Dec

2023

Outlook 2024: Fixed income strategy

DIY Investor

28 December 2023

“With the bulk of central bank rate tightening done we can expect a more “steady state” environment going forward. However, benefiting from very attractive bond valuations will require patience in 2024 given the divergence we are seeing in terms of both economic outlook and monetary policy.“

Franck Dixmier

Global CIO Fixed Income

Back in the game

It is fair to say the big bond reset has taken rather longer than many investors expected. Global bonds remained under pressure for much of 2023 as the aberrations of the post-Covid economy, such as inflated consumer and corporate balance sheets, have emboldened central banks’ “higher for longer” mission and made navigating rates extremely challenging.

The juggernaut of rising rates, which has put 10-year US Treasuries on course for a third successive year of negative total returns for the first time ever, is slowing to a halt as central banks pause and attention turns to the potential, and timing of, rate cuts in 2024. We think weaker growth, lower inflation, tighter monetary and fiscal policy, and attractive valuations make fixed income a compelling proposition once more.

We have already seen equity and credit markets beginning to digest the risks of an extended period of restrictive monetary policy, and we think elevated rates will begin to weigh on both consumers and corporates heading into 2024.

We believe deteriorating corporate fundamentals over the next three-to-six months will also lead to a deterioration in labour market conditions. A persistently strong labour market has so far been a major barrier to a long overdue bond rally, keeping consumer spending robust underpinning inflation. We expect the US economic outlook to become less rosy, against the backdrop of an already weak global economy with elevated geopolitical risks and growing financial stability risks. These could all be strong buy signals for bonds, which look well capable of outperforming cash in 2024.

US compelling, Europe requires patience

The US fixed income market looks particularly compelling given our conviction that the Fed is done with rate hikes. Even if one more hike were to materialise, we expect investors would now look through it to the timing of a Fed pivot to rate cuts. Market pricing points to a first cut in mid-2024, and we find it hard to argue with that assessment given we think a mild recession looks more likely than a soft landing.

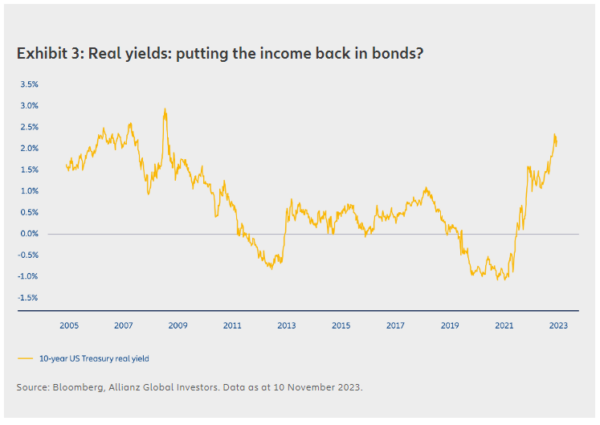

With that in mind, valuations are attractive – with 10-year US Treasury yields having risen close to 5% early in Q4 2023, real yields (bond yields adjusted for inflation) of almost 2.5% rose to levels not seen since 2007 (see Exhibit 3). We like the short end of the yield curve, where volatility looks to have subsided, as well as the five- to seven-year part of the curve. We also think yield curve steepeners in the US look attractive.

In Europe, we will have to be more patient before buying into interest rate duration. Currently markets are pricing in no more hikes from the European Central Bank, but we are not comfortable with that view. We see a genuine wage-price spiral in the euro area that doesn’t exist in the US; in Europe every wage increase is being translated virtually one-to-one as an increase in unit labour costs (mainly due to negative productivity growth). We think that leaves investors exposed to a potential upward surprise on core inflation that is not priced in today.

Stay nimble in credit and diversify

The flip side of bonds showing value again is of course that money has a cost again, and this impacts credit markets. As economic conditions deteriorate in the coming months, we are likely to see greater dispersion in credit quality and performance, so investors might consider staying nimble in credit and keeping a lid on overall spread risk. That said, we don’t think investors will want to ignore high yield (HY) bonds, where yields are providing plenty of cushion against what we think will be a relatively contained rise in default rates. With its shorter duration profile, HY can keep portfolios invested at the front end of corporate credit curves where creditworthiness can be evaluated with higher conviction.

One big opportunity we see for 2024 is Asian fixed income beyond China, which we think can offer an antidote to the anticipated global slowdown and broader market volatility. Asia ex-China is expected to contribute significantly to global economic growth both in 2024 and the coming decade, driven by supply chain diversification, growing desynchronisation with the US and younger populations. We expect superior growth prospects to gradually translate into improving macroeconomic fundamentals, upgrades to sovereign credit ratings and a fundamental repricing of fixed income assets in the region. Historically, Asian local currency government bonds have the lowest beta to US Treasuries compared with other emerging markets, which along with competitive yields and lower currency volatility make them a good candidate for diversification. Similarly, Asian investment grade corporate bonds offer a competitive risk-reward profile compared to other global credit markets.

Active strategy can capture value while managing risks

Overall, with the bulk of central bank rate tightening done we can expect a more “steady state” environment going forward. However, benefiting from very attractive bond valuations will require patience in 2024 given the divergence we are seeing in terms of both economic outlook and monetary policy, chiefly between the US and Europe. An active, flexible strategy could be helpful in allowing investors to start accruing income at these higher levels while managing duration and spread risk tightly in the near term.

Investing involves risk. The value of an investment and the income from it may fall as well as rise and investors might not get back t

he full amount invested. Past performance does not predict future returns. For further information contact the issuer at the address indicated below. From 25 July 2022, discretionary portfolio management services formerly provided to Allianz Technology Trust PLC (the “Company”) by Allianz Global Investors (“AllianzGI”) have been delegated to Voya Investment Management Co. LLC (“Voya IM”). All members of the former AllianzGI Global Technology Team transferred to Voya IM and continue to manage the Company’s portfolio. It is anticipated that there will be no change to the investment process. AllianzGI will remain the Company’s AIFM (Alternative Investment Fund Manager), providing company secretarial, administration and sales and marketing services. This is a marketing communication issued by Allianz Global Investors UK Limited, an investment company, incorporated in the United Kingdom, with its registered office at 199 Bishopsgate, London, EC2M 3TY, www.allianzglobalinvestors.co.uk. Allianz Global Investors UK Limited company number 11516839 is authorised and regulated by the Financial Conduct Authority. Details about the extent of our regulation are available from us on request and on the Financial Conduct Authority’s website (www.fca.org.uk). The duplication, publication, or transmission of the contents, irrespective of the form, is not permitted; except for the case of explicit permission by Allianz Global Investors UK Limited. Allianz Technology Trust PLC is incorporated in England and Wales. (Company registration no. 3117355). Registered Office: 199 Bishopsgate, London, EC2M 3TY.

Leave a Reply

You must be logged in to post a comment.