policy rate is, however, expected to continue to climb in 2023.

Most sectors rose over the quarter, a number climbing significantly. Energy stocks posted especially strong gains, with sector heavyweights Exxon and Chevron posting record profits in the quarter. Consumer discretionary was a notable exception, with Tesla’s decline an outsized influence.

Eurozone

Eurozone shares notched up a strong advance in Q4, outperforming other regions. Gains came from a variety of sectors, notably economically-sensitive areas like energy, financials, industrials and consumer discretionary. More defensive parts of the market such as consumer staples lagged the wider market’s advance.

Equity gains were supported by hopes that inflation may be peaking in Europe as well as in the US. Annual inflation (as measured by the harmonised consumer price index) fell to 10.1% in November from 10.6% in October. The European Central Bank (ECB) raised interest rates by 50 basis points (bps) in December, a slower pace than its previous 75 bps hikes. However, ECB President Christine Lagarde warned that the central bank was “not done” with increasing interest rates. The ECB also confirmed plans to stop replacing maturing bonds.

Data showed that the eurozone economy grew by 0.3% quarter-on-quarter in Q3, slowing from 0.8% growth in Q2. Forward-looking indicators continued to point towards contraction although the rate of decline moderated. The composite purchasing managers’ index for December was 48.8, up from 47.8 in November. (The PMI indices are based on survey data from companies in the manufacturing and services sectors. A reading below 50 indicates contraction, while above 50 signals expansion.) Falling gas prices, amid unusually mild weather for much of the period, helped to alleviate some cost pressures.

UK

UK equities rose over the quarter, helped in part by the country emerging from its September crisis. Markets had been volatile in September as the former prime minister and chancellor announced huge fiscal stimulus, with little detail on how it would be funded. Many of the policies announced in that September ‘mini-budget’ were reversed and the new chancellor Jeremy Hunt used the Autumn Statement in November to promise the country would tighten its belt in the future. His assertions were supported by fiscal and economic forecasts from the independent Office for Budgetary Responsibility (OBR).

This message was in keeping with the fiscally conservative reputation of Rishi Sunak, who was appointed leader of the Conservative Party and, by extension, became the country’s new prime minister. Sunak’s prior experience as chancellor also helped to stabilise gilt yields and in turn interest rate expectations, which lent support to domestically focused areas of the UK equity market. The decision by the Bank of England to reduce the pace of interest rate hikes also helped these areas recover well from their mid autumn lows.

More broadly, economically sensitive areas of UK equities outperformed in line with other markets. This occurred amid hopes that the US Federal Reserve might be in a position to ‘pivot’ to cutting interest rates in late 2023.

Japan

After rising for most of October and November, the Japanese stock market declined in December. Nevertheless, the total return for the fourth quarter remained positive, at 3.3% in yen terms. Having weakened against the US dollar for most of 2022, the yen reversed direction from November, returning to levels last seen in July and August.

During November, most Japanese companies reported quarterly earnings for the July to September period. This proved to be another strong set of results, particularly for larger companies benefiting from yen weakness. The level of confidence among company managements is highlighted by the record level of share buybacks that have been announced so far this fiscal year.

The other main event for investors in Q4 was the decision by the Bank of Japan to widen the band within which it has been maintaining 10-year bond yields. Although such a change had always been recognised by investors as a logical first step towards policy normalisation, the timing of the decision was a complete surprise.

Although the change in yield-control policy is not a de-facto interest rate rise, it was still sufficient to drive a sharp strengthening of the yen in December. The earlier than expected move by the central bank may also reflect a belief that Japan’s inflation rate is finally moving into a more sustainably positive range after decades of deflation.

The government was able to assemble an additional substantial fiscal package in the fourth quarter, through which it aims to bolster the nascent domestic recovery in 2023. There was also a positive development with the lifting of international travel restrictions from 11 October, including a resumption of the visa-waiver programme for many countries. The long-suspended programme of incentives for domestic travel has also been restarted.

Asia (ex Japan)

Asia ex Japan equities achieved robust gains in the fourth quarter, with almost all markets in the index ending the period in positive territory. China, Hong Kong and Taiwan all achieved strong growth over the quarter, with share price growth particularly strong in November after US President Joe Biden and Chinese leader Xi Jinping signalled a desire to improve US-China relations at a meeting ahead of the G20 summit in Indonesia.

The recovery in Hong Kong and Chinese share prices continued in December after Beijing loosened its pandemic restrictions that have constrained China’s economic growth since early 2020. However, the share price rally didn’t continue in Taiwan in December, with ongoing geopolitical tensions, higher US interest rates and lower demand for electronic goods (one of Taiwan’s biggest exports), weakening investor sentiment. South Korean shares ended the quarter in positive territory after the country’s central bank raised interest rates. However, share prices declined in December due to weaker export data and cooler demand from China.

Thailand, the Philippines and Singapore also ended the quarter firmly in positive territory. The announcement by the US Federal Reserve during the quarter that it expects to switch to smaller rate hikes soon, also boosted many Asian equity markets in the quarter.

Emerging markets

Emerging market (EM) equities posted strong returns over Q4, helped by a weaker US dollar. Most of the MSCI EM index’s returns were generated in November on optimism that as policy tightening from the Federal Reserve (Fed) slowed, any recession would be shallow and markets would begin to discount the recovery. Optimism faded somewhat in December, however, when the Fed re-iterated its commitment to fighting inflation. An earlier and more comprehensive than expected relaxation of the dynamic zero Covid policy by the Chinese authorities also boosted sentiment later in the quarter. The MSCI EM Index performed in-line with MSCI World.

The Middle East markets underperformed the EM index as they were impacted by weaker energy prices. Qatar and Saudi Arabia were major laggards. Returns in Indonesia were also negative. Other underperformers included India, where macroeconomic data releases were mixed; Brazil, where policy uncertainty clouded the outlook after President Lula’s election in October; and Taiwan.

China outperformed. Investors welcomed the relaxation of Covid regulations, which helped boost optimism regarding an earlier-than-expected re-opening of the economy. Support for the housing sector also added to the positive sentiment. Latin American markets Peru and Colombia outperformed the broader index. South Korea and South Africa posted strong returns with the latter boosted by President Ramaphosa’s re-election as the president of the ruling African National Congress (ANC), although allegations of gross misconduct and possible violation of the constitution weighed on returns in December.

Poland and Hungary continued to rebound following months of underperformance as a consequence of the war in neighbouring Ukraine while Greece and Egypt were up too. Turkey was the strongest index market as the central bank continued to loosen monetary policy. Authorities cut interest rates to 9% in November but, in acknowledgement of rising inflation risks, which topped 85% in October, announced an end to the current easing cycle.

Global bonds

Markets ended the year on a mixed note in the final quarter. Government bond yields edged up towards the end of Q4, reflecting some market disappointment at the hawkish tone from some central banks, despite mounting evidence of slowing economic growth. The Federal Reserve (Fed) raised rates twice during the quarter, ending at 4.5%. The Bank of England also announced two rate hikes, bringing the UK interest rate to 3.5% at the end of Q4, while the Bank of Japan announced a modification to its yield curve control policy.

Credit spreads tightened across the quarter on improved risk sentiment. The credit spread is the difference in yield between bonds of a similar maturity but with different credit quality. Although strong performance was tempered slightly into year end, US and European investment grade and high yield credit generated positive returns and outperformed government bonds over the quarter. Investment grade bonds are the highest quality bonds as determined by a credit rating agency; high yield bonds are more speculative, with a credit rating below investment grade.

The eurozone faced its most challenging year for inflation in its history, though signs emerged towards the end of Q4 that there may be some respite as the region’s latest indicators signalled slowing headline inflation, helped by falling energy price pressures. Nevertheless, the European Central Bank (ECB) continued to tighten monetary policy conditions, maintaining its hawkish message and indicating future rate hikes.

The US 10-year yield rose from 3.83% to 3.88%, with the two-year rising from 4.28% to 4.42%. Germany’s 10-year yield increased from 2.11% to 2.57%. The UK 10-year yield decreased from 4.15% to 3.67% and 2-year eased from 3.92% to 3.56%, after the country’s new prime minister reversed most of his predecessor’s ‘mini budget’ proposals, which had been very poorly received by the markets.

The US dollar’s rally continued to slow into Q4. Across the quarter, the dollar index lost just under 8%, though ended 2022 higher than a year ago at 7.9%. Among G10 currencies, the New Zealand dollar and Norwegian Krone made the strongest gains against the US dollar in Q4. The Japanese Yen also rebounded strongly during the quarter.

The convertible bond benchmark, the Refinitiv Global Focus, stated a gain of 4.0% for the quarter. The universe of convertibles is still biased towards growth. Against tech-heavy benchmarks such as the Nasdaq, convertibles protected well. Against the broad stock market, convertibles once more could not show their traditional upside participation qualities. The primary market for convertibles remained lacklustre and the overall new issuance volume for 2022 marked a record annual low.

Commodities

The S&P GSCI Index recorded a positive performance in the fourth quarter, with higher prices in industrial and precious metals offsetting weaker prices in agriculture.

Industrial metals was the best-performing component of the index, with sharply higher prices in the quarter for nickel, lead and copper. Zinc and aluminium prices, however, fell during the quarter. Within precious metals, silver also achieved strong price gains, while the rise in the price of gold was more muted.

In agriculture, coffee and wheat prices fell, while prices for sugar, cocoa, corn and soybeans gained. Within energy, strong price gains for unleaded gasoline and heating oil helped to offset a sharp decline in the price of natural gas.

The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested.

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.

Alternative investments Commentary » Commentary » Equities » Equities Commentary » Equities Latest » Exchange traded products Commentary » Exchange traded products Latest » Fixed income Commentary » Fixed income Latest » Investment trusts Commentary » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.