Dec

2021

IT Investor: Quarterly Review – quality fights back

DIY Investor

3 December 2021

Hello again; here’s my latest quarterly portfolio review.

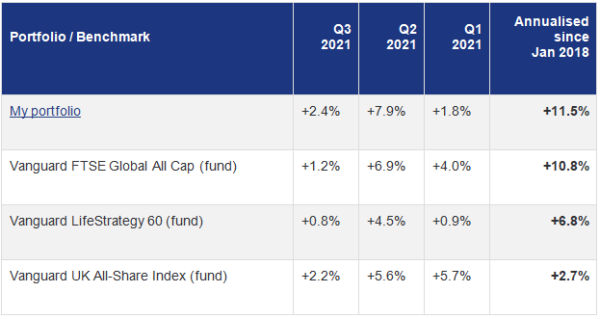

After lagging behind global markets in the first quarter, I was a little ahead in both the second and the third. Year-to-date, both my portfolio and the global market tracker I benchmark against are up around 12.5%

The usual explanatory note: I use the Vanguard global tracker fund as my main benchmark. The more conservative LifeStrategy 60 fund (essentially a global 60% equity/40% bond portfolio) and UK index tracking fund provide additional reference points.

Annualised since January 2018, I’m up 11.5% compared to 10.8% for global markets; I’m a little shy of my +2-3% a year stretch target, but still pretty happy with my overall progress.

Bond yields have started to rise again in the last few weeks; while they fell from mid-May to early August, my quality-type investments (Fundsmith, Lindsell Train etc) put in a decent showing again, and that’s probably why I outperformed a little in the second and third quarters.

Markets have been pretty skittish for the last couple of weeks, even though the rise in bond yields has been both smaller and gentler than we saw earlier this year.

That said, 2021 has been unusual in that we’ve seen no major market decline of 10% or more; I’m not even sure we’ve had a 5% drop. On average, as stock market historians often tell us, we should probably expect to see a 10% fall around once a year.

After its late spurt at the end of 2020, the UK market was only marginally ahead of global markets this year at 14%. In other major markets, US was up 15%, Europe 12%, Japan 6%, and China down 16%; in smaller markets, both India and Russia posted returns in excess of 30%.

Not so great expectations

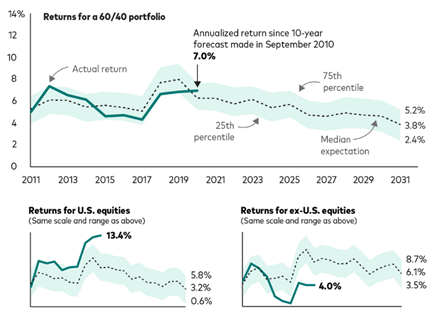

Trusts4U tweeted an interesting piece from Vanguard recently where the fund giant looked at how its market forecast model had performed over the last ten years and what it is suggesting about future potential returns:

US equities did a lot better than Vanguard expected over the last 10 years and non-US equities did much worse; in the 60/40 portfolio, these two effects net off.

From a lower base, Vanguard expects non-US equities to perform better over the next ten years but its mid-point prediction is an anaemic-looking 6% a year; mid-point prediction for the 60/40 is just 3.8%, well below the 7.0% enjoyed over the last decade.

Lower forward expectations are something I have mentioned occasionally, but I thought it was a useful way to present the data; Vanguard deserve credit for highlighting the accuracy or otherwise of their old forecasts.

My trading

Another quiet quarter for me on the trading front; I took part in an open offer for Bluefield Solar Income, topped up International Biotechnology Trust after its discount widened, and added some non-ISA dividends to my Vanguard All-World ETF.

I’ve still got a few non-ISA positions to tidy up over the next few years and the introduction of the extra 1.25% dividend tax last month serves as another good reason for doing so.

Acorn Income, one of my UK small-cap holdings, decided to fall on its sword after initially proposing a complete mandate change to a global sustainable equity income strategy; I think it’s a sensible decision, given the trust’s size and overly complicated structure.

My options are to either roll my holding into Unicorn UK Income, an open-ended fund run by the same managers, or cash out close to net asset value; I’ll probably choose the latter and decide where to put it when the distribution is made in mid-November. Currently, I’m thinking of topping up my three biotech/healthcare trusts, Gresham House Energy Storage, and Keystone Positive Change.

Crypt-oh!

I’ve casually observed cryptocurrencies for a few years, alternatively shaking and scratching my head; but along with a number of other financial bloggers, I finally took the plunge, albeit in a very limited way.

I have a small position in a crypto company called KR1; it’s been around since 2016 and is invested in several dozen crypto assets, getting into some very early-stage projects. Its management team own a significant number of its shares and have a long-term incentive deal that could see their stake increase. This blog post by Wexboy from November 2020 covers the company in some detail, although the figures are dated.

KR1 trades on the Aquis Stock Exchange, so although you can put it into an ISA, the level of regulation and disclosure is much lower than the main London market. There’s no up-to-date portfolio leaving you to piece together what it owns from its individual announcements; it publishes its half and year-end results late – it’s very much buyer beware.

Last night its portfolio of crypto assets was worth in the region of £275m with a market cap of about £223m, but a significant number of shares – about 30% if my back of the envelope maths is correct – are yet to be issued in respect of performance fees for 2020 and 2021 and for options yet to be exercised.

So KR1 is probably trading at a premium of around 10% to its NAV, although this figure shifts around, as you might imagine. This morning, the portfolio value had dropped to £260m; it’s been as high as £320m and as low as £100m even in the short time that I have owned it.

Under its new management arrangements, fees of 1.9% are payable up to £250m of net assets and 1.7% above that level with 20% of any gains paid out as a performance fee entirely in new shares. That’s very expensive compared to most funds, being more in line with fee structures for private equity or hedge funds.

I’ve only been invested for a few months and see this as a learning position (I’m working my way through The Basics Of Bitcoins and Blockchains) combined with an experiment as to how much volatility I can live with.

Crypto price falls can be savage, with 25% daily or overnight drops a regular occurrence and numerous 80-90% drawdowns over the last decade; KR1 has been less volatile than crypto prices and the value of its own portfolio in recent months but it’s the most speculative position I hold.

It’s included in my overall portfolio returns, hence the reason I’ve mentioned it here, although it’s my smallest position by some distance.

Performance by holding

Here’s how my individual holdings have performed so far this year and in 2020. The names link to my most recent review of each holding.

| Holding | End of Q3 2021 |

2020 |

| Acorn Income | +35.7% | -14.1% |

| HgCapital | +30.0% | +21.6% |

| RIT Capital Partners | +25.5% | -0.4% |

| Baronsmead Venture Trust | +22.0% | +6.2% |

| BlackRock Smaller Companies | +19.7% | +4.1% |

| JPMorgan Global Growth & Income | +18.4% | +15.9% |

| Henderson Smaller Companies | +18.3% | -0.6% |

| Gresham House Energy Storage | +15.9% | +10.8% |

| Fundsmith Equity | +13.3% | +18.4% |

| Vanguard All-World ETF | +12.6% | +12.2% |

| BB Healthcare | +12.5% | +29.1% |

| Smithson | +9.2% | +31.7% |

| Keystone Positive Change | +4.4% | -0.8% |

| Lindsell Train Global | +2.9% | +11.9% |

| Bluefield Solar Income | -0.5% | -2.5% |

| HICL Infrastructure | -0.7% | +7.0% |

| Worldwide Healthcare | -2.3% | +19.9% |

| International Biotechnology | -8.3% | +35.6% |

It’s been a good year for UK smaller companies with Acorn, Baronsmead, BlackRock, and Henderson all in the upper echelons of my chart; Acorn Income’s discount narrowed because a cash exit is in sight, so it’s at the very top of the pile.

My long-term holdings in HgCapital and RIT have both done very well; for Hg, it’s merely a continuation of the last few years while RIT spent some time in the doldrums so it’s good to see it bounce back, especially considering Lord Rothschild has officially retired as Chairman having run the trust for so long.

In the battle of the quality managers, Terry Smith outboxed Nick Train and Michael Lindsell, and Fundsmith has done better than Smithson. For the third year on the trot Lindsell Train Global Equity has lagged its benchmark, although it wasn’t far behind in 2019 or 2020, and it’s level with world markets over five years. I don’t expect Lindsell Train to make any major strategic changes and I’m happy to sit tight for now.

Keystone bounced back a little after Baillie Gifford took over at probably the worst possible time for its style of investing in February of this year. At the end of August, it had nearly 13% of its assets in Moderna, which more than trebled this year, making it by far the best performing stock in the S&P 500, but it fell heavily on 1st October after Merck announced positive results for its COVID pill.

Keystone has lagged Scottish Mortgage over the last six months but is well ahead of Baillie Gifford US Growth, Monks, and Edinburgh Worldwide.

It continues to be a difficult year for healthcare stocks and for biotech in particular. BB Healthcare has done alright; both Worldwide Healthcare and International Biotechnology are in negative territory although they have done a lot better than sector rivals Syncona and Biotech Growth.

It’s a similar mixed story for my renewables and infrastructure holdings with Gresham House Energy Storage striding ahead but HICL and Bluefield largely flat. HICL is probably the position I have the least conviction in here but I’m in no rush to make any rash decisions.

Caledonia, which I sold out of in March/April, is up just under 20% year to date but I’ve taken it out of the performance table. KR1, being a tiddler of a position, is also left out for the time being but it’s up a few hundred per cent this year, all before I bought it naturally!

You can read my fund profiles at Money Makers

I’ve been busy writing fund profiles over at Money Makers these past few months with recent pieces on the likes of Baillie Gifford US Growth, Supermarket Income REIT, Montanaro European Smaller, and Law Debenture to mention just a few. I’ve also published updated pieces on Fundsmith Equity, HgCapital, and Lindsell Train Investment Trust.

Here is the sign-up page that provides full details of what you get as a paying member of Money Makers.

Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.