May

2022

QD view – What’s going on?

DIY Investor

11 May 2022

A couple of years ago, as the initial panic of the pandemic eased, commentators started to talk about the probable shape of the post-COVID economic recovery – writes James Carthew

When we found out that the vaccines worked in November 2020, markets soared on hopes that things would start to return to normal. Expectation grew of a synchronised global economic recovery. To some extent, that happened – it was one of the main drivers of inflation last year. However, various spanners have been thrown into the workings of the global economy and, increasingly the mood is darkening.

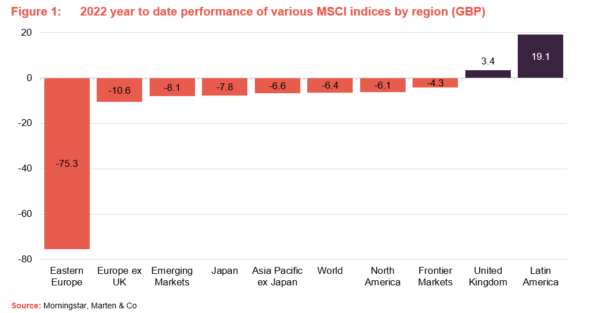

The chart shows the performance of various regional stock markets since the start of the year (in sterling).

Unsurprisingly, Eastern Europe has been dragged down by the Russia’s invasion of Ukraine, and this has hit Europe too. Soaring commodity prices have boosted Latin American markets (see last week’s chat with Viktor Szabó, manager of abrdn Latin American Income Fund). They have also helped propel the UK market higher – Shell is up over 25% so far in 2022, for example.

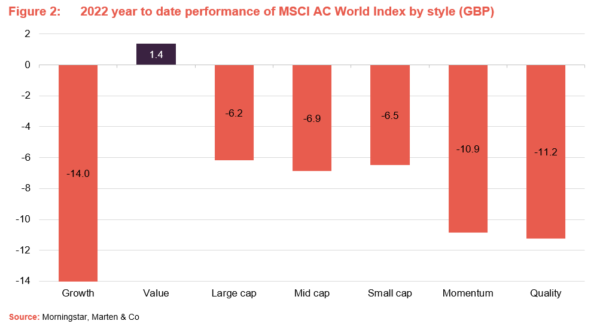

As we have discussed a few times here, inflation is weighing on growth stocks. The next chart shows the performance of the global index by style. The outperformance of value relative to growth is considerable. This has been working to the benefit of value-focused funds such as Temple Bar.

There isn’t much difference in the breakdown of returns by market cap size. For a UK-based investor, that might be quite surprising. The MSCI UK Large cap Index has returned +8.5% so far this year – way ahead of the -14.1% return on the MSCI UK Small cap Index. UK smaller companies trusts have been hit quite hard. The really odd – to me – thing is that focusing on quality has worked against you in all of this. You might have reasoned that in a period of extreme uncertainty, investors would seek the comfort of high-quality stocks. That may yet come to pass, but in the meantime, quality-focused trusts that we have written about quite a bit like BlackRock Throgmorton and Montanaro UK Smaller are amongst the worst-performing UK smaller companies funds over 2022.

We follow the asset allocation views of JPMorgan’s multi-asset solutions team fairly closely because of the work we do with JPMorgan Multi Asset Trust (MATE). At the end of March 2022, they were acknowledging that the global economy was slowing, but were not predicting a global recession. US interest rates are rising, and this will have an effect, but they feel that US companies’ margins are going to hold up better than those in the EU. Playing to Jayna’s QD view last week, JPMorgan favours US equities and the dollar – MATE’s asset allocation reflects that.

China should be acting as the engine of growth but Xi Jingpin has pinned his colours to a zero COVID policy that is struggling to cope with the more infectious Omicron variant. Lockdowns in Shanghai and now Beijing are causing serious economic disruption and may compound the inflation problem. Chinese-focused investment trusts are some of the worst-performing of all investment companies over 2022.

For fear of tipping the economy into recession, China is upping spending on infrastructure. That means yet more demand for metals – probably good news for commodities and natural resources trusts. CQS Natural Resources Growth & Income is one of the best-performing of all trusts this year, but still sits on a 14% discount.

Navigating your way through the rest of 2022 may be tricky. Interest rate rises may eventually squeeze consumers to the point where markets have another wobble. In the UK, tax hikes are making the problem worse.

In the face of all this uncertainty, the new issue market appears to have dried up completely. That isn’t stopping investors pouring money into established names, however. Alternative investments with decent yields are still favourite, as Supermarket Income REIT’s £300m fundraise and International Public Partnership’s £325m issue illustrated this week.

Leave a Reply

You must be logged in to post a comment.