Jan

2024

Quarterly markets review – Q4 2023

DIY Investor

6 January 2024

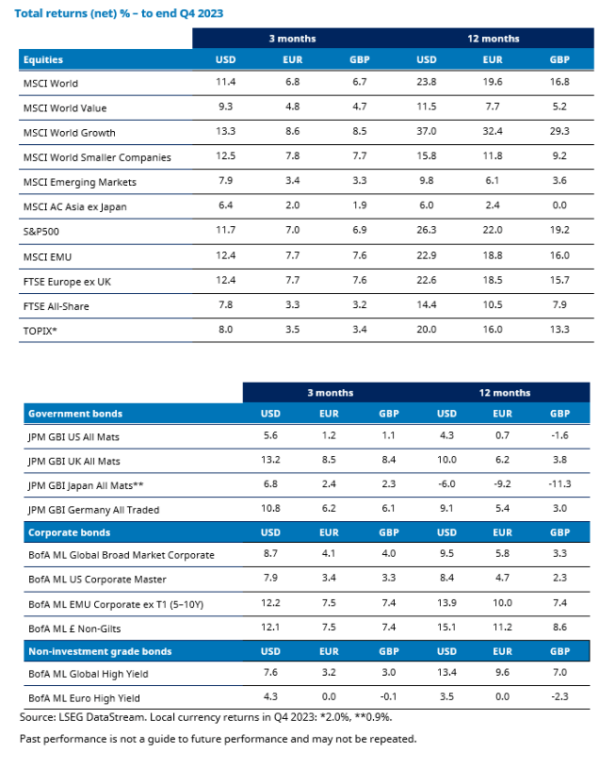

A look back at markets in Q4 when hopes of imminent interest rate cuts boosted shares and bonds.

It was a strong quarter for global shares as the US Federal Reserve signalled that interest rate cuts may be on the way for 2024. Developed markets outperformed emerging markets amid ongoing worries over China’s real estate sector. Crude oil prices fell despite some output cuts.

Please note any past performance mentioned is not a guide to future performance and may not be repeated. The sectors, securities, regions and countries shown are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

US

US shares registered strong gains in the final quarter of the year, buoyed by expectations that interest rate cuts may be approaching. The S&P 500 index ended the year just short of its record high set in early 2022.

The annual inflation rate in the US (consumer price index) slowed over the period from 3.7% in September to 3.2% in October and 3.1% in November. The Federal Reserve’s (Fed) preferred measure of inflation – the core personal consumption expenditure index – was softer than expected, rising 0.1% month-on-month in November. Meanwhile, economic growth for Q3 was revised down to an annualised rate of 4.9% from the previous reading of 5.2%.

The data reinforced market expectations that the Fed has finished its rate hiking cycle and will move towards cuts in 2024. Fed chair Jerome Powell indicated that the central bank was aware of the risk of keeping rates at restrictive levels for too long. Minutes from the Federal Open Market Committee’s latest policy meeting showed policymakers expect rates to end next year at 4.5%-4.75%, down from the current 5.25%-5.5% range.

US shares rallied strongly on expectations of imminent rate cuts. Top performing sectors were those most sensitive to interest rates, including information technology, real estate and consumer discretionary. The energy sector posted a negative return with crude oil prices weaker over the quarter.

- Read more: Peak rates? Options for investors

Eurozone

The final quarter of the year was a strong one for eurozone shares, boosted by expectations that there may be no further interest rate rises. The MSCI EMU index advanced 7.8%. Top gaining sectors included real estate and information technology, while healthcare and energy were the two main laggards, registering negative returns.

Shares were supported by softer inflation figures from both the eurozone and the US, which raised hopes that interest rates may not only have peaked, but that cuts could soon be on the way in 2024. Euro area annual inflation fell to 2.4% in November from 2.9% in October. A year previously, the annual inflation rate was 10.1%.

Higher interest rates have weighed on the eurozone economy. Eurozone GDP fell by 0.1% quarter-on-quarter in Q3, Eurostat data showed. The HCOB flash eurozone purchasing managers’ index (PMI) fell to 47.0 in December. This suggests that the region’s economy is likely to have contracted in Q4 as well. (The PMI indices are based on survey data from companies in the manufacturing and services sectors. A reading below 50 indicates contraction, while above 50 signals expansion.)

Most sectors rose amid optimism over future rate cuts. The real estate sector advanced strongly amid the prospect of a cheaper cost of debt. IT stocks, the value of which is based on future cash flows and earnings, also performed well. Other economically sensitive sectors such as industrials and materials registered strong gains. By contrast, the energy sector fell amid weaker oil prices. Stock-specific factors weighed on the healthcare sector.

UK

UK equities rose over the quarter. UK small and mid-cap indices outperformed the broader market as domestically focused stocks performed very strongly. This occurred as hopes built further that interest rates may have peaked and amid a continued pick-up in overseas “inbound” bids for smaller UK companies.

Some of the large internationally exposed and economically sensitive areas of the market also performed well, especially in the industrial and financial sectors. More generally, however, larger companies were held back as sterling performed strongly against a weak US dollar.

UK inflation moderated more than expected over the period with the Office for National Statistics (ONS) revealing that the consumer prices index had dropped to 3.9% in November. This contributed to hopes that the Bank of England may have finished its series of interest rate hikes. Meanwhile, revised data from the ONS revealed UK GDP fell in Q3, having previously showed zero growth.

Chancellor of the Exchequer Jeremy Hunt announced an Autumn Statement that contained more policy measures than many had expected. Key initiatives included the extension of the 100% capital expenditure allowance, which allows companies to deduct expenditure on plants and machinery from taxable income.

Japan

Despite some weakness in October and December, the gain in November brought the positive total return of Japanese equity market during Q4 by 2.0% for the TOPIX Total Return index. Over the quarter, there was significant changes in the market trend. In October, worries that US interest rates may remain higher for longer given still strong inflation weighed on market sentiment. Additionally, heightened geopolitical risks, such as renewed conflict in the Middle East, were a cause for concern. However, investor sentiment improved, primarily due to weaker-than-expected macroeconomic figures in the US leading to expectation of US rate cuts.

Although the US market continued to rise in December, the Japanese equity market lagged as investors became concerned about yen appreciation. Due to a reversal of the market trend, the growth style performed stronger than value stocks over the quarter and small caps also regained from the material underperformance against large cap.

From a corporate fundamentals viewpoint, the first half of the fiscal year concluded with reasonably strong earnings results. While yen weakness certainly played a role, pricing power held up well. More companies disclosed management plans to address lower valuations, such as a price-to-book ratio below 1x. Another positive development was the steady progress in unwinding cross-shareholdings.

The overall macroeconomic conditions in Japan continued to improve. Somewhat sluggish Q3 GDP data was driven by higher inflation associated with slower wage growth. However, the Bank of Japan (BOJ) tankan survey released in December showed continuous improvement in business sentiment for both the manufacturing and non-manufacturing sectors. Capital expenditure plans also suggested that there would continue to be strong demand in machinery and IT service companies. The BOJ made gradual steps to normalise its extraordinary monetary easing policy at October end and continued to hint that they are likely to take further actions early 2024.

Asia (ex Japan)

Asia ex Japan equities gained in the fourth quarter. Hopes that US interest rates may have peaked led to renewed investor appetite for risk assets across the region.

All markets in the MSCI AC Asia ex Japan index ended the quarter in positive territory apart from China, where shares fell due to investor concerns over weaker economic growth. There were fears that stimulus measures by the Chinese government may not be sufficient to spur growth in the world’s second-largest economy. The ongoing real estate crisis and uncertainty over China’s regulatory regime also weakened sentiment towards Chinese stocks.

Taiwan, South Korea, and India were the strongest index markets in the quarter, with all three achieving robust growth. In Taiwan and South Korea, technology stocks and chipmakers gained as investor enthusiasm over artificial intelligence continued to accelerate. Malaysia, the Philippines, and Singapore also achieved strong growth in the fourth quarter, while gains in Indonesia, Thailand, and Hong Kong were more muted.

Emerging markets

Despite pressure early in the quarter, when rising bond yields and conflict in the Middle East weighed on emerging market (EM) returns, overall EM equities were strong in Q4 2023, albeit behind developed market equities. Signs of a “soft landing” for the US economy and increased expectations for interest rate cuts in 2024 were supportive. However, China continued to be a drag on broad EM performance.

Poland was the top performer over the quarter as markets welcomed Donald Tusk’s election as prime minister at the head of a pro-EU liberal coalition government, which ends the eight-year rule of the populist Law & Justice (PiS) party. Peru, Egypt and Mexico also posted strong double-digit returns in US dollars.

Brazil’s outperformance was driven by ongoing signs of disinflation and the central bank’s resultant reduction in policy rates. Taiwan was ahead of the EM index, helped by strong returns from some tech-related stocks and as tech exports remained robust. Korea also rallied on the back of tech-related performance. Hungary and Colombia were up too, as were Greece and South Africa with the latter supported by an easing in electricity black outs (so called “load shedding”). India gained strongly against a backdrop of moderating inflation and a strong showing for the ruling Bharatiya Janata Party in key state elections.

While Saudia Arabia just outperformed the index, the remaining markets lagged. Those generating negative returns included Kuwait, UAE, China and Turkey. Mixed economic data from China continued to suggest a lacklustre economic recovery from the Covid-induced slowdown of prior years and stimulus measures remained limited. The ongoing real estate crisis continued to weigh on sentiment while worries about pressure on tech companies from potential gaming regulation also had a negative impact later in the quarter. Despite an apparent shift to a more orthodox monetary policy given a number of interest rate hikes over the quarter, Turkey was the worst performing index market. Inflation remains over 60%.

Global bonds

The final quarter of the year was a very positive one for fixed income markets, marking their best quarterly performance in over two decades, according to the Bloomberg Global Aggregate indices. The major driver of this performance was a perceived shift in monetary policy direction, from a “higher-for-longer” stance to prospective rate cuts. Government bond yields fell sharply, and credit markets rallied, outperforming government bonds.

The US Federal Reserve (Fed) kept rates unchanged throughout the quarter, with a much clearer shift to a more dovish tone in December accelerating the market rally. The revised dot plot – a chart plotting Federal Open Market Committee (FOMC) projections for the federal funds rate – indicated that three rate cuts are now anticipated for 2024, up from the previously expected two. With more encouraging news on PCE inflation (the Fed’s most watched measure), the FOMC appears more comfortable with the progress made in bringing inflation back towards the target.

Other major central banks held steady rates, although they appeared more cautious about inflation. The European Central Bank (ECB) made progress in its plan to unwind some of its Pandemic Emergency Purchase Programme support, while highlighting concerns about domestic inflation. However, the market priced in several rate cuts for next year. Despite relatively healthy labour markets across the region, the Purchasing Manager Index (PMI) underscored a pessimistic growth outlook.

Meanwhile, the Bank of England’s Monetary Policy Committee remained divided on further tightening. The latest inflation release surprised to the downside which extended the gilt market rally.

Elsewhere, the Bank of Japan’s decision to make only minor adjustments to its yield curve control policy fell short of market expectations.

As markets priced in easing conditions, government bond yields fell across the board. The US 10-year Treasury yield fell from 4.57% at the end of Q3 to 3.87% at the end of Q4. The UK 10-year gilt yield fell from 4.44% to 3.54%, while the German 10-year Bund yield ended the quarter 0.81% lower at 2.03%.

Despite a slowing growth outlook, the corporate bond market staged an impressive rally on hopes that a deep recession could be averted as financial conditions eased. High yield markets outperformed investment grade in both the US and Europe, with a tightening of spreads also marking significant outperformance over government bonds. Investment grade bonds are the highest quality bonds as determined by a credit rating agency; high yield bonds are more speculative, with a credit rating below investment grade.

Meanwhile, quarterly returns in US and European investment grade credit markets have not been better since Q3 2009. The rally was broad-based across all sectors, with securitised credit, covered bonds, and quasi-government bonds all performing strongly over the quarter.

In the foreign exchange (FX) market, the Swedish krona was the top performer among major currencies. Although the Riksbank paused interest rate hikes, the currency benefited from FX hedging operations conducted by the central bank designed to support the currency. Meanwhile, the Fed’s pivot towards rate cuts weighed on the US dollar.

Balanced convertible bonds, as measured by the Refinitiv Global Focus index, benefitted from the equity market tailwind and made a gain of 6% in US dollar hedged terms. Convertibles delivered strong upside participation in market gains in December. Convertible primary markets stayed very active throughout the fourth quarter, with US$22.4 billion of new paper coming to the market. That brings up the annual issuance to a strong US$90 billion – about double the volume of 2022.

Commodities

The S&P GSCI Index declined in the fourth quarter, with price gains for precious metals and industrial metals failing to offset weaker prices for agriculture, energy, and livestock. Energy was the worst performing component, with sharply lower prices for natural gas, crude oil, and gas oil. Oil prices fell despite output cuts from Opec+ (the Organization of the Petroleum Exporting Countries, plus some other oil-producing countries).

Within agriculture, higher prices for coffee, cocoa, soybeans, and wheat failed to offset price declines for sugar, cotton, corn, and Kansas Wheat. In industrial metals, nickel and lead prices fell in the quarter, while zinc, copper, and aluminium achieved gains. In precious metals, both gold and silver achieved robust price gains in the quarter.

- Find out more: Podcast: The case for gold in 2024

Digital assets

Digital asset markets performed strongly during Q4 after a quiet period in Q2/Q3. Bitcoin and Etherem returned +57% and +37% respectively, bringing the yearly return to +155% and +91% respectively.

During the quarter, altcoins performed exceptionally well, with names such as Solana (SOL, +399%) and Avalanche (AVAX, +320%) bringing their respective 2023 returns to +917% and +254%. Both are alternative smart contract platforms which have demonstrated an uptick in usage or potential integration with traditional financial institutions.

A main market driver over the quarter has been speculation that a US spot Bitcoin exchange-traded fund (ETF) will be approved by the Securities and Exchange Commission (SEC), with market consensus placing the approval date at the start of January. Probabilities of this happening have improved as the SEC has disclosed that their officials have met 24 times with ETF issuers, resulting in numerous amendments to the original filings, all which demonstrates a positive working relationship.

2023 will be seen as a transition year for crypto, during which more regulated and strongly backed custodians built out their offerings, off-exchange settlement solutions were ramped up to resolve the counterparty risk issue, and Binance came clean of its wrongdoing.

The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested.

The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested.

The views and opinions contained herein are those of Schroders’ investment teams and/or Economics Group, and do not necessarily represent Schroder Investment Management North America Inc.’s house views. These views are subject to change. This information is intended to be for information purposes only and it is not intended as promotional material in any respect.

Brokers Commentary » Commentary » Equities » Equities Commentary » Equities Latest » Exchange traded products Latest » Fixed income Latest » Investment trusts Commentary » Isas commentary » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.