Apr

2022

On the Hunt: 10 ‘cheap’ investment trusts that could super-charge returns

DIY Investor

23 April 2022

It is fair to say this year has not got off to a great start for markets. There are a few bright spots, but the major global indices are down, with some of the top trades of the last few years giving back returns.

Anecdotally, we believe investors are looking to top up defensive alternatives, especially those which can provide an income. These have generally managed to eke out positive returns despite the volatility, if only from dividends. However, for investors with a greater risk appetite, volatile markets can provide opportunities as investments sell off and become cheaper. In the below article, we look at our portfolio of discounted opportunities, trusts we think have strong NAV potential and yet are or have been trading on wide discounts which could super-charge returns.

Market review

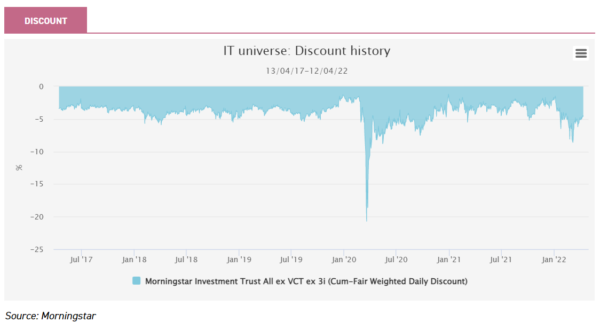

Russia’s invasion of Ukraine led to discounts widening across the investment trust space. In fact, the discount on Morningstar’s universe reached levels last seen in May 2020 in the aftermath of the initial wave of the pandemic. As the graph below shows, only some of this move has reversed, with discounts significantly wider than how they started the year.

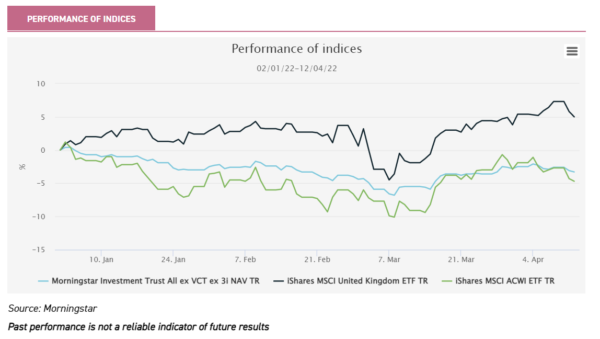

The recovery in discounts coincides with a consolidation period in markets once the outbreak of war had been digested. Global equities are down around 5% year to date, while the UK market, buoyed by its miners and energy producers, is up around 1% (see graph below).

Since our last review on 03/01/2022, Latin America has been the stand-out performer on a sector level. Latin America is benefitting from raw material price inflation as well as political tensions between the West and China and Russia. Rising commodities prices benefit companies across the region, which has large supplies of oil, gas, copper, and lithium, as well as agricultural commodities.

Meanwhile, the region is a potential alternative trading partner for the West. Companies in Latin America now have the highest earnings momentum in emerging markets. Latin America has outperformed even the specialist commodity and natural resources trusts, which are the second-best performers. After these two, there is a gap to the returns seen on various alternatives sectors which have done a decent job in eking out positive returns a falling equity market (see below table).

Performance by sector

| NAV TR (%) | SHARE PRICE TR (%) | |

| Morningstar Investment Trust Latin America | 26.3 | 27.1 |

| Morningstar Investment Trust Commodities & Natural Resources | 16.0 | 18.6 |

| Morningstar Investment Trust Infrastructure Securities | 4.2 | 4.9 |

| Morningstar Investment Trust Insurance & Reinsurance Strategies | 3.9 | 32.0 |

| Morningstar Investment Trust Leasing | 3.8 | 14.5 |

| Morningstar Investment Trust Royalties | 3.2 | 2.0 |

| Morningstar Investment Trust Debt – Structured Finance | 2.8 | 3.7 |

| Morningstar Investment Trust Hedge Funds | 2.7 | -0.1 |

| Morningstar Investment Trust Debt – Direct Lending | 2.1 | 1.1 |

| Morningstar Investment Trust Renewable Energy Infrastructure | 2.0 | 3.6 |

| Morningstar Investment Trust Property – UK Commercial | 1.6 | 3.7 |

| Morningstar Investment Trust Property – Rest of the World | 1.5 | -10.7 |

| Morningstar Investment Trust Property – UK Healthcare | 1.5 | 0.9 |

| Morningstar Investment Trust Infrastructure | 1.2 | 0.0 |

| Morningstar Investment Trust Private Equity ex 3i | 1.0 | -5.9 |

| Morningstar Investment Trust Property – UK Residential | 1.0 | -4.1 |

| Morningstar Investment Trust Property – Debt | 0.8 | -3.8 |

| Morningstar Investment Trust Property – Europe | 0.5 | -5.2 |

| Morningstar Investment Trust Property – UK Logistics | 0.3 | -0.9 |

| Morningstar Investment Trust Farmland & Forestry | 0.0 | -6.1 |

| Morningstar Investment Trust Asia Pacific Equity Income | -0.4 | -3.4 |

| Morningstar Investment Trust Debt – Loans & Bonds | -0.6 | -1.7 |

| Morningstar Investment Trust Flexible Investment | -1.0 | -2.0 |

| Morningstar Investment Trust UK Equity & Bond Income | -1.0 | 1.2 |

| Morningstar Investment Trust Global Equity Income | -1.8 | -0.8 |

| Morningstar Investment Trust Asia Pacific Smaller Companies | -2.5 | -2.8 |

| Morningstar Investment Trust North America | -2.6 | -2.5 |

| Morningstar Investment Trust India | -2.8 | -5.5 |

| Morningstar Investment Trust UK Equity Income | -2.9 | -0.4 |

| Morningstar Investment Trust Financials | -3.4 | -3.2 |

| Morningstar Investment Trust Global Emerging Markets | -3.7 | -4.1 |

| Morningstar Investment Trust Property Securities | -4.0 | -7.9 |

| Morningstar Investment Trust Biotechnology & Healthcare | -4.7 | -11.1 |

| Morningstar Investment Trust Growth Capital | -6.7 | -18.6 |

| Morningstar Investment Trust UK Smaller Companies | -7.3 | -10.2 |

| Morningstar Investment Trust Technology & Media | -7.6 | -13.8 |

| Morningstar Investment Trust Asia Pacific | -9.5 | -11.3 |

| Morningstar Investment Trust North American Smaller Companies | -9.8 | -15.4 |

| Morningstar Investment Trust Environmental | -10.7 | -13.7 |

| Morningstar Investment Trust Global | -11.8 | -12.3 |

| Morningstar Investment Trust UK All Companies | -12.6 | -13.9 |

| Morningstar Investment Trust Europe | -13.6 | -14.9 |

| Morningstar Investment Trust Global Smaller Companies | -14.3 | -20.2 |

| Morningstar Investment Trust Japan | -17.7 | -17.5 |

| Morningstar Investment Trust European Smaller Companies | -18.6 | -20.5 |

| Morningstar Investment Trust Japanese Smaller Companies | -19.4 | -18.8 |

| Morningstar Investment Trust China / Greater China | -20.6 | -21.3 |

| Morningstar Investment Trust Country Specialist | -27.0 | -25.2 |

Source: Morningstar

Past performance is not a reliable indicator of future results

It is unsurprising to see the small-cap sectors amongst the worst performers in a time of risk aversion. China trusts have also performed poorly, with lockdowns in major cities adding to the country’s problems. Unsurprisingly the country specialist sector is the worst hit, including JPMorgan Russian, which has had to write down its portfolio almost to zero due to sanctions.

It is interesting that the UK commercial property sector has done well in share price terms as well as reporting positive NAVs, unlike the logistics sector. In our last review, we highlighted the sector as a possible value play, with discounts potentially reflecting hangovers from the lockdown period. With rent collection now not an issue in the sector, we think the discounts look attractive, especially considering the inflation protection potential in property.

Portfolio review

Despite the widening of discounts on a universe and sector level, the trusts in our Discounted Opportunities portfolio have mostly seen their discounts narrow. We think this illustrates the defensive potential in buying on a wide discount. In part, this comes from a contrarian bias to this strategy which means investors will tend to be investing in countervailing trends to the market leaders when markets sell off. A good example is the performance of CC Japan Income & Growth (CCJI). The managers’ income objective means they are led into more undervalued areas of the Japanese market. While growth stocks have been leading the Japanese market down, CCJI’s portfolio has held up relatively well, and the share price has actually risen.

Another major mover has been BMO Real Estate Investments (BREI). When we added the trust in January, the NAV was stale, and the real discount turned out to be 29.4% when the end-December NAV was published. This has now drifted in to 22.4%. In its annual results, the board announced that manager Peter Lowe was leaving BMO, but this has not led to a widening discount.

In our view, this doesn’t change the value story, which is based on the potential in the portfolio and the undervaluing of commercial property in the aftermath of the pandemic. We note that BREI is relatively small compared to its generalist peers, which may make corporate action to narrow the discount more likely in the future.

However, the greatest narrowing and greatest share price appreciation came from Riverstone Energy (RSE), up 38.5% during the period. When we added RSE, traditional energy was deeply out of favour. A lot has changed since then, with an energy price crisis in Europe last year compounded by the Ukraine war. These gains for RSE add to 111% made during 2021, and the manager continues to implement an energy transition strategy. The discount remains wide at c. 39%.

Discounted opps portfolio performance – 03/01/2022-13/04/2022

| LATEST DISCOUNT (CUM FAIR) | DISCOUNT MOVEMENT | NAV TR | SHARE PRICE TR | |

| Riverstone Energy | -39.0 | 10.4 | 0.0 | 38.5 |

| CC Japan Income & Growth | -4.1 | 7.7 | -4.7 | 2.5 |

| BMO Real Estate Investments | -22.4 | 7.0 | 0.8 | 11.3 |

| Menhaden Resource Efficiency | -26.9 | 1.4 | -6.3 | -4.9 |

| abrdn Asia Focus | -9.4 | 1.4 | -3.7 | -4.5 |

| Scottish Oriental Smaller Cos | -9.7 | 0.4 | -2.1 | -3.0 |

| Schroder Japan Growth | -10.4 | -0.3 | -9.5 | -8.9 |

| Downing Strategy Micro-Cap | -17.7 | -0.9 | 3.9 | 4.7 |

| abrdn Smaller Companies | -16.4 | -1.4 | -17.0 | -18.6 |

| NB Private Equity Partners | -27.8 | -9.3 | 1.5 | -10.5 |

| FTSE All Share TR | 1.2 | 1.2 | ||

| MSCI ACWI NR USD | -4.8 | -4.8 |

Source: Morningstar

Past performance is not a reliable indicator of future results

Conclusions and additions

Surveying the scene for possible additions, one trust which catches the eye is Herald. Herald now trades on a c. 21% discount, having been caught up in the sell-off of growth stocks over the past year. The trust has an excellent long-term record, having doubled in NAV total return terms over five years. Over that time, global small caps, judging by the MSCI World Small Cap, are up just 47%. Herald traded at par in early 2021 but has generally traded on a double-digit discount in recent years. Herald has a strong technology focus, with 64%, in that sector according to Morningstar.

This is supplemented with companies in other growth areas, such as YouGov, the research company, and Next Fifteen, the digital marketer. The outlook seems poor for a growth portfolio such as this. However, timing the bottom is hard, and we think buying at a wide discount helps with the difficulties. Buying on a wide discount gives an extra cushion to the valuation of an out of favour NAV, while we think discounts often stop widening before NAVs recover as new buyers are attracted by the extra discount.

Regular readers will recall we have target levels for the discounts of each of the trusts in the portfolio, which we show in the table below. While we have seen some decent movements in a number of our trusts, none have got close to target. However, we also want the portfolio to reflect ideas we have the most conviction in.

We think Herald on a discount of 21% is more attractive than Menhaden on a discount of 28%. Menhaden has been in our portfolio for a long time but the discount has remained persistent. Menhaden, which has an ESG focus, has seen its discount come into mid-double digits at times when ESG is most in favour. However, the discount has always widened again. Performance has been better in recent years, but it has still not found a constituency.

The portfolio currently has 28% in Alphabet and 12% in Microsoft, with its private investments now down to 12%. We think Herald is more likely to get back to par quicker, and the small-cap focused NAV has greater growth potential, so we are making the switch. The new portfolio is listed below with target discounts.

New discounted opportunities portfolio

| TRUST | SECTOR | DISCOUNT (CUM FAIR) 13/04/2022 | TARGET |

| Aberdeen Smaller Companies Income | AIC UK Smaller Companies | -16.4 | Level with SLS’ discount (currently -11.3%) |

| Aberdeen Standard Asia Focus | AIC Asia Pacific Smaller Companies | -9.4 | <5% |

| BMO Real Estate Investments | AIC Property – UK Direct | -22.4 | <5% |

| CC Japan Income & Growth | AIC Japan | -4.1 | Par |

| Downing Strategic Micro-Cap | AIC UK Smaller Companies | -17.7 | Level with UK Smaller Companies sector average (currently -10.6%) |

| Herald | AIC Global Smaller Companies | -20.9 | Par |

| NB Private Equity | AIC Private Equity | -27.8 | <10% |

| Riverstone Energy | AIC Commodities & Natural Resources | -39.0 | Par (or wind up) |

| Schroder Japan Growth | AIC Japan | -10.4 | Par |

| Scottish Oriental Smaller Cos | AIC Asia Pacific Smaller Companies | -9.7 | <5% |

| AVERAGE | -17.8 | ||

| MEDIAN | -17.1 |

Source: Morningstar

Brokers Latest » Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.