Nov

2023

Jupiter Strategic Bond: Q4 2023 update

DIY Investor

9 November 2023

Ariel Bezalel and Harry Richards, investment managers of the Jupiter Strategic Bond fund, outline their macro thesis for investing in current markets and give an update on portfolio positioning.

“Financial markets are tightening up and they are going to do some of the work for us”, said Federal Reserve governor Christopher Waller, in a sign that the tide is beginning to turn in the Fed’s rhetoric about the future path of interest rate policy.

While the minutes from a recent FOMC meeting still speak of “proceeding” with current policy, the committee twice stresses that they must do so “carefully”. We would argue they should have been more careful before now.

Central banks, guided as they are by their main KPIs of managing inflation and unemployment, are having their policy action dictated by two of the most lagging indicators it is possible to find. It is the equivalent of driving a car while looking in the rear-view mirror. But if we look at the latest leading indicators to get a view of the road ahead, we can see a range of factors pointing towards recession.

Our macro thesis

-

Hard landing

for the US economy driven by monetary contraction and tighter lending standards. -

Recessionary forces

fuelled by depletion in household savings and slack in the job market. -

End of the tightening cycle

as the rolling over of growth and wages create room for central banks to act.

Monetary policy acts with “long and variable lags”, and while US GDP numbers and spot job market data (e.g., unemployment) have been fairly solid up until now, there are cracks starting to appear as Manufacturing remains weak and Services PMIs are now starting to follow.

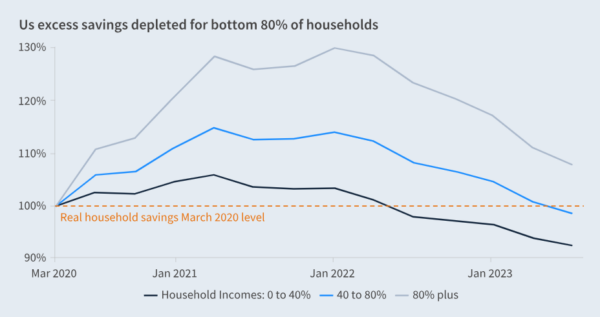

Consumer spending has been a key supportive factor in the last quarters as excess savings get re-absorbed into the economy, but (see chart below) savings buffers have now been depleted for the large majority of households. In such an environment, it is hard to see how consumer momentum can keep contributing to robust growth – especially with the resumption of student debt repayments in Q4.

Source: Federal Reserve, Bloomberg calculations, as at September 2023. Note: March 2020 = 100

While the job market remains strong on the surface, we are starting to see some change in trends. The unemployment rate continues to trend upwards, coming in higher than consensus for September at 3.8%. Similarly, the decrease in quit rates and the increase in permanent job losses signal some loosening in the jobs market, while trends in temporary employees and overtime hours point to additional slack ahead.

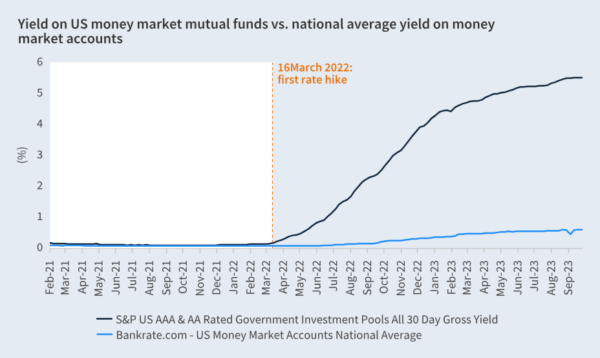

Furthermore, it seems that many market participants have stopped focusing on the state of the US banking system. As the chart below shows, there is still a chasm between deposit costs for commercial banks and the yields offered by simple money market instruments, with deposit uncertainty or lower profitability a very likely consequence. Recent trends in bank assets and commercial and industrial loans, now in contractionary territory, clearly show the consequences of tighter credit standards in action. This should be a further headwind for the broad economy and the job market moving forward.

On a more positive note, we see clear progress in the disinflation path across many major economies, with trends in supply chains and commodity markets showing that further disinflation is in the pipeline. Recent trends in energy markets and especially crude prices are something we are closely monitoring, especially in relation to the current instability in the Middle East. The combined effect of a stronger dollar, higher fuel prices in a moment of lower excess savings and as student loan repayments start once again looks to us a toxic cocktail for the US consumer. It is worth noting that any rise in oil prices at this juncture will simply divert spending from other areas of the economy.

In such an environment, we think that the next 6 to 12 months should provide central banks across the globe with reasons (or perhaps the need) to be less hawkish. Developed markets central banks look still fairly data dependent, but looking at emerging markets we already see some rate cuts. Brazil and Chile already started their rate cutting cycle, as has Hungary. These are the same central banks that first started hiking two years ago and may be a good leading indicator for developed markets.

China is the elephant in the room. Although August data showed some improvement, the data remains sluggish. We do not believe that current support measures enacted by the government will prove sufficient to solve the structural imbalances within the housing market where 20-30% of GDP is from construction. Chinese property is the biggest asset class in the world. Piecemeal measures announced thus far are unlikely to have much long-lasting effect

Our portfolio positioning

-

Material value in government bonds

from select developed and emerging market issuers.

-

Increased exposure to the front and middle of the curve

which would be set to benefit from a shift in Fed policy.

-

Reduced cyclicality across the credit book

while taking advantage of individual situations where there is an opportunity to invest at attractive yields.

We see material value in government bonds in developed markets (US and Australia in particular) and in some emerging markets (such as S. Korea, Brazil) and prefer to maintain the strategy’s relatively high duration exposure.

We nevertheless remain active in adjusting the strategy’s exposure as market realities develop. The most important shift since the beginning of the year occurred in our allocation to government bonds, where we increased overall duration to 9.4 years (+1.4 year). This increase in rate exposure mostly came from increased exposure to the United States, in the middle segment of the curve, and more partially from the UK.

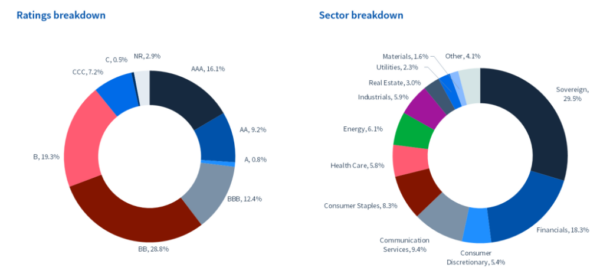

Credit markets look complacent in the face of mounting recessionary risk, with global high yield spreads well below recessionary averages. Nevertheless, the overall level of yield provides a decent cushion for investors even in an environment of higher spread volatility. We also see dispersion across regions, rating segments and sectors. Lower quality European High Yield is already pricing recession risk. Across our corporate bond holdings, we continue to reduce overall cyclicality with an eye to potential future economic weakness. We prefer companies that we have confidence will survive even a tough recession, with a strong bias to conservative sectors and shorter maturities.

Current events in the Middle East are highly fluid, but there is a clear potential for escalation which – in addition to the appalling human cost – may have implications for oil prices. In terms of direct exposure to Israel, at the moment Jupiter Strategic Bond only holds Teva Pharmaceuticals (c.1.8% position size), although the company’s actual production in Israel is just 8% and revenues generated in the country are just 2%. We do not have any meaningful credit exposure in the portfolio to the Middle East (just 0.6%).

An enticing investment opportunity

Market participants would perhaps be wise to remember that changes in monetary policy can be slow to manifest themselves. However, history suggests when the impact is felt it can be dramatic and quick.

An environment in which inflation rolls over, growth falters, and the employment picture worsens is one in which continued hawkish policy from the Federal Reserve will rapidly become untenable and cuts will follow. In our view this lays the foundation for an extremely promising investment environment for fixed income.

We have a high level of conviction in our macro view, but of course we know that nothing is guaranteed and there are factors which could de-rail the world from this path. The world is an unpredictable and volatile place, as we all see ample evidence of every day. Whatever fate throws at bond markets, however, the vast breadth of fixed income asset classes available means we have confidence that a flexible and dynamic global bond portfolio should have the tools at its disposal to meet that challenge. The investment opportunity in fixed income, as we see it, is an enticing one.

Fund specific risks:

The fund can invest a significant portion of the portfolio in high yield and non-rated bonds. These bonds may offer a higher income but carry a greater risk of default, particularly in volatile markets. Quarterly income payments will fluctuate. The fund uses derivatives, which may increase volatility; the fund’s performance is unlikely to track the performance of broader markets. Losses on short positions may be unlimited. Counterparty risk may cause losses to the fund. In difficult market conditions, it may be harder for the manager to sell assets at the quoted price, which could have a negative impact on performance. In extreme market conditions, the Fund’s ability to meet redemption requests on demand may be affected. The Key Investor Information Document, Supplementary Information Document and Scheme Particulars are available from Jupiter on request. This fund can invest more than 35% of its value in securities issued or guaranteed by an EEA state. Please refer to the Prospectus for further information.

The value of active minds – independent thinking:

A key feature of Jupiter’s investment approach is that we eschew the adoption of a house view, instead preferring to allow our specialist fund managers to formulate their own opinions on their asset class. As a result, it should be noted that any views expressed – including on matters relating to environmental, social and governance considerations – are those of the author(s), and may differ from views held by other Jupiter investment professionals.

The value of active minds – independent thinking: A key feature of Jupiter’s investment approach is that we eschew the adoption of a house view, instead preferring to allow our specialist fund managers to formulate their own opinions on their asset class. As a result, it should be noted that any views expressed – including on matters relating to environmental, social and governance considerations – are those of the author(s), and may differ from views held by other Jupiter investment professionals. Important Information: This document is intended for investment professionals and is not for the use or benefit of other persons, including retail investors. This document is for informational purposes only and is not investment advice. Market and exchange rate movements can cause the value of an investment to fall as well as rise, and you may get back less than originally invested. Past performance is no guide to the future. The views expressed are those of the Fund Manager(s) at the time of writing, are not necessarily those of Jupiter as a whole and may be subject to change. This is particularly true during periods of rapidly changing market circumstances. Every effort is made to ensure the accuracy of any information provided but no assurances or warranties are given. Holding examples are not a recommendation to buy or sell. Quoted yields are not a guide or guarantee for the expected level of distributions to be received. The yield may fluctuate significantly during times of extreme market and economic volatility. Issued by Jupiter Unit Trust Managers Limited (JUTM), registered address: The Zig Zag Building, 70 Victoria Street, London, SW1E 6SQ which is authorised and regulated by the Financial Conduct Authority. No part of this document may be reproduced in any manner without the prior permission of JUTM.

Brokers Commentary » Commentary » Fixed income Commentary » Fixed income Latest » Investment trusts Commentary » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.