Sep

2022

Our new fund purchase even as markets fall

DIY Investor

27 September 2022

Saltydog Investor takes a stake in one of the best-performing stock markets this year.

At Saltydog Investor, we help private investors who want to invest in funds. We highlight which sectors of the market are doing well and which ones are underperforming. We then shortlist the leading funds. By investing in funds, you can avoid some of the risks associated with buying shares in individual companies, and are more likely to pick up on the general trends in the sectors.

Unfortunately, global markets have had a tough year and September is not providing any relief.

| Stock Market Indices 2020 | ||||||

| Index | Jan, Feb, March | April, May, June | July | Aug | 1st Sept to 24th Sept | Year -to-date |

| FTSE 100 | 1.8% | -4.6% | 3.5% | -1.9% | -3.6% | -5.0% |

| FTSE 250 | -9.9% | -11.8% | 8.0% | -5.5% | -5.7% | -23.5% |

| Dow Jones Ind Ave | -4.6% | -11.3% | 6.7% | -4.1% | -6.1% | -18.6% |

| S&P 500 | -4.9% | -16.4% | 9.1% | -4.2% | -6.6% | -22.5% |

| NASDAQ | -9.1% | -22.4% | 12.3% | -4.6% | -8.0% | -30.5% |

| DAX | -9.3% | -11.3% | 5.5% | -4.8% | -4.3% | -22.7% |

| CAC40 | -6.9% | -11.1% | 8.9% | -5.0% | -5.6% | -19.1% |

| Nikkei 225 | -3.4% | -5.1% | 5.3% | 1.0% | -3.3% | -5.7% |

| Hang Seng | -6.0% | -0.6% | -7.8% | -1.0% | -10.1% | -23.4% |

| Shanghai Composite | -10.6% | 4.5% | -4.3% | -1.6% | -3.6% | -15.1% |

| Sensex | 0.5% | -9.5% | 8.6% | 3.4% | -2.4% | -0.3% |

| Ibovespa | 14.5% | -17.9% | 4.7% | 6.2% | 2.0% | 6.6% |

Data source: Morningstar

When economies all around the world are struggling, it is not surprising that most sectors are also having a difficult time and less than 5% of the funds that we monitor have gone up in the last four weeks.

The best-performing index in the table above is the Brazilian Ibovespa. It is the only one showing a gain in September and it is also up over the year. A couple of weeks ago, I published a table of the best-performing funds in August and at the top of the list were Liontrust Latin America, abrdn Latin American, and CT Latin America.

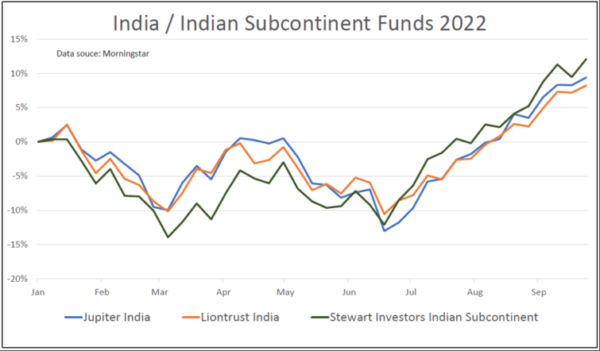

The next best index is the Indian Sensex, which is down over the year, but only by 0.3%. There were three funds from the India/Indian Subcontinent sector that also made it into our top 10 funds in August: Liontrust India, Stewart Investors India Subcontinent, and Jupiter India.

They had a poor start to the year, rallied during March and April, but then went back down again in May and the beginning of June. However, since mid-June they have performed well.

In our Saltydog demonstration portfolios, we have been holding high levels of cash for most of the year. At the moment, it is nearly 90% in the Tugboat and 80% in the Ocean Liner.

We are obviously keen to avoid most funds, which are currently going down, but we are happy to invest small amounts into the few that appear to have some positive momentum. Earlier in the year, we had some success with funds investing in energy and other natural resources.

We have recently decided to invest in the Jupiter India fund and hope the upwards trend that started in June continues.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

Leave a Reply

You must be logged in to post a comment.