Jan

2022

No let-up in sight for fine wine’s stable growth

DIY Investor

7 January 2022

Originally published October 2021 – published by Aston Lark

Fine wine markets remain a source of stability in an uncertain world. The Liv-ex 1000, the broadest measure of the fine wine market, delivered a 2.41% quarterly return to start 2021, continuing its steady growth since last May. The rollout of Covid-19 vaccines programmes and plans to reopen hospitality sectors formed the main drivers, fuelling optimism of a sustained economic recovery over the course of the year.

Most major financial markets have also posted impressive return figures since the initial downturns, when the pandemic shocked the world early last year. However, fine wine is noteworthy for its broad-based consistency, with three straight months of price appreciation to start 2021 and every sub-region of the index enjoying favourable quarterly returns.

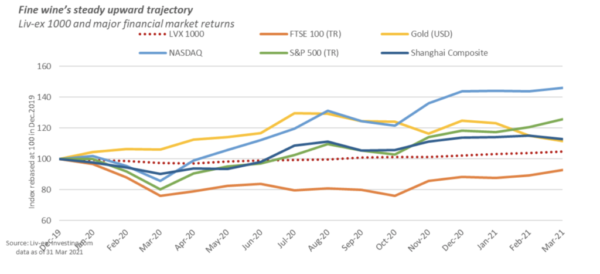

The below chart, showing financial market returns compared to those of fine wine, illustrates how fine wine saw a relatively shallow dip in early 2020 and has since posted consistent growth. Some major equity market returns have been higher, boosted by global stimulus programmes, but fine wine has seen much lower volatility.

Fine wine’s stability has come despite US tariffs in place for much of the period. In January, the outgoing Trump administration broadened the scope of a 25% import tariff on European wines to include nearly all French and German still wines (previously those with alcohol levels above 14% were exempt). However, under new president Joe Biden, the US suspended all tariffs on EU wines, among other goods, on the 5th of March for a four-month period as the two sides agreed to work toward a permanent resolution to the broader trade dispute. The result was a surge in trading activity for wines from Bordeaux, Burgundy and Rhone.

This bodes well for the investment outlook. The biggest event in the fine wine calendar is set to begin in May, when Bordeaux chateaux release their 2020 vintage ‘en primeur.’ The renewed interest from US buyers could prompt producers to set prices higher than the discounted releases last year.

The coronavirus pandemic or a resumption of tariffs remain the primary concerns. Although fine wine has demonstrated it can remain stable, additional waves of the pandemic causing shutdowns would likely pull back on its upside potential in the near term. However, the diversification of the fine wine market has been a leading theme over the past year, which we expect to continue. The Liv-ex trading platform reported record numbers of producers and individual wines traded in March. This should improve the asset class’s long-term outlook. As new producers and new regions gain exposure to a growing base of global investors, a negative impact on one fine wine region could be another region’s gain.

Protecting your wine collection

The value of wine fluctuates, just like a piece of art or jewellery. Therefore, it is important to understand what it would cost to replace. Like any valuable item, having a professional valuation is important. Speak to us for a recommendation on valuers who specialise in wine.

It’s also important to protect your collection, just as you would a piece of art. Relying on a standard home insurance policy could leave you without essential cover or potentially underinsured.

Whether you savour your Lafite or quaff your Barolo, there is a lot to think about, so talk to us and we will help simplify and demystify the best way to insure your wine.

Originally published on astonlark.com

and published by our friends at:

Leave a Reply

You must be logged in to post a comment.