Feb

2023

Funds return to form, and here’s what we’re backing

DIY Investor

7 February 2023

Saltydog investor points out that most fund sectors have had a strong start to the year. Here are the funds it has exposure to.

Each week, we review the performance of funds available to retail investors.

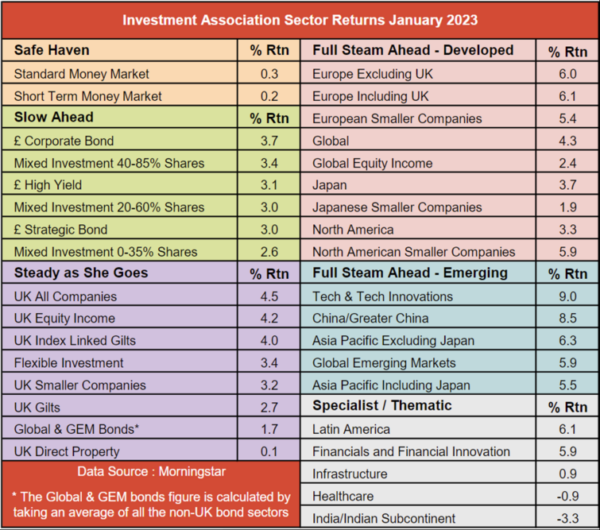

Our start point is the Investment Association (IA) sector averages. Most of them went down in 2022, but have had a good start to 2023.

For our analysis, we put the IA sectors into our own Saltydog groups, based on their historic volatility. This is to show our members the risks involved when selecting funds from different sectors, and helps them build portfolios in line with their appetite for risk. We also show details of two relatively cautious demonstration portfolios so people can see what we are doing with our own money.

The least volatile sectors, Standard Money Market and Short Term Money Market, are in our ‘Safe Haven’ group.

These funds will not make you rich but they are an alternative to holding cash. In our demonstration portfolios we currently hold the Royal London Short Term Money Market fund. The returns from this fund tend to reflect what is happening to the Bank of England interest rate. In 2021, the fund was basically flat over the year, in fact it was marginally down. The bank rate was 0.1%, which was not enough to cover the management fee of the fund. However, over the last 12 months the base rate has moved significantly and last week it was raised again. It is now 4%. We invested in the fund in October and since then it has risen by over 1%.

In our ‘Slow Ahead’ group, we look at the slightly more volatile sectors that invest in UK bonds (Corporate, Strategic, and High Yield) along with three of the ‘Mixed Investment’ sectors. They all went down last year with returns ranging from -9.7%, for the Mixed Investment 20-60% Shares sector, to -16.3%, for Sterling Corporate Bonds.

They started to go up in the final quarter of last year, and in November we began investing in some of the funds from the Mixed Investment 40-85% Shares sector. We currently hold the Liontrust Sustainable Future Managed, EdenTree Responsible & Sustainable Managed, Invesco Managed Income UK and Baillie Gifford Managed funds.

Over the last month, the Sterling Corporate Bond sector has been the leading sector in this group. We do not currently hold any funds from this sector, but we will have a good look at them when we review the numbers later this week.

All the sectors in the slightly more adventurous ‘Steady as She Goes’ group also went down last year. The worst, UK Index-Linked Gilts, fell by more than 35%. However, most of them started to pick up during the last three months of 2022 and they all went up in January.

At the top of the group are the UK All Companies and UK Equity Income sectors. Our demonstration portfolios hold the Baillie Gifford UK Equity Alpha , BNY Mellon UK Income, MI Chelverton UK Equity Income and Janus Henderson UK Smaller Companies funds. We bought the Janus Henderson UK Smaller Companies fund in November and since then it has risen by 9.7%.

The most volatile funds are in the two ‘Full Steam Ahead’ groups and the Specialist/Thematic sectors.

The European sectors are currently at the top of our ‘Full Steam Ahead Developed’ group. We hold the Man GLG Continental European Growth, M&G European Sustain Paris Aligned, and LF Brook Continental European funds. The first one that we went into, Man GLG Continental European Growth, has gone up by 12.1% since November.

The only other fund that we are holding is the Invesco China Equity fund from the Full Steam Ahead Emerging group. The China/Greater China sector was the best-performing sector in December, up 4.0%, and gained a further 8.5% in January. The Technology and Technology Innovation sector lost 6.0% in December, but went up by 9.0% last month putting it at the top of the Full Steam Ahead Emerging group.

The best-performing sector last year was Latin America, which is one of the relatively new ‘thematic’ sectors. It went up by 17% when most sectors went down. It has also had a good start to this year, going up by 6.1% in January. The Financials and Financial Innovation sector gained 5.9% in January and the Infrastructure sector made 0.9%. The Healthcare and India/Indian Subcontinent sectors went down last month. Our portfolios are not currently holding any funds from the Specialist or Thematic sectors.

Since the middle of November we have been gradually reducing the amount of cash in each of the portfolios. All the funds we are holding are currently showing gains.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

Commentary » Latest » Mutual funds Commentary » Mutual funds Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.