Jun

2022

Options for taking sustainable income from your portfolio

DIY Investor

20 June 2022

Taking a sustainable income from your portfolio could be more complicated than accumulating it in the first place. Dominique Riedl explores your options.

You’ve finally got enough in your ETF portfolio to start taking an income from it; how do you sustain that income over many years, especially if it’s your sole source of funding? Firstly:

- How much income can I take?

- How long will my portfolio last at that rate of income?

Inevitably, the more income you take, the faster your portfolio is likely to be depleted; how can you maximise your income while ensuring that your pot lasts as long as you need it.

Sustainable income

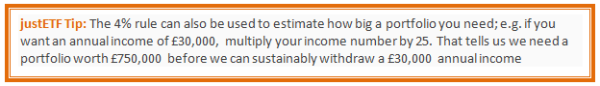

A popular rule of thumb is the ‘the 4% rule’; conceived by William Bengen based on US equity and bond returns since 1926, historical data tells us that you could have withdrawn an inflation-adjusted 4% from your portfolio annually, over any of the studied 30-year periods, without completely exhausting your assets.

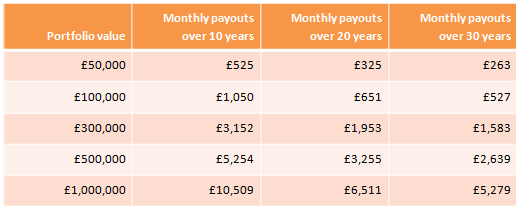

This simple table gives a rough idea of how much monthly income a portfolio can provide over different time periods although it doesn’t account for taxes, costs, inflation or asset return volatility.

Assuming a 5% annual investment return, a £300,000 portfolio could sustain a £1,583 monthly income for 30 years when all capital is spent and the portfolio is exhausted.

Monthly incomes over time assuming a 5% annual portfolio return

How flexible are your income needs?

A major consideration is whether you need your portfolio to provide a steady income i.e. the same amount every year, adjusted for inflation.

The 4% rule and some of its variants are calibrated on this premise; e.g. 4% of a £1 million portfolio means equates to £40,000 income in year 1.

However, you don’t take 4% of whatever is left in your portfolio in year 2, you adjust your year 1 income by inflation. For example, if inflation at the end of year 1 is 2%, then year 2 income is £40,000 x 1.02 = £40,800.

You take £40,800 from your portfolio in year 2, regardless of how much your portfolio is worth, maintaining a steady income over time.

That’s important if your annual expenses are fixed and there’s no way to reduce them. However, few people are that inflexible in practice and there is a risk of running down your portfolio too quickly if you’re unlucky enough to suffer years of poor asset returns.

If equities fall by 50% then you’d need to sell twice as many ETF shares to take the same level of income as before the crash; low share values deplete your portfolio faster if your income needs are fixed.

However, by maintaining a diversified portfolio you can withdraw from whichever assets have best preserved their value; e.g. you may sell equities after a period of outperformance when you’d need to rebalance back into bonds anyway.

‘by maintaining a diversified portfolio you can withdraw from whichever assets have best preserved their value’

During a market crisis, you withdraw from safer government bonds that are likely to have outperformed equities; or from your gold allocation if you maintain one and it is performing well.

You may also allow your income to vary rather than always withdrawing the same inflation-adjusted amount; a simple way of doing this is to sell a fixed amount of ETF shares.

Don’t sell more shares than you’re comfortable with but your income will vary in line with asset values; this works well if your essential needs are met by other sources of income and your ETF portfolio provides extra spending money on top. If your portfolio is your main source of income then it only works if you can cut consumption too.

Alternatively, you can investigate the various dynamic withdrawal rate strategies that exist. These strategies suggest portfolio management rules that require you to lower your income if your portfolio shrinks below certain thresholds. Happily, they also allow you to raise your income if returns are kind and you experience strong growth.

Income investing: living off the interest

One way to ensure your portfolio lasts as long as you do is to live off the income only; this strategy requires you to preserve your capital in all but the direst of emergencies. You don’t sell your ETF shares, only your dividends and interest.

‘be mindful of over-concentration in assets that can be unexpectedly volatile’

The advantage is that you can all but ignore the fluctuating value of your portfolio; you’re not going to sell, so what does it matter if equities crash? If all goes to plan then you’ll pass on your portfolio as a legacy to your heirs.

The drawback is that you’ll need a much larger portfolio to sustain a given level of income when you don’t intend to spend such a large component of your wealth

Income investing strategies also produce fluctuating levels of income over time because yields change. The trend line for bond yields was down for 30 years from the early 1980s and dividends are often cut during market turmoil. For example, dividends fell by 50% during the Great Depression.

Moreover, income strategies can push investors to concentrate their portfolios in high yielding assets such as:

- High dividend equities

- Junk bonds

- Emerging Market bonds

- REITs

Those assets can all play a part in highly diversified portfolios, but income investors need to be mindful of over-concentration in assets that can be unexpectedly volatile in comparison to broad market indexes.

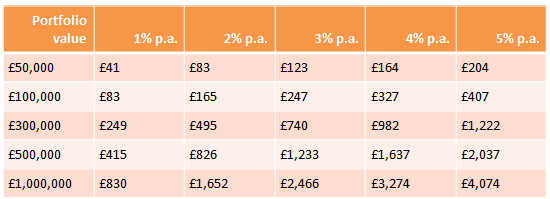

If you understand the risks then income strategies can work perfectly well. For example, some global dividend ETFs currently yield 3% to 4% whereas the MSCI World ETF yields around 1.8%. Including price gains, global dividend ETFs have an expected return of 5% to 7% over the long term.

Monthly income at various portfolio values and yields

ETF withdrawal strategy costs

UK platforms do not usually offer automated withdrawal plans for ETF portfolios*. Instead, you must execute sales manually in line with your income needs. As ever, you need to keep your costs as low as possible. Specifically, watch out for:

- ETF dealing fees – applied on every trade.

- Drawdown fees – administrative charges levied when you take income from your SIPP. They are usually applied annually and some platforms apply additional one-off charges.

That may make it worth switching your provider as a platform that offered competitive rates in your accumulation phase becomes comparatively expensive as you deaccumulate.

‘If all goes to plan then you’ll pass on your portfolio as a legacy to your heirs’

Also note that it can be more cost effective to sell your ETFs quarterly, or annually, as opposed to monthly. For example, if ETF dealing fees are £10 per trade then it’ll cost you £40 to sell an ETF every quarter versus £120 monthly.

You could consider consolidating your holdings too if that will reduce trading costs. For example, you could hold a global equities ETF as opposed to separate US, UK, Europe and Pacific ETFs.

Cost savings become especially important at relatively low withdrawal amounts and can easily outweigh the potential gain of keeping money invested for a few months longer

Click to visit:

Commentary » Exchange traded products Commentary » Exchange traded products Latest » Financial Education » Latest » Take control of your finances commentary » Uncategorized

Leave a Reply

You must be logged in to post a comment.