Dec

2021

Personal Finance as a Gift: Best books for Christmas

DIY Investor

28 December 2021

The holiday season is just around the corner, and with it comes the challenge of finding a great gift for your loved ones.

The holiday season is just around the corner, and with it comes the challenge of finding a great gift for your loved ones.

Why not opt for a personal finance book this year?

Over the last few months, we have compiled reviews of some of the most helpful works on managing money effectively.

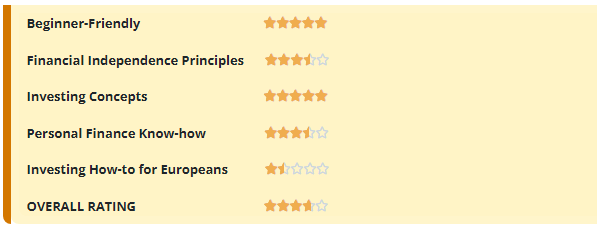

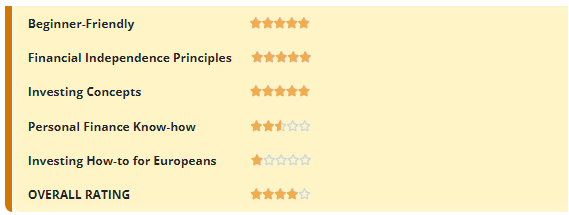

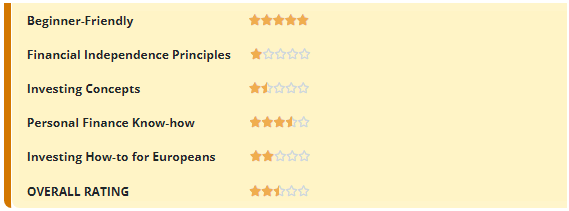

We have rated the books based on the following criteria:

- Beginner-Friendly – Can you grab the book without needing an introduction to finance and covered topics?

- Financial Freedom – Is the book centred on helping you become Financially Independent? Does it go a step beyond and cover Early Retirement?

- Investing Concepts – Are explanations of how to benefit from the Stock Market intuitively presented?

- Personal Finance Know-How – Are Taxes, Saving Accounts, Mortgages and similar topics covered by the book?

- Investing How-To – Will European and UK Investors find an introduction to local Investment Funds, Products and Portfolio Construction?

There is a range of content, appropriate for readers of different ages, in different situations, and living in various parts of the world.

Today, let’s go through them and see which ones could be appropriate for you and your family.

We have also included links to our reviews.

All the books listed below have merit, and they can appeal to a variety of readers. Which one is best for you or your loved one depends on your current life stage, where you live, and what your preferences are.

FOR AN ENTHUSIASTIC BEGINNER

Invest Your Way to Financial Freedom by Ben Carlson and Robin Powell is a great book for anyone early on in their journey and looking to optimize their investments.

It is meant for UK investors and covers topics such as your savings rate, investment vehicles, and the types of investments you should make.

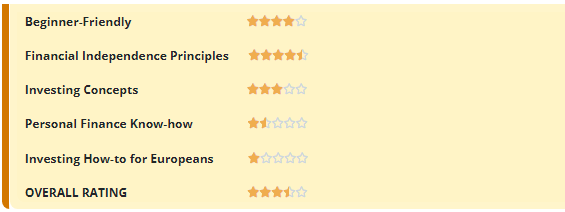

We have rated this book particularly highly in the categories “Beginner-Friendly” and “Investing Concepts”. A great gift idea, especially for UK residents.

Our Rating

It is appropriate for people about to start their first job or those who have already begun and are now looking to create good habits.

While the concepts also apply to older readers, the authors emphasize the fact that you should get started as quickly as possible to take advantage of compounding.

Because the book covers the specifics for people in the UK, it may not be as applicable to other European countries as some of our other options.

However, the authors are familiar with and enthusiastic about financial independence, so it is suitable for those looking to FIRE (Financial Independence, Retire Early).

FOR A RATIONAL INVESTOR

Investing Demystified by Lars Kroijer is a comprehensive guide to investors all over the world looking to optimize their portfolios.

Investing Demystified by Lars Kroijer is a comprehensive guide to investors all over the world looking to optimize their portfolios.

The premise is that 95% of us don’t have an edge over the market, so we should simply choose a minimum-risk bond asset and a world equity tracker. This takes the guesswork out of investing and helps us achieve the excellent long-term results the stock market offers.

For European investors outside the UK, it can be hard to find a book that doesn’t need to be ‘translated’ into the local currency and system. This book ticks the box.

Our Rating

With Investing Demystified, Kroijer has created a truly international work that draws examples from all over the world.

However, the book might be hard to understand for a complete beginner, since it is quite technical.

It will be most appreciated by someone who genuinely enjoys reading about finance and the “why” behind the “how”.

Investing Demystified discusses the risks involved in investing in a much more comprehensive way than the other books on the list.

Thus, it could be a great choice for someone interested in optimizing their portfolio for both performance and security.

Read the full review (with videos) here >

FOR A YOUNG PROFESSIONAL

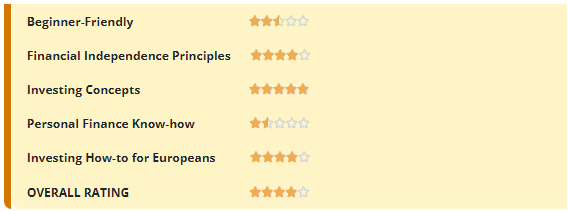

The Simple Path to Wealth by JL Collins is another well-known personal finance book and has been translated into multiple other languages.

The Simple Path to Wealth by JL Collins is another well-known personal finance book and has been translated into multiple other languages.

The author, one of the early proponents of financial independence, has been running a successful blog for over a decade. He has helped countless people to improve their financial life.

Because Collins wrote this book for his 19-year-old daughter, it provides important information for young savers entering the adult world.

No matter if you’re hoping to optimize your financial life from the start or improve on your current situation, you can benefit from JL Collins’ timeless advice.

Our Rating

Unlike many other authors, he advocates an aggressive 50% savings rate, which is in line with financial independence principles.

He discusses how this is achievable for most people in jobs that pay an average or above-average salary, which is a big differentiating aspect compared to other books.

European investors will find the first and last parts of the book useful but might have to skip over the middle bits, which go into detail about the American system.

Read the full review (with videos) here >

FOR A GLOBAL DIY INVESTOR

The Little Book of Common Sense Investing by John C. Bogle is a classic in the finance world, and it illustrates the benefits of index investing.

The Little Book of Common Sense Investing by John C. Bogle is a classic in the finance world, and it illustrates the benefits of index investing.

If you’re hoping to adopt a passive indexing strategy but believe you might be overwhelmed by Lars Kroijer’s book, give The Little Book of Common Sense Investing a go.

Our Rating

The author has founded Vanguard, one of the largest and most respected financial institutions in the world.

If you want to read about Index Investing from the Father of Passive Funds, Bogle may be the perfect choice.

Although Bogle’s aim wasn’t to create a resource for complete beginners, the book is understandable for everyone and clearly highlights important investing principles.

It is written for an American audience, but people around the world can benefit from the advice.

This is especially true since index investing has spread around the globe in recent years.

Read the full review (with videos) here >

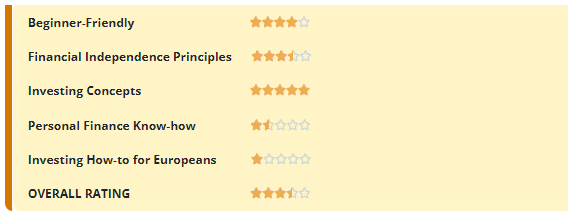

FOR A PSYCHOLOGY ENTHUSIAST

The Psychology of Money by Morgan Housel can teach you a lot about why you and those around you make certain financial decisions.

The Psychology of Money by Morgan Housel can teach you a lot about why you and those around you make certain financial decisions.

It’s a great resource for anyone hoping to improve their money management skills.

What’s more, the book promotes a non-judgmental approach and reminds us that everyone has a different money story and therefore different values.

Our Rating

Housel’s book was an incredibly enjoyable read.

It isn’t a manual that teaches you all you need to know about personal finance, and it only touches on individual investment approaches.

However, it’s a great read for people who enjoy examining the reasons behind their actions.

The twenty lessons he shares can help us all examine our decisions and become more open to other people’s points of view.

As a bonus, Housel is a proponent of the financial independence movement and states that buying freedom is the best thing we can do with our money.

FOR THE ASPIRING MILLIONAIRE

The Millionaire Next Door by Thomas J. Stanley and William D. Danko is a well-known work from the 1990s.

The Millionaire Next Door by Thomas J. Stanley and William D. Danko is a well-known work from the 1990s.

It analyzes various aspects of millionaires’ lives to demonstrate what they are doing differently to other people.

Although many concepts, such as living below one’s means and investing wisely, will be familiar to personal finance enthusiasts, the book touches on inheritance and generational wealth, which is crucial for long-term success.

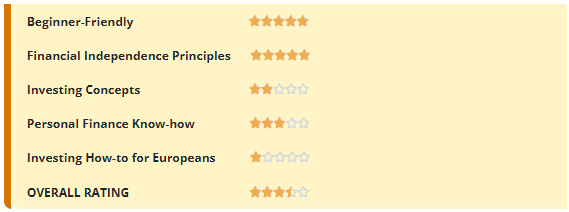

Our Rating

The concepts in The Millionaire Next Door are easily understandable for everyone.

That’s why the book will provide a lot of value to beginners.

Many of the people interviewed were financially independent, so it can provide valuable information for people who want to manage their money better.

However, it is equally interesting for those of us who are further along in our journey.

Stanley and Danko explain how millionaires build on their existing wealth and how they optimize the inheritance process.

In particular, the focus is on raising strong and independent children, which is crucial for people hoping to create generational wealth.

Read the full review (with videos) here >

FOR THE RELUCTANT SAVER

Money: A User’s Guide by Laura Whateley is different to the other books on this list because the focus is not on investing. Instead, the author aims to give readers a broader overview of their finances and includes tips on renting, buying a home, optimizing bills, and ethical money management.

Money: A User’s Guide by Laura Whateley is different to the other books on this list because the focus is not on investing. Instead, the author aims to give readers a broader overview of their finances and includes tips on renting, buying a home, optimizing bills, and ethical money management.

The information is very basic, so it will appeal to complete beginners who are reluctant to get started.

Our Rating

I had an issue with the tone of this book, which is overly negative and portrays saving as a necessary evil, not something that can improve your overall quality of life.

For this reason, I would not recommend it to young people aiming for financial independence.

Instead, it would make a good gift for someone who is struggling with their finances and who doesn’t enjoy managing their money.

Such a reader will find Whateley’s voice more relatable than many of the other, highly enthusiastic personal finance writers listed above.

Alternative investments Commentary » Brokers Commentary » Brokers Latest » Commentary » Equities » Exchange traded products Commentary » Fixed income Commentary » Investment trusts Commentary » Mutual funds Commentary » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.