Apr

2021

Paging Dr Alpha

DIY Investor

10 April 2021

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

The pandemic has boosted secular growth drivers behind healthcare as an investment theme…

The pandemic has boosted secular growth drivers behind healthcare as an investment theme…

Adversity promotes innovation. World War II provided the impetus for many huge technological leaps forward in many areas, including radar, computing, nuclear power, jet engines, synthetic oil and the mass production of penicillin.

And so it is that the pandemic has directly and indirectly led to what could be huge leaps forward in the world of healthcare. Funded by emergency government programmes, Pfizer-BioNTech (and later, Moderna) successfully developed the first mRNA vaccine licensed for use in humans.

Up until that point, no vaccine using this new technology had ever been approved. Indeed, many companies had abandoned the technology after many years of (failed) research.

It is entirely possible that the developments pioneered by BioNTech and Moderna could usher in a new era for vaccines and drugs. However, the lockdowns that we have all endured have prompted consumers, businesses and governments to consider and/or accept new ways of doing things.

In this way, lockdowns have also opened the window to new ways that healthcare providers can deliver their services, and have potentially brought forward industry trends by many years.

It is no wonder therefore that investors are once again looking at the biotechnology & healthcare sector, which, as we discuss below, holds a number of unique attributes.

Waves of innovation

Innovation in any sector often comes in waves, with a new discovery or enabling technology spawning a storm of innovation that means a significant leap forward in a number of related areas.

The new era for science in healthcare comes on the back of several waves of innovation. The first wave in the 1950s saw a proliferation of small-molecule drugs, which was dominated by large pharmaceutical companies.

The second wave in the 1990s then saw large molecules come to the fore, often from smaller, more innovative companies whose technology was then acquired by large pharmaceutical companies.

The third wave is seeing more advanced biologic drugs derived from, or containing, living organisms, as well as gene therapy and DNA/RNA medicines.

Like with the second wave, many of these developments are being discovered by niche businesses. If the second wave is anything to go by, they will be bought by the larger companies which have the distribution networks to maximise the chance of commercial success on a global basis within the relatively short patent window.

This provides high-growth investment opportunities for specialist investors who understand the science and are happy to take an active approach to stock-picking.

Employ an expert

Looking back, one of the key enabling technologies that enabled the current wave of innovation and rapid development of the COVID-19 vaccine is genetic sequencing.

Huge leaps forward have occurred, enabling sequencing to be performed in ever shorter time frames and at lower cost. Oxford Nanopore, which recently announced it would seek to IPO in London, is an example of this innovation.

It has benefitted from a surge in demand for its new generation of DNA/RNA sequencing technology. According to the company, around a fifth of the SARS-CoV-2 virus genomes were generated on one of its devices by scientists in over 85 countries.

As it was, the entire genome of COVID-19 was sequenced and published on the internet within ten days of the initial announcement of a novel coronavirus in Wuhan.

This enabled scientists around the world to start designing a vaccine immediately, including those at Oxford University’s Jenner Institute.

Showing how quickly this information then enabled vaccine development, in just over a month after the genome was published, on 18 February 2020 the Jenner Institute had agreed a contract with an Italian manufacturer to produce vaccines for a clinical trial – showing their confidence in what they had developed.

On 20 March, they announced they had found a likely candidate for a vaccine and were working towards starting human trials.

We think these dates are important because they highlight how far ahead of the curve scientists were. By comparison, politicians and many non-scientists seem to have been hopelessly behind the curve.

Based on the gathering storm clouds, it seems unlikely that there were many virus scientists who didn’t cancel any plans they might have had to join the 250,000 people who gathered for the Cheltenham Festival between 10 and 13 March 2020!

It was 23 March 2020 that Boris Johnson announced the first lockdown in the UK – three days after scientists had announced they were already “onto something” in countering the very threat that society was only just cottoning on to.

Aside from being a salutary lesson to all of us that experts’ advice should be heeded, it also shows us that having a specialist active investment team for this area of the stock market will likely pay dividends.

Another wave is breaking

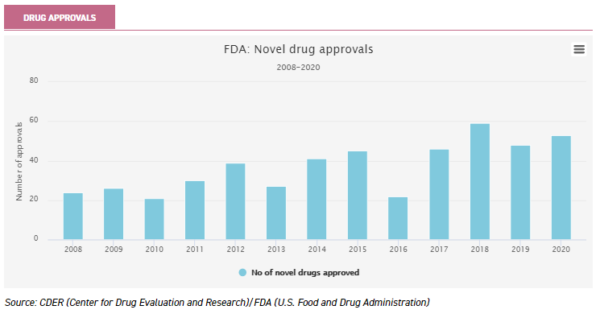

As evidence that we are in one of the waves of innovation that periodically breaks, we show the chart below. During 2020, the FDA approved 53 novel drugs. This is the second-largest number approved annually in any of the last 20 years.

This is good news for society, but also good news for investors in this space. Whilst drug pricing is a hot topic politically, it is also true that prescription drugs only made up 14% of total US spending on healthcare in 2019.

However, one might argue that the pandemic has shown us all the value to society of having a strong and dynamic drug-discovery ecosystem. The high risks of invention are set against the potential rewards of success.

As Boris Johnson famously stated (and then retracted) “the reason we have the vaccine success is because of capitalism, because of greed, my friends”.

Despite the unfortunate language, we all know what Boris is talking about. We certainly would not be in the position we are today if upside financial returns on successful drug development were somehow capped. As such, we believe that pressure for controls on pricing is less likely to occur after the pandemic than it was before it.

International Biotechnology Trust (IBT) invests in some of the most innovative companies in the biotech sector. The team behind IBT at SV Health Managers believe that double-digit annual returns are achievable from their sector over the long term.

They take a measured approach to investment, aiming for a diversified portfolio of quoted and unquoted investments in companies aiming to address a clear medical need, and which have financial strength.

The team bring a detailed understanding of the science behind companies in the portfolio, not to mention the industrial processes behind product research. An important differentiator is that the team prefer to reduce risk to specific stock-moving events, such as clinical trial results, ahead of their announcement.

This risk management tool has helped the team deliver a lower-volatility return stream than the trust’s benchmark, whilst still enabling IBT to outperform over the long term (with five-year NAV total returns of 86.6% vs 85.2% for the Nasdaq Biotechnology Index in sterling).

A strong contributor to returns during 2020 was IBT’s exposure to private companies. Investments here are led by Kate Bingham (who took time off from investment management during 2020 to chair the UK’s Vaccine Taskforce), and her team offer exposure to early-stage companies with explosive growth potential.

Life outside drugs

Drugs are by no means the whole picture. As we highlight above, in terms of overall spend, 86% of US healthcare spending is spent on other things. BB Healthcare (BBH) was set up to invest in companies providing new approaches to transform what the managers view as fundamentally broken healthcare systems around the world.

The pandemic has given an early view of how the managers’ thesis fits, and what might evolve over the longer term. For example, the experience of seeing a GP during lockdown shows the potential for the NHS to save significant amounts of money on ‘digital first’ consultations.

The pandemic has shown how models of care can shift very significantly given willingness (or need) to adopt alternative approaches. ‘Digital first’ is something BBH’s managers have championed for several years.

Similarly, the pandemic highlights how constrained by capacity hospitals are and that they should only be occupied by those in the most acute need. In any event, in more normal times, patients generally wish to minimise a hospital stay and only stay there as a last resort.

A key theme for BBH’s managers is connected care, enabling patients to remain at home with passive sensing technology that enables and enhances physician decision-making without the need for lengthy hospital stays.

The increasing usage of these technologies would clearly be a win-win for both patients and providers, and enable acute treatment to be significantly more efficient and effective.

On average, the vast majority of the AIC sector invest in companies listed in the US (north of 80% on average). Syncona (SYNC) offers a very different exposure to peers, not least because of its focus on early-stage UK science.

SYNC doesn’t just invest at arm’s length – the management team found life science companies with academics, as well as funding these companies from the earliest stages of their lives.

SYNC aims to set up two to three companies per year in order to deliver a handful of companies (three to five over a ten-year period) to the point of product approval, whilst still owning a significant proportion of the equity of the companies.

Over time, SYNC seeks to build a relatively concentrated/high-conviction portfolio of up to 15–20 companies. As such, the risks and potential rewards are very different to those of peers.

The managers are highly active, but there are also high hurdles that each portfolio company must overcome to be successful. Whilst the number of winners from the portfolio will be relatively low, the financial rewards to SYNC will be very high if they are achieved.

Health is wealth

Whichever way an investor interprets the opportunity and chooses to access it, the healthcare sector is likely to be a beneficiary of the secular tailwind of the rising number of middle-class consumers around the world.

According to the OECD, by 2030 the global middle class is expected to number 5.3 billion people. This means an additional two billion people around the world (or an increase of 60% over current numbers).

As a new consumer, once one has realised that a hot tub brings you very little long-term satisfaction, one’s thoughts will usually turn towards health insurance and helping one’s extended family through their own healthcare issues.

This is reflected in World Health Organization (WHO) statistics, which show that middle-income countries are rapidly converging towards higher levels of healthcare spending. In those countries, health spending rose 6.3% a year between 2000 and 2017 while economies rose by 5.9% a year.

High-income countries account for about 80% of global spending, but the middle-income country share increased from 13% to 19% of global spending between 2000 and 2017.

Most of the growth will be in Asia. By 2030, China and India together will represent 66% of the global middle-class population and 59% of middle-class consumption.

Whilst developing nations are destined to spend more on healthcare, so too are developed nations. The oft-discussed demographic time bomb from declining fertility rates and rising life expectancy is one of the certainties in life (alongside death and taxes).

According to the WHO, over the next 30 years the world’s population aged 60 or over is expected to total two billion people, up from 900 million in 2015 (or an increase of c. 120%).

The numbers of those aged 80 or over are expected to increase by 247%, from 125 million to 434 million (of which an incredible 120 million will live in China alone).

Demographic drivers will make significant changes to consumer behaviour and consumption patterns. However, one of the clear beneficiaries will be the healthcare industry.

According to the WHO, there is little evidence to suggest that older people today are experiencing their later years in better health than their parents did.

While rates of severe disability have declined in high-income countries over the past 30 years, there has been no significant change in mild to moderate disability over the same period.

As the managers of BBH have observed, mortality has been overcome at a cost of chronic morbidity. We can prevent people from dying, but we cannot necessarily cure them completely, which means a rising number of people have to manage their health over the long term – at a cost.

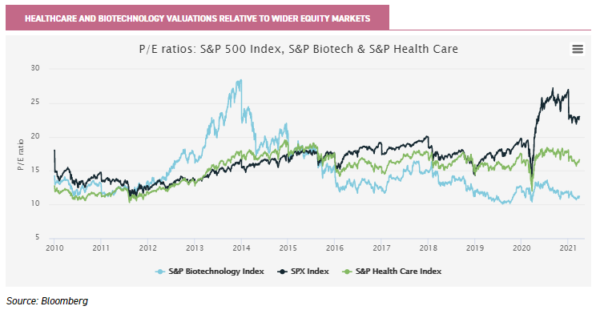

It is with this considerable tailwind in mind that the various managers in the AIC’s Biotechnology & Healthcare sector invest. As the graph below suggests, valuations are by no means stretched relative to broader equity markets. For long-term investors, this is a sector that looks likely to run and run.

Past performance is not a reliable indicator of future results. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. In particular, this website is exclusively for non-US Persons. Persons who access this information are required to inform themselves and to comply with any such restrictions.

The information contained in this website is not intended to constitute, and should not be construed as, investment advice. No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not a recommendation, offer or solicitation to buy or sell or take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm’s internal rules. A copy of the firm’s Conflict of Interest policy is available on request.

Commentary » investment trust commentary » Investment trusts Commentary » Investment trusts Latest » Latest

Leave a Reply

You must be logged in to post a comment.