Dec

2019

Make or Break

DIY Investor

3 December 2019

Risk sentiment has improved further during the last month as the heightened recession fears that built over the summer are gradually getting priced out.

Global equities have risen back towards their January 2018 highs, led by the US market; and sovereign bond yields have bounced off their August lows.

More recently, investors have also taken heart from signs of truce in the US-China trade dispute and the fading probability of a crash-out Brexit.

The Fed’s decision to start expanding its balance sheet again has added to the positive mix by spurring talk of ‘global QE’ that is supportive of risk assets against what remains a soft macro fundamental backdrop.

The global industrial downswing is long in the tooth but is gradually spreading to the services sector. The US data look OK on the surface, with the combination of steady household consumption and signs of improvement in the housing market lending support to the FOMC’s glass half-full view of the economy.

‘macro momentum is fragile, underscored by sustained weakness in manufacturing’

At closer inspection, however, macro momentum is fragile, underscored by sustained weakness in manufacturing.

China’s slowdown continues but policymakers are minded to manage it, not to reflate.

Real GDP growth drifted lower in Q3, with the contribution from domestic demand hitting a 30-year low.

Net exports’ share of output growth is on course to be the highest in over two decades for 2019, but this is the mirror image of domestic weakness: imports are falling faster than exports, a reminder that China is now a drag on world trade.

Our China team thinks Beijing is unlikely to set a hard growth target for 2020, giving the authorities plenty of room to allow sub-6% annual real rates of expansion amid efforts to de-risk the economy.

What could change policymakers’ tone is a deeper slowdown in business revenue that puts into question the corporate sector’s ability to cover interest payments and roll over debt.

With PPI falling – raising the real cost of capital even as the PBoC eases – and annual growth in nominal GDP veering below 8%, the chances of such a scenario materialising are on the rise.

‘Those counting on China to pull the world economy out of the current slowdown will therefore continue to be disappointed’

But we are still far from seeing the kind of deterioration that would spur a panicked policy response. Those counting on China to pull the world economy out of the current slowdown will therefore continue to be disappointed.

For the time being, policymakers in Beijing can be counted on to retain their preference for ‘measured’ easing, led by fiscal policy.

Infrastructure investment should increase going into 2020 to offset weakness in property and manufacturing capex – under pressure from weak profitability and high inventories of industrial commodities.

Monetary policy remains cautious, with further cuts in RRR and small reductions in MLF rates unlikely to reverse the deceleration in economic activity. Net repo liquidity injections have increased of late, helping arrest the decline in bank reserves at the PBoCl; but this still leaves a lot to be desired in terms of adding stimulus.

Interestingly, while the central bank’s balance sheet has continued to expand after going through a period of contraction between mid-2016 and 2017Q1, bank reserves peaked in 2018.

Even after a moderate rebound in 2019, they remain around 10% lower than they were a year ago.

In this regard, it is notable that contractions in the amount of bank reserves at the PBoC have coincided with global growth scare episodes in recent years, marked by simultaneous strong dollar upswings and sizeable equity market corrections (2015/16, 2018Q4).

With global inventory ratios elevated and the dollar resilient, all this still leaves the world economy in limbo. Correspondingly, investors’ conviction on what lies ahead is low.

Yet with exogenous tail risks receding, bond yields depressed and central banks pumping more liquidity, risk assets remain bid even as corporate profitability (earnings, margins) rests on shaky ground.

‘Fading base effects are part of the story but there is also some evidence of improving momentum, i.e. ‘light green shoots’.’

Leading indicators remain lacklustre overall but continue to imply a bottoming out process that should sooner or later start to manifest itself in ‘less bad’ hard data. Fading base effects are part of the story but there is also some evidence of improving momentum, i.e. ‘light green shoots’.

The global manufacturing PMI (49.8) remains in contraction territory but appears to have found a firmer footing after a long period of deterioration, edging higher for the second consecutive month in September.

The breadth of the malaise in global industrial activity appears to be diminishing, with the share of total PMIs under 50 declining.

Importantly, China’s PMIs have improved, with the Caixin index (51.7) rising in each the last three months and the official index (49.3) on a moderate uptrend this year.

Taiwan’s manufacturing PMI (49.8), a bellwether for the Asian tech cycle, has bounced off its summer lows.

In the same vein, the latest industrial production print from Singapore surprised positively (+7.9% MoM); and while non-oil domestic exports remain under pressure the pace of the decline is moderating, with shipments to China bucking the trend in September (+20.8% YoY).

‘Capex intentions remain soft but new orders and (especially) employment are on the rebound’

In the US, the regional Fed surveys have been faring better of late after a year-long slump. Capex intentions remain soft but new orders and (especially) employment are on the rebound, auguring well for some stabilisation in the ISM (48.3) following recent pronounced weakness.

Germany’s economic woes continue to weigh on the euro area, but the French economy appears to be finding a firmer footing.

Our Leading Indicator for France is exhibiting positive divergence, consistent with the PMIs – welcome news, even if France alone cannot lift the whole region out of its funk.

Market-based indicators are sending a similar message: trading the slowdown has become somewhat of a stale theme.

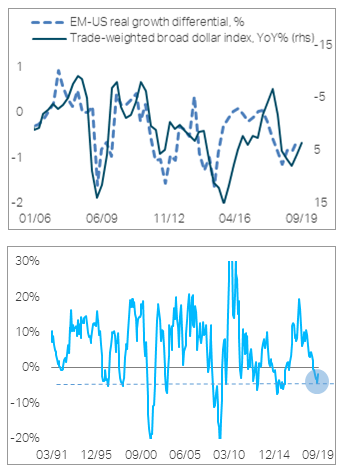

EM equities have been quietly outperforming their US counterparts since the end of August, in tandem with a modest recovery in EM currencies.

Within equities, there is evidence of a rotation away from growth/defensive towards value/cyclical stocks – consistent with better macro momentum.

Charts:

First published by our friends at:

TS Lombard are celebrating 30 years of independent investment research. To find out more, or request a trial, visit www.tslombard.com

Leave a Reply

You must be logged in to post a comment.