Jan

2019

January Market: The UK Stock Market Almanac

DIY Investor

8 January 2019

Seasonality effects and anomalies that are seen in January

Since 1970 the market has seen positive returns in January in 60% of years and has had an average return of 2.1%. Which sounds pretty good and, indeed, January used to be one of the strongest months for shares in the whole year.

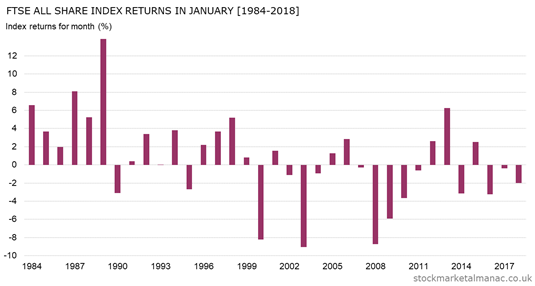

From 1984 to 1999 the average FTSE All-Share return in the month was 3.3%, and as can be seen in the accompanying chart in those 16 years the market only fell twice in January. But after year 2000 things changed dramatically.

Since 2000 the average market return in January has been -1.6% with the market seeing positive returns in only six years, and in four years since 2000 the market has fallen more than 5% in the month.

This makes January the worst of all months for shares since 2000.

The average January

In an average January shares usually start trading strongly in the first few days most likely a momentum effect from the surge in prices traditionally seen in the last two weeks of the year. However, that ebullience soon wears off and prices then slide for the rest of the month until recovering somewhat in the last few days.

January Effect

In the stock market this month is famous for the imaginatively-titled January Effect. This describes the tendency of small cap stocks to out-perform large caps in the month.

This anomaly was first observed in the US, but it applies to the UK market as well. For example, since 1999 the FTSE 250 index out-performed the FTSE 100 Index in January in 68% of years, with an average out-performance of 0.6 percentage points.

Although it should be noted that the medium cap index has actually under-performed the large cap index the last two years in 2017 and 2018, leading one to wonder if this phenomenon might be breaking down.

Sectors

The FTSE 350 sectors that tend to be strong in January are: Health Care Equipment & Services, Software & Computer Services, and General Industrials; while the weak sectors have been: Electricity, Food Producers, and Oil & Gas Producers.

Shares

At the company level, FTSE 350 shares that have tended to be strong this month are: JD Sports Fashion [JD.], Paysafe Group [PAYS], Domino’s Pizza Group [DOM], Mitchells & Butlers [MAB], and St James’s Place [STJ]

The weak shares have been: FirstGroup [FGP], Berkeley Group Holdings (The) [BKG], Paragon Banking Group [PAG], Royal Dutch Shell [RDSB], Dairy Crest Group [DCG].

Aside from equities, January traditionally sees strong silver prices and weak sterling against the dollar.

Commentary » Equities » Equities Commentary » Equities Latest » Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.