Dec

2023

Outlook 2024: Equity Strategy

DIY Investor

26 December 2023

“In a world of restrictive monetary policy and slower growth, strong cash flow generation and balance sheets will be key, as will the ability of management teams to lead sustainably through volatility and, in some cases, fast changing ecosystems.“

Virginie Maisonneuve

Global CIO Equity

Quality counts

We think equity markets in 2024 will be shaped by several major themes. These include a divergence of markets and economies globally – driven by desynchronised growth prospects and monetary policy stances – and an interplay of geopolitics with cyclical and structural trends such as technology and climate transition. It follows a period of normalisation and adaptation to a new world where capital discipline is back and an uncertain geopolitical order is developing. 2023 was a year of two halves as this process played out. The first half saw support for growth equities as markets awaited a pivot by the US Federal Reserve (Fed) away from its cycle of interest rate rises. But sentiment reversed in the second half with value stocks once again outperforming growth as markets came to terms with a “higher for longer” scenario – which we had been warning about for some time.

Macroeconomic divergence

Heading into 2024, the US, European Union and China all face divergent macroeconomic outlooks. The US looks resilient, with job figures and purchasing managers’ indices (PMIs) painting a relatively benign picture. China’s economy is soft but possibly at an important crossroads. We see a need to resolve outstanding issues in the property sector, which represents about 20% of its GDP. But we draw optimism from China’s “new economy” (spanning technology, fintech, financial services, health tech and the “green economy”), which we expect to be the engine of future growth. Elsewhere, Europe is facing recession risks and potentially sticky inflation, with Germany – the continent’s largest economy – battling structural headwinds. The diverging outlook may offer favourable conditions for active stock picking.

Technology generally performs well when “growth”, as a style, also does – for example, when the outlook for rising interest rates is incrementally low. With the end of rate increases in sight, a disciplined, bottom-up approach may help investors uncover opportunities in the coming months – as long as the global economy does not fall into a deep recession. In the US, tech has dominated the headlines this year, but as AI and other technologies begin to be deployed across sectors, investors can look more broadly – for instance, cyber security and health technology are seeing a lot of activity. In China, the new economy may offer opportunities.

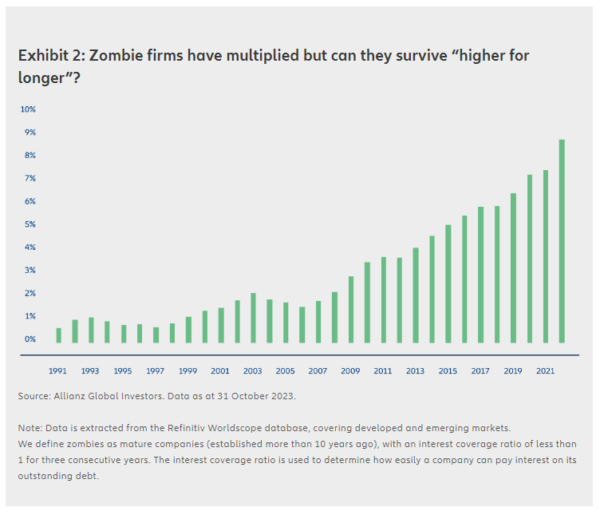

Now that money has a cost again, we are likely to see fewer so-called zombie companies (see Exhibit 2). Buoyed by the cheap financing they were able to access during the last decade, these low-quality companies face a reckoning and may struggle to survive. “Zombification” is more prevalent in certain sectors than others. Our research shows them to be more prevalent in Oil & Gas, Natural Materials and Healthcare, for instance. Investors should thus seek to navigate these sectors – which may remain attractive for other reasons – with the required expertise. Again, a commitment to quality throughout the portfolio and across investing styles will be vital.

Interplay of geopolitics, structural and cyclical themes: invest for a new world order

While different regions face challenges associated with their specific position in the business cycle, structural issues will also play a significant role. For instance, how China manages its transition will be crucial to its medium-term future, as well as to retaining the confidence of investors who are watching these developments keenly. In this context, it is important to monitor how US-China trade rivalry, particularly virulent in the technology space, will unfold in the coming years. Globally, the energy transition is a key structural consideration for all regions, especially for Europe which has had to rapidly adjust to supply issues over the past two years. Direct and indirect beneficiaries of China’s changing role in the global supply chain will also continue to be a trend in Asia, as investors seek a “China + 1” strategic positioning.

A final structural consideration that is likely to shape world economic development for some years is the implication of rapidly developing hardware and software industries considering advances in AI. As we have discussed before, how – and how quickly – companies and governments react to these changes will determine the winners and losers in this new era of Digital Darwinism. The growing influence and leadership of China in this area may lead to the development of rival tech hemispheres.

Investor outlook: opportunities in diversification and efficient portfolio construction

For investors, ongoing uncertainty and the impact of higher rates on some companies means that the focus should remain on quality names and themes in portfolios. Uncertainty also means that agility and the ability to react to ongoing events will remain critical. However, the volatility associated with uncertainty may offer positioning opportunities for long-term investors. Taking an active approach to managing uncertainty via careful stock selection and portfolio construction – that affords both a base of liquidity and access to growth – should offer the best of both worlds.

Indeed, investors can think of their equity portfolio as a pyramid. Consider a base of multi-factor, low-volatility strategies. The layer above can comprise quality value, growth and income stocks. In a world of restrictive monetary policy and slower growth, strong cash flow generation and balance sheets will be key, as will the ability of management teams to lead sustainably through volatility and, in some cases, fast-changing ecosystems. Finally, at the top of the pyramid, explore areas that may continue to provide growth, either via a multi-theme approach, or by considering individual themes such as cyber security, AI, climate transition, food security and water.

Investing involves risk. The value of an investment and the income from it may fall as well as rise and investors might not get back t

he full amount invested. Past performance does not predict future returns. For further information contact the issuer at the address indicated below. From 25 July 2022, discretionary portfolio management services formerly provided to Allianz Technology Trust PLC (the “Company”) by Allianz Global Investors (“AllianzGI”) have been delegated to Voya Investment Management Co. LLC (“Voya IM”). All members of the former AllianzGI Global Technology Team transferred to Voya IM and continue to manage the Company’s portfolio. It is anticipated that there will be no change to the investment process. AllianzGI will remain the Company’s AIFM (Alternative Investment Fund Manager), providing company secretarial, administration and sales and marketing services. This is a marketing communication issued by Allianz Global Investors UK Limited, an investment company, incorporated in the United Kingdom, with its registered office at 199 Bishopsgate, London, EC2M 3TY, www.allianzglobalinvestors.co.uk. Allianz Global Investors UK Limited company number 11516839 is authorised and regulated by the Financial Conduct Authority. Details about the extent of our regulation are available from us on request and on the Financial Conduct Authority’s website (www.fca.org.uk). The duplication, publication, or transmission of the contents, irrespective of the form, is not permitted; except for the case of explicit permission by Allianz Global Investors UK Limited. Allianz Technology Trust PLC is incorporated in England and Wales. (Company registration no. 3117355). Registered Office: 199 Bishopsgate, London, EC2M 3TY.

he full amount invested. Past performance does not predict future returns. For further information contact the issuer at the address indicated below. From 25 July 2022, discretionary portfolio management services formerly provided to Allianz Technology Trust PLC (the “Company”) by Allianz Global Investors (“AllianzGI”) have been delegated to Voya Investment Management Co. LLC (“Voya IM”). All members of the former AllianzGI Global Technology Team transferred to Voya IM and continue to manage the Company’s portfolio. It is anticipated that there will be no change to the investment process. AllianzGI will remain the Company’s AIFM (Alternative Investment Fund Manager), providing company secretarial, administration and sales and marketing services. This is a marketing communication issued by Allianz Global Investors UK Limited, an investment company, incorporated in the United Kingdom, with its registered office at 199 Bishopsgate, London, EC2M 3TY, www.allianzglobalinvestors.co.uk. Allianz Global Investors UK Limited company number 11516839 is authorised and regulated by the Financial Conduct Authority. Details about the extent of our regulation are available from us on request and on the Financial Conduct Authority’s website (www.fca.org.uk). The duplication, publication, or transmission of the contents, irrespective of the form, is not permitted; except for the case of explicit permission by Allianz Global Investors UK Limited. Allianz Technology Trust PLC is incorporated in England and Wales. (Company registration no. 3117355). Registered Office: 199 Bishopsgate, London, EC2M 3TY.

Leave a Reply

You must be logged in to post a comment.