Sep

2021

Mutual Funds vs Trading: Guest Post From India’s Wisdomcapital

DIY Investor

23 September 2021

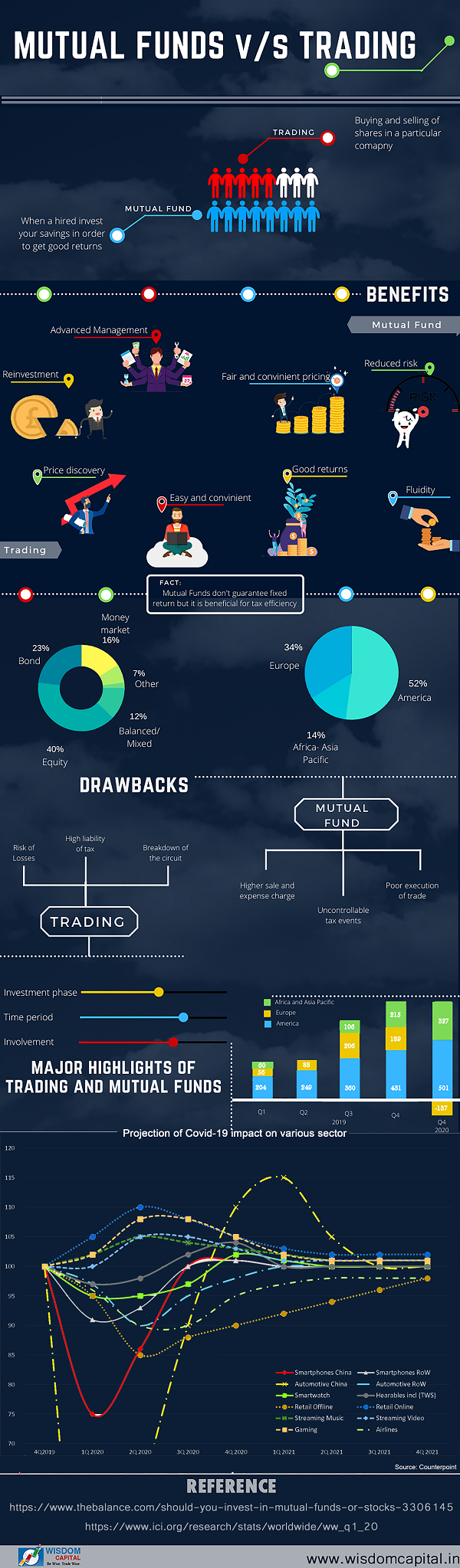

We all know the dilemma about stocks and mutual funds, especially when it comes to starting your investment journey. There are several differences between their investment approaches, such as monitoring, lock-in periods, trade fees, tax-benefits, and many more – writes Anurag Vishwakarma

Stock trading involves an investor who purchases and sells a firm’s share. A crucial thing to remember is that the prices of these shares fluctuate very rapidly and significantly. It is the shareholder who decides what & when to buy, how long to hold, and when to sell. Each of these processes requires careful market research and frequent stock monitoring.

While in mutual funds, fund managers are the ones who perform all the required transactions on the fundholder’s behalf. Once a fund owner purchases a particular fund, the respective fund manager then starts the rest of the process, such as fund performance watch, buying/selling the funds, market research, and stock calculations.

In the attached infographic, the benefits and drawbacks of mutual funds and stock trading, their differences, and critical points are also described. Fund managers come with a few added benefits, such as low prices, convenience, dividend reinvestment, and reduced risk. In comparison, its drawbacks are lousy trade performance, inefficient taxes, and high expense ratios.

On the other hand, the advantages of stock trading are well-protected interests, acquired ownership of the company, exceptional liquidity, and high returns in short intervals. Shareholders’ responsibilities, high floating prices, market fluctuations, and the need for investor relations are its disadvantages.

The infographic also consists of world open-ended funds data, both regionally and percentage-wise. The stats say that equity funds had 40% of worldwide regulated open-end funds at the Q1 2020 end, bond funds held 23%, and 12% was by balanced funds.

Furthermore, 16% of the worldwide total was held by the money market funds; the U.S. had fifty-two per cent of global assets in the Q1 2020, 34% for Europe, Asia-Pacific regions and Africa together held 14 per cent.

Anurag is exceptionally passionate about his work. He works as a Marketing Manager for Wisdom Capital that is a leading Discount broker in India, the first to introduce a discount brokerage segment. They have a highly experienced team that guarantees effective and swift online trading experience.

Commentary » Equities Commentary » Equities Latest » Latest » Mutual funds Commentary » Mutual funds Latest » Uncategorized

Leave a Reply

You must be logged in to post a comment.