Dec

2023

Ohayō Japan!

DIY Investor

2 December 2023

Our analysts Alan Ray and Josef Licsauer discuss what they think might be a new dawn for the Land of the Rising Sun…

Josef Licsauer (JL) recently joined the team and here he and Alan Ray (AR) get to know each other as new colleagues by discussing Japan.

AR

Welcome to the team JL. I’m glad we decided to make this, your first editorial, a conversation rather than our traditional head-to-head, as it seems a friendlier way to start the ball rolling! And also, I have questions about Japan. I don’t follow it as closely as other markets, but recently I’ve been hearing some things that have piqued my interest, so shall we kick off?

My first question is, why do you think Japan flies under the radar for many investors in the UK?

JL

Thanks, Alan. I think it’s a great question to kick off with as there is a fair bit to talk about. Lots of Japanese practices, products, and customs are adored across the globe. But when we look at the country through an investment lens, I believe the picture is a little more distorted. In my opinion, there are many reasons why it has flown under the radar for investors. I’ll throw a few of them into the ring.

Firstly, I think some of the older investors are still very much scarred from the ‘Lost Decade’ – which I think is now more appropriately named ‘Lost Decades’. Once the envy of the world, its economic bubble burst in the early 90s and years of sluggish growth followed. I believe many were put off investing and Japan became an understandably nerve-wracking place for investors to risk their hard-earned cash.

To follow on from that I also think that many follow the mantra of not investing in things you don’t understand – something I completely agree with. I think a lot of people still don’t understand how the country ticks – from its economic and political system to its work life/social scene. It’s incredibly different from the western world.

We also have access to a plethora of macro-related news, which at times can paint a bit of a dry macro-economic picture for Japan – its export strength, its import reliance, an ever-fluctuating currency, moving from a stable PM over 12 years to having three new ones in three years – though nothing like the UK in recent years. While it’s all very relevant and if you have the time to delve into each topic, it’s very interesting, at times it can be off-putting.

A few other themes that I’ve come across over my time researching Japan are the perceptions that Japan is filled with ‘boring and dull companies’, it’s ‘falling behind in the technology space’, and its ‘shrinking and ageing population means no growth’.

I do think there has been some truth here historically, for example, certain Japanese companies could only agree business via a physical ‘hanko’ seal, far from the comforts and ease of e-signatures and Apple pay that we all enjoy.

But what we need to focus on is where Japan is now. Which in my unbiased opinion… is an exciting topic. Huge changes, through corporate reforms and growth strategies to name a few, are making Japan look like an attractive place to invest. When you look a little deeper, it’s clear that Japan is home to some of the best-known companies on the planet, including Toyota, Sony, and Honda. But there are also some lesser-known businesses with the potential to become the household names of tomorrow.

We can discuss this in more detail but I’d argue that therein lies the opportunity.

AR

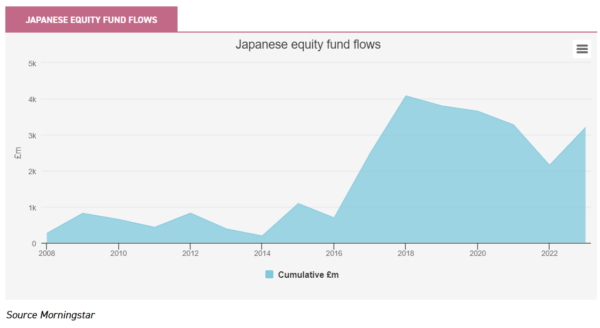

Thanks, JL. I’ve been looking at fund flows for Japanese equity funds and I’ve charted this below. This is just for UK investors. The chart shows cumulative flows in and out of open-ended Japanese funds, and I look at it as a barometer of sentiment. An ascending line denotes money is flowing into Japanese funds, and hence positive sentiment. A descending line indicates the reverse. What I see from that is that positive sentiment can coincide with historically positive performance that doesn’t always last. Investors putting money into markets after they have gone up isn’t of course a phenomenon limited to Japan, but I see that flows have turned positive again after quite a strong run for Japan in the last year. Do you think this time sentiment is turning positive at the right time?

JL

In short Alan, I do. While flows will inevitably fluctuate, I think investor sentiment is positive and, in my view, is well warranted. While I don’t want to draw the readers back into Japanese macroeconomics after my previous comment, there is one factor that must be talked about. And that is the corporate governance reforms.

Huge changes on this front are arguably good drivers behind this increased sentiment. Japanese companies are finally being held more accountable for their actions and being forced to focus more on shareholders. Following many conversations with fund managers who have visited Japan, the general theme here is that a lot of companies are very receptive to this. The most recent change which I think is relevant is the restructuring of the Tokyo Stock Exchange, which, albeit slower than many would like, is raising governance standards for companies – things like workforce diversity, being encouraged to reinvest more cash into a business for future growth, better ESG focus, increased shareholder returns are just a few things worth noting. This ultimately will lead to companies being viewed more positively and could attract more foreign investment.

I’m sure we’ll come onto this, so I’ll save most of it for later, but exciting companies, set to benefit from domestic and international trends are, in my mind, boosting sentiment as well. Valuations are also incredibly low, even versus history, so this is another sentiment driver.

AR

Thanks, JL, that makes sense. Before my next question, I just wanted to note that there has been some corporate activity in the Japanese investment trust sector recently, with some mergers and wind-ups. In my experience this type of activity can coincide with the point of maximum disinterest, or even pain, for investors, so I find it pretty interesting that Japanese investment trusts have been having a tough time. It doesn’t surprise me that this is happening just as sentiment is turning positive as I know from my time on the advisory side that the time between deciding to wind up or merge and the transaction occurring can be quite lengthy, so activity occurring now will have been in process for several months.

JL

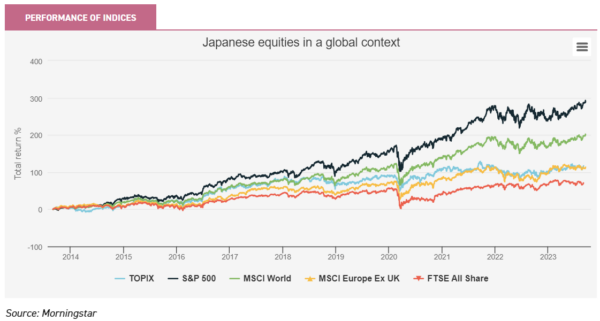

There has been some corporate activity, most notably the rollover of assets in the Japanese smaller companies’ space – abrdn Japan Investment Trust (AJIT) (which could be argued as multi cap) and Atlantis Japan Growth Fund (AJG), are going to merge with Nippon Active Value Fund (NAVF). However, I don’t necessarily agree that Japanese investment trusts are having a tough time. While certain trusts have been impacted by certain market movements/rotations in investment styles of late, Japan has outperformed the UK market over the last ten years. The same can be said for outperforming Europe too, though its close and it does depend on which day you start from.

Like all markets, certain parts have struggled more than others. Japanese trusts are typically more growth tilted so were hit hard when we saw the rotation to the value style of investing. Some trusts like CC Japan Income & Growth (CCJI), which adopt more of a core approach to income and growth weren’t as affected.

So, when you look at Japan’s stock market, it’s done better than many perhaps would have thought over the last ten years. You may be right that the sector being out of favour with investors could be a reason there is so much corporate activity but there of course will be company-specific issues that are impacting many individual trusts too. But again, I’ll throw in one of my favourite sayings for Japan: therein lies the opportunity. Because the sector is out of favour, plenty of alpha and upside is on offer via hidden gems. Though, the further down the cap scale you go, the worse things like transparency, shareholder returns, and liquidity become, so they are riskier.

AR

My next question is related to the idea above that Japan has world-leading technology and manufacturing. It’s a recurring theme in the European and North American equities sectors that I cover, as well as the REITs, that there is a strategic shift in the way the world is interconnected, for varying reasons. The US is actively disengaging with China for one, and while Europe and the UK may be acting in a more nuanced manner towards China, there is also a big effort to reconfigure supply lines following the lessons of the pandemic. We know from property managers that demand for industrial and logistics assets in the UK and Europe remains very high, and we also know that European equity fund managers, in particular, are enthusiastic about what these trends will do for companies involved in automation and robotics, and of course for the European semiconductor industry. Europe is no slouch when it comes to automation, but this is an area Japan is well-known for. Do you think Japan is benefitting from these trends?

JL

For the longest time, the perception was that Japan didn’t offer much in the way of technology or innovation. But referencing some of the previous points – ageing demographics have forced Japan to think outside the box, solve certain issues they have, and make use of their resources more efficiently.

Japan has some seriously amazing companies in the technology sector – this includes automation, AI, chipmakers, and the traditional technology providers. So yes, I think Japan is really benefiting from these themes. For example:

Sony, which a lot of people know for things like game consoles or TVs, is also prevalent in innovative technology like camera technology and music production. When you look into the lesser-known names, the story becomes even more interesting. Tokyo Electron, which boasts a decent market share in the chip-maker space, is set to help lessen reliance on China/Russia for things like semiconductors. Lasertec is another similar player in this space. Looking further afield to technology innovation in the medical field, we come across M3. It’s a unique Japanese company and is currently digitising healthcare, often being referred to as the Facebook for doctors. JPMorgan Japanese (JFJ) provides exposure to all these companies. Baillie Gifford Shin Nippon (BGS) also has a position in M3.

As you touched on Alan, manufacturing is another interesting trend, one of which I believe Japan is benefiting from. For example, a lot of people will be familiar with Toyota, a big player in the electric vehicle (EV) game. Perhaps a nice change of example from the usual Tesla story.

But what people might not be aware of is other companies like Osaka Soda. It’s a supplier of key purification materials and silicone gel, which aids certain global pharmaceutical companies in Europe and the United States to make obesity and diabetes drugs. The company also has a very close relationship with Novo Nordisk.

To gain additional exposure to interesting manufacturing/industrial names, you may want to consider the likes of CCJI and Schroder Japan (SJG).

Both trusts invest in Toyota, given its presence in automation and EVs. SJG also invests in Mitsui & Co, which manufactures and sells steel products globally, and trades in mineral, metal and energy resources (LNG). CCJI also invests in Socionext a developer and manufacturer of certain chips which are crucial in areas like radar sensors, automotives, medical healthcare, and IoT communication.

AR

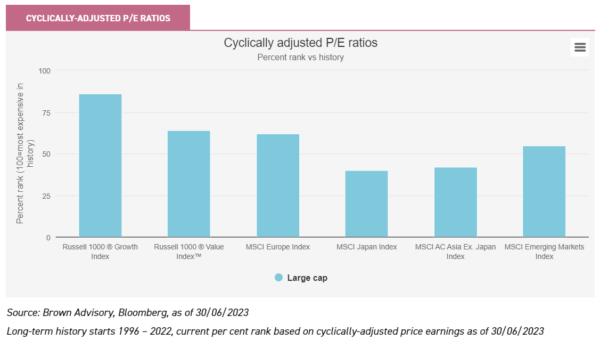

Next, I want to ask about valuations, which I think brings us back to why sentiment is turning positive. The chart below came across my desk in another context, but it’s striking isn’t it how cheap Japanese equities are. It shows how current cyclically-adjusted P/E ratios for various markets relate to history, with a score of 100 meaning that particular market is as expensive as it has ever been. What do you think is the reason that Japanese equities have such a low score, even after quite a strong positive performance?

JL

It’s a really great question and I think it largely comes back to historically poor sentiment. Having spoken to many Japanese fund managers over my time researching Japan, they always seem baffled that despite strong underlying returns, huge cash balances, good earnings, and in more recent times, a very interesting dividend story, they continue to remain cheap/unloved. The broader conclusion is that people don’t want to invest in Japan, given its track record.

I also think it’s worth bringing it back to Japan’s efforts in corporate governance reforms. Since 2012, the first truly recognised effort in this space, backed by Shinzo Abe – which I think was aptly named Abenomics -, there have been radical efforts to improve corporate governance. Historically Japanese companies have hoarded cash on the balance sheet, instead of reinvesting into things like R&D, or increasing shareholder returns via buybacks or dividends. So, it’s been hard to build a case to investors as to why the companies should be valued more highly.

But the signs are there for change now and I think corporate governance reforms could be the catalyst for a historic rerating. Many companies are announcing more aggressive medium-term business plans which bodes well for earnings growth. Meanwhile, the country has seen record dividends and record buybacks two years in a row. So, things are changing, and they are changing fast: this is no longer theory, but it’s happening in front of our eyes.

I think these radical changes could impact the stock market’s price to book. A lot of companies in Japan have been sitting below a P/B of one, so there is general scepticism around these companies generating higher returns on equity. Being forced, but in fairness very receptive to the measures, to increase their focus on shareholder returns and future company growth will help strengthen the rationale as to why companies should be valued at a higher rate.

We could therefore see things getting more expensive going forward. But for now, it could be argued that Japan’s recent market strength, coupled with an interesting macro story, low valuations, and lesser-known companies that are making more of a global name for themselves, could be well placed for patient long-term investors.

AR

Thanks again JL. It sounds to me like sentiment is turning positive at a point where valuations are still low and those long slow changes to corporate Japan’s attitude to stock markets are really paying off, and while there’s been some pain in the Japanese investment trusts, that itself is something of a sign that perhaps the low point has passed.

Disclaimer

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary

Brokers Commentary » Commentary » Equities Commentary » Equities Latest » Investment trusts Commentary » Investment trusts Latest » Uncategorized

Leave a Reply

You must be logged in to post a comment.