Mar

2022

JETS: A Dynamic, Rules-Based ETF

DIY Investor

27 March 2022

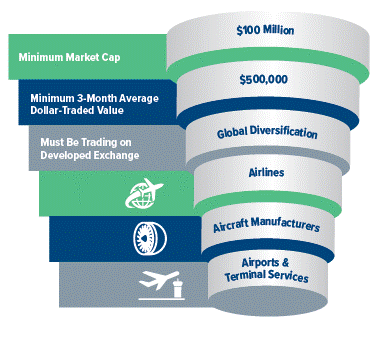

It was precisely for these long-term value propositions and more that the U.S. Global Jets UCITS ETF (JETS) was created—to capture the performance of global companies in not just the commercial airline industry but also the important aircraft manufacturing and airport and terminal services subindustries.

Before the JETS Airline ETF, no other ETF tracked all three airline spaces collectively on a global scale.

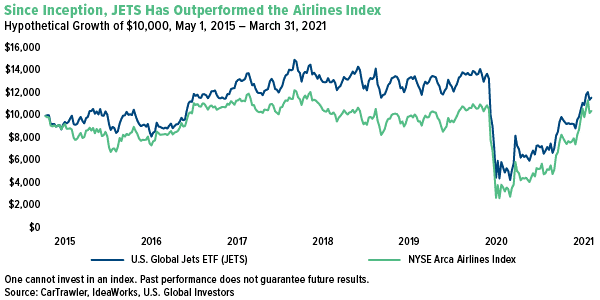

Below, you can see the results thus far. JETS has outperformed its chief rival index, the NYSE Arca Airline Index, since its inception in April 2015.

We like to call JETS a smart-beta 2.0 ETF. Using a proprietary quant factor model, JETS seeks to outperform what might be offered by a simple market cap-weighted product. It seeks to track the U.S. Global Jets Index (JETSX), a 50-stock index that seeks to provide diversified access to the global airline industry.

JETSX uses various fundamental screens to determine the most efficient airline companies in the world, and also diversifies through exposure to global aircraft manufacturers, airport companies and airline-related internet media and services companies. The index consists of common stocks listed on developed and emerging market exchanges across the globe.

As for weighting, the top four American airlines, based on a ranking of market capitalization, average dollar value traded and load factor, receive a weight of 10% each. The next eight stocks, with a 3% weighting each, are U.S. or Canadian airlines, based on a combined ranking of market cap, average dollar value traded and load factors.

The next eight stocks, with a 2% weighting each, include U.S. or Canadian companies (non-airlines included) based on a fundamental factor ranking. After that comes the top 10 international companies (excluding the U.S.) based on a fundamental factor ranking, with a 1% weighting each. Lastly, 20 international companies (excluding the U.S.) based on a fundamental factor ranking get a weighting of 0.5% each.

The portfolio is rebalanced and reconstituted on a quarterly basis.

To learn more about our Airline ETF, please view our fund page for more information.

Alternative investments Commentary » Commentary » Exchange traded products Commentary » Exchange traded products Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.