Apr

2024

Positive start to 2024 for UK dividend payments

DIY Investor

25 April 2024

UK dividend payments had a positive start to 2024 according to the latest Dividend Monitor, published by global financial services company Computershare, but it warned that growth is likely to slow

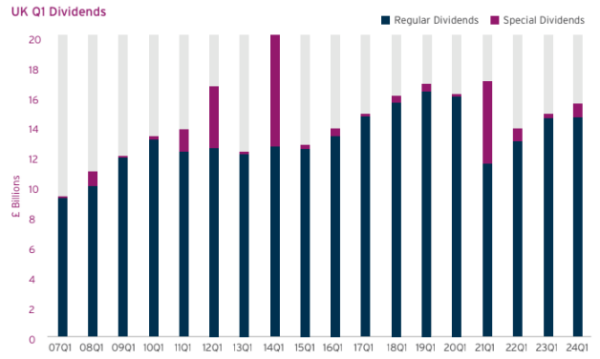

- UK dividends rose to £15.6bn in Q1, up 4.9% on a headline basis, boosted by one-off payments

- 95% of Q1 payers increased dividends or held them steady

- Underlying growth was slower – regular dividends (which exclude one-off specials) rose 2.0% on a constant-currency basis in line with the previous report’s forecast

- Only the food, drink and tobacco sector showed dividend growth among Q1’s seasonally important sectors

- Payments in the airline, leisure and travel sector grew fastest, reflecting continued recovery from the pandemic

- Exchange rates and share buybacks reduced the total sterling value paid in the healthcare, oil and telecoms sectors

- Headline growth forecast upgraded for 2024 to 4.3% (£94.5bn), but underlying growth forecast reduced to 1.5%

Payouts rose 4.9% to £15.6bn and were boosted by higher one-off special dividends, with 95% of Q1’s payers either increasing dividends or holding them steady.

Regular dividends, which exclude these volatile one-offs, were £14.7bn in Q1: up just 2.0% on a constant-currency basis, with most sectors delivering steady, low single-digit growth.

The brightest spots included the airline, leisure and travel sector, where payouts are finally rebounding from the pandemic (although they remain some way below pre-2020 levels).

The caterer Compass is also benefiting from the recovery in global travel, and its large increase pushed dividends from the consumer goods sector higher.

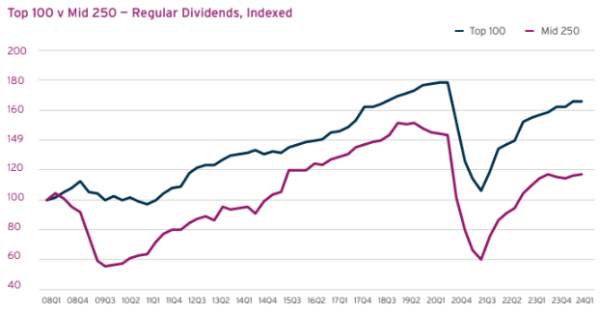

The Dividend Monitor cited the impact of share buyback programmes on long-term dividend growth: with around thirty large British companies currently running such schemes, they are spending around three times more on stock repurchases than a decade ago.

Key Sector Developments in Q1:

The food, drink and tobacco sector was the only large sector to show growth in the total value of dividends paid in Q1, mainly thanks to strong profits at Associated British Foods.

However, the other dominant sectors during Q1, healthcare, oil and telecoms, all declined modestly owing to a stronger pound and the impact of share buybacks.

For example, although per-share dollar dividend increases are rapid in the oil sector, the total sterling value of payments in the sector dipped 2.8%.

The lack of Q1 dividend payments from banks helps explain the relatively subdued underlying payout growth at market level, as the sector has recently been the main driver of UK dividend growth.

Forecast for 2024:

The Dividend Monitor’s forecast for headline growth in 2024 is increased to 4.3% (up from 3.7%) or £94.5bn in total payouts following higher-than-anticipated special dividends in Q1 and a slightly lower sterling exchange rate since January.

It also said that regular dividend growth is likely to be slower than anticipated, with payouts rising 1.5% on an underlying basis to £89.5bn (down from 2.0% three months ago).

The twelve-month prospective yield on UK equities currently stands at 4.0%: unchanged from its position three months ago.

Mark Cleland, CEO Issuer Services United Kingdom, Channel Islands, Ireland and Africa at Computershare, said: “Dividends were healthy in the first quarter of 2024, but the general picture of flat or slowly growing dividends in most sectors is setting the tone for the whole year.

“Only the banks and the recovering leisure and travel sector look likely to deliver double-digit growth this year, while only the mining sector, which is defined by the ups and downs of the commodity cycle, seems set for double-digit declines.

“This modest growth in dividends reflects the earnings picture: cost pressures have eased for many businesses, but the cost of capital has risen sharply, and economic growth is sluggish at best in the UK and in much of the world.

“This makes it difficult for companies to build earnings momentum, which influences how much boards decide to return to shareholders in the form of buybacks or dividends.

“This largely explains why the outlook for 2024 is relatively modest.”

Leave a Reply

You must be logged in to post a comment.