Nov

2023

Once more into the breach

DIY Investor

11 November 2023

With yawning discounts across the board, some sectors have been hit harder than others – our analysts think there could be value there for those with the sangfroid to fight for it…

MIGO Opportunities’ manager Nick Greenwood argues we are living through a “once in a generation” opportunity in the investment trust sector. This is chiefly because sentiment is so poor—and perhaps technical factors are playing a role too—that investment trust discounts are at extreme levels. Meanwhile, NAVs have also taken hits in most sectors as markets digest the meaning of higher rates for asset prices. We discussed some of these issues in a recent strategy note.

Next week we will be running a series of webinars with managers across a number of sectors where we think there may be an opportunity in the discount. The format is intended to be a discussion, with managers discussing with each other and with you, the audience, where the value is. Below we preview each of the four events, on Europe, Property, Private Equity, and the UK. Please send through any questions you’d like to put to the managers on the markets they invest in or on their funds, using the links below the texts.

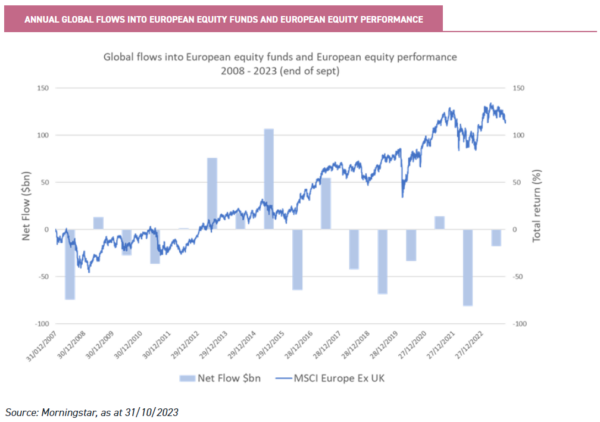

Europe – Making stuff matters in a material world

A sharp rise in inflation and interest rates as well as Russia’s invasion of Ukraine have posed significant economic and geopolitical headwinds for Europe. Last year, 2022, saw the largest net outflows from European equities since the financial crisis, illustrating that investor sentiment towards the region is close to historically low levels. The chart below suggests that from an asset allocation perspective, investors remain underinvested in Europe.

But is this distaste for Europe really warranted considering the raft of European equities that have continued to deliver positive earnings? European companies typically are available at discounted valuations relative to the US, and so we think it is reasonable to expect that there remains a latent potential for markets to move substantially higher should earnings continue to grow.

According to Henderson European Focus Trust (HEFT) managers Tom O’Hara and John Bennett, Europe is a “maker of stuff” which also presents diversification opportunities away from the service-driven economies of the UK and US. John and Tom’s bottom-up focus has built a strong track record, which has been maintained in challenging market conditions. In addition, Martin Currie Global Portfolio (MNP) manager, Zehrid Osmani, continues to look towards some of Europe’s highest-quality companies to gain core exposure to some of the world’s most exciting secular growth themes in his high-conviction global equity portfolio. The competition for capital is fierce with Zehrid taking a long-term, very high-conviction approach.

Join us on Monday 13 November 2023 where we will discuss with Tom and Zehrid the potentially unrealised opportunities the European equity market has to offer.

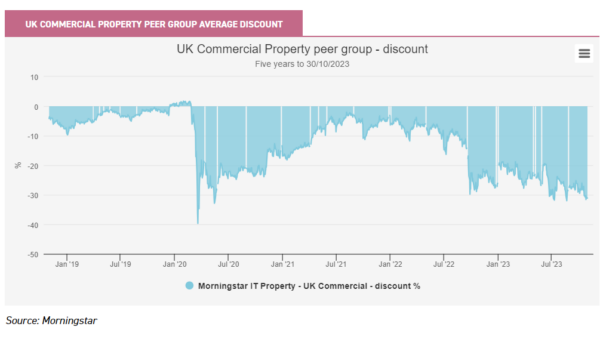

Property – when will the prodigal return?

UK commercial property has taken it on the chin in the last two years. Property has always had a correlation to interest rates, and whilst property trusts generally entered 2022 with conservative levels of gearing, investors have been concerned about what higher rates mean for valuations and the cost of debt and what that means for earnings and dividends. These concerns have proved well-founded, with property valuations down significantly from their peak, and the cost of debt now much higher, and in most cases share prices have fallen even further than net asset values. As a result, many property trusts are now trading on 30% or even 40% discounts.

With interest rates and government bond yields now at much higher levels, and perhaps set to stay that way for a while, it’s a good time to reflect on where property trusts are now. The last few years did not, perhaps surprisingly, see a speculative property development boom, so in many cases, there is a shortage of supply of the right kind of assets, with strong tenant demand for areas such as industrial and logistics. While offices overall are in a state of flux, there is a short supply of offices that will meet increasingly demanding energy efficiency standards. So, the right assets can and still are achieving rental growth, which is the bedrock of long-term property returns.

Richard Kirby and Will Fulton, managers of Balanced Commercial Property (BCTP) and UK Commercial Property REIT (UKCM) respectively, will join us on Wednesday 15 November at 12pm to discuss the state of the property market and whether discounts represent an opportunity for investors.

Private equity – the worst-kept secret?

For a long time, it has been clear to investors that public markets are becoming less representative of the economy, or the best investment opportunities. Bain’s 2023 global private equity report highlighted that fewer than 15% of companies with revenue over $100m are publicly listed. Given the high regulatory and reporting burdens that come with being listed, it is perhaps not surprising that we have reached this situation.

At the same time, institutional investors around the world have become more sophisticated and in many cases are prepared to invest long term in private, illiquid companies. Yale is often held out to have been in the vanguard of this movement, having a perpetual investment mandate and sophisticated investment team which has allowed it to invest in private companies of all sorts for over three decades. As a result, private companies tended to be able to attract all the capital they wanted, at attractive valuations.

This is for institutional investors. What then for wealth managers or retail investors who want a piece of the action? For a long time now, listed private equity investment trusts have been offering exposure—largely to buyouts which tend to be profitable and established businesses, with significant growth opportunities (as opposed to venture capital which tends to be less well established, higher growth/higher risk opportunities).

As we have discussed previously, we argue that listed private equity trusts offer a better way of accessing buyouts than would be available to a sophisticated institution. Outside of buyouts, the only real route for UK investors for high-growth private company opportunities akin to venture capital has historically been venture capital trusts (VCTs).

They tend to be high risk and come attached with attractive tax breaks for new investments which are not conferred to investors who buy their shares in the secondary market. As a result, they are not evergreen, and without ‘permanence’ individual VCTs have not grown to the scale which investment trusts can.

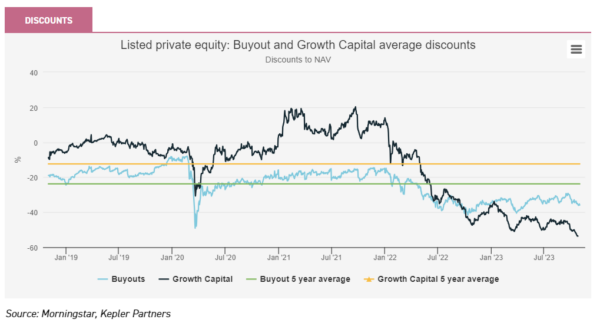

Over the last five years, a number of trusts have launched which the AIC classifies as Growth Capital. These trusts target unlisted, private companies and take minority equity stakes. The prospective returns are high, which meant that in the febrile markets of 2021, premiums to NAV reached eyewatering levels. Since then, premiums have given way to significant discounts.

However, as we show below, whilst buyout-focussed trusts have also seen discounts widen, growth capital has widened yet further. Investor caution on private assets has affected both of these subsectors, and the impact of higher interest rates on the valuations of growth companies can explain a large part of the significantly wider discounts that the growth equity sub-sector has experienced.

For buyouts, the ability of private equity managers to drive value and deliver transformative change to businesses and thereby generate strong earnings growth is unchanged. Certainly, the higher interest rate environment and slower pace of deal activity are challenges, but not unique. There are a number of different trusts offering exposure to buyouts, but NB Private Equity Partners (NBPE), who will be presenting at our event is unique amongst them in that it solely targets co-investments. This brings a number of structural advantages, including lower fees and an ability to control the balance sheet of the trust more strictly.

In the growth capital space, tighter financial conditions do present challenges for companies that require further funding. However, the pace of innovation is not slowing, and investing alongside an experienced manager with plenty of firepower should help avoid situations where investee companies run out of road. For those that make it to scale and eventual profitability, the lack of competition when they get there should amplify returns. Schroders Capital Global Innovation (INOV) is well on its way towards becoming a private company-focussed vehicle, aiming to identify long-term growth opportunities from a range of subsectors primarily within technology and healthcare industries and split across three sub-strategies: venture, growth, and life sciences.

Join us on Thursday 16 November at 11:30am to discuss the outlook for unlisted companies with Harry Raikes, manager of INOV, and Paul Daggett, manager of NBPE.

UK small caps – why let the truth get in the way of a good (bad news) story?

The UK has suffered from a slew of negative headlines in 2023, with topics ranging from industrial action to crumbling infrastructure to political trouble, all of which have cast a veil of pessimism over the country. The stock market has been far from immune from this, even leading to questions being raised over the health of the LSE by some. However, we would argue there is plenty to be excited for in the UK, not least of all valuations, which may be pricing in the worst possible outcome.

One of the more interesting areas is in smaller companies where valuations are at their most extreme. Not only is the UK cheap relative to peers, but the smaller companies are cheap versus their large-cap equivalents. When this is combined with the discounts available on investment trusts, it may make for a very compelling opportunity.

Jonathan Brown and Robin West, co-managers of Invesco Perpetual UK Smaller Companies (IPU) note that when the FTSE Small Cap Index has traded below a P/E of 10x, the average return of the next 12 months has been 36%, and over the next 24 months, this figure jumps to 60%. At the time of our most recent note, published in June, this figure stood at 9x. We believe this could be seen as a very attractive entry point for long-term investors. Meanwhile, the manager of Henderson Opportunities (HOT), James Henderson, remains excited about the opportunity in the UK, particularly in small and mid-caps, and is seeing pockets of interest picking up, with catalysts such as buybacks, buyouts, and relisting all potential factors to spark a recovery.

There may be excuses for negativity currently, but these are all arguably temporary. Meanwhile, the reasons to be positive about smaller companies, namely the long-term growth prospects, their flexibility and nimbleness, and the potential for M&A, persist, and for that reason, we think investors should consider whether there is a generational opportunity in the UK market.

On Friday 17 November, we will be discussing the outlook for the UK with James Henderson, manager of HOT, and Jonathan Brown, co-manager of IPU.

Leave a Reply

You must be logged in to post a comment.