Jul

2023

Mid-year Outlook 2023: entry points?

DIY Investor

14 July 2023

For investors, we think the coming months will likely deliver more than their share of twists and turns. Whether negotiating the path of interest rates or confronting the possibility of recession, it will be essential to stay agile, because opportunities should also arise. Learn how to prepare for what comes next – and be ready for the entry points that market shifts may bring.

Key Takeaways

- With inflation still high and an economic downturn likely around the corner, we think it could be a bumpy second half of the year, particularly as markets may have to adjust expectations in key areas.

- A good example: with the battle against inflation still not won, central banks may have to raise rates further – even after a pause – before they “pivot” to lower levels.

- Turning points may arrive as economic growth slows and central banks re-evaluate interest rate paths – at which point investors might adapt their risk to suit market conditions.

- With the right timing, potential entry points could surface in equities, high-yield bonds, and commodities. Look for companies with pricing power and those anchored around reasonable valuations and structural trends.

- Resilience will be important – both for investors and corporates – as high rates may trigger further financial instability. Be watchful and ready for any opportunities.

“We expect further rate hikes in the US and the European Central Bank will likely have to hike by more than currently priced by markets.

While we do not expect a smooth ride for the remainder of the year, investors may find good entry points.“

Stefan Hofrichter

Head of Global Economics & Strategy

Macro view: better than feared, but instability risks remain

Let’s start with the good news. Since late 2021, global supply chains have very much normalised: the Federal Reserve Bank of New York’s Global Supply Chain Pressure index is now at one of the lowest readings in history – which should at least help to bring down goods price inflation, everything else being equal. And global economic activity is hovering along at a rate of close to 2.5%, according to OECD1 data. This is not amazing, but it is still significantly better than feared during the winter.

The last couple of months have also turned out to be a good period for investors: global equities, measured by the MSCI World, have returned around 10% adjusted for US inflation since last October (as at mid-June). Bond yields have remained quite stable since early 2023, thereby generating a positive nominal return for investors.

So, are we back in a “Goldilocks” environment that is supportive for all major asset markets, where the economy is running neither too hot or too cold? Not so fast: we think there are several challenges ahead of us and investors face a bumpy ride in the coming months:

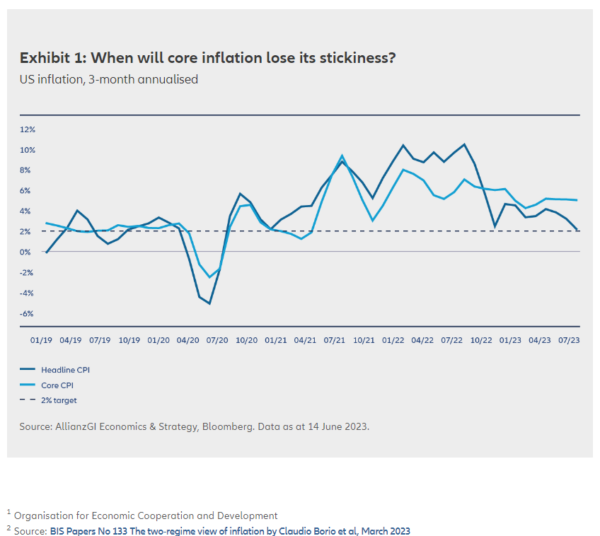

- Inflation remains stubbornly high. True, headline inflation has moderated – thanks largely to a fall in energy prices. However, annualised core inflation (excluding highly volatile energy and food prices) has been hovering at around 4% to 5% for several quarters already – significantly above central banks’ targets of 2% (see Exhibit 1). Due to second-round effects such as wage increases, it takes longer for inflation to moderate once we have been in a high-inflation regime for an extended period, as academic insight and our own research shows.2 It is also worth noting that central bank rates at current levels are not overly tight, if at all. Given the persistent underlying inflation, we do not share the market’s optimism that the world’s most important central bank, the US Federal Reserve, can afford to cut interest rates in the second half of this year. We expect further rate hikes in the US. In fact, at the Federal Open Market Committee meeting in June, the Fed pointed to two more rate rises before the end of the year. And the European Central Bank will likely have to hike by more than currently priced by markets. We therefore consider the chances of a further drop in bond yields to be limited.

- Recession in the US and Europe later this year is our base case. Admittedly, high-frequency data continue to point to an ongoing expansion of economic activity in the near term. Still, various leading indicators are consistent with our recession call: the inversion of yield curves, the contraction in money supply measures, and the topping out of the financial cycle (a measure for the joint dynamics of house prices and private sector leverage). Historically, whenever central banks have hiked rates to tight levels to fight inflation the outcome is almost always a recession. This matters for investors, as risk assets typically start to outperform during rather than ahead of a recession. The consensus seems to be that the downturn will be soft and shallow. We are not so convinced. The topping out of the real estate market, both residential and commercial – as a period of rising prices comes to an end – could result in a more marked economic slowdown than so far anticipated by investors.

- Financial instability risks persist. Certainly, all the US banks that either failed or had to be bailed out earlier this year looked to be undone by issues unique to them. The same goes for Credit Suisse. The common denominator, however, was their failure to adapt to the sharp rise in interest rates at a time of high leverage in the private sector following the economic boom in 2021. Higher rates have impacted not only banks, but also non-bank financials. Markets for illiquid assets, especially real estate, may turn out to be a source of financial instability, as the International Monetary Fund has warned repeatedly. Financial stability considerations will make central banks’ job more complicated. However, so far, they have shown no appetite for letting these financial stability risks interfere with the fight against inflation.

To conclude, while we do not expect a smooth ride in financial markets for the remainder of the year, investors may find good entry points across the asset classes. In equities, that could be when earnings expectations trough during the anticipated slowdown and stock prices “climb a wall of worry” even in the face of market negativity. Given our growth outlook, and following the rise in bond yields in 2022, we expect positive returns for bonds – although without any guarantee. It is a time to stay agile.

“Slower global economic growth will likely weigh on results in the second half, but with fundamentals holding up better than once feared we think there is still room for positive surprises, which will support stock pickers.“

Virginie Maisonneuve

Global CIO Equity

Equity strategy: point of impact

With the US Federal Reserve taking a “hawkish pause” on interest rate hikes, and the European Central Bank (ECB) flagging there is no pause in sight – despite an economy technically in recession – investors will likely contend with further macro uncertainty in the second half of 2023.

Investors face three key questions: how fast will the monetary policy tightening of the last 12-15 months impact economies? What sort of recession or slowdown should we expect? And how will corporate earnings hold up under these conditions?

It normally takes 12-18 months for the lagged effect of monetary policy tightening to bite. However, it is fair to expect the impact may be delayed by the excessive liquidity central banks injected during the Covid-19 pandemic. The demonstrable resilience of the US economy is another factor.

Inflation stickiness will also impact how long the central banks send a hawkish message and determine their action going forward. Monitoring inflation data and its sub-trends will therefore be critical. Headline inflation numbers are easing, but central banks want to see clearer signs of cooling prices before they shift towards policy easing. In the US, core inflation – which strips out food and energy prices – eased to 5.3% year-on-year in May but hasn’t fallen much since December. Euro zone core inflation also eased to 5.3% in May, still higher than the start of this year.

With core inflation proving sticky, there is reason to believe price pressures for services will remain robust, even as economies potentially begin to slow. Significantly, labour costs are rising in many sectors even as raw material costs soften. The pick-up in euro zone wage growth to 5.6% in Q1 2023 (vs 4.8% in Q4 2022) will concern the ECB, for example.

So, while investors may be relieved this cycle of rate rises could be coming to an end, firms operating in the real economy will remain under pressure in the coming months. Some will prove more resilient than others.

Slowdown or recession?

While recession seems to be looming in some regions, so far the point of impact is proving elusive. The exception is Europe where -0.1% growth in both Q4 2022 and Q1 2023 meant a technical recession.

In the US and the UK, many economic indicators are pointing downwards. Money supply measures – which indicate the total amount of money in the economy – have been shrinking for several months. The latest manufacturing purchasing managers’ index (PMI) figures – closely watched measures of business activity – also showed ongoing declines.1

Despite this, in all three economies unemployment has remained at multi-decade lows, helping to delay the sort of contraction in consumer spending that might have pulled them into recession. With employment at a 30-year high and the OECD predicting growth of 0.9% in the euro zone this year, Europe’s technical recession shows unusual characteristics. A recession would normally feature weaker data on both fronts.

China’s economy, which rebounded in Q1 2023 thanks to its post-Covid reopening, is now weakening again on the back of lower global demand for its exports, because of slowing economies elsewhere. There is also the impact of some reorganisation of global supply chains – eg, the “China-plus-one” trend, where companies additionally expand their operations outside China with the aim of building more resilient supply chains.

We expect bad news to bring good news in China as the authorities are likely to give ongoing support to the property sector and consumers in the second half of the year. The authorities are also set to focus on reforms to support national industrial champions around technology and innovation. In the short term, though, the slowdown in Chinese growth will add to the global economic deceleration at play.

Earnings: the preservation game

Given this backdrop, what should investors look for? One of the major tests for companies will be whether they can pass on rising costs without sacrificing sales. In other words, which companies will be able to preserve margins?

If interest rates stay higher for longer, the fact that “money has a cost again” will cause some firms to struggle as employees demand higher wages and suppliers demand higher prices. Still, in the first quarter of 2023, many companies actually beat analysts’ earnings expectations after forecasts were lowered to account for the impact of inflation.

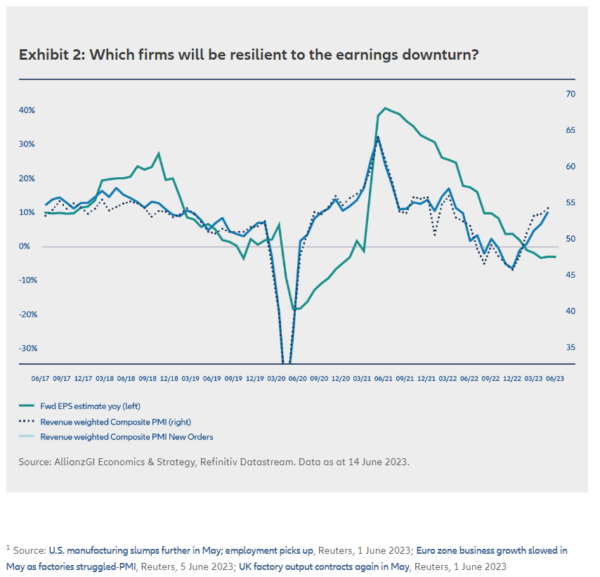

Some firms have shown a tendency for “greedflation”, where they are pushing prices beyond inflationary pressures – hence some of these earnings beats. But this approach can have a detrimental effect on volumes and impact future earnings. We want to hold quality companies with genuine pricing power. Slower global economic growth will likely weigh on results in the second half, but with fundamentals holding up better than once feared (see Exhibit 2) we think there is still room for positive surprises, which will support stock pickers.

The stresses in the banking sector – and its concentration on some very specific names – are a timely reminder that the impact of higher rates will play out unevenly across regions and asset classes. Another reason for investors to avoid any “one size fits all” approach.

Rely on resilience and structural trends

As the focus shifts from interest rates to the timing of recession or slowdown, volatility could return to equity markets, particularly as earnings expectations appear out of kilter given the shifting macroeconomic visibility.

Our focus for the rest of 2023 will be on resilience and long-term structural growth opportunities. Investors should seek to ensure portfolios are resilient to further volatility while positioning for the opportunities that appear – including those companies that are resilient to higher input costs and margin pressures.

Key for portfolios will be holding strong companies across the style spectrum with an emphasis on quality, dividend and sustainability, and anchored around reasonable valuations and long-term structural trends.

Themes we believe remain attractive include profitable technology firms and artificial intelligence and selected industrials, such as companies benefiting from reshoring, automation or climate solutions. In our view, China’s historically counter-cyclical economy also continues to present selective opportunities.

“Given our bumpy macro outlook, we are focused on the more robust balance sheets (and ample yields) of investment grade corporates rather than reaching further down the credit curve.“

Franck Dixmier

Global CIO Fixed Income

Fixed income strategy: yields compelling but transition won’t be seamless

The macro environment we see playing out in the second half of 2023 – weakening growth, inflation past its peak, and maturing rate hike cycles – should be a constructive backdrop for fixed income markets. But turning points in rate cycles tend to be uneven and with credit valuations not yet pricing in a more significant slowdown in growth, we think caution is warranted.

In our view, investors’ big challenge going into the second half is a lack of conviction over the global macro outlook and therefore the trajectory of monetary policy. Economic indicators are deteriorating, and we expect this to continue in the coming months. But data surprises continue to cloud the picture for central bankers and investors – core inflation is proving stubborn and labour markets are not yet cracking under the pressure of interest rate rises. As a result, we think volatility will remain a feature of fixed income markets this year, but these conditions may present investors with attractive entry points.

We expect uncertainty around the financial sector to persist in the coming months. However, we do not believe the banking stresses seen earlier this year should be dismissed as purely idiosyncratic when the events all involved excessive leverage exposed by a historically fast increase in interest rates. Silicon Valley Bank, Signature Bank and Credit Suisse were all specific cases, but that did not stop risk assets selling off after these credit events, often indiscriminately.

We also expect volatility in government bond (or “rates”) markets to persist in the short-term. Given a split of market views there is rarely a smooth journey from rate hikes to rate cuts – the recent volatility in two-year US Treasury yields as investors pared back hopes of a 2023 Fed rate cut neatly demonstrated how the transition between monetary policy regimes will not be seamless.

Dipping into duration

However, as expectations around the pace of monetary policy tightening continue to slow and policy rates approach their cycle peaks, we do anticipate an eventual decline in rates market volatility. As a result, we are becoming more constructive on government bonds and interest rate duration, especially in the US where the tightening cycle is more advanced. In the near term, we recognise that the front end of the US yield curve remains vulnerable given the Fed’s reluctance to reduce rates when inflation is still above its target, but over a three-to-six-month horizon we think 7-10yr US Treasuries could be an area to consider.

In the euro zone and the UK, we are more wary of adding duration. The European Central Bank and Bank of England may not be done with rate hikes, though how high they can raise rates going into a global slowdown is open to question. In general, the government bond markets we think offer most value are those with attractive “real” yields (ie, returns from interest payments after taking account of inflation) across the curve and where hiking cycles are well priced-in. Attractive markets therefore could include the US, New Zealand, Mexico and Brazil, while opportunities could also emerge in periphery European sovereigns with steeper yield curves.

Earnings key with slowdown not priced in

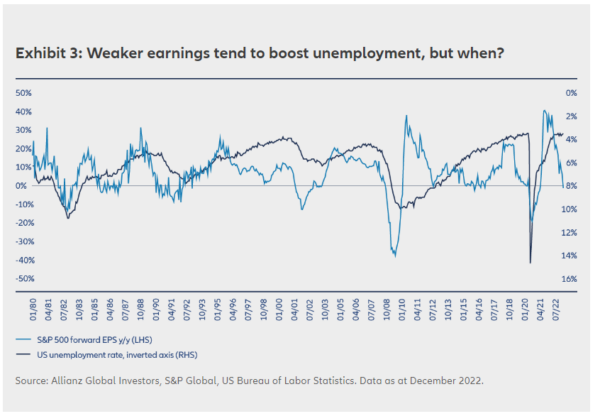

In credit (ie, corporate bonds and other non-government securities), we do not think valuations are fully pricing in the potential for a more significant growth slowdown ahead. Fundamentals have held up better than expected – particularly versus sentiment in late 2022 – but credit quality is likely to peak soon. Investors should remain focused on company earnings (see Exhibit 3), which will reveal the more resilient sectors and names as higher funding costs and slower earnings growth put pressure on weaker corporate balance sheets.

Caution is therefore warranted, though we remain overweight credit since all-in yields (ie, underlying rates plus credit spreads) offer attractive carry and should also provide some buffer against further volatility. Given our bumpy macro outlook, we are focused on the more robust balance sheets (and ample yields) of investment grade corporates rather than reaching further down the credit curve. However, we are ready to add risk on further sell-offs in high yield on a single-name basis, particularly in B-rated bonds which are a potential hedge if fundamentals continue to hold up better than expected.

When it comes to financials, we believe the US regional bank sector remains sound and the possibility for widespread regional bank failures is low at this juncture. We remain overweight systemically important European and US banks with ample capital and diversified funding and revenue.

“Of the main asset classes, we are most constructive about equities in our multi asset portfolios. Our quantitative and positioning signals are quite supportive but, with the potential for renewed volatility ahead, we are selective.“

Gregor MA Hirt

Global CIO Multi Asset

Multi asset strategy: flexibility in a fluid environment

Given the overall uncertainty and the obvious recession risks, markets have been quite resilient year-to-date. One explanation could be some kind of “mean reversion” following the annus horribilis of 2022 and cautious positioning from institutional investors during the winter. Still, an open question is whether central bankers can bring inflation under control without derailing the economy. The increased stress in the banking system and signs of financial instability are early indicators that the aggressive rate increases have affected the overall ecosystem.

As expected, bond and equity markets are showing more diversion after their rare correlation of underperformance last year. To date in 2023, global equity and fixed income markets have made gains, and balanced multi asset portfolios have performed positively in absolute terms. So where should investors position for the second half of the year?

Pockets of potential value emerge in equities

Of the main asset classes, we are most constructive about equities in our multi asset portfolios. Our quantitative and positioning signals are quite supportive but, with the potential for renewed volatility ahead, we are selective:

- Emerging markets – After a weak year-to-date performance, emerging markets are one of our preferred relative value picks among global stocks in our multi asset portfolios. We see emerging markets benefiting from attractive valuations and a weaker US dollar. China’s reopening after Covid-19 lockdowns and government support for the world’s second-largest economy should help broader emerging market sentiment.

- Europe – Earnings trends suggest European companies are showing resilience in the face of a stagnating economy. The outlook also hinges on the steepness of interest rate rises by the European Central Bank (ECB). More increases than markets anticipate could bring fresh headwinds.

- Japan – The Bank of Japan’s (BOJ) ultra-easy monetary policy has provided a brisk tailwind for one of the recent best-performing equity markets, which still profits from attractive valuations and supportive flows from overseas. But investors may need to be ready to review positions if – as we expect – new BOJ governor Kazuo Ueda revises the current controls on government bond yields this summer, a move that could stir market volatility.

In the US, lingering recession fears and rich valuations are weighing on part of the markets. Equities will be sensitive to signs of fresh stress in the banking sector but fears over the health of US regional banks have receded for now. Large US tech stocks have been buoyed by significantly enhanced revenue projections for artificial intelligence (AI) applications and related components. The actual impact of AI on revenues is still to play out, but we should not underestimate the power of emerging trends on equity markets.

Fixed income – rate pivots in play

Within a balanced multi asset portfolio, we see the potential to become more constructive on fixed income in the months ahead.

Once central banks approach the end of their monetary tightening cycles, sovereign fixed income may become more compelling as yield picks up. We are seeing this phenomenon in US Treasuries, as short-term rates surge in anticipation that the US Federal Reserve is near the end of its interest rate increases. Signs of a weakening US economy and the recent concerns over regional banks have raised investor hopes of a Fed “pivot” – a change in direction from tighter to looser monetary policy. As noted above, we think such expectations could be premature.

We are slightly defensive on European government bonds given the likelihood of further monetary policy tightening by the ECB. Investors might consider emerging market sovereign bonds as a diversifier aided by the US dollar’s consolidation and China’s growth prospects. Growth in China should also help some global commodities, compensating for lower demand due to the weaker growth environment elsewhere:

- Copper – With copper being essential for everything from electric vehicle charging stations to oil drilling platforms, researchers have forecast a lack of future supply. In the coming months, however, we think there may be room for some further downside.

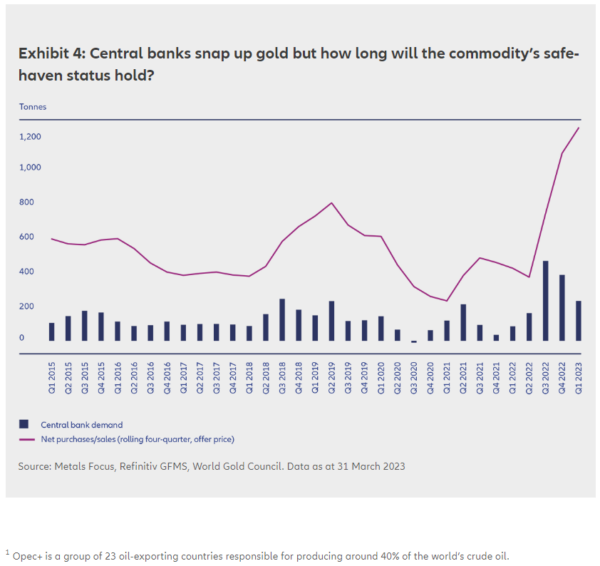

- Gold – Lower real yields and a stocking up in gold reserves by central banks have underpinned gold prices (see Exhibit 4). Precious metals may remain attractive in an environment of still-elevated inflation and geopolitical risks, but we would consider holding fire for a better entry point for gold.

- Oil – We think markets underestimate the impact of the recent Opec+1 supply tightening, which was comparable to the demand destruction of the 2008 financial crisis. The group has also given a clear signal that it will not tolerate low prices.

US dollar path is key to many investments

An important factor for the months ahead will be the path of the US dollar. The currency has retreated after scaling a 20-year high against a basket of currencies last year. Investors think the Fed has raised interest rates as much as they plan to, whereas in Europe there will likely be further increases. Valuations support other major currencies such as the euro. But the US dollar could retain its safe-haven status as global recession fears come to the fore.

We have been positive on the Japanese yen given its valuation and the risk-averse environment. We expect the currency to receive a boost in the event of the BOJ ending its yield curve controls.

Overall, our multi asset outlook favours flexibility to benefit from opportunities in risk assets while managing looming recession risks and higher interest rates.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is for Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations and is for information purpose only. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication’s sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced without express permission from Allianz Global Investors. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; Allianz Global Investors, UK Limited, authorised and regulated by the Financial Conduct Authority; in HK, by Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; in Singapore, by Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; in Japan, by Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424], Member of Japan Investment Advisers Association, the Investment Trust Association, Japan and Type II Financial Instruments Firms Association; in Taiwan, by Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan; and in Indonesia, by PT. Allianz Global Investors Asset Management Indonesia licensed by Indonesia Financial Services Authority (OJK).

2949710

Commentary » Equities Commentary » Equities Latest » Exchange traded products Latest » Fixed income Latest » Investment trusts Commentary » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.