Apr

2019

Please can we have more openness and visibility: Thoughts of Saltydog Investor

DIY Investor

2 April 2019

Fanny’s rest stop sign reads, “Eat here and get gas”.

Does this remind you of any present location? Perhaps the Houses of Parliament at the moment?

I am fortunate enough to be sitting in the sun on the other side of the world, able to quietly puzzle over questions that have concerned me in the past.

One of which is whether there are some funds where the manager has such a good handle on his investments, that he is worth sitting with through the thick and thin of the market machinations.

‘A falling tide takes all boats down with it’

My instinct has always been that this cannot be the correct course of action. A falling tide takes all boats down with it, so why stay invested?

Some funds however definitely recover quicker than others, and even with up-to-date sector and fund performance numbers, there is no certainty when making investment decisions.

So, for the future, rather than bailing out completely to re-invest back in when the storm passes, maybe I should only sell half.

There is one fund that for me is worth this experiment, and that is Fundsmith Equity; I have been in and out of this fund over the last dozen years like a ferret down a rabbit hole.

Unfortunately I do not have sufficient past information, or the will, to make a comparison between what I gained by moving, against the result from staying. I just know that over the years, Fundsmith has been kind to me.

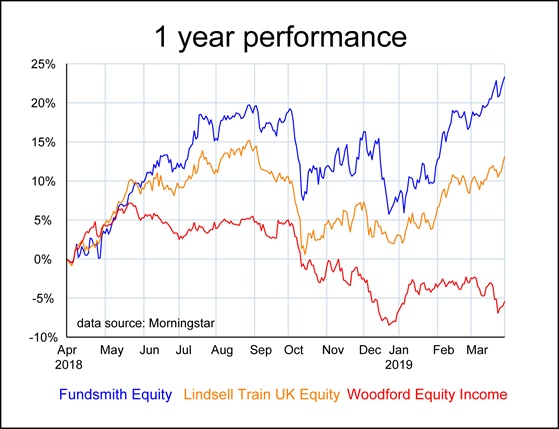

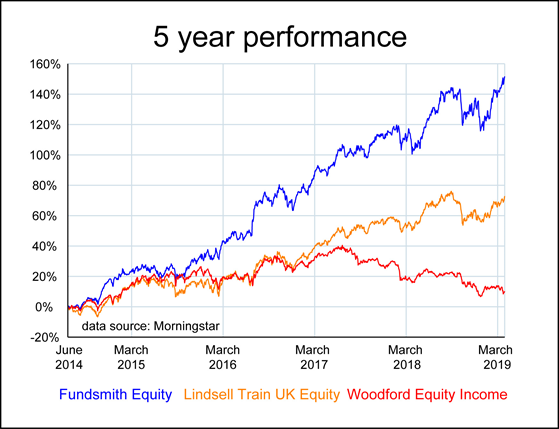

There are another two funds that constantly receive positive press from the fund platforms and the financial media and these are Linsell Train UK Equity and Woodford Equity. Below you can see the three funds graphed over one year and five years

Lindsell Train is reasonable, and its Global Equity fund is better.

Woodford however begs questions about the people and financial organisations which push this fund onto the innocent DIY investor.

Surely this sort of action should merit a public spanking from the F.C.A., especially if the pushers are making gains from promoting these funds?

Please can we have more openness and visibility.

Best wishes and good investing,

Douglas.

Founder & Chairman

Leave a Reply

You must be logged in to post a comment.