Apr

2018

Property crowdfunding 101

DIY Investor

9 April 2018

In the last few decades, crowdfunding in all sorts of industries and investments has really kicked off, becoming an incredibly popular way to make a bit of money in an area that would normally be impossible to invest in alone.

in all sorts of industries and investments has really kicked off, becoming an incredibly popular way to make a bit of money in an area that would normally be impossible to invest in alone.

Recently, property crowdfunding has seen a sudden rise in interest and investment, especially amongst the younger generations, with millennials making up 54% of the property crowdfunding investments last year.

Because of this rise, the brothers Haaris and Shaan Ahmed decided to create a site which would make the process easier and help investors understand how property crowdfunding works. This idea became reality in the form of UOWN.

So, what is UOWN?

Put simply, UOWN is a site which acts as a hub for people looking to invest in property crowdfunding. Property crowdfunding is a pretty straightforward concept and essentially involves a group of people coming together to invest money into buying a property. Then, when the property is rented out, the investors all receive returns on the rent based on the amount they invested into the property.

‘millennials making up 54% of the property crowdfunding investments last year’

Whilst the concept of property crowdfunding may be easy to understand, actually gathering a group of people together and finding a suitable place to invest in, let alone manage, can become quite a complicated business. This is why UOWN was created: to make these aspects of property crowdfunding as easy to manage and understand as possible.

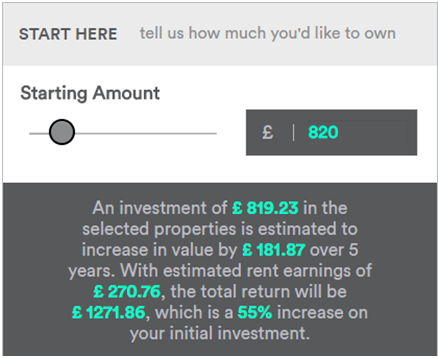

Using UOWN, investors can find properties that are available to buy, get in touch with others interested in investing in them and track the investments they make through their account page. As little as £20 can be invested in a property making the market incredibly accessible, and the site also features a clever piece of software which uses a sliding scale, predicting the kind of return you will receive from the amount of money you invest in a property.

How does it work?

The UOWN system is designed to be as simple to use and understand as possible. All you need to do is set up an account on the site and you can begin looking for places to invest in and people to invest with. When enough capital has been pooled by a group of investors, the property can be purchased and then UOWN manages it from there.

‘As little as £20 can be invested in a property’

You literally don’t have to do anything but invest in the property and track the investment, and the returns, on your account page. UOWN handle the property, sort out the tenant agreements and the maintenance of the property. Your return is based on the amount of money you put into the property and you can sell your share back through the UOWN system.

There are a few fees applied to using UOWN, based on the amount you invest and receive in rent. There is an initial 2% fee, however this is the only fee you pay up front, and the 10% (+ VAT) management fee along with the annual 0.5% fee are both taken into account when the Net Rental figures are stated. It is also worth noting that there are absolutely no fees when you finally come to sell your share.

Are there risks involved?

As with any investment, there are risks involved with all types of crowdfunding, including property crowdfunding.

Because the value of an investment share changes with the property prices on the market, this inevitably means they could either rise or fall. In the latter case, UOWN vet properties to minimise the risk of falling property prices and keep them at a high standard of living to help ensure a rise in value for UOWN users. Furthermore, UOWN only use properties with long-term, strong rental histories (5+ years) in high demand student areas.

However, the future cannot be predicted so the risk of a properties value falling is always there and it is best to see a UOWN investment as a long-term investment to gain the most benefit from it.

Another risk involved in property  crowdfunding is the guarantee of a property being occupied. UOWN work only with the best letting agents to ensure their properties are filled, however there will always be periods when rooms are free, and properties are unoccupied leading to no rent income. Another thing to keep in mind is that, if you want to sell your share in a property, there must be someone willing to buy it. Again, this means you should not invest with money you will need in the near future, and a long-term investment plan is the better option.

crowdfunding is the guarantee of a property being occupied. UOWN work only with the best letting agents to ensure their properties are filled, however there will always be periods when rooms are free, and properties are unoccupied leading to no rent income. Another thing to keep in mind is that, if you want to sell your share in a property, there must be someone willing to buy it. Again, this means you should not invest with money you will need in the near future, and a long-term investment plan is the better option.

Where can I find out more about UOWN?

If you are interests in property crowdfunding and want to know more about UOWN, you can visit their site at https://www.uown.co/ or get directly in touch with UOWN here.

There is also a free guide you can download on the site as well as more information on property crowdfunding in general on their dedicated learning page

Leave a Reply

You must be logged in to post a comment.