May

2023

Where we hold our cash to earn 4% returns

DIY Investor

17 May 2023

Higher interest rates have improved the returns available from cash, and Saltydog Investor is profiting with two funds.

When the Bank of England base rate was down at 0.1%, as it was for most of 2020-21, the funds in the money market sectors struggled to earn enough to cover their management costs.

After 12 consecutive interest rate rises, that is no longer the case.

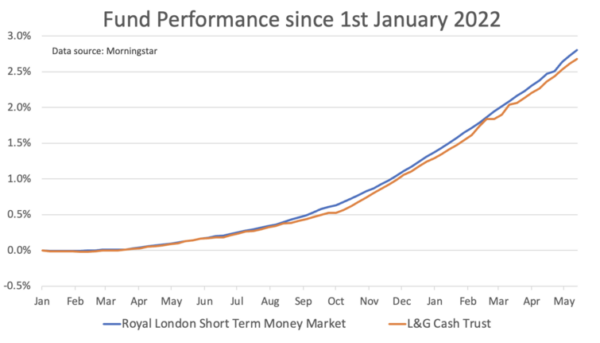

The largest holdings in the Saltydog demonstration portfolios are currently the Royal London Short Term Money Market fund and the L&G Cash Trust fund. In the last four weeks, they have risen by more than 0.3%. If they keep going up at a similar rate, they will produce an annual return of 4% or more.

There is typically a trade-off between risk and reward when it comes to investing. This is because investors demand compensation for taking on additional risk. While higher-risk investments may provide opportunities for greater returns, they also come with a greater likelihood of loss. We saw this last year when some of the racier sectors, that have done well in the past, made significant losses. China/Greater China fell by 16%, European Smaller Companies dropped 22%, UK Smaller Companies lost 26%, and Technology & Technology Innovations ended the year down by more than 27%.

Investors need to evaluate their risk tolerance when considering investment options. A risk-averse investor may opt for lower-risk investments with lower potential returns, while a more risk-tolerant investor may be willing to take on higher-risk investments with greater potential for reward.

To help our members with this tricky balancing act we have put each of the funds that we report on into one of our Saltydog groups.

We have based the groups on the historic volatility of the sectors that the funds are in. The least volatile sectors have been Short Term Money Market and Standard Money Market. The funds from these sectors are in the Saltydog ‘Safe Haven’ group. In last week’s reports, the funds from these sectors were showing an average four-week return of 0.3%. Over 12 weeks, they were up 0.9%, and they had gained 1.8% in the last 26 weeks.

Next up is our ‘Slow Ahead’ group. This is made up of sectors which are normally low risk, but can often generate better returns than the Safe Haven funds. Here is an excerpt from last week’s analysis showing their recent performance. We calculate the cumulative returns over four, 12 and 26 weeks and then give the individual weekly returns for the last eight weeks.

One of our investment strategies is to only invest in funds from the more volatile groups when they are giving higher returns. It is all well and good taking on additional risk in search of greater profits, but why do it when recent performance would suggest that the odds are not in your favour?

At the moment, none of the sectors in our ‘Slow Ahead’ group have done any better than the money markets sectors in our ‘Safe Haven’ group over four or 12 weeks. That is why our largest holdings are in two of the money market funds, and we do not hold any funds from the ‘Slow Ahead’ group.

There are some sectors in our more adventurous ‘Steady as She Goes’ and ‘Full Steam Ahead’ groups that have outperformed the money market funds and that is where we do have some exposure.

The best-performing sector last month was UK All Companies from the ‘Steady as She Goes’ group and we hold two funds from that sector, Schroder UK Alpha Plus and Ninety One UK Special Situations.

The European sectors were the best-performing sectors in the ‘Full Steam Ahead’ groups, and we also hold a couple of European funds; Man GLG Continental Eurp Growth and M&G European Sustain Paris Aligned.

The best-performing funds in the Specialist sector, over four, 12 and 26 weeks, are the ‘Gold’ funds. We invested in the BlackRock Gold and General fund just over a month ago.

It does sometimes feel a bit frustrating sitting on the sidelines, being predominantly in cash or the money market funds, but we take comfort from the fact that now it is probably the best place to be. We have got a little bit of exposure to the sectors that have done well so far this year, but their performance has not been great in the past few weeks. We are hoping to add to our holdings, but only when we are confident that they are heading in the right direction.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

Leave a Reply

You must be logged in to post a comment.